Imagine earning a share of streaming royalties every time your favorite song is played on Spotify, Apple Music, or YouTube, without ever stepping into a studio. Thanks to blockchain technology and the rise of tokenized music royalties, this vision is now accessible to everyday investors. By leveraging decentralized platforms, you can invest in music royalties on blockchain and build a portfolio designed for passive income, all while supporting the artists you love.

What Are Tokenized Music Royalties?

Tokenized music royalties are digital assets that represent fractional ownership in the revenue streams generated by songs or entire catalogs. Through IP tokenization, rights holders convert their music assets into blockchain-based tokens. Each token entitles its holder to a proportional share of future royalty payments, whether from streaming, downloads, or licensing deals. This process not only democratizes access to an asset class once reserved for industry insiders but also brings transparency and automation via smart contracts.

For example, platforms like Bolero, Anotherblock, and Ripe Capital have pioneered models where users can buy tokens linked to established hits or curated indices. As these songs generate income across various channels, token holders receive distributions, often weekly or monthly, directly to their wallets.

The Platforms Powering Blockchain Music Royalty Investments

The landscape for investing in fractional music royalty ownership has evolved rapidly since 2023. Here are some notable platforms transforming how fans and investors access music revenue:

Top Blockchain Platforms for Tokenized Music Royalties

-

Royal: Co-founded by musician Justin Blau (3LAU), Royal enables users to buy tokens representing shares of streaming royalties from songs by artists like Nas and Diplo. Investors earn passive income as the music generates revenue.

-

Anotherblock: Anotherblock allows artists to sell fractions of their streaming royalties as NFTs. Investors purchase these NFTs to receive a portion of the music’s ongoing revenue.

-

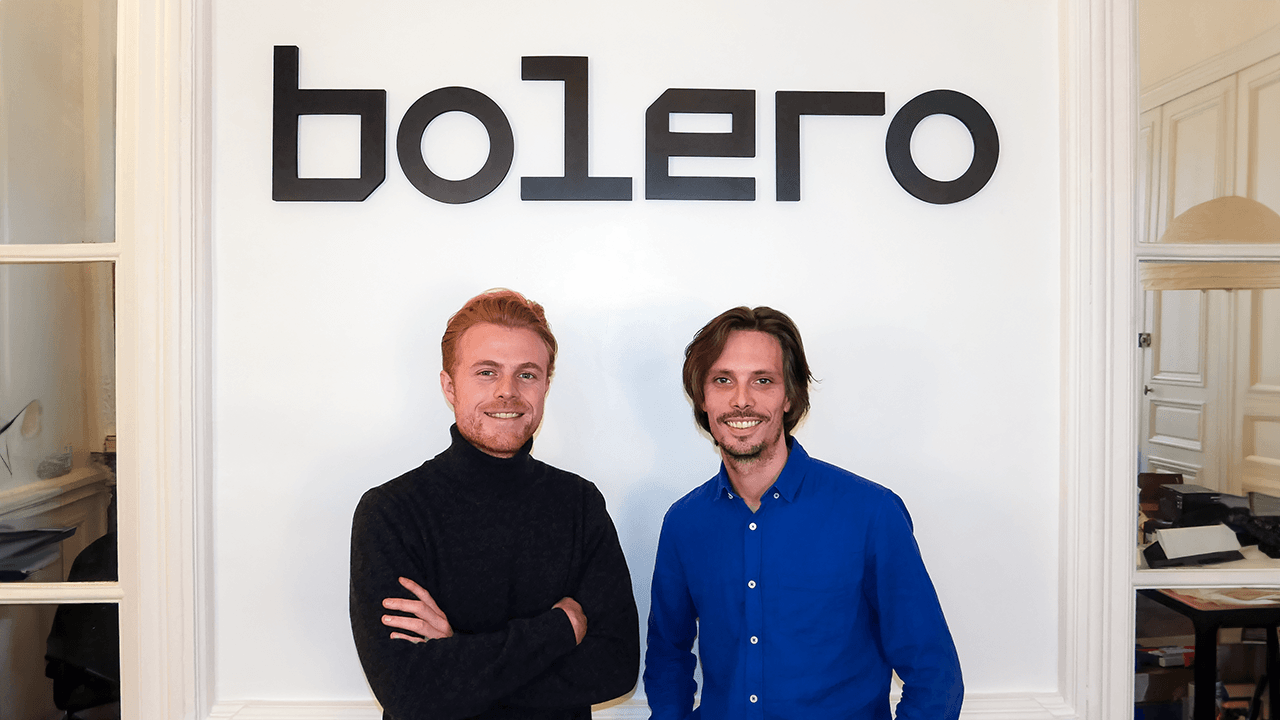

Bolero: Bolero focuses on tokenizing master recording rights, offering investors the chance to earn royalties from multiple revenue streams, including physical sales, digital downloads, and sync licensing.

-

Ripe Capital: Ripe Capital offers investment in curated music indices, providing diversified exposure to music royalties. The platform reports an annualized yield of 27% since its October 2023 launch, with weekly royalty distributions.

-

Joint Investment Streaming Platform (JIS Platform): JIS Platform lets users invest in royalties from specific songs, such as Justin Bieber’s “As Long As You Love Me.” Investors purchase shares and receive monthly income based on song performance.

Royal: Co-founded by DJ 3LAU, Royal lets users buy shares of streaming royalties from high-profile artists like Nas and Diplo.

Anotherblock: Offers NFT-based fractions of streaming rights from top-charting tracks.

Bolero: Focuses on master recording rights with exposure to multiple revenue streams.

Ripe Capital: Provides diversified indices with reported annualized yields as high as 27% since October 2023.

Joint Investment Streaming Platform (JIS): Allows direct investment into specific songs, such as Justin Bieber’s “As Long As You Love Me”: with monthly income based on performance.

This ecosystem empowers both seasoned investors and newcomers to participate in the potential upside of the global music business without needing deep industry connections.

The Process: How to Start Earning Passive Income via Music NFTs

Earning passive income through blockchain music royalty platforms is more straightforward than many anticipate. Here’s how it typically works:

- Research Platforms: Compare offerings from Royal, Anotherblock, Bolero, Ripe Capital, and JIS for fit with your goals.

- Create an Account: Register and complete any required identity verification.

- Add Funds: Deposit fiat or crypto depending on platform requirements.

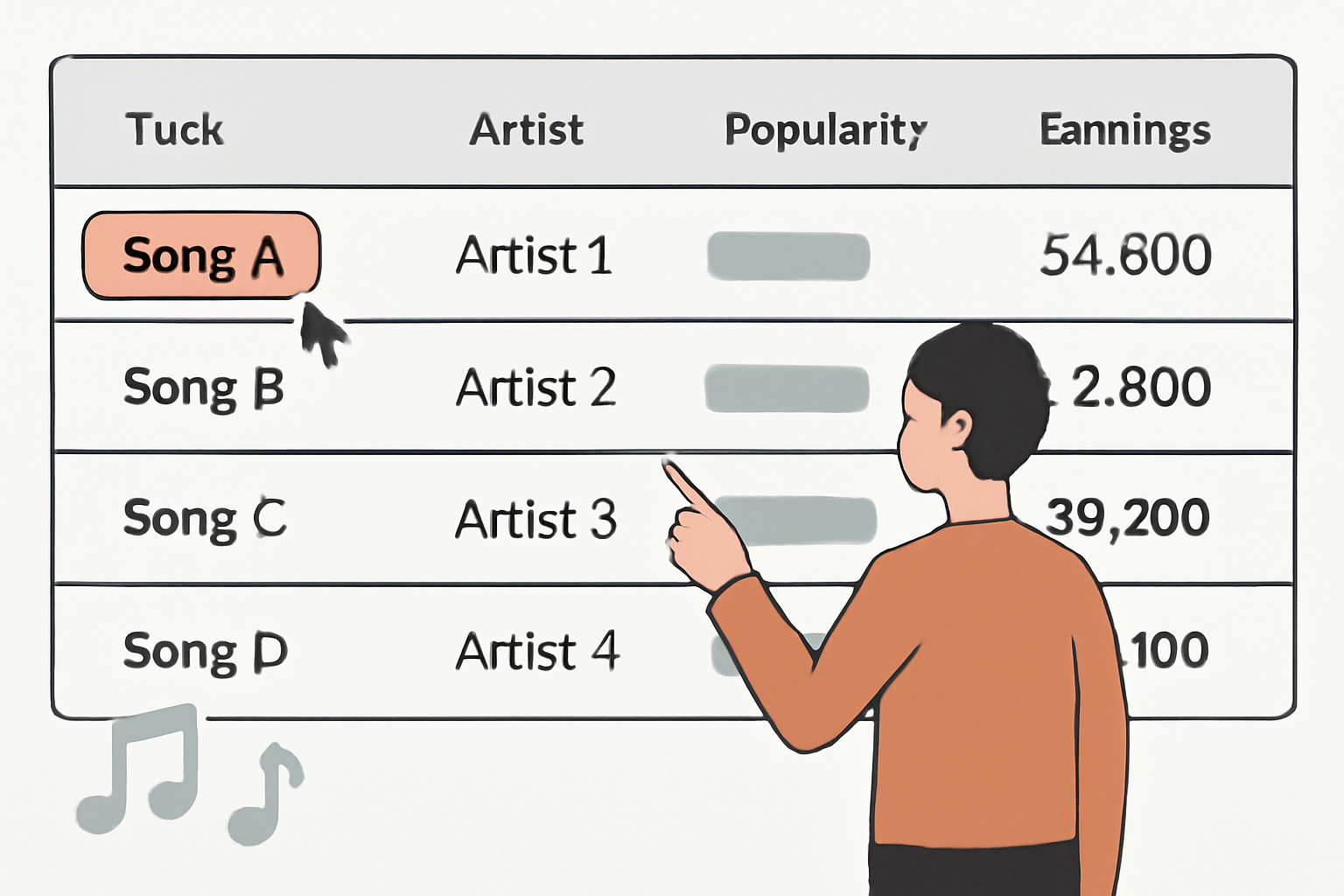

- Select Assets: Browse available tracks or indices; review artist popularity and historical earnings data.

- Purchase Tokens: Acquire your share(s) representing actual royalty rights.

- Sit Back and Earn: Collect your portion of royalties automatically as earnings are distributed by smart contract.

- (Optional) Trade Tokens: Use secondary markets if you want to adjust your holdings or exit positions early.

The barrier to entry is lower than ever before, many platforms allow investments starting at just $100, and ongoing management is minimal compared to traditional real estate or stock portfolios. The core appeal? Your returns are tied directly to real-world consumption of popular music across global markets rather than speculative hype alone.

As you build your portfolio of tokenized music royalties, it’s important to understand the factors that influence your returns and how to optimize your passive income strategy. Unlike volatile crypto assets, music royalties are driven by consistent, real-world demand: whenever a track is streamed, downloaded, or licensed for film and advertising, revenue flows back to rights holders and investors. This creates a unique opportunity for diversification, music royalties often have low correlation with traditional equity or crypto markets.

Maximizing Returns and Managing Risk

To maximize returns from fractional music royalty ownership, consider diversifying across genres, artists, and revenue streams. Platforms like Ripe Capital offer curated indices that spread risk across multiple songs and catalogs. Meanwhile, platforms such as Bolero empower you to handpick tracks or catalogs that align with your personal taste or market research. Remember: past performance doesn’t guarantee future results. A hit song can generate impressive yields one year but taper off the next as trends shift.

Smart contracts underpinning these platforms ensure transparency, royalty payments are distributed automatically based on predefined logic, reducing the risk of human error or delayed payouts. However, liquidity is not always guaranteed; while some platforms have active secondary markets for trading tokens, others may require you to hold until a set exit period.

Regulatory Landscape and Platform Security

As with any emerging asset class, staying informed about the regulatory environment is crucial. Jurisdictions differ on how they treat tokenized assets and NFTs representing royalty rights. Reputable blockchain music royalty platforms implement robust KYC (Know Your Customer) processes and comply with local regulations where possible, but it’s wise to review terms of service and legal documentation before investing significant capital.

Security is another priority: choose platforms with transparent smart contract audits and a proven track record of safeguarding user funds. Read platform reviews, join community forums, and ask questions about custody solutions for both fiat deposits and crypto wallets.

The Future of Passive Income in Web3 Music Markets

The intersection of AI-driven analytics and blockchain automation is accelerating innovation in this space. Platforms are beginning to use AI to forecast streaming trends or identify undervalued catalogs, potentially giving early investors an edge in building sustainable passive income streams from music NFTs.

The appeal goes beyond financial returns: by investing in tokenized music royalties, you become part of an ecosystem that empowers artists directly while benefiting from global consumption patterns. As Web3 entertainment matures into 2025 and beyond, expect increased liquidity for music tokens, more sophisticated indices tailored to investor risk profiles, and new ways for fans to engage with creators through fractional ownership models.

If you’re ready to explore this innovative asset class further, or simply want a new way to support your favorite musicians, there’s never been a better time to start building passive income through blockchain-enabled royalty markets. Do your research, diversify thoughtfully, monitor your investments regularly, and let the world’s playlists work for you.