In 2025, the intersection of blockchain and the music industry is no longer a theoretical promise but a day-to-day reality for Web3 investors. Tokenized music royalties have become a core strategy for those seeking passive income, offering a blend of cultural impact and financial innovation. As streaming platforms continue to dominate music consumption, the underlying revenue streams have been unlocked and fractionalized, enabling investors to own pieces of songs and albums in ways that were previously impossible.

How Tokenized Music Royalties Work in 2025

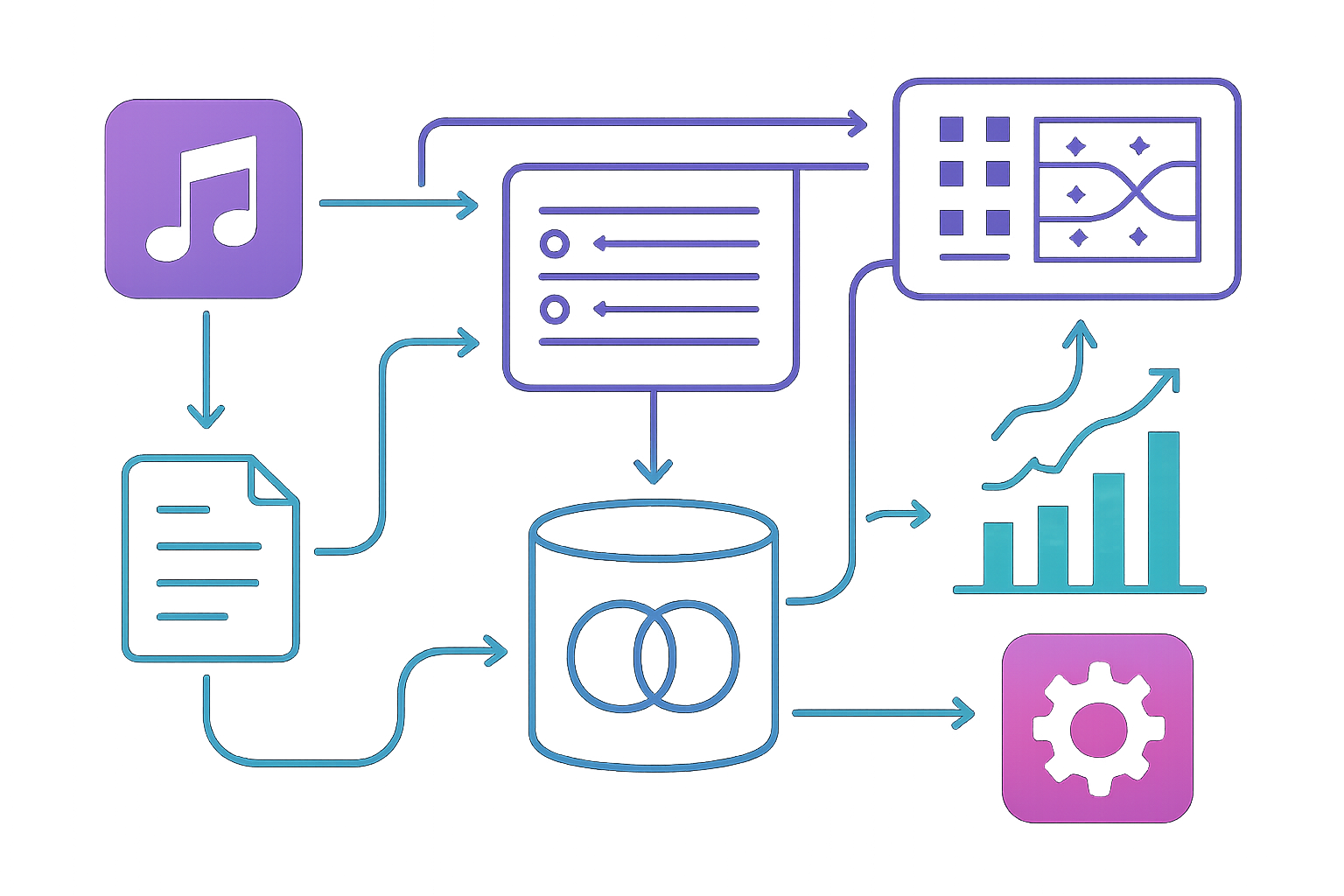

At its core, tokenization transforms music rights into digital assets on the blockchain. Artists or rights holders mint Non-Fungible Tokens (NFTs) or similar blockchain tokens that represent shares in future earnings from a specific track, album, or catalog. These tokens are then sold directly to fans and investors on specialized platforms. In exchange, token holders receive a proportional share of all royalties generated, whether from Spotify streams, radio play, sync licensing, or other sources.

The revenue distribution is handled by smart contracts, which automate the calculation and payment of royalties without reliance on traditional intermediaries. This not only increases transparency but also accelerates payout times and reduces administrative costs. For investors, it means that royalty income arrives predictably and efficiently, often in real time or at regular intervals dictated by the smart contract.

Platforms Leading the Charge: Where Investors Earn Passive Income

The rise of tokenized royalties has given birth to new marketplaces tailored for both artists and investors:

- Royal. io: Co-founded by musician 3LAU, Royal. io lets users purchase NFT-based shares in songs from top-tier artists like Nas and Diplo. Investors receive direct streaming revenue payouts as part-owners.

- Audius: Built on Solana, Audius empowers creators to monetize their work directly while rewarding listeners with $AUDIO tokens for participation.

- NEWM: By bridging traditional publishing models with Web3 infrastructure, NEWM ensures all revenue flows transparently through smart contracts to both artists and token holders.

This ecosystem shift allows anyone, from diehard fans to seasoned portfolio strategists, to participate in music’s upside through fractional ownership. The result? A new class of passive income opportunities that align investor interests with artist success.

The Strategic Advantages for Web3 Investors

Diversification is key. Tokenized music royalties offer exposure to an asset class historically uncorrelated with equities or crypto markets. By owning fractions of different songs across genres and geographies, investors can reduce risk while tapping into global streaming trends. The ability to trade these tokens on secondary markets also adds liquidity, a stark contrast to traditional royalty investments which are often illiquid and opaque.

Transparency, too, is central. Every transaction, from initial investment to royalty payout, is recorded immutably on-chain. This removes ambiguity around who owns what percentage of which song, ensuring fair compensation for every stakeholder involved.

If you’re curious about practical steps for entering this market or want a deeper dive into platform mechanics, check out our comprehensive guide: How To Earn Passive Income With Tokenized Music Royalties: A Guide For Web3 Investors.

Navigating Risks: What Every Investor Should Know

No investment is without risk, even one as innovative as tokenized music royalties. Market volatility can affect token values based on song popularity shifts or broader economic conditions. Regulatory frameworks around digital assets are still evolving; compliance risks may impact where and how these tokens can be traded globally. Finally, intellectual property rights must be meticulously managed within smart contracts to avoid legal disputes down the line.

Seasoned investors are taking a measured approach, combining thorough due diligence with dynamic portfolio allocation. Tools for on-chain analytics now allow users to track historical royalty flows, token price movements, and even artist engagement metrics before committing capital. This data-driven strategy is helping to separate speculative hype from sustainable, income-generating opportunities.

Top Strategies to Mitigate Risk in Music Royalty Token Investments

-

Diversify Across Multiple PlatformsSpread your investments among reputable platforms like Royal.io, Audius, and NEWM to reduce exposure to platform-specific risks and technical issues.

-

Vet Music Assets and Artists ThoroughlyPrioritize tokens linked to established artists or high-performing tracks with proven revenue history. Research artist backgrounds and track streaming data before investing.

-

Understand Smart Contract TermsReview the smart contract’s royalty distribution logic, payout frequency, and ownership rights. Ensure the contract is audited and transparent to avoid unexpected outcomes.

-

Monitor Regulatory DevelopmentsStay updated on evolving regulations in your jurisdiction regarding tokenized assets and digital royalties. Compliance reduces legal and financial risks.

-

Assess Secondary Market LiquidityCheck if the platform supports active secondary trading of music tokens. Higher liquidity makes it easier to exit positions if needed.

-

Leverage Analytics and Community InsightsUse analytics tools and participate in platform communities (e.g., Audius Discord) to track music performance, trending assets, and platform updates.

As the landscape matures, secondary markets have become more robust. Investors can now buy and sell fractional music ownership on open marketplaces, providing liquidity that was unimaginable in the legacy music royalty market. This tradability means passive income streams are not only accessible but also flexible, holders can rebalance their positions as new songs trend or as their financial goals change.

Another advantage is the alignment of incentives between artists and investors. When fans become stakeholders in a song’s success, they’re more likely to promote it organically across social media and streaming platforms. This creates a virtuous cycle: increased streaming leads to higher royalties for both artist and investor. The traditional wall between creator and consumer is breaking down, replaced by a collaborative model where value flows both ways.

The Outlook for Passive Income in Web3 Music

Looking ahead to 2025 and beyond, on-chain royalty payouts are poised to become a mainstream component of diversified digital portfolios. As regulatory clarity improves and major rights organizations begin adopting blockchain infrastructure, expect even greater transparency and trust in these markets. The ability to invest in music NFTs tied directly to real revenue streams is drawing institutional attention as well as retail participation.

For those ready to explore this space further, or seeking actionable steps for portfolio construction, our curated guides break down everything from platform selection to smart contract literacy:

- How To Invest In Tokenized Music Royalties: Platforms, Risks and Passive Income

- How To Buy And Sell Tokenized Music Royalties On Blockchain Marketplaces

The bottom line: music has always been an emotional investment for fans, now it can be a financial one too. With the right research and risk management, tokenized music royalties offer Web3 investors a compelling path to passive income that’s both culturally meaningful and economically sound.