For investors seeking predictable music royalty income without the volatility of crypto assets or the uncertainty of traditional music deals, the OVAULT model from Opulous has emerged as a compelling solution. By staking USDC stablecoins, participants can access yields up to 10% APY, all powered by revenue from an expanding catalog of tokenized music royalties. In a landscape where real-world assets are increasingly being brought on-chain, OVAULT is at the forefront of merging blockchain transparency with the enduring value of legendary and contemporary music catalogs.

How OVAULT Turns Stablecoins Into Music-Backed Yield

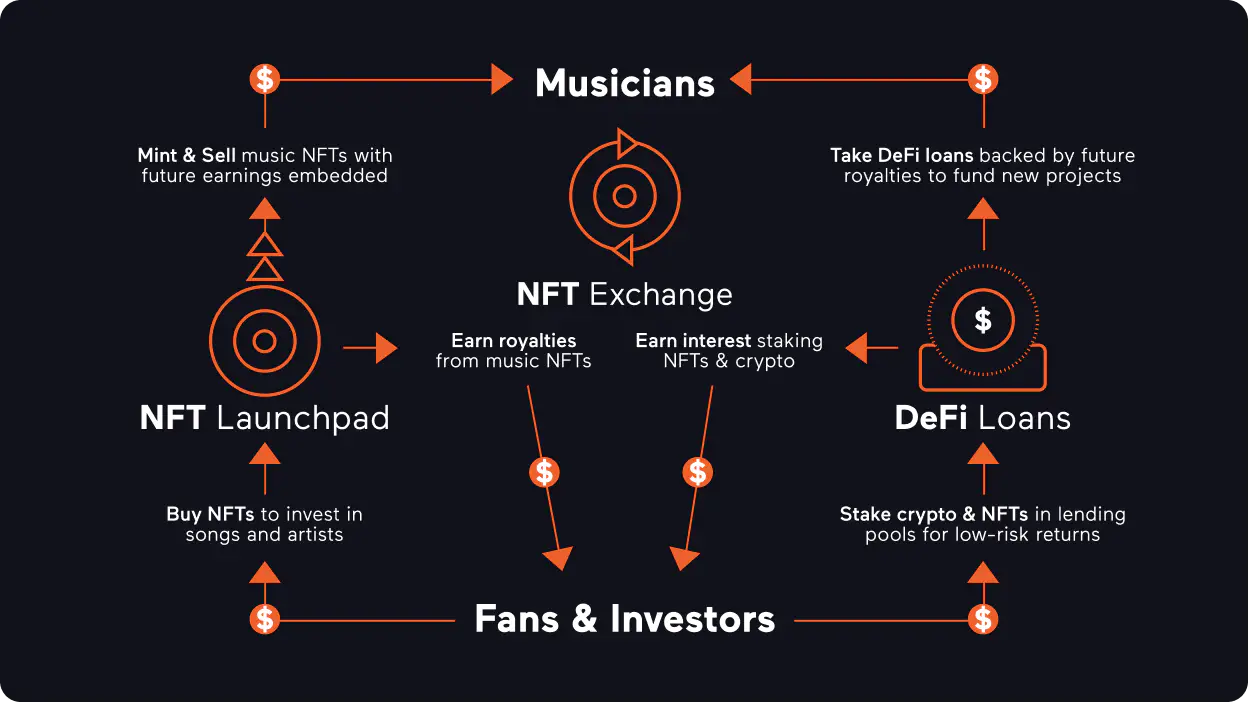

The mechanics behind music royalty staking USDC are refreshingly straightforward yet innovative. Investors deposit USDC into the OVAULT pool and receive liquid staking tokens representing their share. These funds are used to finance royalty advances and purchase stakes in high-performing music catalogs, including works from icons like Michael Jackson, Mariah Carey, Prince, and BTS. As these assets generate revenue through streaming and licensing, proceeds flow back into the pool. The result: holders of OVAULT tokens see their value increase over time as royalties accumulate.

This approach leverages two key strengths:

- Stability: USDC is a fully-backed stablecoin pegged to the dollar, minimizing crypto price risk.

- Diversification: With over 300 titles spanning genres and eras, returns are not dependent on any single artist or trend.

The APY is variable but has remained close to 10%, according to recent platform data (source). This yield is funded by actual royalty earnings rather than speculative DeFi incentives, making it unusually robust in today’s market.

The Evolution: Merging OLOAN and Expanding Catalogs

In early 2024, Opulous merged its OLOAN product into OVAULT, an important move that consolidated liquidity and streamlined user experience. Now all participants benefit from both direct catalog investments and short-term advance deals with artists or rights holders. This integration has made it easier for investors to deploy capital efficiently while enjoying exposure to a wider range of royalty streams.

Crucially, Opulous continues to expand its offering. As of September 2025, its catalog features more than 300 titles spanning pop legends and modern superstars alike (source). This diversification is vital for maintaining stable returns even if individual songs or artists fluctuate in popularity.

Key Benefits of Staking USDC in OVAULT vs Traditional DeFi Yield Farms

-

Stable, Music-Backed Yields: OVAULT rewards are powered by real-world music royalties from over 300 catalog titles, including legendary artists like Michael Jackson and BTS, offering a more predictable APY compared to volatile DeFi farms.

-

Attractive APY up to 10%: OVAULT provides an annual percentage yield of approximately 10%, derived from music advances and catalog revenue, which is generally higher and more stable than most traditional DeFi yield farms as of September 2025.

-

Enhanced Liquidity and Flexibility: The integration with PolyTrade allows OVAULT token holders to access secondary markets, making it easier to trade or exit positions compared to many DeFi farms with lock-up periods.

-

Real-World Asset Exposure: By staking in OVAULT, investors gain exposure to the growing music royalties sector, a real-world asset class, rather than relying solely on crypto-native lending or liquidity pools.

-

Transparent and Audited Platform: OVAULT operates under the Opulous ecosystem, which is known for its transparency and regular reporting, offering greater confidence and oversight than many anonymous DeFi yield farms.

How To Start Staking USDC For Music Royalties

The process for getting started with OVault music yields is designed for both crypto natives and newcomers:

- Create an account and complete KYC: Regulatory compliance ensures a secure environment for all users.

- Deposit USDC: Funds can be added directly from your wallet to the platform’s smart contract pool.

- Receive liquid staking tokens: These represent your proportional claim on pooled assets and future royalties.

- Earnings accrue automatically: As music deals pay out royalties or advances are repaid with interest, your stake grows over time.

- Liquidity options: Thanks to partnerships like PolyTrade, secondary market trading provides additional flexibility if you need to exit early (source).

This simplicity stands in stark contrast to many DeFi protocols that require constant monitoring or complex strategies. Here, yield is driven by real-world consumption, people listening to their favorite songs, rather than speculative tokenomics.

Another advantage is transparency. Every transaction, from royalty advance funding to catalog acquisition and payout, is recorded on-chain. This gives investors a clear view of how their staked USDC is being deployed and how returns are generated, an assurance rarely found in off-chain music rights deals.

Unlike traditional music investing, where minimums are high and liquidity can be limited for years, OVAULT’s liquid staking model means you can adjust your position as market conditions or personal needs change. This flexibility is enhanced by the growing secondary market for OVAULT tokens, where buyers and sellers can transact without waiting for catalog sales or contract expirations.

Risks and Considerations

No investment is without risk, even one built on stablecoins and real-world assets. While USDC minimizes crypto volatility, yields remain variable depending on the performance of underlying music catalogs and the pace of royalty collections. There’s also smart contract risk, though Opulous has undergone regular audits, it’s crucial to understand that blockchain-based platforms carry inherent technical vulnerabilities.

Regulatory changes in digital assets or stablecoins could also impact platform operations in the future. As always, investors should perform their own due diligence and consider portfolio allocation carefully before committing significant capital.

Who Should Consider Music-Backed Stablecoin Staking?

The OVAULT approach suits a range of profiles:

- Yield-seeking DeFi users who want less exposure to volatile governance tokens

- Music fans interested in supporting artists while earning passive income

- Traditional investors looking for blockchain music investment with real-world backing

- NFT collectors seeking new ways to diversify into income-generating assets

This model bridges the gap between inflation-prone fiat savings accounts and high-risk DeFi protocols by offering a predictable return tied to an asset class with decades of proven value.

What Sets OVAULT Apart?

The combination of stablecoin staking, blue-chip music catalogs, transparent on-chain accounting, and liquid secondary markets sets OVAULT apart from both legacy music funds and typical crypto yield farms. The ability to earn up to 10% APY, backed by streaming revenue from global hits rather than speculative trading fees or inflationary token models, marks a significant evolution in decentralized finance.

Iconic Artists Featured in the OVAULT Pool

-

Michael Jackson — The King of Pop’s legendary catalog, including hits like Billie Jean and Thriller, is a cornerstone of the OVAULT pool, offering exposure to some of the most enduring music royalties in history.

-

Mariah Carey — With chart-topping classics such as All I Want for Christmas Is You, Mariah Carey’s catalog adds significant value and seasonal royalty stability to the pool.

-

Whitney Houston — The timeless appeal of Whitney Houston’s hits like I Will Always Love You contributes to consistent royalty flows for OVAULT participants.

-

Prince — Prince’s influential and diverse body of work, including songs like Purple Rain, is featured in the OVAULT pool, enhancing its diversity and long-term earning potential.

-

Phil Collins — The catalog of Phil Collins, known for both his solo work and contributions to Genesis, provides a steady stream of royalties from global classics.

-

BTS — As contemporary icons, BTS’s catalog brings modern, global pop appeal and robust streaming revenues to the OVAULT pool.

The future will likely see further integration between blockchain infrastructure and real-world entertainment assets. For now, platforms like OVAULT demonstrate that predictable income streams, once reserved for major labels or private equity, are increasingly accessible to everyday investors through fractionalized ownership models.