Picture this: you pour your soul into a track, push it live on Spotify, and after 10,000 streams, you’ve got maybe $30 in your pocket. Brutal, right? That’s the grind for independent artists battling tiny payouts and shady middlemen. But blockchain flips that nightmare into a payday dream. With tokenized music royalties, you’re selling fractional shares of your songs directly to fans, pocketing up to 98% payouts on platforms built for the Web3 era. No more waiting months for crumbs – it’s instant, transparent, and stacked in your favor.

Streaming’s Dirty Secret: Pennies Per Play Leave Indies Broke

Let’s get tactical. Traditional streaming giants like Spotify pay out laughable rates – around $0.003 per stream, per recent data. Tidal does a bit better at $0.0125, Apple Music $0.0075, but it’s still peanuts for most. Indie artists, especially those outside the top 1%, scrape by on fractions of a cent while platforms balloon to billion-dollar valuations. Add demonetization hitting 88% of music and delayed royalties, and you’re set up to fail.

Traditional Streaming vs. Blockchain Platforms: Royalty Payouts Comparison

| Platform | Type | Payout Rate |

|---|---|---|

| Spotify | Traditional | $0.003 per stream |

| Tidal | Traditional | $0.0125 per stream |

| Apple Music | Traditional | $0.0075 per stream |

| Unchained Music | Blockchain | 100% net to artists |

| OnChain Music | Blockchain | 92% net to artists |

| Blockchain Average | 98% net to artists |

These numbers aren’t hype; they’re from real reports exposing the inequality. Spotify’s tweaking its model to favor pros, but indies? Still sidelined. Blockchain platforms smash that by tokenizing royalties into NFTs or shares, letting you bypass the BS and sell independent artist royalties blockchain style.

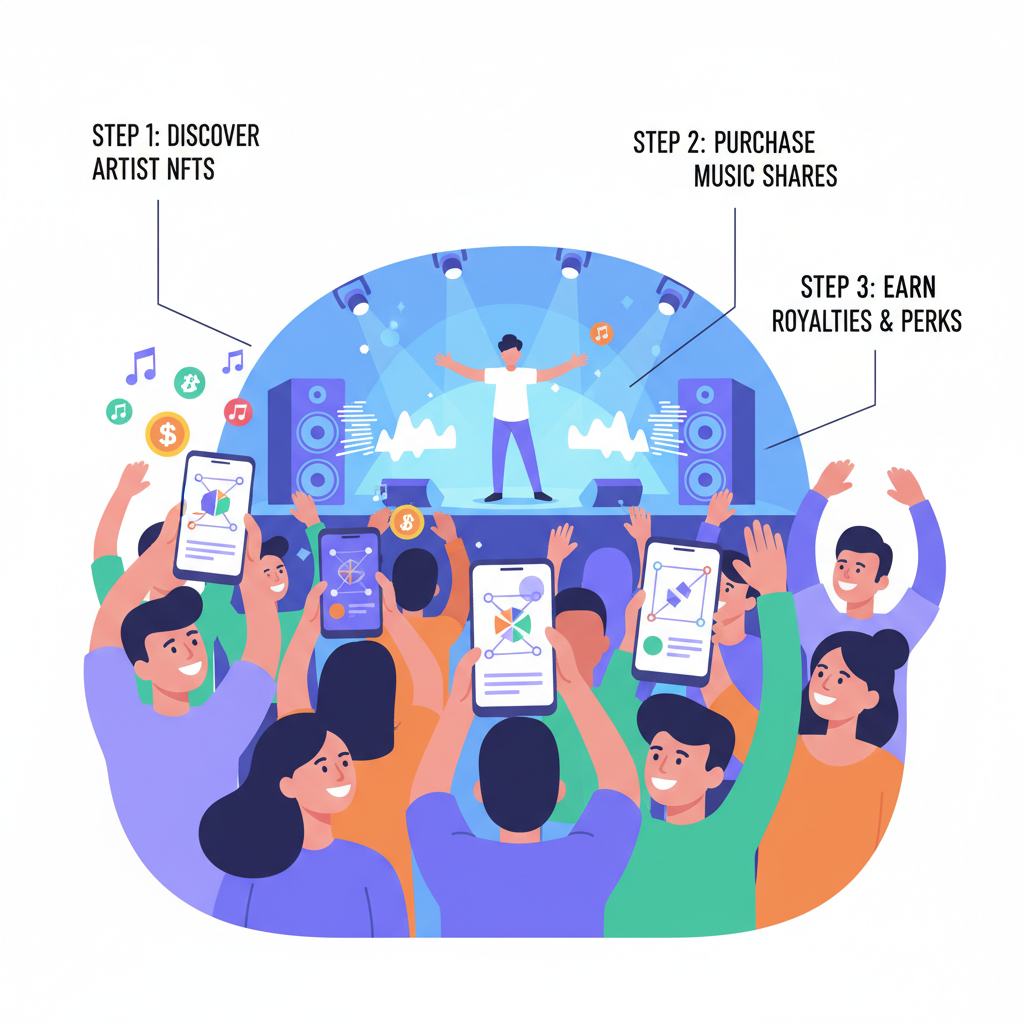

Tokenization Unlocks Fractional Ownership – Fans Buy In, You Cash Out Big

Here’s the play: fractional music ownership Web3 means slicing your song’s future royalties into tokens. Fans snag fractions via NFTs, becoming mini-investors who get a cut of every stream or sale. You? Retain control and grab 98% and of revenues. It’s like crowdfunding your catalog without losing the rights. Platforms handle the smart contracts, ensuring every penny flows on-chain instantly.

Royal. io, cooked up by DJ 3LAU, nails this. Artists drop limited NFTs tied to royalties; buyers score passive income. OnChain Music pushes 92% gross revenue in their $MUSIC token. Unchained Music goes nuclear with 100% streaming royalties kept by you, plus interest from stablecoin pools. Audius lets you stream decentralized, tip in crypto, full rights intact. Too Lost adds catalog smarts and direct data access. These aren’t gimmicks – they’re tactical edges for selling music royalties blockchain.

Top 5 NFT Royalty Wins for Indies

-

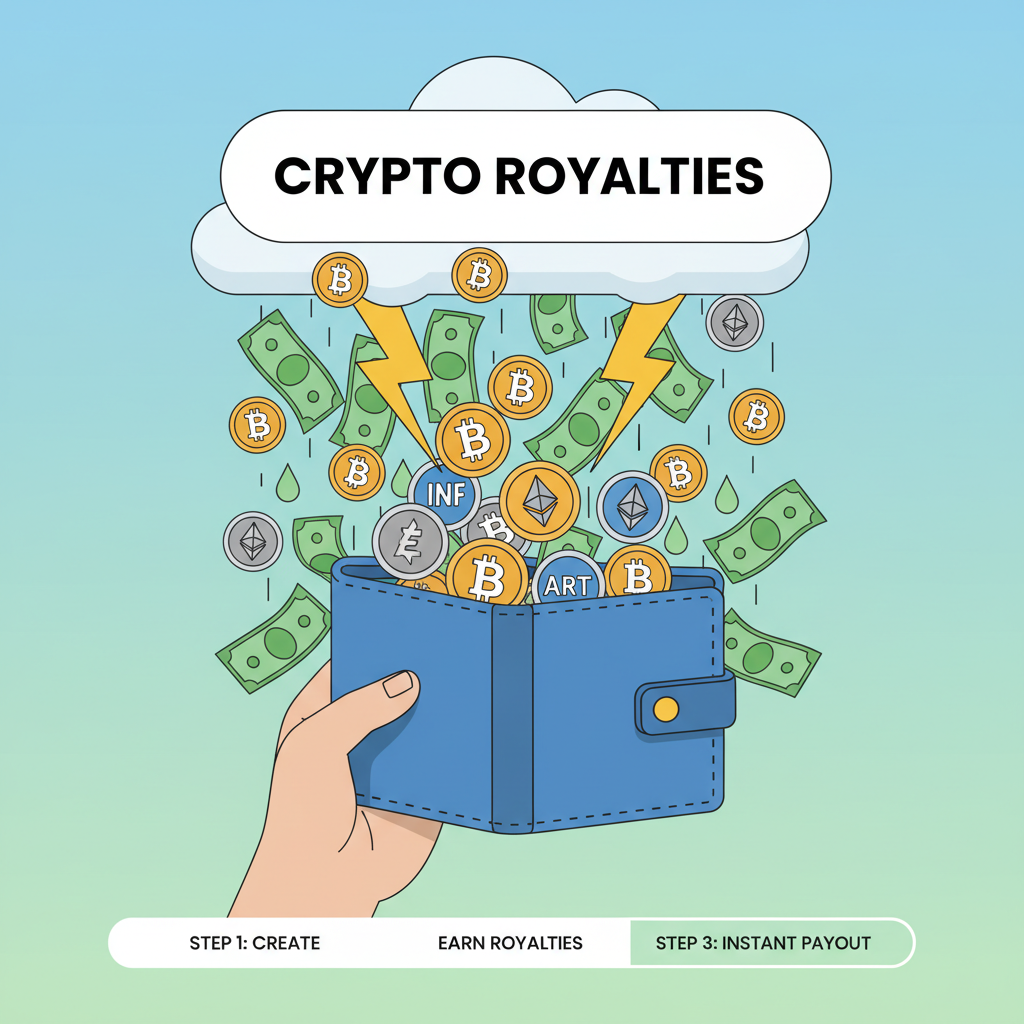

Cut Middlemen, Max Take-Home: Ditch labels & streamers – keep up to 98% like Unchained Music‘s 100% model!

-

Instant On-Chain Payouts: Cash hits your wallet instantly via Sei & Dynamic on Unchained – no delays!

-

Fan Investment = Loyalty: Fans snag NFT shares on Royal.io, earning royalties & becoming true investors!

-

Transparent Revenue Tracking: Blockchain logs every stream & payout – full visibility, zero BS!

-

Global Reach, No Borders: Beam music to fans worldwide 24/7 on Audius or OnChain – borderless bucks!

Real Platforms Delivering 98% Payouts Right Now

Dive deeper: Unchained Music distributes free, on-chains royalties via Sei network for speed and security. Artists keep every streaming dime, earning extra from liquidity. Pair it with Dynamic ID for fraud-proof payouts. Royal. io turns fans into stakeholders; buy a slice of Nas or Nas X tracks, royalties hit your wallet auto. On-chain revenue sharing like this empowers you to monetize niches traditional labels ignore.

OnChain Music’s whitepaper spells it: opt for $MUSIC token royalties, pocket 92% gross from distro, NFTs, merch. Audius flips streaming – upload, stream, get rewarded per play, no gatekeepers. These setups tackle demonetization head-on, where collectors pay hundreds over pennies. Indies, this is your momentum trade: tokenize now, ride the Web3 wave to real ownership. Check NFT music royalties momentum building fast.

Stacking these tools means tactical wins: higher cuts, fan armies, data dominance. Forget Spotify’s scraps; blockchain’s your volatility play for sustainable income.

Ready to execute? Time to break down the sell music royalties blockchain playbook. Indies are flipping the script, turning tracks into tokenized assets that print money while labels watch from the sidelines. But it’s not just hype – these platforms deliver real alpha, with NFT music royalties 98% payout baked in. Let’s map your entry.

Tactical Launchpad: Tokenize Your Tracks in 5 Moves

Follow that guide, and you’re live in days, not months. Pick Unchained for free distro and 100% royalties – upload, hit Sei chain, watch stablecoin pools juice your earnings. Dynamic ID locks it down, no fraudsters siphoning shares. Royal. io? Mint NFTs for Nas-level tracks; fans buy in at low entry, you skim 98% after chain fees. OnChain Music rewards $MUSIC holders with 92% gross – distro, merch, NFTs all included. Audius keeps it streaming-focused: direct uploads, crypto tips, zero cuts beyond gas.

Too Lost rounds it out with backend muscle – catalog tracking, royalty financing, streaming data straight to you. No black-box algorithms hiding plays. This stack crushes Spotify’s $0.003 joke, where indies need millions of spins for rent money. Blockchain’s volatility? Manage it smart: diversify tokens, hedge with stables, track on-chain dashboards 24/7.

Blockchain Platforms vs. Traditional: Payouts and Key Advantages

| Platform | Payout % / Model | Key Advantages |

|---|---|---|

| Unchained Music | 100% | Free distro and liquidity interest, Instant Sei payouts |

| Royal.io | 98% | Fan fractional NFTs, Auto royalty splits |

| OnChain Music | 92% | $MUSIC token opt-in, NFTs and merch revenue |

| Audius | Full control | Decentralized streams, Crypto tips direct |

| Spotify | $0.003/stream | Gatekept model, Months-delayed pennies |

Numbers don’t lie – that table’s your cheat sheet. Indies on these nets report 10x uplifts, fans locked in as co-owners boosting virality. Demonetization? Obliterated when collectors drop hundreds on your tokenized drops over streaming scraps.

Risks? Yeah, But Here’s Your Edge

Blockchain ain’t risk-free – gas fees spike, markets swing, scams lurk. But tactical traders like me thrive here. DYOR platforms, use audited contracts, start small with one track. Volatility analysis? Watch $MUSIC token charts for momentum; pair with stable pools for steady drip. Fan armies mitigate dumps – loyal holders HODL for royalties. Compare to streaming’s slow bleed: predictable poverty vs high-upside plays.

One killer tactic: hybrid it. Distro traditional for reach, tokenize for revenue. Buy and sell tokenized music royalties on marketplaces, flip fractions during hype cycles. Platforms like these make splits automatic – no label haggling. Indies, you’re the house now.

The wave’s cresting. Spotify tweaks royalties? Too late, pros only. Blockchain hands indies the keys: independent artist royalties blockchain at 98%, fractional cults, global scale. Upload that bedroom banger, tokenize, sell shares. Watch wallets fill while you create. Ride smart, stack wins – future’s tokenized, and you’re early.