The sound economy of 2025 is being redefined by a quiet but powerful revolution: fractional music royalties. In this new landscape, blockchain technology is democratizing what was once an exclusive asset class, empowering both artists and everyday investors to participate in the future earnings of music. No longer do you need to be a record label executive or a hedge fund manager to invest in music royalties. Today, anyone with an internet connection and a crypto wallet can own a piece of their favorite song, and share in its success.

How Fractional Music Royalties Work

At the heart of this transformation is the process of tokenizing music rights. Platforms such as Royal.io, Anotherblock, and Fractis allow artists to issue digital tokens representing fractional ownership of streaming royalties. These tokens are traded on-chain, making music royalty investing accessible and liquid for all.

When you buy a fraction of a song’s royalty rights, you are entitled to a proportional share of the revenue generated from streams, downloads, and sync licenses. Smart contracts automate the tracking and distribution of these payments, ensuring transparency and eliminating disputes. For example, Royal. io’s partnership with Nas generated over $500,000 in royalty-based token sales within its first week, a clear signal that fans are eager to become stakeholders rather than just passive listeners.

The New Investment Frontier: Platforms Leading the Charge

The movement toward on-chain music rights is being championed by several innovative platforms:

Top Platforms Pioneering Fractionalized Music Royalties

-

Royal.io: Co-founded by DJ and producer Justin “3LAU” Blau, Royal.io empowers artists to tokenize their royalty rights and offer fans direct fractional ownership in songs. Notably, rapper Nas used Royal to sell streaming royalty rights, generating significant new revenue and making fans true stakeholders in his music.

-

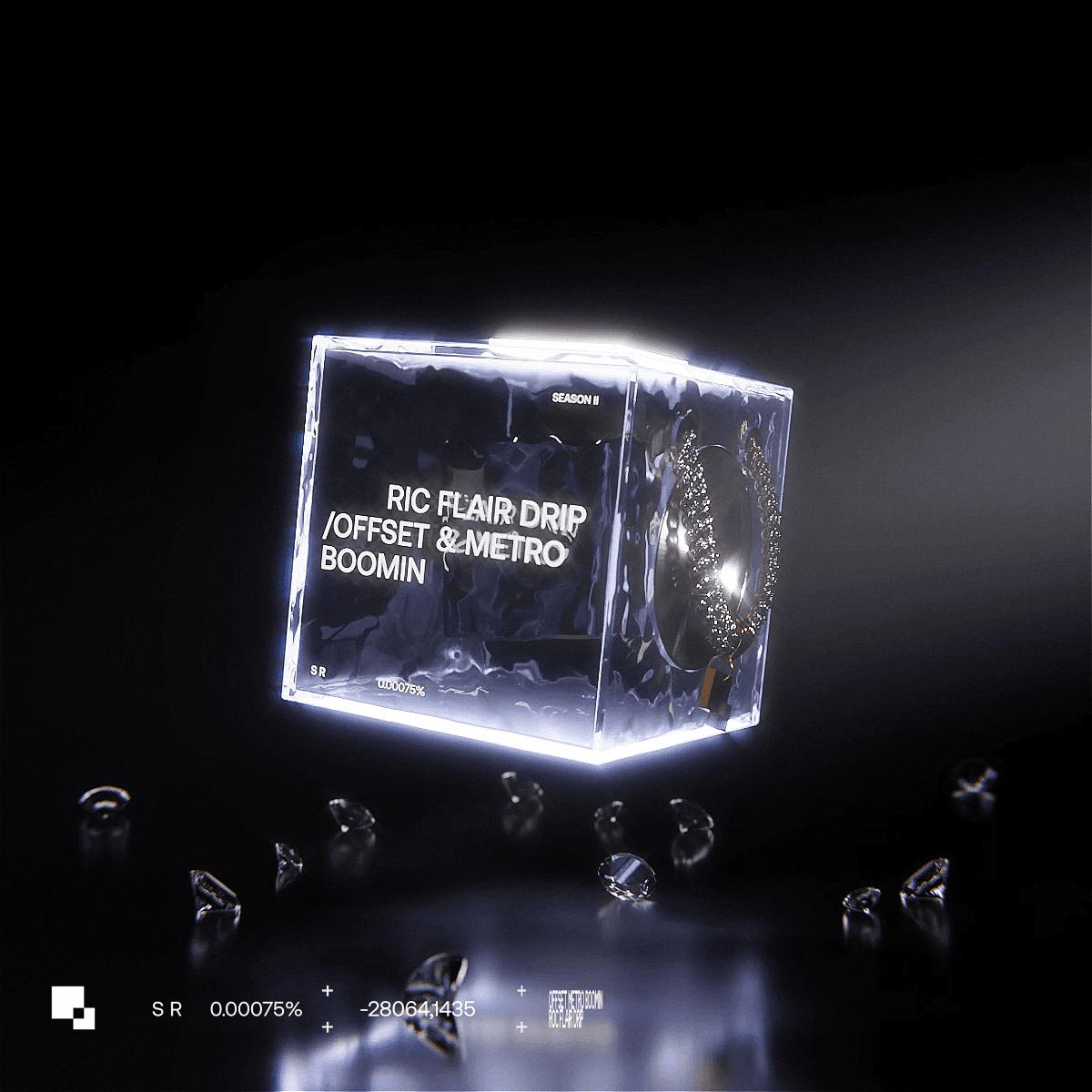

Anotherblock: Anotherblock specializes in fractionalizing streaming royalties as NFTs, allowing fans and investors to own portions of master streaming rights. Artists like The Weeknd and R3hab have partnered with the platform, giving collectors regular payouts based on streaming revenue and fostering direct artist-fan financial connections.

-

Fractis: Fractis enables artists to sell a share of their streaming royalties as NFTs, providing immediate funding while letting fans earn a portion of ongoing revenue. This model strengthens artist-fan relationships and opens up music investment to a wider audience.

-

Artyfile: Artyfile offers Limited Edition music NFTs that represent fractional ownership in master recordings. Investors earn both streaming revenue and synchronization fees, transforming music rights into a tangible, tradable asset class.

Royal.io, co-founded by DJ 3LAU, lets fans invest directly in songs through tokenized shares. Anotherblock issues NFTs representing master streaming rights; collectors receive regular payments based on actual streaming data (source). Fractis enables artists to sell portions of their streaming royalties as NFTs to fans who then earn recurring revenue, a win-win model that combines immediate funding for creators with passive income opportunities for supporters.

Why Investors Are Flocking to Fractionalized Music Royalties in 2025

This shift isn’t just about accessibility, it’s also about performance and diversification. The global market for music NFTs surged to $72 million in 2023, with forecasts pointing toward more than $1 billion by 2033 (source). As platforms like Sonomo and ANote Music emphasize, recurring income from music royalties often remains resilient even during economic downturns.

Key benefits fueling investor interest include:

- Increased liquidity: Tokenization allows for rapid trading on secondary markets, no more waiting months or years for payouts or catalog sales (source).

- Enhanced fan engagement: Fans are no longer just consumers; they’re co-investors whose support can directly impact a song’s popularity, and their own returns.

- Automated revenue distribution: Smart contracts ensure that every stakeholder receives their fair share quickly and transparently.

- Diversification: Investors can build balanced portfolios across genres, eras, and risk profiles, something previously unimaginable outside major industry circles.

This new era of blockchain music investing is not only empowering artists with new funding models but also giving rise to a generation of fans who are financially invested in the cultural works they love. The result? A more transparent, inclusive sound economy, one where value flows seamlessly between creators and communities alike.

As the sound economy of 2025 matures, the ripple effects of fractional music royalties are being felt across both investment and creative spheres. This model is giving rise to a dynamic new class of music stakeholders: fans, retail investors, and even DAOs, all participating in the upside of global streaming growth. The transparency and accessibility provided by on-chain music rights are fueling a virtuous cycle, more capital for artists, more diversified returns for investors, and a deeper alignment between creators and their communities.

“Fractionalized royalties are not just a financial innovation, they’re reshaping how we value art and participation in music culture. “

The Mechanics of Passive Income: What Investors Need to Know

Unlike traditional equity or real estate assets, music royalties offer recurring income streams that are often uncorrelated with broader market cycles. Platforms like Sonomo and ANote Music highlight that these cash flows can deliver monthly dividends, sometimes outperforming more volatile asset classes during periods of economic uncertainty. For those seeking to invest in music royalties, understanding catalog performance metrics (such as stream counts, sync placements, and historical earnings) is critical. On-chain analytics tools now allow for real-time tracking of song revenue, providing a level of transparency previously unavailable in the opaque world of publishing contracts.

Risks and Rewards: Navigating the 2025 Landscape

No investment is without risk. While blockchain-based royalty shares offer liquidity and automation, factors such as changing streaming rates, copyright disputes, or shifts in consumer taste can impact returns. However, the ability to build diversified portfolios, across genres, time periods, or even individual songs, mitigates some of these risks. The most successful investors in 2025 are those leveraging data-driven tools to assess catalog quality and platform reliability before allocating capital.

The proliferation of Royal.io, Anotherblock, Fractis, Sonomo, Bolero, and others has also spurred healthy competition among platforms to improve user experience and security standards. As smart contract infrastructure matures further this year, expect even greater automation in royalty splits, and fewer administrative headaches for both artists and investors.

The Future Sound Economy: Where Do We Go From Here?

The projected growth from $72 million in 2023 toward a $1 billion and market by 2033 (source) is more than just a bullish forecast, it’s evidence that blockchain music investing is rapidly gaining mainstream traction. As more catalogs become tokenized on-chain and as secondary markets mature, expect increased liquidity events for early adopters as well as new opportunities for latecomers seeking exposure to this emerging asset class.

Would you consider investing in fractionalized music royalties in 2025?

Fractionalized music royalties let fans and investors own a portion of music rights and earn revenue from streams, thanks to blockchain platforms like Royal.io, Anotherblock, and Fractis. With increased liquidity, transparent payments, and deeper fan engagement, this market is growing fast. Would you take part in this new way to invest in music?

If you’re considering joining this movement, whether as an artist seeking alternative funding or an investor eager for passive income, the time has never been better to explore fractional ownership models. The convergence of blockchain transparency with the cultural power of music is unlocking value previously trapped by legacy intermediaries. By embracing on-chain innovation today, you help shape a fairer sound economy where creativity and capital work hand-in-hand.