In the evolving landscape of 2025, fractional music royalties blockchain investments offer a compelling avenue for steady, long-term returns. As streaming revenues surpass traditional sales and blockchain ensures immutable ownership records, platforms like MelodyAssets democratize access to music assets once reserved for high-net-worth institutions. This isn’t speculative frenzy; it’s a fundamentals-driven shift where investors claim slices of enduring catalog income from hits by artists like The Weeknd or Rihanna.

Grasping the Mechanics of Fractional Ownership

Fractional music royalties divide a song’s or album’s revenue streams into tradable tokens, secured on blockchains like Ethereum or Polygon. Each token represents a precise share of royalties from Spotify streams, sync licenses, or downloads. Platforms tokenize these rights as NFTs or ERC-20 tokens, enabling buy tokenized music royalties 2025 with minimal entry barriers, often starting under $100 per fraction.

Source: Royalty Exchange highlights buying partial rights as a top strategy, with music royalties expanding rapidly amid streaming dominance.

This model thrives on transparency; smart contracts automate payouts, eliminating intermediaries that historically siphoned 30-50% of artist earnings. From my 17 years analyzing alternative assets, this setup mirrors fixed-income securities but with cultural upside. Risks persist, however: catalog performance hinges on algorithmic playlists and artist relevance, demanding rigorous due diligence over hype.

Consider Royal. io, co-founded by 3LAU, where tokens yield semi-annual streaming payouts. Anotherblock offers NFT shares in established tracks, blending collectibility with income. These exemplify music RWA fractional ownership, turning passive listening into active investment.

Navigating Top Blockchain Platforms

Choosing a platform requires a conservative lens: prioritize audited smart contracts, proven payout histories, and liquidity. MelodyAssets stands out for its user-centric interface and focus on indie artists, but compare it against peers. Royal. io excels in fan engagement; Anotherblock leverages major-label catalogs; Artyfile emphasizes master recordings with one-time buys; Collabhouse on Polygon minimizes gas fees for frequent trades.

Diversification tempers volatility; allocate across genres like hip-hop’s consistent earners and pop’s viral potentials. Per Growth Market Reports, fractional shares empower fans as co-owners, fostering loyalty that sustains streams. Avoid unvetted newcomers; stick to those with third-party audits and public royalty dashboards.

| Platform | Blockchain | Key Feature |

|---|---|---|

| MelodyAssets | Ethereum/Polygon | Indie focus, low entry |

| Royal. io | Ethereum | Semi-annual payouts |

| Anotherblock | Multiple | Major artist NFTs |

Regulatory clarity in 2025 bolsters confidence, with SEC guidelines treating most tokens as securities yet approving compliant platforms. Link to deeper insights: how fractional ownership works on blockchain.

Essential Preparations: Wallets and Funding

Gas fees fluctuate; time buys during low network congestion. Test with small amounts. This methodical setup, akin to portfolio onboarding, positions you for on-chain music royalties platforms without unnecessary exposure.

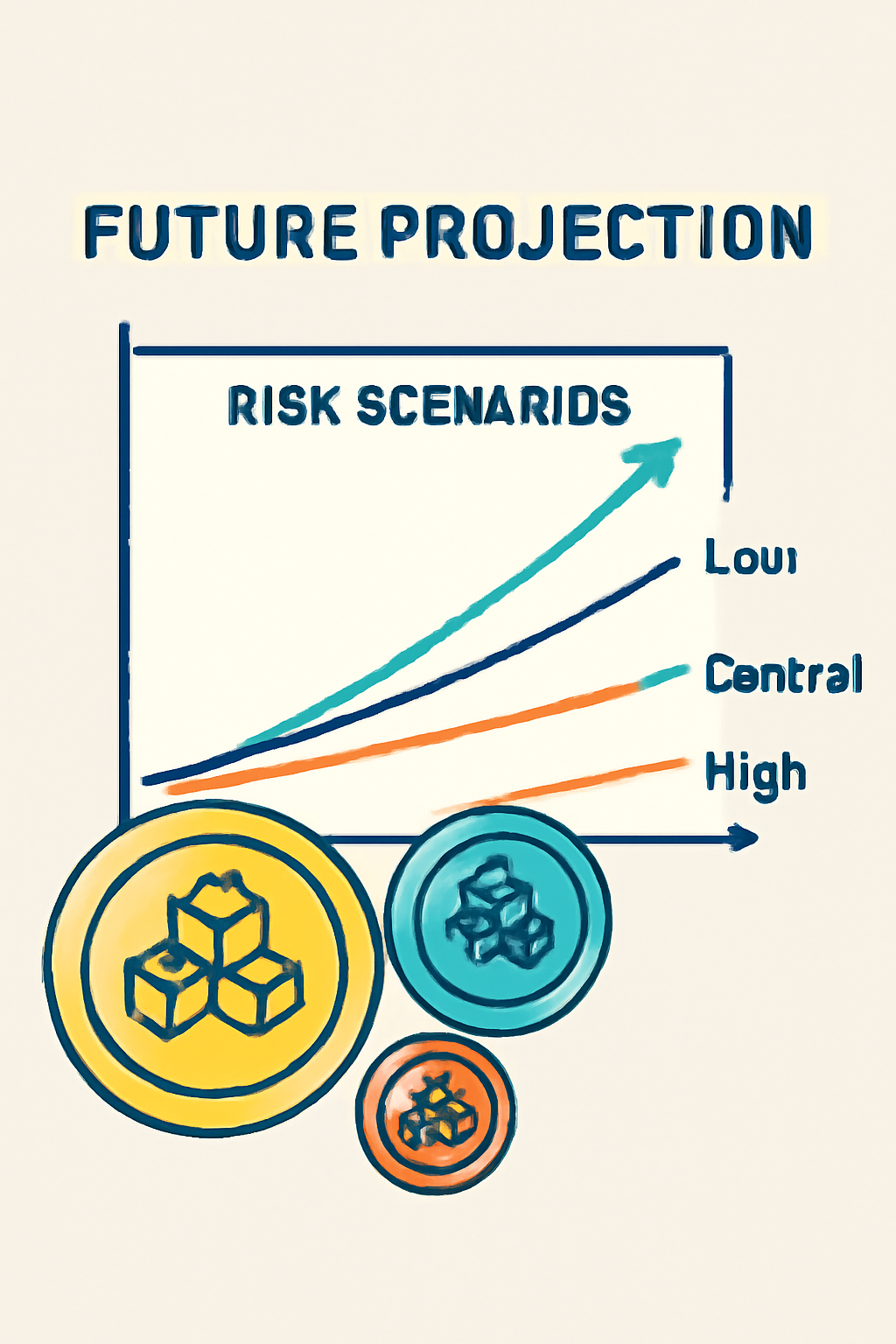

Research assets meticulously: platforms provide dashboards showing historical royalties, often 4-12% annualized yields on blue-chip catalogs. Binance notes royalty NFTs surging, offering direct artist-fan bonds. Yet, my philosophy holds: steady compounding trumps chasing trends. As Aria Protocol and Protokol innovate, patience in selection yields the race.

Once your wallet is primed, the purchase phase demands precision to capture value without overpaying amid network volatility. Platforms like MelodyAssets streamline this with intuitive interfaces that preview exact shares, projected yields, and fee breakdowns before confirmation.

Executing Purchases on Platforms Like MelodyAssets

Select your target asset, say a fraction of an indie track with rising Spotify spins or a proven hit from Rihanna via Anotherblock. Review the smart contract terms: does it cover mechanical royalties, performance rights, or sync deals? MelodyAssets excels here, displaying passive income music streams NFT projections based on PRO data from ASCAP or BMI. Connect your wallet, approve the transaction, and confirm; blockchain finality arrives in minutes on Polygon, longer on Ethereum.

Gas optimization is key; tools like L2Fees. info guide timing. From experience, batching buys during off-peak hours preserves margins, much like dollar-cost averaging in bonds. Post-purchase, your dashboard updates in real-time, logging streams into accruing royalties.

| Asset Type | Avg. Annual Yield (2025) | Risk Level | Example Platform |

|---|---|---|---|

| Established Catalog | 8-12% | Low | Anotherblock |

| Indie Rising Star | 10-15% | Medium | MelodyAssets |

| Viral NFT Track | 5-20% | High | Royal. io |

These yields, drawn from Royalty Exchange strategies and Binance trends, underscore diversification’s role. A hip-hop staple might deliver steady 9% from playlists, while a pop NFT spikes on TikTok virality. Freeduhm and AInvest highlight blockchain’s direct transactions cutting label cuts, boosting net returns.

Tracking Performance and Payouts

Ownership brings ongoing stewardship. Platforms automate quarterly or semi-annual distributions via smart contracts, converting streams to stablecoins or ETH. MelodyAssets’ dashboard integrates Chainlink oracles for verified stream data, ensuring payouts mirror PRO reports. Monitor via apps; set alerts for payout thresholds. My conservative approach favors catalogs with 5 and year track records, where volatility dips below 15% annually.

Rebalancing annually keeps portfolios aligned; sell underperformers, reinvest in high-conviction picks. YouTube insights from BeCEXY note tokenization empowering indies, skipping labels for upfront capital. Yet, over-reliance on one artist courts risk; blend 10-20 assets for resilience.

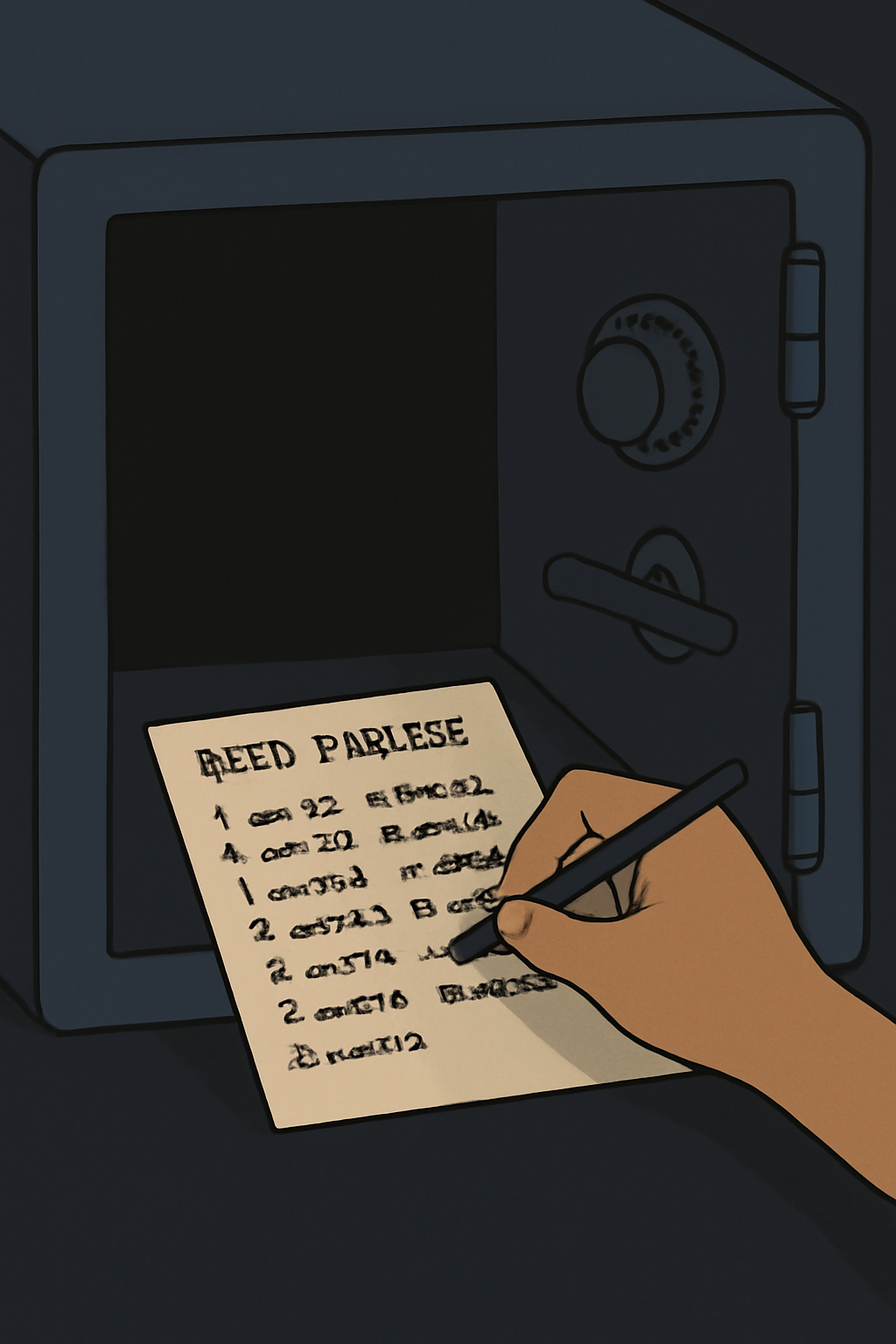

Regulatory horizons brighten with EU MiCA frameworks validating tokens, though U. S. investors note KYC on major platforms. For deeper mechanics, explore blockchain fractional ownership for NFT investors or fractionalized royalties for passive income. Security remains paramount: hardware wallets for holdings over $5,000, multisig for groups.

Ultimately, buy tokenized music royalties 2025 via MelodyAssets or peers builds a portfolio echoing timeless melodies: reliable, appreciating with each play. Patient selection of proven streams, coupled with blockchain’s ledger, crafts enduring wealth in this cultural asset class. Investors attuned to these rhythms position for decades of compounded gains.