Fractionalized music royalties on blockchain have rapidly shifted from an experimental niche to a headline investment strategy in 2025. The traditional barriers between artists, fans, and investors are dissolving as music rights become accessible, transparent, and tradeable digital assets. This transformation is not only creating new wealth opportunities for investors but also fundamentally changing how artists monetize their work and engage with their audience.

Demystifying Fractional Music Royalties: How Blockchain Makes It Possible

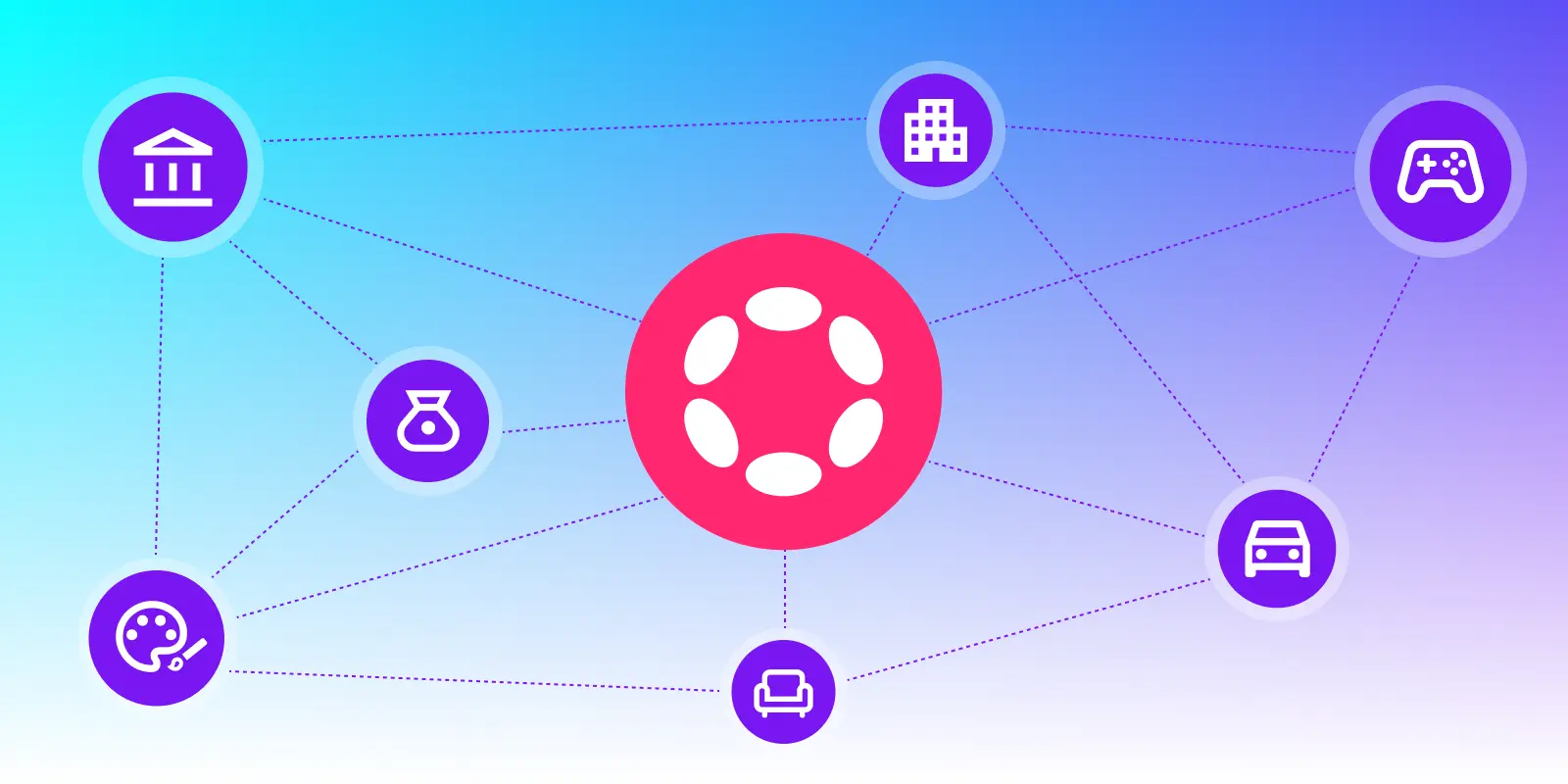

At the heart of this revolution is fractional ownership. Instead of a single entity holding all the rights to a song, blockchain technology enables these rights to be broken down into many small pieces, each piece represented by a unique token or NFT. Investors can now buy these tokens, effectively owning a fraction of the song’s future earnings from streaming, licensing, or sync deals. Platforms like Royal. io and Bolero have made it simple for both seasoned investors and newcomers to participate in this market by offering intuitive interfaces and robust secondary markets.

This approach democratizes access to music royalty streams that were historically reserved for industry insiders or major labels. Now, anyone can strategically build a portfolio of songs across genres and eras, diversifying risk while gaining exposure to uncorrelated cash flows. As highlighted by Royalty Exchange, music royalties are less volatile than equities and provide consistent returns, a compelling proposition for those seeking passive income in an unpredictable macro environment.

The Mechanics: From Token Purchase to Passive Income

The process begins when an artist or rights-holder chooses to tokenize their royalty stream. Here’s how it plays out:

- Initial Offering: A portion of a song’s revenue rights is converted into digital tokens and offered on a marketplace.

- Investment: Individuals purchase these tokens using crypto or fiat currency; each token entitles the holder to a share of future royalty payments.

- Automated Distribution: Smart contracts track streaming and licensing data in real time, distributing revenues directly (and instantly) to token holders’ wallets, no intermediaries required.

- Liquidity via Secondary Markets: If you want out (or see another opportunity), you can sell your tokens peer-to-peer on open marketplaces at prevailing prices.

This seamless system is powered by blockchain’s transparency and automation. Investors receive payouts proportional to their holdings whenever the song generates revenue, whether from Spotify streams in Tokyo or movie placements in Los Angeles. The result? A steady stream of passive income that arrives without paperwork delays or opaque accounting practices. For more detail on how this works under the hood, see our breakdown at How Fractional Ownership of Music Royalties Works on Blockchain in 2025.

The Strategic Case: Diversification, Stability, Direct Artist Support

The appeal goes beyond novelty. In 2025’s climate of market uncertainty, fractionalized music royalties offer three key advantages for investors:

- Diversification: Royalty streams are largely uncorrelated with stocks or crypto prices. Adding them to your portfolio can reduce overall risk while opening up new return drivers.

- Steady Cash Flow: Unlike speculative assets, established songs often generate predictable revenue from streaming platforms like Apple Music and Spotify, providing reliable monthly income.

- Direct Artist Support: By purchasing royalty tokens directly from creators (or their teams), investors provide upfront capital that empowers artists creatively and financially, cutting out layers of middlemen.

This confluence of financial opportunity and cultural impact is why platforms such as Bolero tout “sound investments on repeat. ” For those seeking more guidance on building an allocation strategy around tokenized music assets, explore our insights at How Fractionalized Music Royalties Are Transforming Blockchain Investing in 2025.

Yet, as with any emerging asset class, success in music royalty investing demands thoughtful research and an understanding of both the opportunities and the risks. While blockchain streaming revenue is transparent and automated, the underlying value of a royalty token still hinges on the enduring popularity of the song or catalog it represents. As a result, savvy investors are increasingly turning to data-driven platforms that offer analytics on streaming trends, historical earnings, and artist engagement before committing capital.

One of the most exciting developments in 2025 is the rise of dynamic royalty portfolios. Rather than betting everything on a single hit, investors can now assemble baskets of fractional music royalties spanning genres, decades, and even geographies. This not only spreads risk but also enables exposure to global listening patterns that might be uncorrelated with local market cycles. For those seeking hands-on strategies for building such portfolios, see our resource on how to earn passive income by investing in tokenized music royalties.

Risk Factors and Due Diligence: What Every Investor Should Know

While the promise of passive income music blockchain investments is substantial, it’s crucial to recognize potential pitfalls:

- Popularity Decay: Songs can fall out of favor quickly; older catalogs may see declining revenue unless revived by cultural moments or sync placements.

- Regulatory Uncertainty: The legal landscape for tokenized assets remains fluid. Investors should monitor jurisdictional changes affecting how royalties are recognized or taxed.

- Platform Security: Not all marketplaces have equal safeguards. Prioritize platforms with robust smart contract audits and transparent governance structures.

- Liquidity Constraints: Although secondary markets exist, some tokens may be thinly traded, especially those tied to niche or less popular tracks.

If you’re new to this space, start small and diversify broadly. Engage with communities on Discord or X (formerly Twitter) where investors share real-world experiences, often more candid than official platform marketing materials.

Looking Ahead: The Future of Tokenized Music Royalties

The next wave will likely see further integration between music NFTs and broader Web3 ecosystems, think exclusive content drops for token holders or cross-platform rewards tied to real-world events. As AI-driven curation reshapes how people discover music globally, songs with viral potential could deliver outsized returns for early royalty investors. Meanwhile, artists are embracing these tools not just for funding but for cultivating superfans who have a literal stake in their creative journey.

The bottom line: fractional music royalties are no longer just an alternative asset, they’re a bridge between culture and capital that empowers both creators and collectors. Whether you’re seeking yield uncorrelated with traditional markets or simply want to own a piece of your favorite anthem’s success story, there’s never been a more accessible time to get involved.