Blockchain technology is rapidly transforming the music industry, offering new ways for artists, fans, and investors to interact with music assets. One of the most significant innovations is fractional ownership of music royalties through blockchain-powered NFTs. This model empowers anyone to buy a share in a song’s future earnings, unlocking fresh revenue streams for creators and democratizing access to music investing.

From Gatekeepers to Decentralized Markets: How Blockchain Changes Music Royalties

Traditionally, royalty streams from popular songs were controlled by record labels, publishers, and a handful of institutional investors. Artists often saw only a fraction of the profits generated by their work. Blockchain disrupts this closed system by allowing rights holders to tokenize their royalties, dividing them into digital shares that can be bought and sold by anyone on-chain.

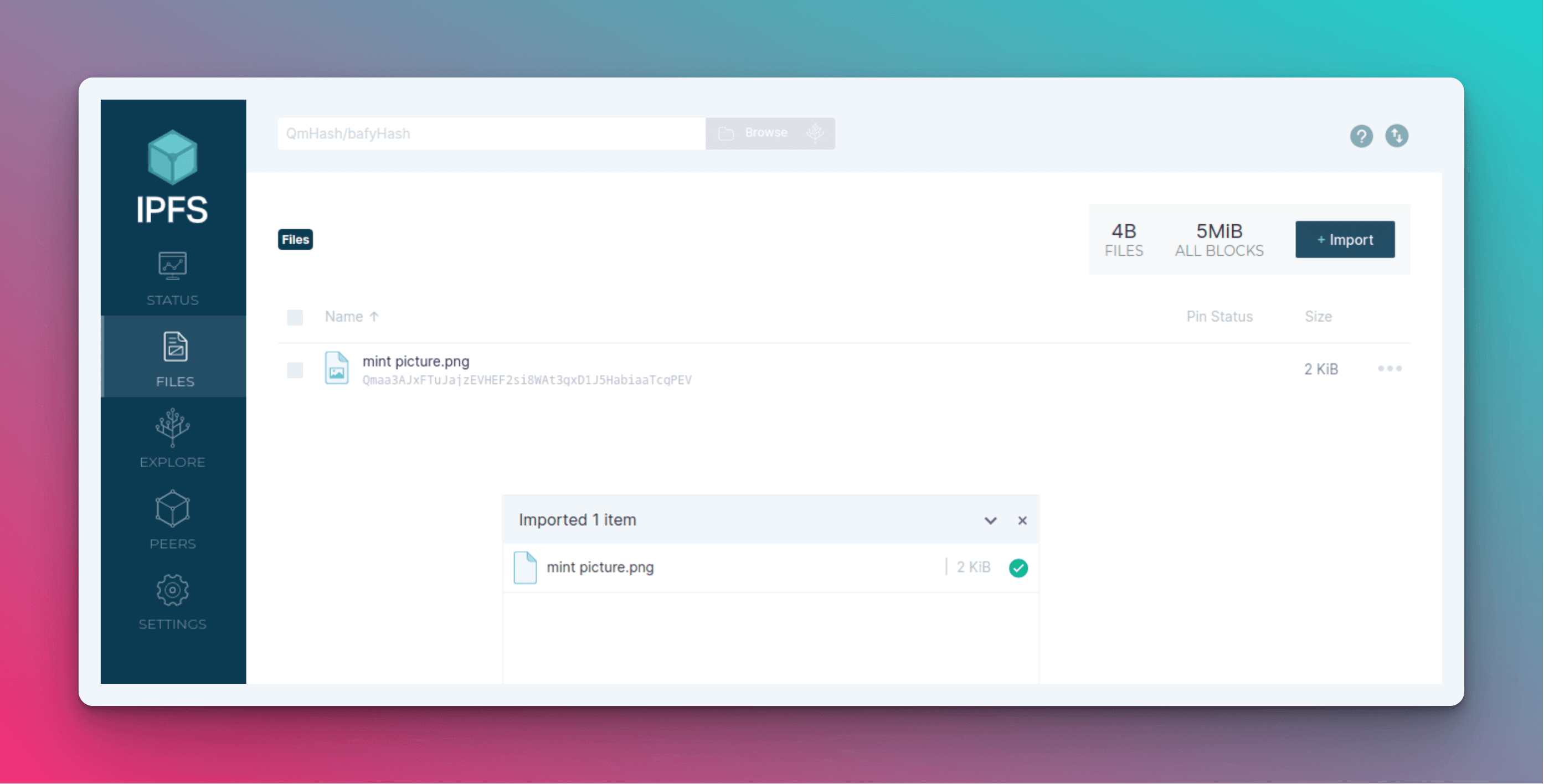

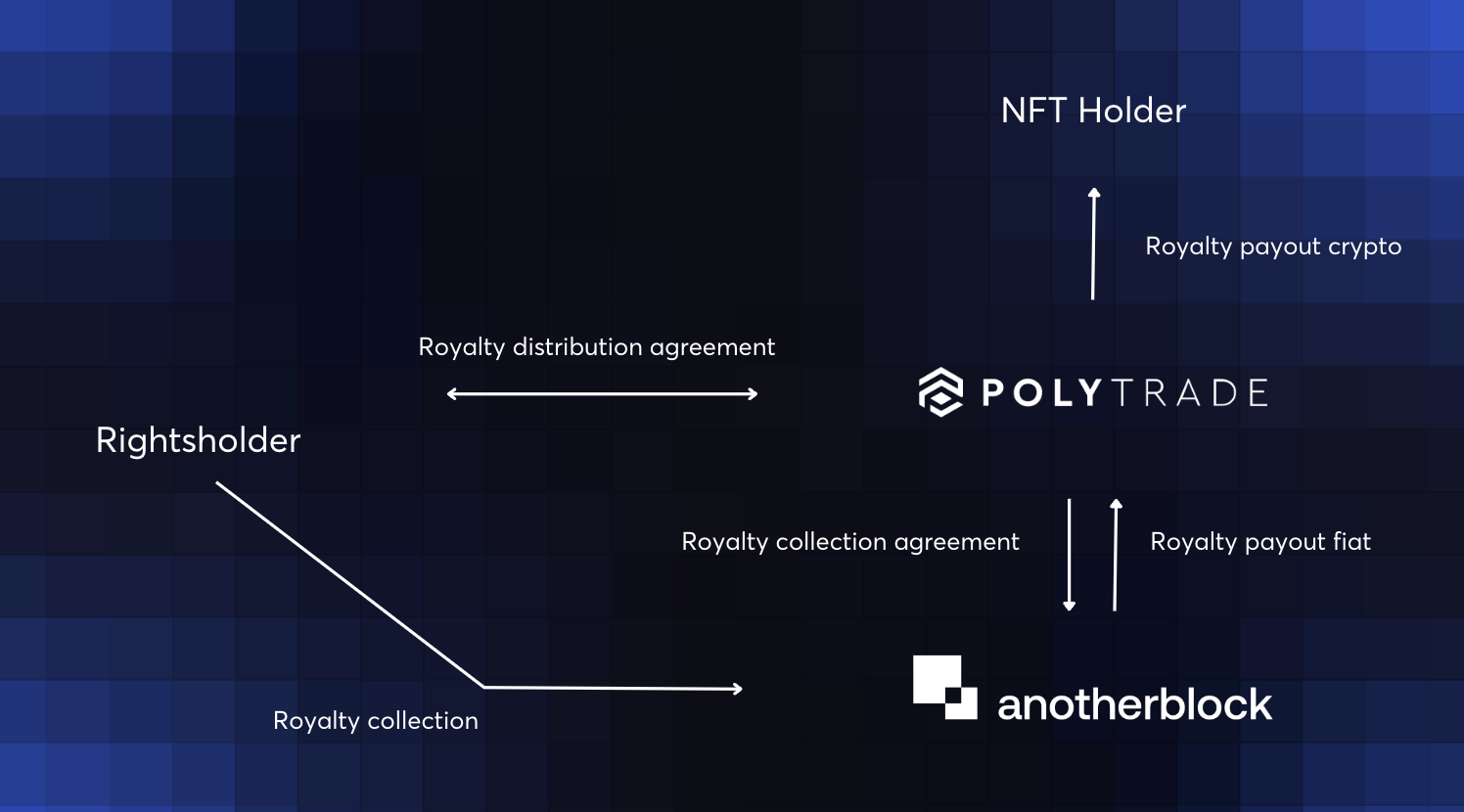

This process is already live on platforms like Royal, Anotherblock, and Bolero. Here’s how it works: an artist or rights holder decides to sell a portion of their royalty stream. That portion is converted into NFTs – each representing a fractional claim on future revenues from streaming, licensing, or other uses. Investors purchase these NFTs and receive payouts proportional to their share whenever royalties are distributed.

The Mechanics: Tokenization vs. NFTs in Music Royalty Markets

The terms tokenization and NFTs are sometimes used interchangeably but have distinct meanings in this context:

- Tokenization: The process of converting real-world assets (like royalty rights) into digital tokens that represent ownership or economic interest.

- NFTs (Non-Fungible Tokens): Unique blockchain tokens that can represent individual shares of music royalties – each NFT is distinct and traceable back to its specific slice of revenue.

This distinction matters for investors looking at NFT music investing opportunities. While tokenization can also use fungible tokens (where each unit is identical), NFTs allow for more granular tracking of ownership and can embed additional rights or perks for holders.

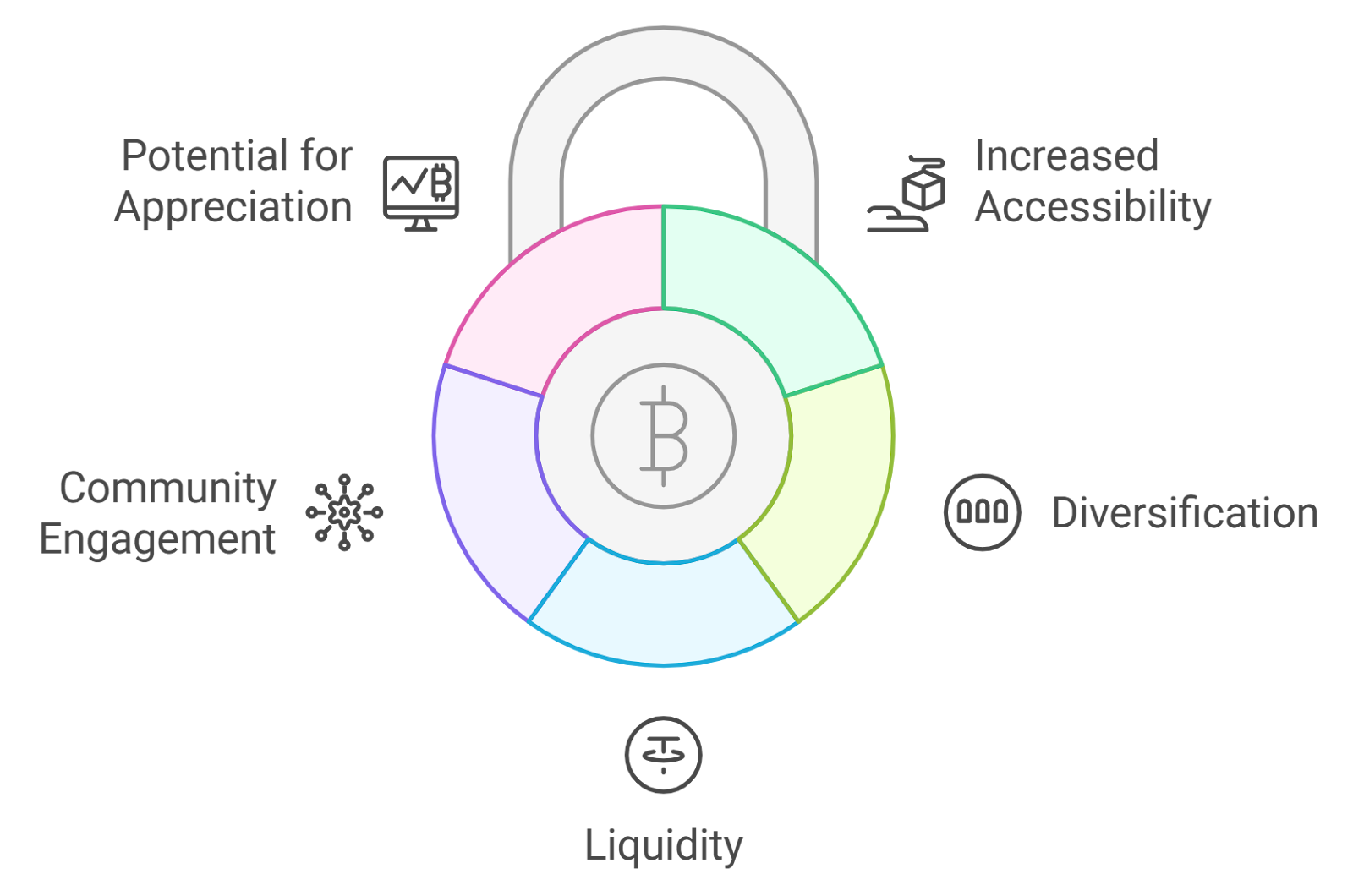

Key Benefits of Fractional Music Royalties for NFT Investors

-

Access to High-Value Music Assets: Platforms like Royal and Anotherblock allow investors to purchase fractional ownership in songs by top artists, democratizing access to previously exclusive revenue streams.

-

Regular Royalty Payouts: NFT holders receive proportional streaming royalty payments based on their share of the music rights, providing a potential source of passive income.

-

Transparency and Security: Blockchain technology ensures all royalty transactions are recorded immutably, reducing disputes and increasing trust among investors and artists.

-

Tradable Assets: Music royalty NFTs can be bought, sold, or traded on secondary marketplaces, offering liquidity and flexibility for investors.

-

Direct Artist Support: By purchasing fractional music royalties, investors support artists directly, helping them retain more control and a larger share of profits compared to traditional music industry models.

-

Diversification of Investment Portfolio: Music NFTs offer a non-correlated asset class, allowing investors to diversify beyond traditional stocks and cryptocurrencies.

Investor Benefits: Transparency, Access, and Liquidity

The rise of tokenized music royalties via NFTs brings several advantages for both artists and investors:

- Transparency: Blockchain ledgers make all transactions public and immutable, reducing disputes over payments.

- Direct Access: Fans can directly support artists they believe in while sharing in their success through royalty payouts.

- Liquidity: Unlike traditional rights deals that lock up capital for years, NFT-based shares can be traded instantly on secondary markets.

- Diversification: Investors can build portfolios across genres or artists instead of betting everything on one catalog.

This shift isn’t just theoretical – it’s already generating real returns as platforms distribute streaming revenues directly to NFT holders using smart contracts. For an in-depth look at how these distributions work securely and efficiently thanks to blockchain transparency, see recent coverage at Artyfile’s blog.

Smart contracts are the backbone of this new ecosystem. They automate royalty calculations and distributions, ensuring payouts are accurate and timely without manual intervention. This automation reduces administrative friction and costs, further enhancing the appeal for both artists and investors. The result is a system that is not only more efficient but also more equitable, as every participant can verify payments on-chain.

Risks and Considerations: What NFT Investors Should Know

While fractional ownership music royalties offer compelling opportunities, it’s important to recognize the risks:

- Volatility: Streaming revenues can fluctuate based on trends, platform policies, or artist popularity.

- Regulatory Uncertainty: Laws governing tokenized assets are evolving. Jurisdictional differences may impact rights enforcement or taxation.

- Platform Risk: Not all marketplaces have equal security or transparency. Choose established platforms with robust smart contract audits.

- Liquidity Constraints: While NFTs are tradable, niche catalogs may not always have deep secondary markets.

Diversification remains key. Building a basket of different songs, genres, or artists can help manage risk while capturing upside from emerging talent or viral hits.

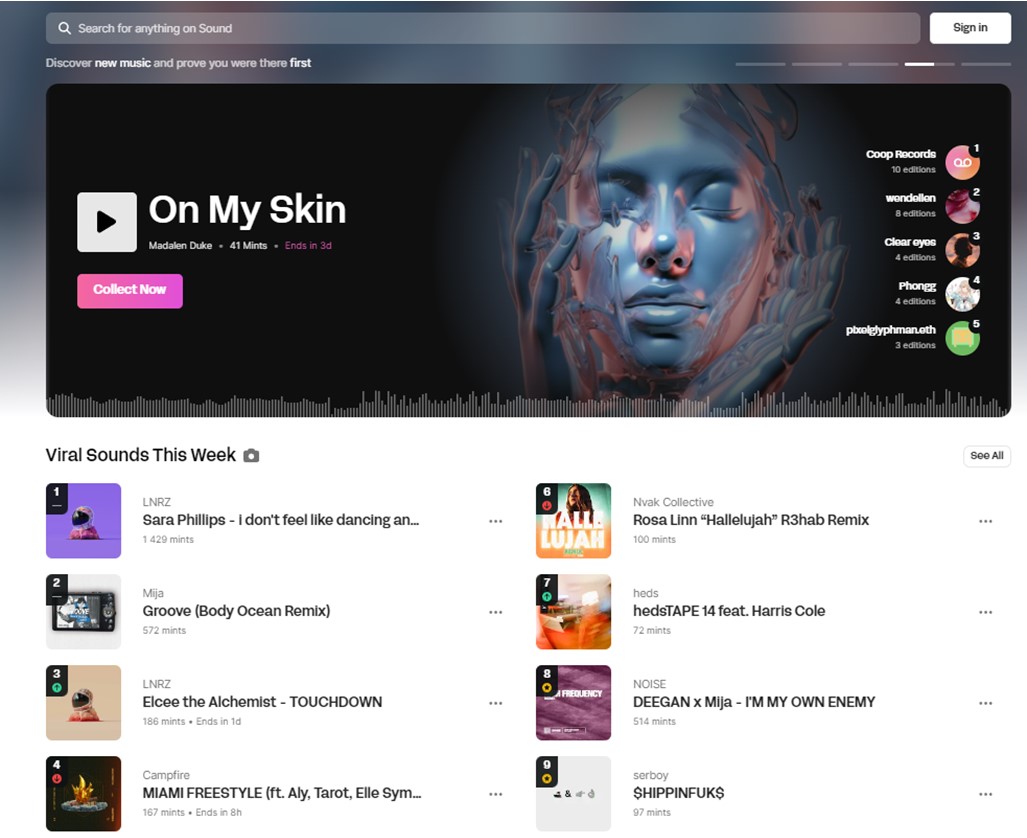

Top NFT Music Royalty Platforms in 2025

-

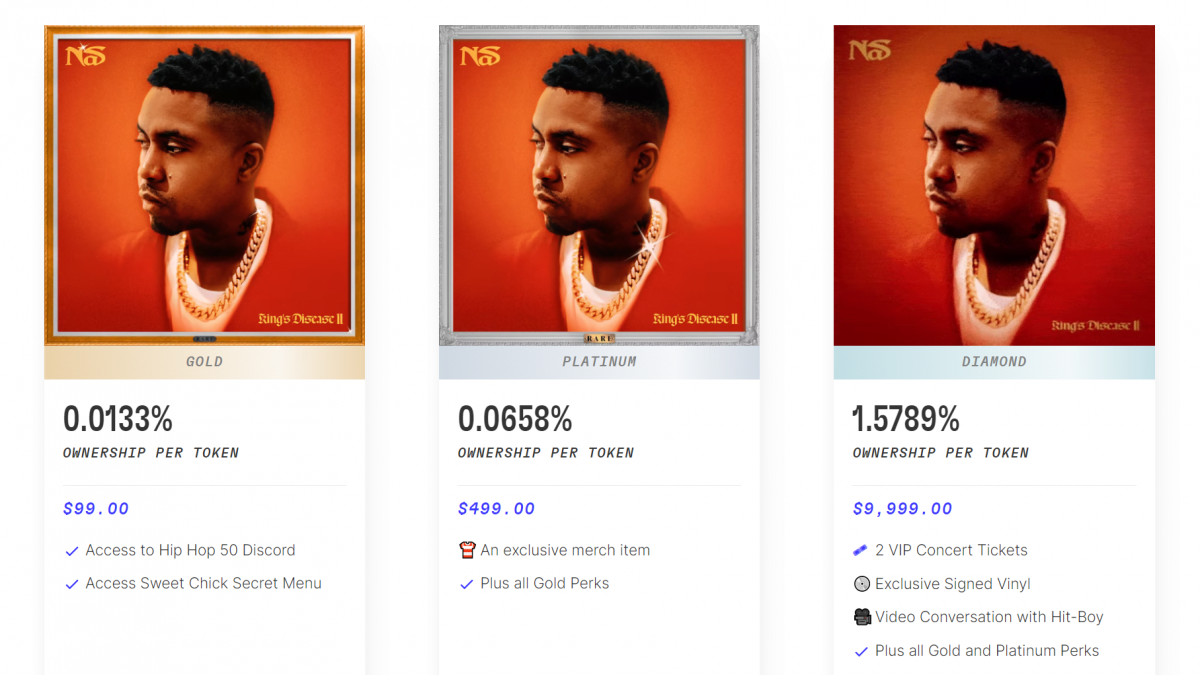

Royal — A leading platform where artists like 3LAU and Nas have sold fractionalized music royalties as NFTs, allowing fans and investors to earn a share of streaming revenue directly through blockchain-powered smart contracts.

-

Anotherblock — Known for collaborating with high-profile artists, Anotherblock enables users to purchase NFT-based royalty shares in tracks from musicians such as The Weeknd and Rihanna, with transparent royalty tracking and payouts.

-

Bolero — Bolero offers a user-friendly marketplace for buying and trading fractional music rights as NFTs, supporting both established and emerging artists while ensuring secure, automated royalty distributions.

-

Opulous — Specializing in music copyright NFTs, Opulous allows artists to tokenize their tracks, giving fans the opportunity to invest in music royalties and receive proportional streaming revenue payouts.

-

Artyfile — Artyfile provides a decentralized platform for investing in music NFTs, with a focus on transparency and regular royalty payments to token holders, helping democratize music investment for fans worldwide.

Looking Ahead: The Future of Music Royalty Markets

The landscape for blockchain music royalties continues to evolve rapidly. As more artists embrace direct-to-fan models and as regulatory clarity improves, expect broader adoption and innovation in how music rights are packaged and sold. Fractional ownership could soon extend beyond streaming royalties to sync licensing, live performance rights, and even merchandise revenue streams.

This democratization is already fostering a new kind of fan engagement, where listeners aren’t just passive consumers but active stakeholders in an artist’s success story. The potential for community-driven curation and funding is immense, with fans incentivized to promote the music they co-own.

For anyone considering NFT music investing today, the fundamentals remain clear: assess platform credibility, diversify holdings, understand smart contract mechanics, and stay informed about industry developments through resources like Cointelegraph. As with any emerging asset class, due diligence is essential, but for those willing to learn the ropes, blockchain-enabled fractional ownership offers a front-row seat to the future of music investing.