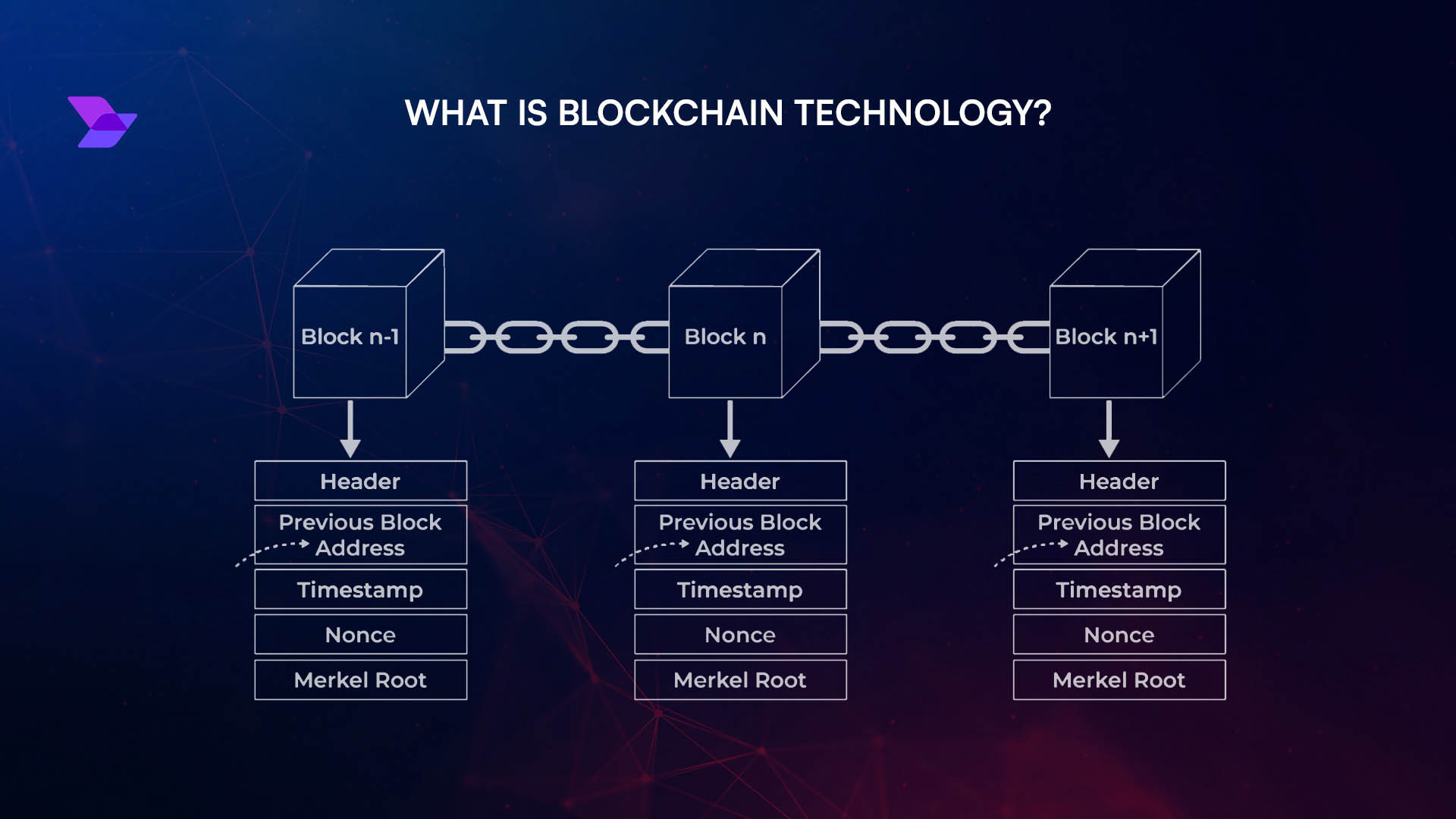

Blockchain technology is rapidly rewriting the rulebook for independent musicians, making what was once a labyrinth of middlemen and opaque contracts into a transparent, direct, and data-driven marketplace. By leveraging blockchain music royalties and NFT music platforms, indie artists are not just cutting out the old gatekeepers – they’re unlocking new revenue streams and forging deeper connections with fans.

Tokenized Music Ownership: The Data-Driven Revolution

The core innovation is tokenized music ownership. By converting songs or albums into NFTs (Non-Fungible Tokens), artists can sell fractional royalty rights directly to fans. This isn’t just hype – it’s quantifiable change. Consider Grammy-winning producer RAC’s 2024 drop on Sound. xyz: he earned 20 ETH in primary sales, which equaled approximately $68,000 at the time. For comparison, that’s the payout from nearly 7 million Spotify streams. And unlike streaming income, RAC also receives royalties every time those NFTs are resold on secondary markets.

This model flips the script on traditional music economics. Instead of waiting months for streaming payouts or losing margin to labels and aggregators, musicians receive funds instantly via smart contracts. Every transaction is immutably recorded on-chain, ensuring transparency and eliminating disputes over who gets paid what and when.

Direct Revenue for Musicians: Cutting Out the Middlemen

The blockchain ecosystem empowers independent artists in ways that were previously impossible:

Key Benefits of Blockchain Music Royalties for Indie Artists

-

Direct Monetization Through NFTs: Platforms like Royal.io empower artists to sell shares of their songs as NFTs, letting fans invest directly and earn a portion of royalties. This model fosters a more profitable and transparent relationship between musicians and their audience.

-

Enhanced Revenue Compared to Streaming: Independent artists such as RAC have generated significant income by releasing music NFTs. For example, RAC earned 20 ETH (approximately $68,000) from two NFTs on Sound.xyz—an amount that would require nearly 7 million Spotify streams to match.

-

Greater Control Over Rights and Royalties: Blockchain allows musicians to tokenize their work, define ownership terms, and automate royalty distribution via smart contracts. This reduces reliance on intermediaries and ensures artists receive a fair share of revenue.

-

Innovative Platforms Supporting Indie Musicians: Decentralized platforms like Audius, Sound.xyz, and Anotherblock enable artists to upload, tokenize, and sell their music directly, providing new avenues for fan engagement and funding.

-

Transparent and Automated Royalty Payments: Blockchain’s immutable ledger and smart contracts ensure royalty payments are distributed instantly and transparently, eliminating delays and disputes common in traditional royalty systems.

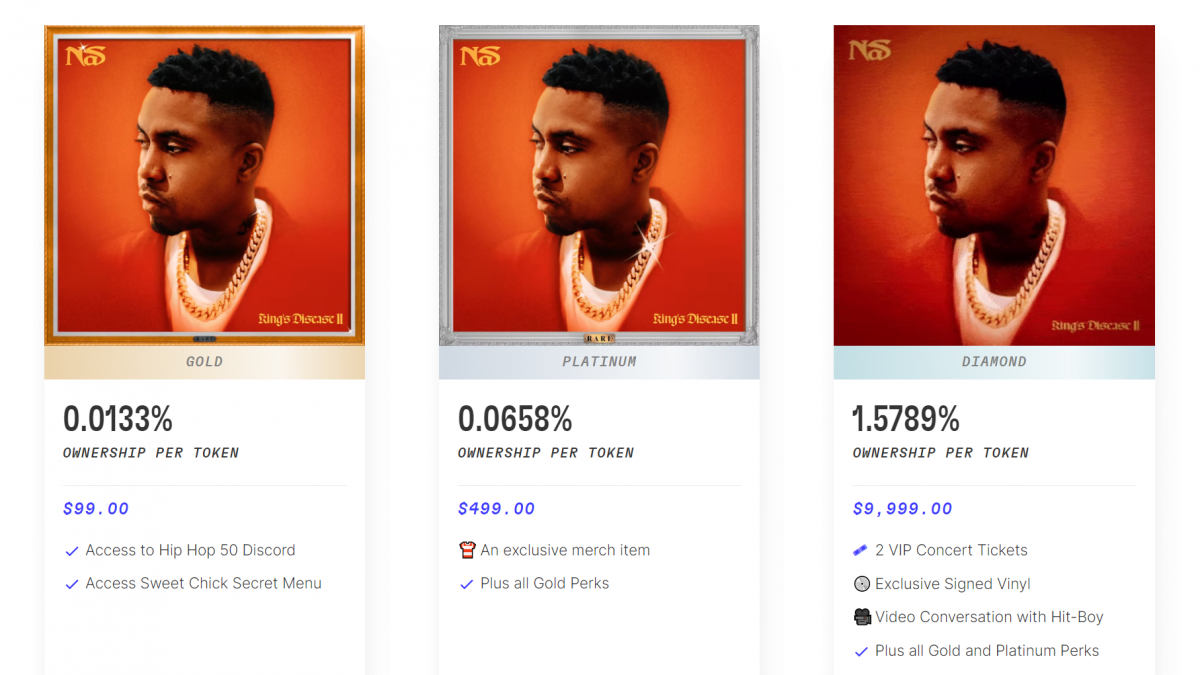

Platforms like Royal. io enable artists to sell portions of their streaming royalties as NFTs to fans who want to invest in their favorite tracks. When Nas dropped his single “Ultra Black” through Royal. io, buyers received a share of future streaming revenue – a tangible alignment between artist and audience interests.

This isn’t just about hype collectibles. It’s about direct revenue for musicians, with smart contracts automatically distributing payments whenever royalties are generated. No more chasing down labels or publishers; no more surprise deductions buried in fine print.

NFT Music Platforms Powering Independence

The surge in NFT music for independent artists has spawned a new breed of platforms:

- Audius: Decentralized streaming where artists upload tracks directly to the blockchain and monetize via NFTs.

- Sound. xyz: Lets early supporters buy tokenized singles from emerging talent – giving both parties upside if the track takes off.

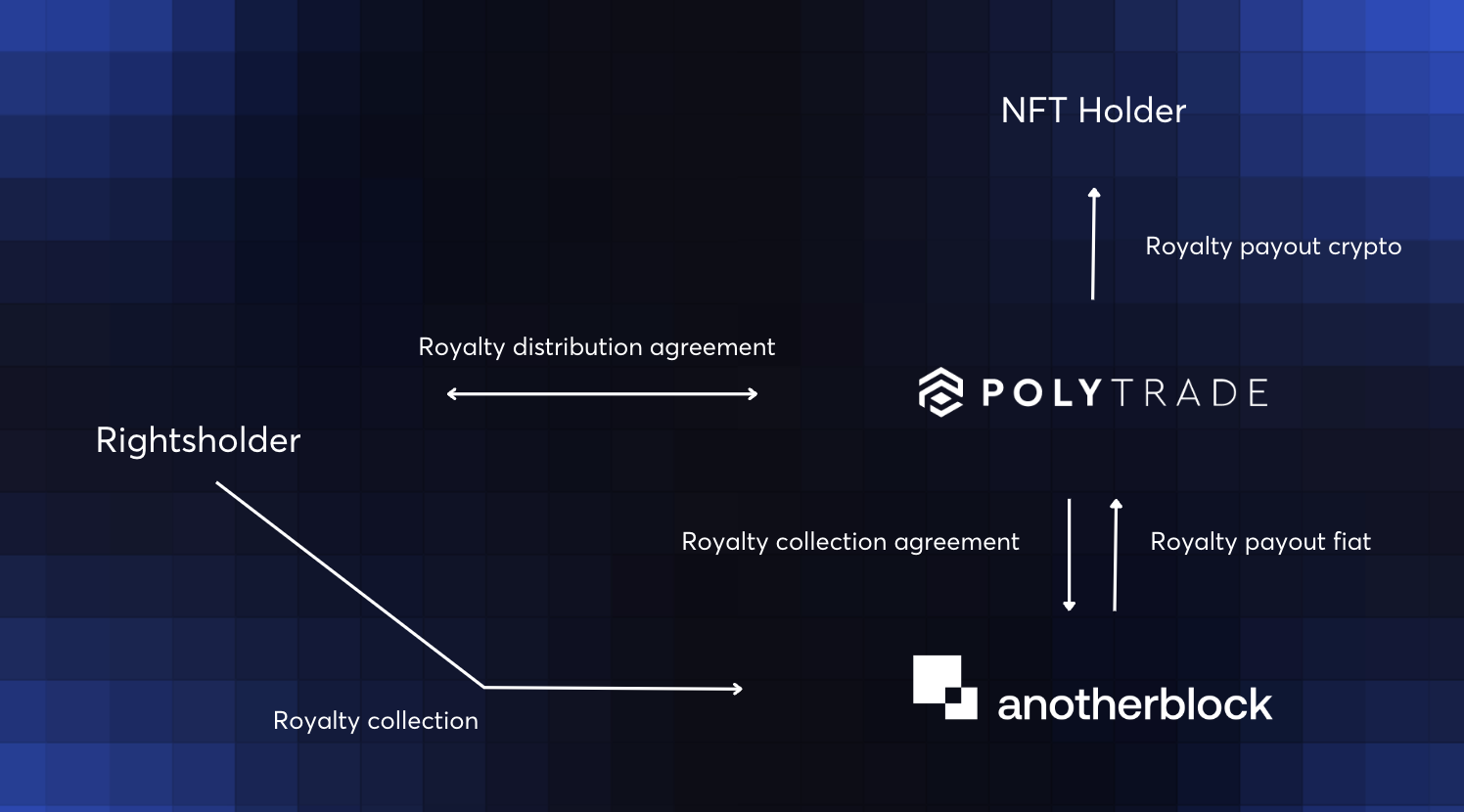

- Anotherblock: Partners with major acts to tokenize streaming royalties as NFTs so fans can invest alongside them.

This ecosystem creates innovative ways for fans to participate financially in an artist’s journey while providing musicians with capital without giving up creative control or ownership rights. The result? More sustainable careers and a fairer split of revenues in real time.

Transparency is more than a buzzword in this space, it’s quantifiable. Every royalty split, resale, and secondary market transaction is logged on-chain, creating an auditable trail that eliminates the notorious “black box” of legacy music accounting. For independent musicians, this means no more waiting months for ambiguous streaming statements or battling with intermediaries over missing revenue. Instead, smart contracts execute payments instantly and precisely, down to the last decimal.

Beyond direct sales and royalty splits, artists are leveraging NFTs to unlock exclusive fan experiences. Think unreleased demos, behind-the-scenes content, or personalized remixes, each minted as a unique digital asset. This not only drives additional revenue but also deepens the emotional connection between artist and audience. In a world where attention is scarce and fandom is fragmented, these NFT-driven incentives are proving to be a powerful retention tool.

Fractional Music Royalties: Investing in the Soundtrack of Tomorrow

Fractionalization isn’t just for high finance anymore. Thanks to tokenized music ownership, fans can now invest in fractions of future royalties, essentially turning every hit song into its own micro-equity market. On platforms like Anotherblock and Royal. io, independent musicians have tokenized as much as 25% of their future streaming royalties to fund upcoming projects or tours. Fans buy these tokens not just for speculative upside but for the satisfaction of backing artists they believe in.

For investors with an eye for data-driven alpha, this opens up new asset classes previously reserved for industry insiders. The liquidity and transparency afforded by blockchain rails mean that music royalties are no longer illiquid or opaque, they’re tradable assets with real-time pricing and clear provenance.

Top Ways Fractional Music Royalties Are Revolutionizing Investment

-

Direct Fan Investment via Platforms like Royal.io: Royal.io enables artists to tokenize music royalties as NFTs, allowing fans to purchase fractional ownership and earn a share of streaming revenue. This model was exemplified by Nas, who sold royalty rights to his songs, letting fans become direct stakeholders.

-

Higher Earnings Potential for Independent Artists: By leveraging NFT platforms such as Sound.xyz, artists like RAC have generated significant income—RAC earned 20 ETH (approx. $68,000) from two NFT sales, a sum that would require nearly 7 million Spotify streams, demonstrating the lucrative potential of fractional royalty sales.

-

Transparent and Automated Royalty Distribution: Blockchain-based smart contracts ensure that royalty payments are automatically and transparently distributed to all fractional owners, reducing disputes and delays common in traditional music industry models.

-

New Revenue Streams from Secondary Sales: NFT music royalties can be resold on secondary markets, with artists and investors earning additional income from each transaction. This mechanism, available on platforms like Sound.xyz and Anotherblock, introduces ongoing revenue beyond initial sales.

-

Democratized Access to Music Investments: Platforms such as Anotherblock and Audius allow everyday fans and investors to participate in music royalty markets, a domain previously limited to industry insiders and major labels, thus broadening the investor base and diversifying funding sources for artists.

Risks and Considerations: Not All That Glitters Is Gold

Of course, every revolution has its growing pains. While blockchain music royalties offer unprecedented opportunities for independence and monetization, they also introduce new risks: market volatility in crypto prices, regulatory uncertainty around digital assets, and the challenge of building sustainable demand beyond early adopters.

Yet the trajectory is clear, NFT music platforms are here to stay, offering a radically different model from the status quo. As more artists experiment with tokenized releases and as fans become accustomed to owning slices of their favorite tracks’ futures, expect further innovation at the intersection of music and blockchain tech.

The numbers speak volumes: $68,000 from 20 ETH in primary sales on Sound. xyz versus millions of streams required on traditional platforms, a stark illustration of how blockchain is tilting the playing field toward creators. For underrepresented musicians especially, these tools represent not just financial empowerment but creative liberation.

If you want to dive deeper into how blockchain empowers niche creators through tokenization, and see real-world examples, check out our feature on tokenizing niche and independent music.