Imagine turning your favorite songs into a steady stream of passive income, all powered by blockchain. That’s the reality of tokenized music royalties trading today, where platforms like Bolero are making fractional music royalties blockchain accessible to everyday investors and fans alike. No longer reserved for big labels or wealthy insiders, music rights are now tradeable assets on-chain, offering liquidity and transparency that the old industry could only dream of. With Bolero’s recent migration to Base, Coinbase’s Ethereum Layer 2, transaction fees have plummeted, and scalability has soared, drawing in more users eager for Bolero music rights investment.

Bolero: Pioneering Tokenized Debt Instruments for Royalties

Bolero stands out as the industry leader, letting you buy tokenized debt instruments backed by future royalties from high-value music catalogs. Think of it as lending to proven hits, earning yields from streams and sales without owning the masters outright. Their new NFT Song Share feature takes it further, enabling NFT music royalty ownership through fractional shares of individual tracks. This French startup has nailed the balance between artist empowerment and investor returns, with audited smart contracts ensuring every payout is verifiable on-chain.

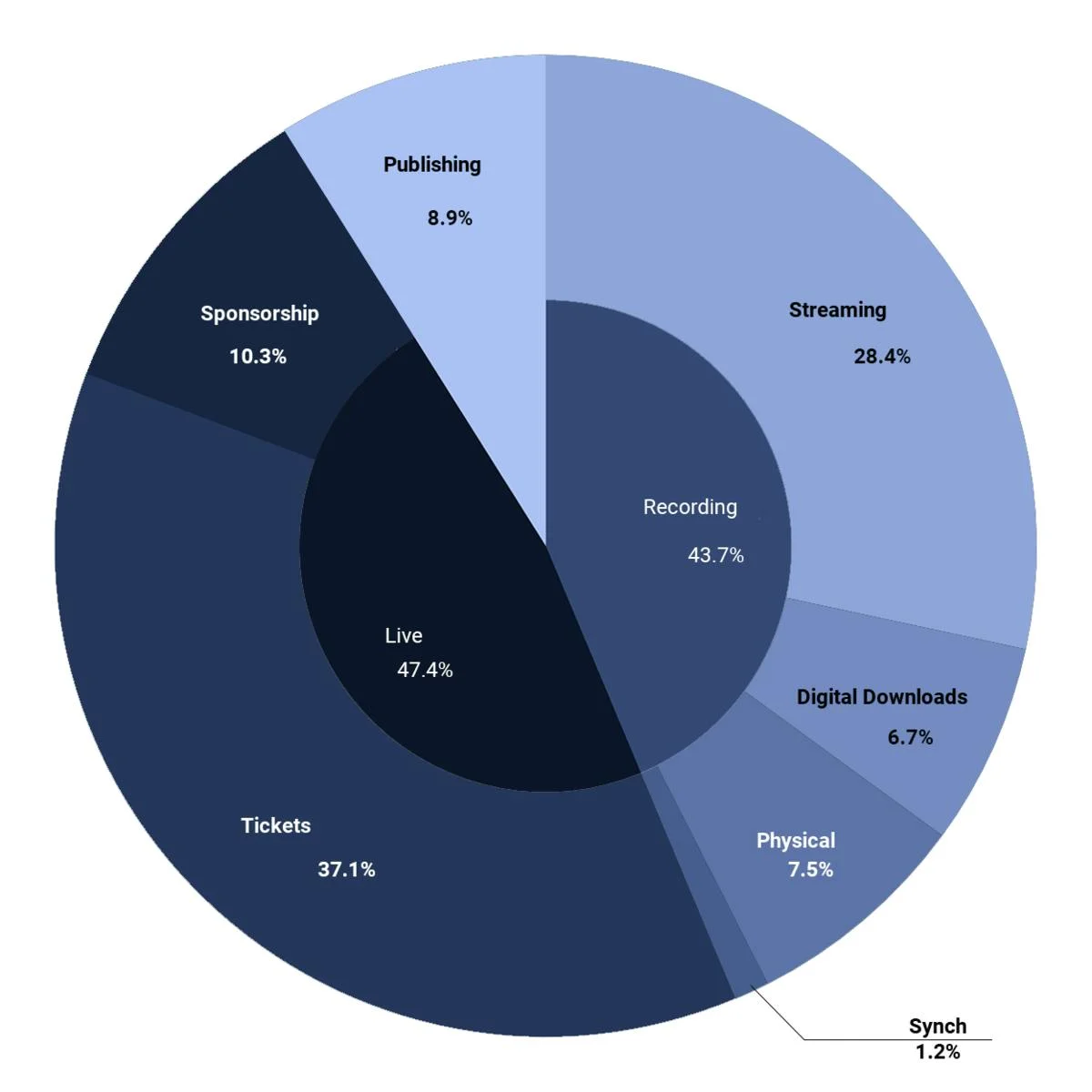

What reassures me most, after years in crypto and stocks, is Bolero’s focus on real-world assets. Revenues flow directly from PROs like ASCAP and BMI, tokenized and distributed weekly or monthly. Investors, from novices to pros, can start small, diversifying across catalogs that have generated billions in royalties historically. Patience here truly compounds, as steady streaming growth amplifies long-term gains.

For those dipping toes, Bolero’s platform simplifies wallet connections and trades, much like swapping ETH on Uniswap but for music cash flows. Their move to Base means gas fees under a dollar, making frequent trading viable. I’ve seen platforms come and go, but Bolero’s partnerships and tech stack position it for dominance in blockchain music royalty platforms 2026.

Ripe and Royal. io: Fresh Faces Reshaping the Landscape

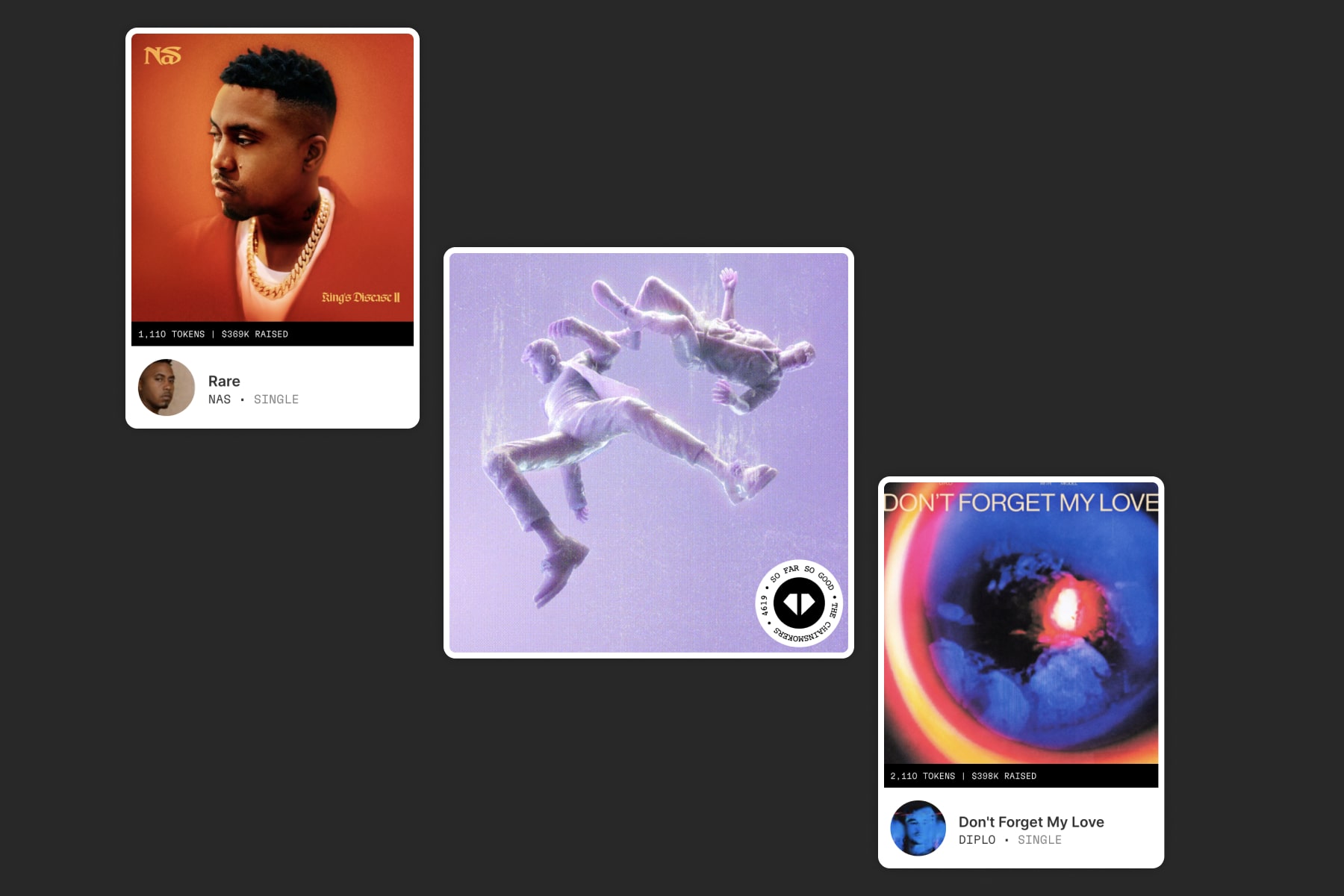

Beyond Bolero, Ripe is gaining traction with its Web3 approach to music investments. Users buy royalty-backed assets and pocket weekly payouts from streams, all secured by transparent smart contracts. It’s perfect for those wanting predictable income without the volatility of pure crypto plays. Royal. io, co-founded by DJ 3LAU, brings star power, partnering with Nas and The Chainsmokers to fractionalize rights. Fans snag tokens for a slice of royalties, blending fandom with finance seamlessly.

Top Fractional Royalty Platforms

-

Bolero: Leading platform for investing in tokenized music rights and earning passive income from royalties via debt instruments backed by future revenues. Recently migrated to Base for better scalability. Visit Bolero

-

Ripe: Web3 platform to invest in royalty-backed music assets with weekly streaming payouts, secured by audited smart contracts for transparency. Visit Ripe

-

Royal.io: Co-founded by 3LAU, lets artists like Nas and The Chainsmokers sell fractional music rights as tokens, sharing royalties with fans. Visit Royal.io

These aren’t gimmicks; they’re backed by real economics. Tokenization boosts liquidity, letting sellers cash out future streams instantly while buyers enter at low thresholds, often $100 or less. Ripe’s audited contracts and Royal’s artist endorsements add layers of trust I always seek in new markets.

The Mechanics of Trading on These Platforms

Trading tokenized music royalties mirrors NFT marketplaces but with yield-bearing tokens. Connect your wallet, browse catalogs rated by projected revenues, and swap stablecoins or ETH for shares. Platforms handle compliance, KYC where needed, and automate distributions via oracles pulling PRO data. For deeper insight, check our guide on how tokenized music royalties work. Risks? Sure, like streaming dips or legal shifts, but diversification across platforms mitigates that. Bolero’s debt model, for instance, prioritizes principal repayment, appealing to conservative portfolios.

Crowd Records innovates further, letting artists tokenize song concepts for fan-funded development, with blockchain safeguarding copyrights. ANote Music and SongVest complement this, listing royalty streams from Europe to the US, creating a global marketplace. As someone who’s navigated crypto winters, I appreciate how these build sustainable ecosystems, not hype.

These platforms aren’t just replicating each other; each carves a unique niche in the blockchain music royalty platforms 2026 space. ANote Music focuses on European catalogs with a fintech polish, ideal for rights holders seeking quick liquidity on future streams. SongVest, stateside, offers a centralized twist, emphasizing vetted deals for US investors wary of pure DeFi. Together, they form a maturing ecosystem where tokenized music royalties trading feels less like speculation and more like a diversified income strategy.

Platform Comparison: Finding Your Best Fit

Choosing the right platform boils down to your goals, risk tolerance, and preferred assets. Bolero excels in high-value catalogs with debt-backed stability, while Ripe prioritizes weekly streaming payouts for steady cash flow. Royal. io appeals to fans with artist-branded tokens, and Crowd Records suits early-stage backers betting on undiscovered talent. I’ve crunched the details to help you compare.

Comparison of Top Platforms for Trading Tokenized Music Royalties

| Platform | Key Feature | Payout Frequency | Min Investment | Chain |

|---|---|---|---|---|

| Bolero | Tokenized debt instruments, low fees | N/A | N/A | Base L2 |

| Ripe | Audited contracts, royalty-backed assets | Weekly | N/A | Web3 |

| Royal.io | Artist tokens (Nas, Chainsmokers) | N/A | N/A | Blockchain |

| ANote Music | EU royalties marketplace | N/A | N/A | Centralized |

| SongVest | US centralized marketplace | N/A | N/A | Centralized |

| Crowd Records | Song concepts tokenization | N/A | N/A | Blockchain |

This snapshot shows how accessible entry points keep barriers low, often under $100, fostering broad participation. Bolero’s Base migration slashes fees to pennies, outpacing Ethereum mainnet rivals and making it my pick for active traders.

Transparency reigns supreme here. Smart contracts automate everything from revenue oracles to distributions, verifiable by anyone with Etherscan. No more opaque label accounting; blockchain logs every stream dollar on-chain. This shift empowers artists too, with instant access to capital minus middlemen skims.

Risks to Watch and Smart Strategies

Every investment carries hurdles, and fractional music royalties blockchain is no exception. Streaming volatility from algorithm changes or market saturation can dent short-term yields. Regulatory gray areas around tokenized securities loom, though platforms like Bolero navigate with compliant debt notes. Copyright disputes, rare but possible, underscore the need for PRO-verified assets.

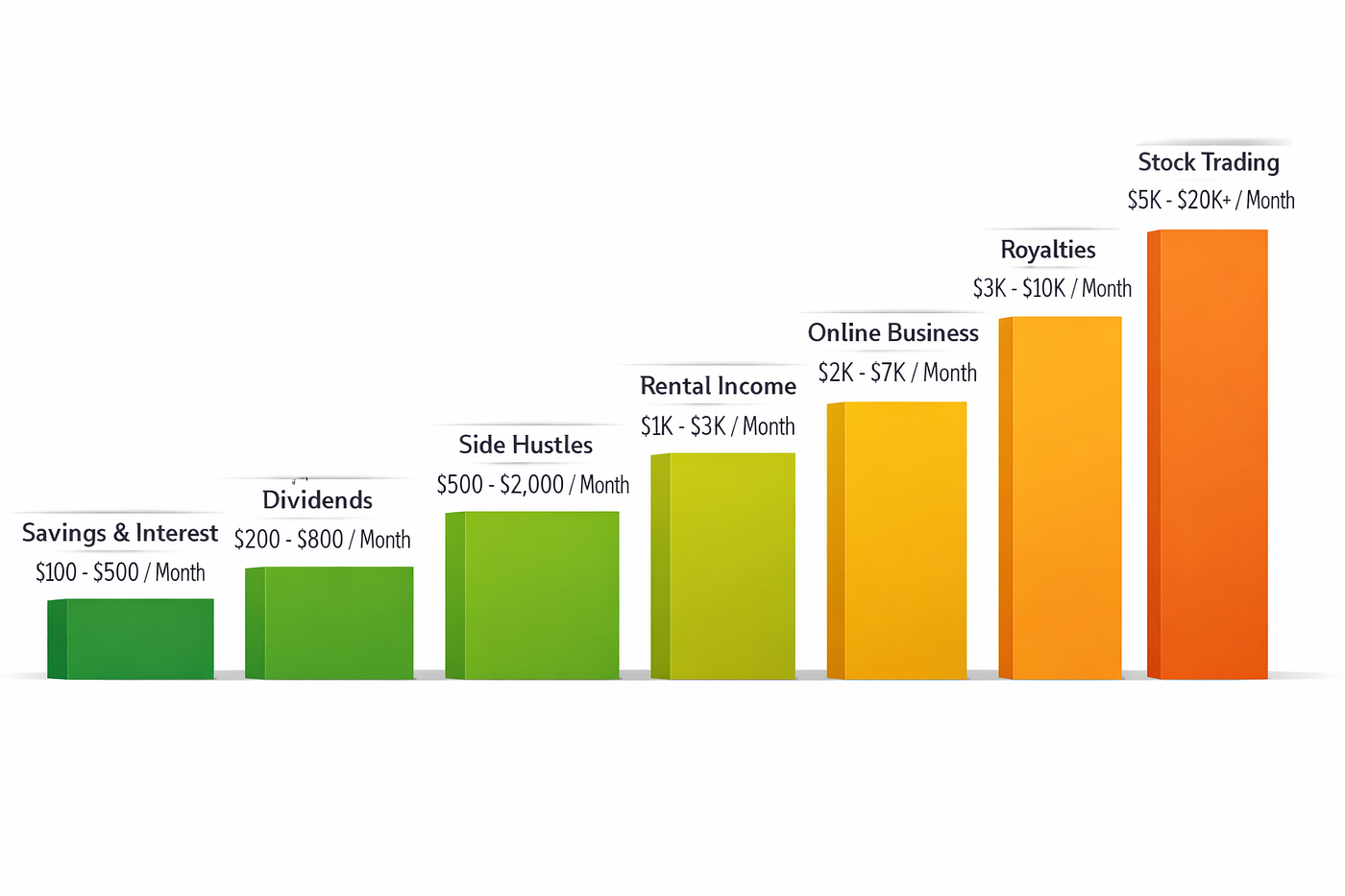

My approach? Diversify across 5-10 tokens from varied genres and platforms. Allocate 60% to proven catalogs like Bolero’s, 30% to mid-tier like Ripe, and 10% to high-upside plays on Royal. io. Monitor via dashboards, rebalance quarterly, and hold through dips; music consumption grows 10% yearly per IFPI data. Patience compounds returns, especially as Web3 adoption swells.

Essential Investing Strategies

-

Check smart contract audits: Always verify audits on platforms like Ripe, which secures royalty-backed assets with audited contracts, ensuring transparency and security for your investments.

-

Track streaming metrics: Monitor real-time streaming data on platforms like Bolero and Royal.io to gauge royalty potential from hits by artists like Nas or The Chainsmokers.

-

Use low-fee L2s like Base: Opt for scalable solutions like Base, where Bolero recently migrated its registry, slashing fees and boosting accessibility for tokenized music rights.

-

Reinvest payouts: Compound your passive income by reinvesting weekly streaming royalties from platforms like Ripe, growing your music rights portfolio over time.

For hands-on starters, connect a wallet like MetaMask, fund with USDC, and browse listings. Platforms guide KYC if required, then approve trades in seconds. Payouts hit automatically, often weekly, blending the thrill of trading with mailbox money vibes. Dive deeper with our how-to-buy guide.

Looking ahead, expect integrations with AI playlist curators and social tokens, amplifying NFT music royalty ownership. Bolero’s innovations signal a tipping point; what was niche in 2024 is mainstream by 2026. Investors tuning in now capture compounding from streaming’s endless tail. Whether you’re a Nas fan or catalog hunter, these markets offer real ownership in the soundtrack of our lives, secured by code that never sleeps.