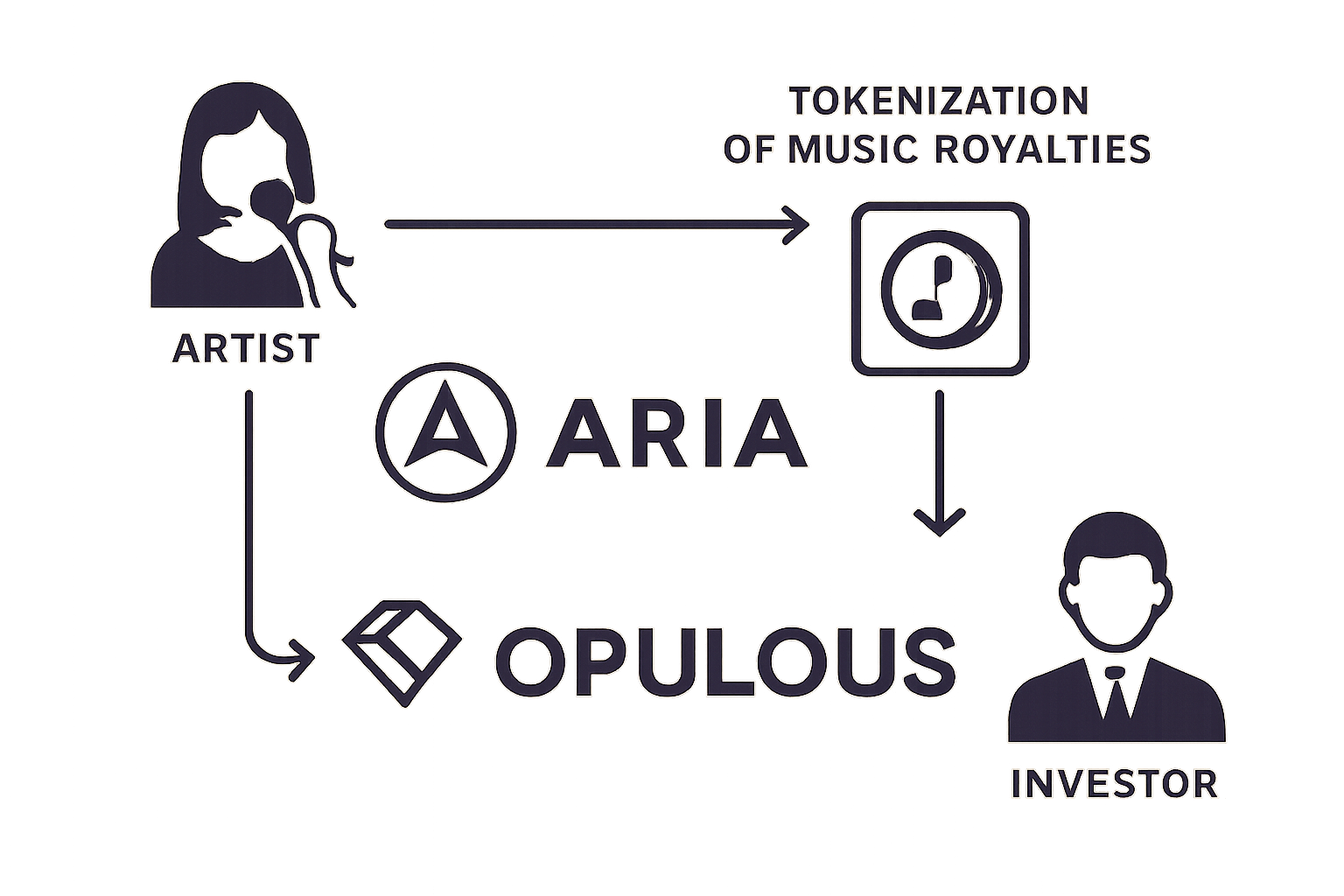

Music royalty tokenization is moving from buzzword to business model, reshaping how artists and investors access, share, and grow on-chain music revenue. Platforms like Aria Protocol and Opulous are at the forefront of this transformation, using blockchain to turn previously illiquid song rights into dynamic, tradeable assets. By enabling fractional ownership and transparent revenue sharing, these protocols are redefining what it means to invest in music IP in 2025.

Tokenizing Music Royalties: The New Revenue Engine

The core innovation behind these platforms is simple but profound: music rights become tokens, which can be bought, sold, or staked for a share of real-world royalties. This model democratizes access to music investment and gives artists new ways to monetize their catalogs while retaining creative control.

Aria Protocol, built on the Story blockchain, has rapidly gained traction by introducing Intellectual Property Real-World Assets (IPRWAs). In June 2025, Aria launched $APL, its first IPRWA token, representing partial income rights to a portfolio of 48 songs from global icons like BLACKPINK, Justin Bieber, Miley Cyrus, and BTS. Token holders can stake $APL to earn actual streaming royalties as they accrue. This launch was powered by a $10.95 million raise on StakeStone’s LiquidityPad.

The current price of Aria. AI (ARIA) stands at $0.1740, reflecting growing confidence in tokenized IP markets as both retail and institutional investors look for exposure to cultural assets with recurring revenue potential.

Aria PRIME and Institutional Onboarding: $100 Million Catalogs Go On-Chain

A major leap came in September 2025 when Aria launched Aria PRIME, an institutional-grade arm that tokenized $100 million worth of Korean music catalogs, including works by BTS and BLACKPINK. This move opens the door for funds and family offices to treat music IP as a yield-bearing asset class within diversified portfolios.

This permissioned approach is designed for large-scale investors who require compliance checks but want direct exposure to streaming revenue flows. By bridging traditional finance with Web3 infrastructure, Aria positions itself as a gateway between mainstream capital markets and the creator economy.

Opulous: DeFi for Musicians and Fans

Opulous, operating on the Algorand blockchain, takes another tack, focusing on decentralized finance (DeFi) tools that empower both musicians and fans. Since its inception in 2021 with high-profile artist partnerships (like Lil Pump), Opulous has enabled anyone to invest directly in new releases or entire catalogs via Music Fungible Tokens (MFTs). Investors receive a cut of streaming royalties proportional to their holdings, a concept that radically lowers barriers compared to legacy industry gatekeepers.

The platform’s latest innovation is the ‘Opulous Royalty Vault’, launched in 2025. Here, investors buy OVAULT tokens backed by actual copyright holdings; staking these tokens generates daily rewards from underlying royalty flows. For artists and songwriters seeking liquidity without giving up all rights or control, Opulous offers an alternative path outside major label advances or publisher deals.

This shift isn’t just about new tech, it’s about access. Fans can now own a slice of their favorite songs’ success stories while artists gain capital without predatory contracts or opaque accounting. To see how these mechanisms work under the hood, and why they matter for creators, check out our deep dive on real-world examples from Aria, Opulous, and APL.

For both artists and investors, the implications of music royalty tokenization are profound. No longer limited to industry insiders or institutional buyers, anyone can now participate in the upside of hit songs and legendary catalogs. Fractional music royalties mean that a fan in Seoul or a retail investor in Berlin can both own a share of streaming revenue from BTS or BLACKPINK, something unimaginable just a few years ago.

On the investor side, platforms like Aria and Opulous introduce blockchain music investment as a real alternative to stocks or real estate. The recurring nature of royalty payments offers attractive yield potential, especially as global streaming continues to grow. With Aria. AI (ARIA) currently priced at $0.1740, market participants can track value movements transparently on-chain, with every distribution and trade recorded immutably.

Risks, Rewards, and Transparency: What You Need to Know

Of course, this new model isn’t without its challenges. Tokenized music assets are still subject to market volatility, rights disputes, and evolving regulations around digital securities. Yet the transparency of on-chain royalty flows makes it easier for holders to audit payouts and verify actual earnings, an improvement over traditional industry opacity.

The ability for artists to access instant liquidity by selling small fractions of their rights also shifts the power dynamic away from legacy intermediaries. Instead of waiting months (or years) for label advances or publisher settlements, creators can tap into global capital markets nearly instantly. For detailed mechanics on how this works in practice, including payout frequencies and smart contract audits, see our guide on instant payouts and transparent revenue sharing.

The Road Ahead: Music as a Borderless Asset Class

The rise of platforms like Aria Protocol and Opulous signals that music is no longer just culture, it’s a programmable asset. As more catalogs are brought on-chain at institutional scale (as with Aria PRIME’s $100 million Korean IP drop), expect further convergence between entertainment IP and decentralized finance.

This borderless model benefits not only global superstars but also independent artists who can now crowdfund projects directly from their fanbases or tap into micro-investment communities worldwide. For fans and collectors who want to learn how to buy or sell these assets themselves, explore our tutorial on trading tokenized music royalties.