Imagine pouring your heart into a track, uploading it to Spotify, and then watching as 28% of your streaming royalties vanish into the ether. That’s the harsh reality for many indie artists right now, and it’s not because your music isn’t connecting with fans. It’s a tangle of unregistered PRO accounts, overlooked publishing rights, and glitchy systems like the Mechanical Licensing Collective (MLC) that are eating your earnings alive. I’ve seen this firsthand advising musicians over my 13 years in markets – talented creators hustling hard but leaving 30-60% on the table simply because the setup is a maze.

Let’s break it down without the jargon overload. Performance Rights Organizations (PROs) like ASCAP or BMI track public plays, but if you’re not registered properly, those mechanical royalties from streams? Poof. Add in the MLC’s rocky road – duplicate works, orphan ISRCs, and fraud weak spots diverting funds, as exposed in Digital Music News investigations. Even big players like Spotify have dodged MLC lawsuits over bundling tricks that slashed payouts, leaving independents in the dust.

The Sneaky Ways Indies Lose Out on Streaming Cash

A 2024 survey hit hard: 69.1% of artists dissatisfied with streaming payouts. Why? The pro-rata model pools all revenue and dishes it out by total streams, supercharging superstars while crumbs fall to everyone else. Then there’s Spotify’s 1,000-stream threshold – tracks below that? Zero royalties, potentially locking away $47 million for smaller acts. No wonder financial literacy gaps amplify this; many creators don’t even know where to start with PRO, publishing, or MLC registrations.

Most artists are leaving 30, 60% of their money on the table because they don’t have their PRO, publishing, and royalty accounts set up correctly. (Source: pitchplus. app)

Historical royalties from MLC’s Phono 3 era started flowing in April 2024, but monthly updates as of November 2025 show persistent hiccups. Criticism mounts over diverted royalties and weak safeguards, turning what should be a safety net into a black hole for indie artists missing royalties.

Streaming’s Broken Pool: Pro-Rata Pitfalls Exposed

Picture this: your viral TikTok sound racks up streams, but under pro-rata, Adele’s catalog siphons the lion’s share from the revenue pot. Independents get pennies, fostering that endless grind. Minimum thresholds exacerbate it – if your gem doesn’t hit 1,000 plays yearly, it’s invisible to payouts. Transparency? Laughable. Delayed reports and opaque distributions mean you’re auditing blind, chasing ghosts.

Traditional Streaming Royalties vs. Tokenized Markets: Why Indies Miss 28% and How It’s Fixed

| Issue | Traditional Impact | Tokenized Fix |

|---|---|---|

| Pro-Rata Distribution | Pools all revenue and favors superstars; indies get crumbs from the pool | Direct splits via smart contracts; royalties proportional to token ownership 💎 |

| Minimum Stream Thresholds | <1,000 streams = $0; $47M lost for small artists | No thresholds; instant payouts for every stream on-chain 🚀 |

| Payment Delays & Lack of Transparency | Slow, opaque reporting leads to disputes and diverted funds | Automated, real-time on-chain transparency; direct to artists 🔗 |

It’s not just numbers; it’s sustainability. Low financial literacy compounds it, as seen in broader studies, hitting artists’ long-term stability. But here’s the reassuring part: you’re not powerless. The industry’s shifting, and blockchain royalty splits are lighting the path forward.

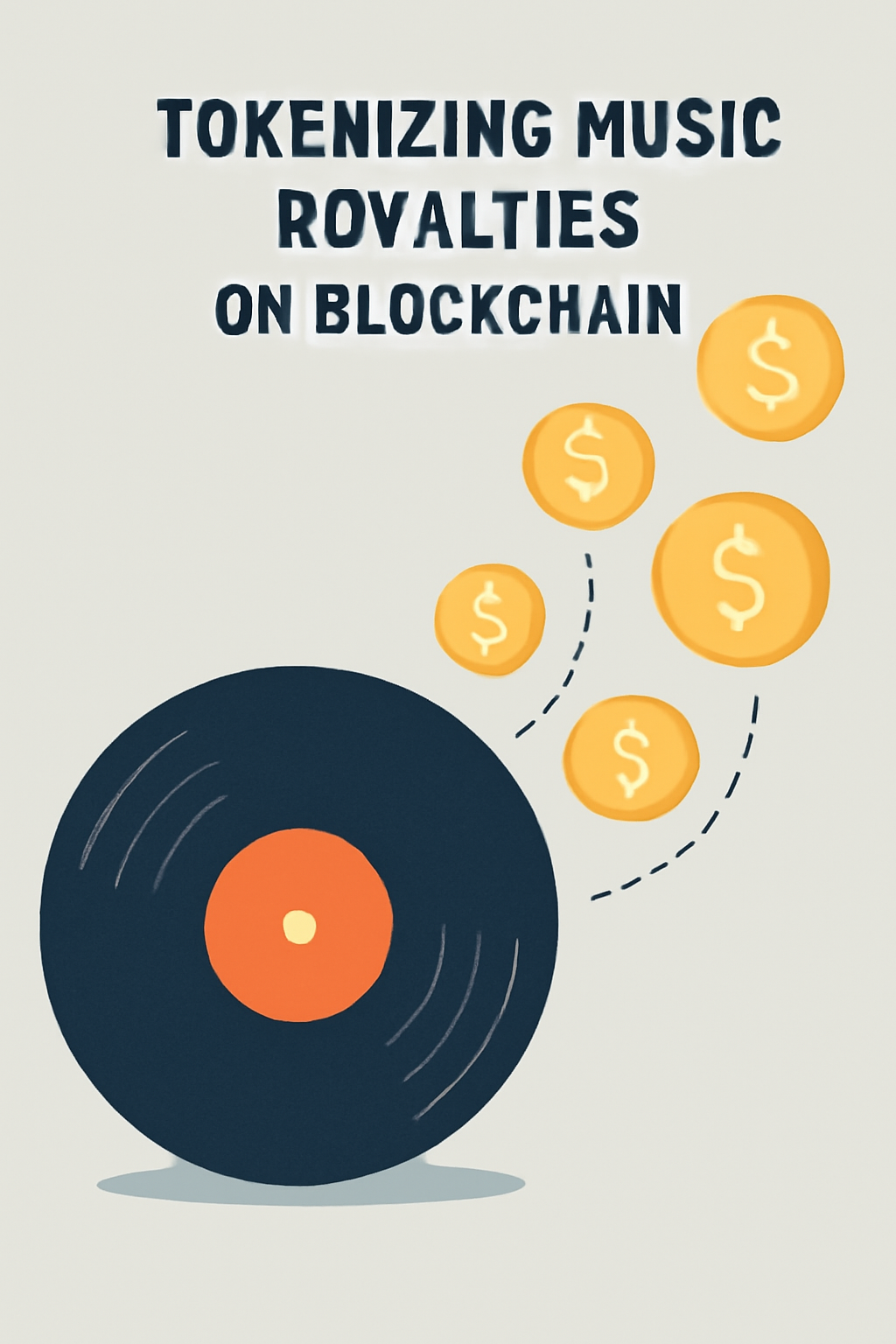

Tokenized Royalties: Your 2025 Game-Changer

Enter tokenized music royalties 2025 – blockchain magic turning rights into tradeable shares. Platforms let fans buy fractional ownership, handing artists upfront cash without label gatekeepers. No more waiting 6-18 months for checks; smart contracts automate splits transparently, directly to your wallet. Record Financial’s on-chain payouts are already buzzing with labels and indies for speed and certainty.

This isn’t hype. Tokenization kills middlemen, aligns fans as investors – they earn from streams, you get liquidity now. Direct engagement builds communities; holders snag merch perks or exclusives. For fractional music ownership, it’s revolutionary, especially on marketplaces like Music Royalty Markets where NFTs meet royalties seamlessly.

I’ve watched too many talented indies grind through these pitfalls, but tokenized markets like Music Royalty Markets flip the script entirely. Here, your royalties become NFTs or tokens on blockchain, tradeable assets that fans snap up for fractional shares. That means instant liquidity – sell a portion of future earnings upfront, fund your next release, and let publishing royalties blockchain handle the rest automatically. No more MLC headaches or pro-rata favoritism; every stream funnels directly via smart contracts.

Take Record Financial’s momentum: labels and artists are flocking to on-chain royalties for payouts that hit wallets in real time, not quarters later. Platforms in 2025 are normalizing this, letting you skip label drama while fans invest like venture capitalists in your sound. It’s reassuring because it puts control back in your hands – transparent ledgers show every cent, every split, no disputes.

Real-World Wins: Indies Thriving on Tokenized Tracks

Picture an indie dropping a track, tokenizing rights on Music Royalty Markets, and watching fans buy in. Streams roll in? Tokens appreciate, holders get cuts, you pocket upfront funds plus ongoing shares. This beats the 28% leak because PRO MLC registration indie setups feed into blockchain seamlessly, capturing everything from mechanical to performance rights without orphans or duplicates.

Critics of MLC point to diverted funds from weak fraud checks, but blockchain’s immutability slams that door shut. Spotify’s bundling wins? Irrelevant when you’re not reliant on their pool. A 2025 shift sees TikTok and others eyeing similar tech, but pioneers on dedicated royalty markets lead the charge. Financial literacy gaps fade too; simple dashboards demystify earnings, building that long-term stability I always preach.

Tokenization shines for blockchain royalties indie artists overlooked in traditional streams. Fans aren’t just listeners; they’re stakeholders earning passive income, boosting promotion organically. Merch drops, VIP access tied to holdings? That’s community glue traditional models lack. And liquidity – trade tokens anytime on secondary markets, cashing out without selling your soul.

From Setup Maze to Streamlined Success

Yes, initial hurdles like wallet setup exist, but they’re one-time, far simpler than chasing MLC historical royalties monthly. Platforms guide you, often with PRO integration tools. Results? Upfront capital for tours, gear, collabs; sustainable revenue beyond streams. I’ve advised artists who tokenized early – patience paid off as tokens compounded with viral hits.

On Music Royalty Markets, it’s user-friendly: upload masters, set splits, mint tokens, market to fans. Blockchain verifies ownership, automates everything. No 1,000-stream gate; micro-earnings count. This empowers underrepresented voices, niche genres thriving via fractional music ownership. 2025 isn’t just tech; it’s equity.

Artists, if you’re tired of pennies from pro-rata pots and registration roulette, tokenized markets deliver the fix. Dive in, claim what’s yours, and watch royalties flow transparently. Your music deserves it, and now the tools do too.