For decades, music royalty distribution has been a black box for artists and investors alike. Delayed payments, opaque accounting, and layers of intermediaries have left both creators and rightsholders at the mercy of legacy systems. Today, blockchain-powered automated royalty splits are rapidly dismantling these barriers. Using programmable smart contracts, platforms can now execute on-chain royalty enforcement with mathematical precision, no more waiting months for statements or wondering if revenue shares have been correctly allocated.

How Automated Royalty Splits Work in Practice

At the heart of this revolution is the smart contract: a self-executing piece of code that distributes music revenue according to predefined terms. When a song generates income, whether from streaming, sync licensing, or NFT sales, the smart contract instantly divides funds among all contributors based on their agreed percentages. For example, if an artist owns 50%, a producer 30%, and a songwriter 20%, the contract disburses each share in real time as soon as payment hits the blockchain address.

This shift eliminates costly administrative overhead and virtually eradicates manual errors. Platforms like Revelator’s Royalty Splits system even allow settlements in USDC, ensuring stable value transfers and global accessibility (see here). For investors and rights holders, this means a transparent audit trail with every transaction immutably recorded on-chain.

The Quantitative Edge: Transparency and Trust in Revenue Sharing

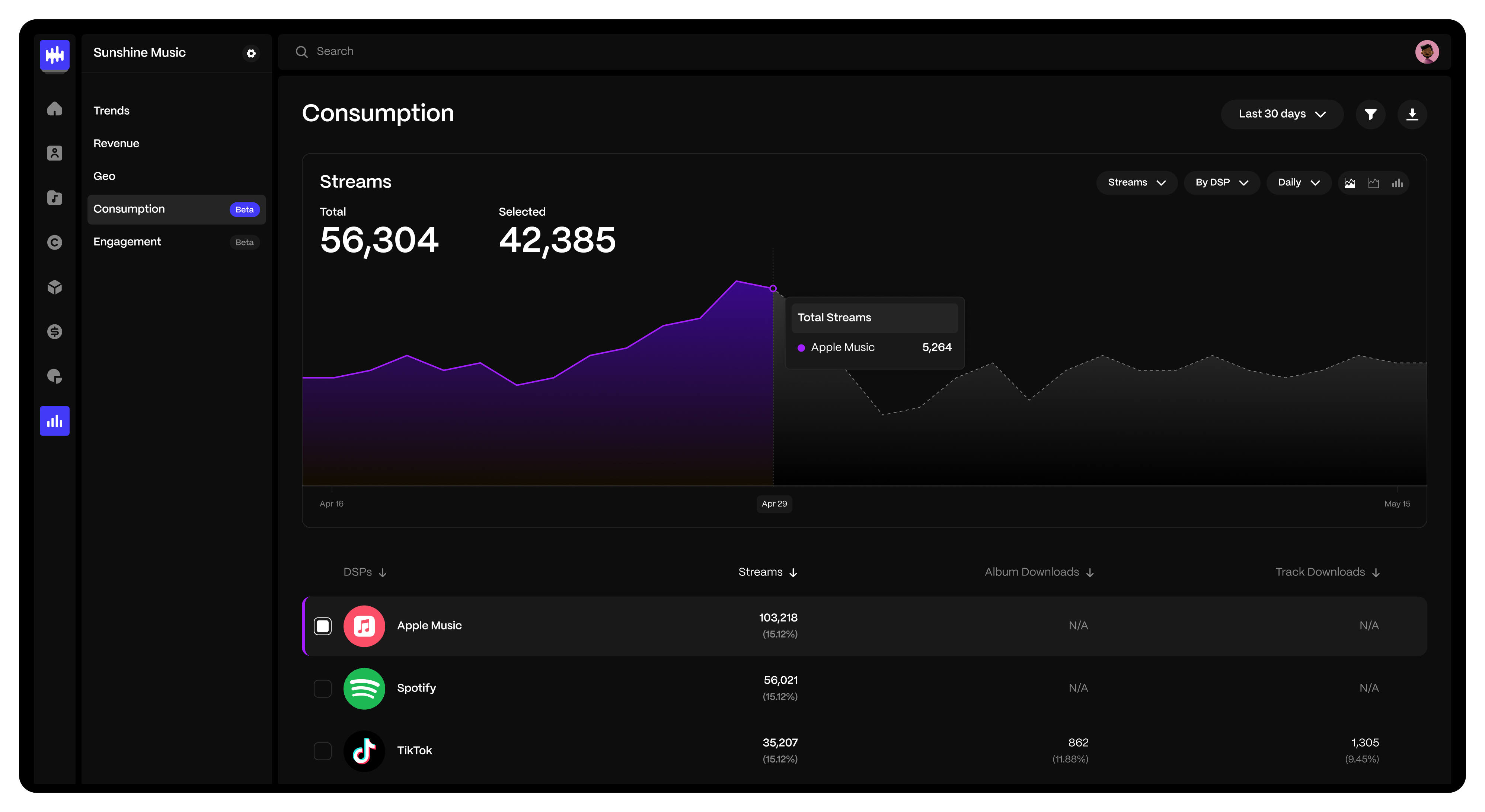

The data-driven nature of blockchain means every dollar (or digital token) is accounted for. Artists can track earnings in real time, while investors can verify their pro-rata share down to the decimal, no more blind faith in opaque statements from collecting societies or publishers. This transparency is especially critical as music assets become increasingly fractionalized and traded as NFTs or tokens.

Key Benefits of Automated Royalty Splits for Music Stakeholders

-

Real-Time, Automated Payments: Platforms like Revelator use smart contracts to distribute royalties instantly in USDC, eliminating payment delays and manual accounting errors.

-

Enhanced Transparency & Trust: Every transaction is recorded on an immutable blockchain ledger, allowing artists, producers, and investors to track royalty flows in real time and verify earnings without relying on opaque intermediaries.

-

Reduced Intermediary Costs: By automating royalty calculations and distributions, smart contracts minimize the need for third-party administrators, leading to lower administrative fees and higher net payouts for rights holders.

-

Fractional Ownership & Fan Investment: Platforms such as Royal.io enable artists to sell portions of their streaming royalty rights as Limited Digital Assets (LDAs), letting fans invest directly in songs and share in future revenue.

-

Dispute Reduction & Single Source of Truth: Blockchain-based rights management systems provide a comprehensive, tamper-proof record of ownership, splits, and payment terms, dramatically reducing disputes over royalty allocations.

The immutable ledger also dramatically reduces disputes over ownership or splits. If a disagreement arises about who owns what percentage of a song’s rights, the blockchain record serves as an authoritative source, a single version of the truth accessible to all parties (learn more).

Fractional Ownership and Fan Engagement: A New Paradigm

Perhaps most excitingly, automated royalty splits are enabling new models for fan engagement through fractional ownership. Platforms like Royal. io let artists sell portions of their streaming royalties directly to fans as Limited Digital Assets (LDAs), giving supporters a financial stake in songs they love (see Wikipedia entry). This not only unlocks upfront capital for creators but also turns listeners into passionate co-promoters whose incentives are aligned with the artist’s long-term success.

For portfolio strategists and risk-conscious investors, these developments mean music assets can now be analyzed quantitatively, with clear cash flow histories, transparent splits, and even secondary trading liquidity emerging in NFT markets. The result is an ecosystem where music revenue sharing is no longer an art shrouded in mystery but a science governed by code.