Imagine pouring your soul into a track, watching it rack up millions of Spotify streams, only to pocket pennies per play. In 2024, Spotify dished out a staggering $10 billion in royalties, propelling nearly 1,500 artists past the $1 million mark. Yet the average payout hovers between $0.003 and $0.005 per stream. At Spotify’s current stock price of $557.17, the platform thrives, but indie creators and savvy investors are left chasing scraps. Enter blockchain tokenization: the force transforming these low Spotify royalties into tradeable fractional assets ripe for fractional music royalties investment.

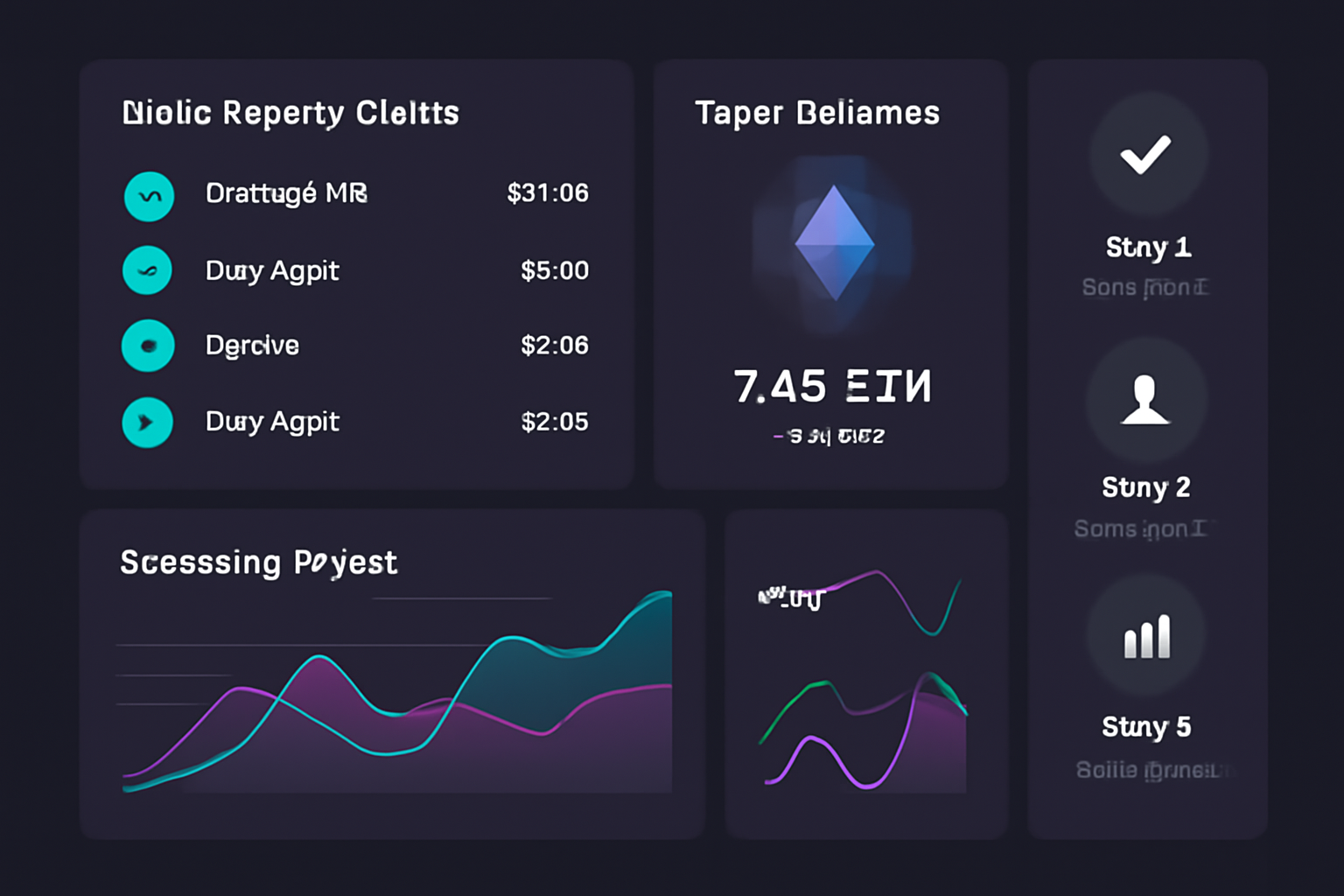

This isn’t hype; it’s a seismic shift. As a swing trader who’s navigated forex, stocks, and digital assets for a decade, I’ve watched tokenized music royalties blockchain platforms democratize access. Artists unlock upfront capital, while investors tap into passive income streaming royalties 2025 without buying entire catalogs. Platforms automate ownership via smart contracts, recording every stream, payout, and trade on-chain for unbreakable transparency.

Spotify’s Payout Paradox: Billions Paid, Creators Starved

Spotify Technology S. A. (SPOT) trades at $557.17 today, down just -0.0344% over 24 hours from a high of $576.70. Impressive resilience, right? But peel back the layers, and the story sours for most musicians. Those micro-payments add up for superstars, yet for emerging talent, they’re a grind. Blockchain steps in as the Spotify royalties blockchain fix, tokenizing rights so fractional shares become liquid assets.

Over $8 billion in music-backed securities have launched since 2020, fueled by streaming’s predictable cash flows. Institutional players now eye these streams like bonds, thanks to data transparency. Republic’s mirror tokens, mirroring equity in giants, pave the way for music. Artists sell fractions of future royalties, gaining liquidity now; investors buy in for yields that beat traditional fixed income.

Tokenization Mechanics: From Streams to Smart Contracts

Here’s the magic: an artist tokenizes royalties on blockchain, splitting ownership into thousands of digital tokens. Each represents a slice of ongoing revenue from Spotify, Apple Music, wherever streams flow. Smart contracts handle distribution automatically; no middlemen skimming cuts. Every transaction, calculation, ownership shift? Immutable on-chain records.

This trade music royalties NFT model empowers DJs and producers with control, as seen in 2025 trends. Fans grab tokens for a piece of the action, fostering loyalty. I’ve traded assets where timing is everything; tokenized royalties offer similar swings, blending cultural hits with macro tailwinds like rising streaming volumes.

Spotify (SPOT) Stock Price Prediction 2026-2031

Forecasts incorporating blockchain music royalty tokenization, streaming revenue growth, and market expansion trends

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $520.00 | $650.00 | $800.00 | +16.7% |

| 2027 | $650.00 | $800.00 | $1,000.00 | +23.1% |

| 2028 | $780.00 | $950.00 | $1,200.00 | +18.8% |

| 2029 | $900.00 | $1,150.00 | $1,450.00 | +21.1% |

| 2030 | $1,100.00 | $1,400.00 | $1,750.00 | +21.7% |

| 2031 | $1,350.00 | $1,700.00 | $2,100.00 | +21.4% |

Price Prediction Summary

Bullish outlook for SPOT with average annual growth of ~20%, driven by tokenization unlocking fractional royalty investments and Spotify’s dominant position in a $10B+ royalty payout ecosystem. Conservative mins account for regulatory hurdles and AI disruptions; optimistic maxes reflect Web3 integration and subscriber surges.

Key Factors Affecting Spotify Stock Price

- Record $10B+ annual royalty payouts enhancing platform value

- Blockchain tokenization enabling fractional ownership and liquidity for music rights

- Rising institutional interest in tokenized RWAs (real-world assets) boosting music sector

- Spotify’s market leadership and predictable cash flows from 500M+ users

- Potential Web3 partnerships and NFT/mirror token expansions

- Regulatory progress in tokenized securities amid challenges like AI-generated content

- Macro streaming growth amid creator economy expansion

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

Challenges? Sure, regulatory fog and AI tracks disrupting streams loom. But standardized valuations and blockchain registries are maturing fast. Check out how blockchain is transforming music royalties into tradeable assets for deeper dives.

Fractional Ownership Fires Up Investor Portfolios

Why bet big when you can fraction? A $100 investment snags shares in a viral track’s royalties, turning passive streams into active gains. Platforms like Music Royalty Markets make it seamless: buy, sell, trade tokenized slices on decentralized exchanges. This isn’t just investment; it’s participation in music’s future.

For artists, it’s liberation. Tokenize 10% of rights, pocket funds for studio time, tours, without losing control. Investors? Diversified exposure to hits, with yields from global plays. As Web3 entertainment surges in 2025, tokenized music royalties blockchain isn’t optional; it’s essential. I’ve spotted patterns where early adopters in RWAs crushed it; music royalties are next.

Picture this: a mid-tier indie artist with 10 million annual streams finally accesses capital without label loans or predatory advances. That’s the power of fractional music royalties investment on platforms like Music Royalty Markets, where blockchain turns illiquid royalties into buzzing marketplace assets. I’ve traded enough RWAs to know; these aren’t speculative memes, they’re revenue-backed tokens with real Spotify streams fueling the flywheel.

Navigating Risks: Regulatory Hurdles and AI Disruptions Meet Their Match

Skeptics point to regulatory gray areas and AI-generated tracks flooding platforms, potentially diluting human royalty pools. Fair concerns, but blockchain’s transparency crushes opacity. Smart contracts enforce fair splits, and on-chain provenance verifies authenticity. Spotify’s $10 billion 2024 payouts underscore streaming’s stability at $557.17 per SPOT share, even as AI scrutiny ramps up. Tokenization sidesteps this by tying tokens to verified catalogs, letting investors cherry-pick proven earners.

Valuation standards are evolving too. Platforms use streaming data oracles for real-time pricing, much like DeFi yield farms. Early movers in music-backed securities cleared $8 billion since 2020; 2025 projections double that as institutions pile in. My macro lens sees tokenized royalties thriving amid rate cuts and crypto adoption, delivering yields north of 8-12% for diversified portfolios.

Diving in feels straightforward once you grasp the flow. Connect your wallet to a marketplace, scout tokenized tracks with live stream metrics, snag fractions starting at $50, and watch royalties drip into your account monthly. No gatekeepers, just code executing payouts. This passive income streaming royalties 2025 model scales globally, from U. S. TikTok virals to Asian K-pop surges.

Real Yields from Virtual Streams: Case Studies Igniting Momentum

Take DJs reclaiming rights via blockchain, as 2025 reports highlight. One producer tokenized a remix catalog, selling 20% fractions for $200K upfront. Investors now collect from every ZIPDJ spin and Spotify loop. Platforms automate via smart contracts, ensuring every cent traces back transparently. Fans buying in aren’t just holders; they’re co-owners cheering streams higher.

Republic’s mirror token blueprint adapts perfectly here, fractionalizing artist futures like private equity drops. With Spotify at $557.17, resilient amid -0.0344% daily flux, royalties remain a cash cow. I’ve swung trades on less predictable assets; music tokens blend hit-driven pops with steady macro flows, perfect for 3-6 month holds.

Check how to buy and sell tokenized music royalties on blockchain marketplaces for the playbook. Or explore how fractionalized music royalties on blockchain create passive income in 2025 to model your yields.

Web3’s creator economy explodes as NFTs evolve into utility tokens, powering recurring revenue. Blockchain registries make reselling feasible, turning nascent markets mature. Artists retain control, deciding token supply; investors gain liquidity via DEX trades. This synergy crushes traditional royalty traps.

Adapt or fade. As Spotify’s empire grows, tokenized slices let you claim the real value. Platforms like Music Royalty Markets lead the charge, blending blockchain security with music’s emotional pull. Jump in, fraction up, and ride the streams to portfolio peaks. Your next trade could soundtrack a bull run.