In the bustling world of blockchain music investments 2026, tokenized music royalties have emerged as a game-changer for savvy investors seeking steady streams of passive income. Picture this: instead of betting on volatile stocks or fleeting NFTs, you can own a slice of future earnings from hit songs via fractional music royalties blockchain. Platforms like Music Royalty Markets make it possible to trade these digital assets seamlessly, turning abstract royalty rights into tangible, on-chain opportunities.

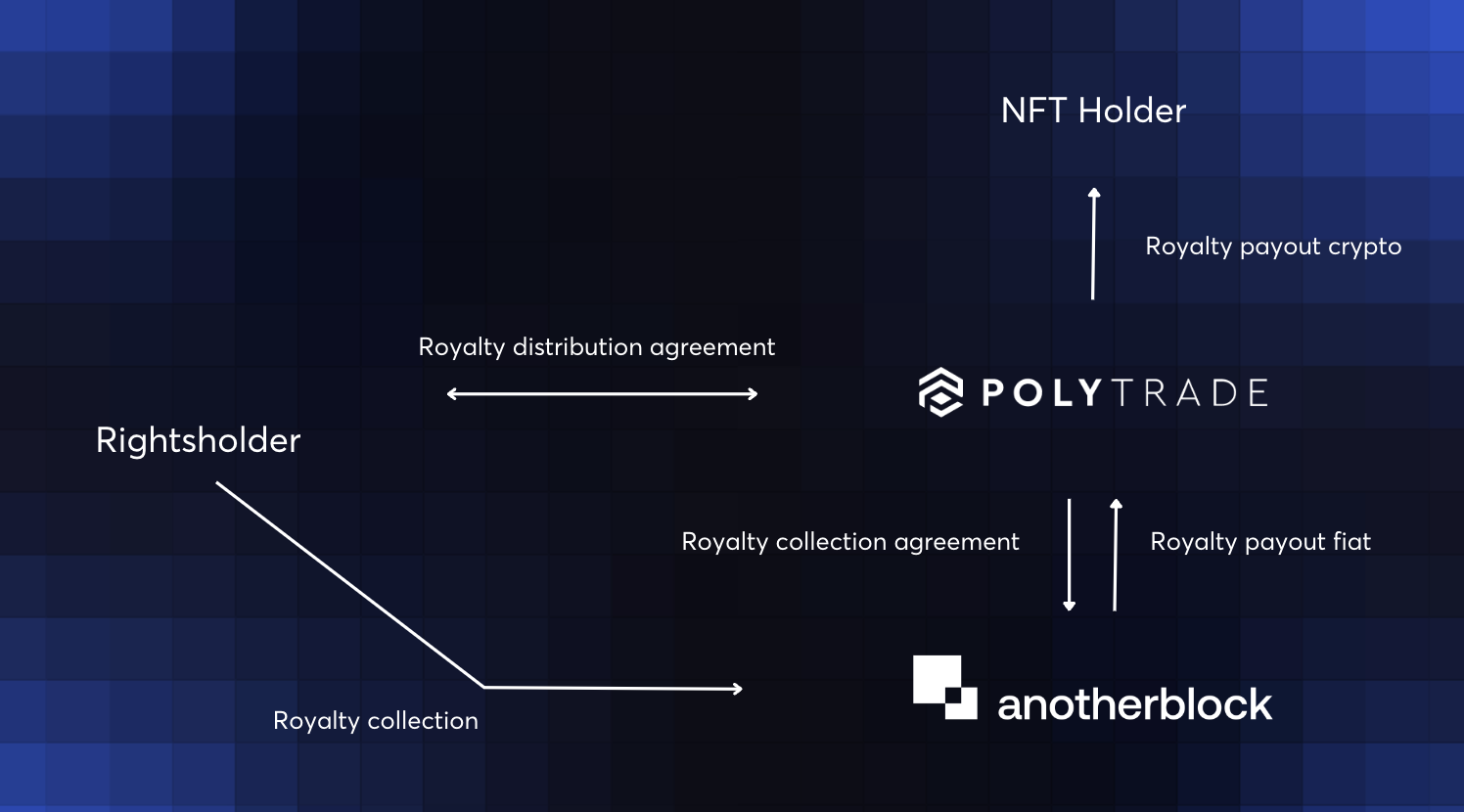

As of January 2026, over $1 billion in music rights has migrated to blockchain, according to industry reports. This shift isn’t just hype; it’s a structural upgrade to how streaming royalties fractional ownership works. Artists tokenize portions of their royalties, investors buy in with minimal capital, and smart contracts handle the rest. No more opaque middlemen or delayed payouts.

Decoding Tokenized Streaming Royalties

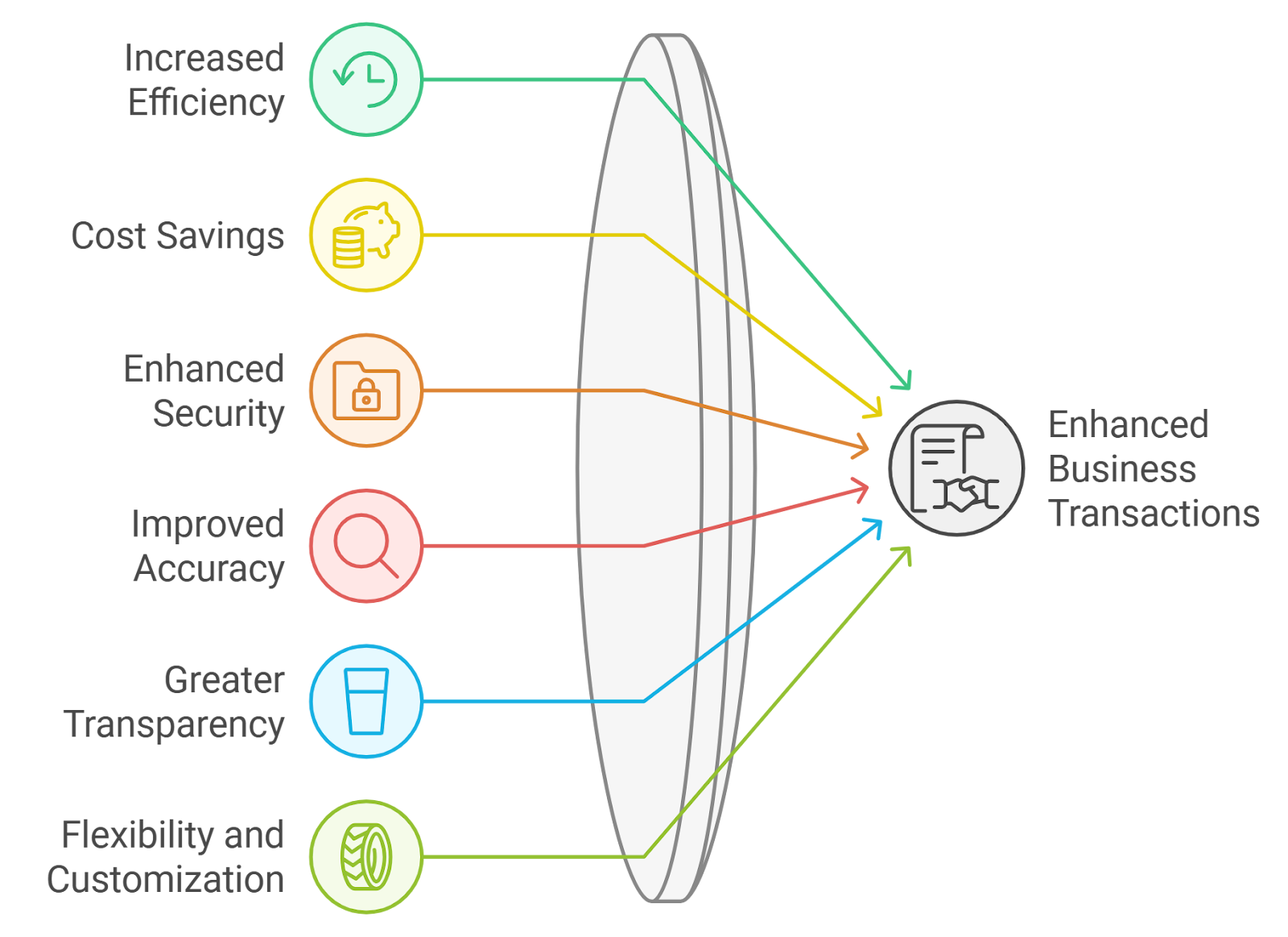

At its core, tokenized music royalties represent real-world assets (RWAs) like publishing and performance rights digitized on blockchain. Every stream on Spotify or Apple Music triggers micro-payments, recorded immutably and distributed automatically. Sources like Chainlink highlight how fractional ownership divides these assets into tradable tokens, lowering barriers from millions to mere hundreds of dollars per stake.

This model shines in transparency. Blockchain’s ledger lets you track every transaction, from initial tokenization to royalty splits. Artists retain control, deciding token supply and vesting, while investors gain liquidity through secondary markets. It’s a far cry from traditional royalty pools, where funds languish in bureaucratic black holes.

Top 5 Benefits of Tokenized Music Royalties

-

1. Accessibility for Small InvestorsFractional ownership via platforms like Zoniqx lowers entry barriers, allowing anyone to buy shares in music royalties, democratizing access to this asset class as seen with Maecenas in art tokenization.

-

2. Automated PayoutsSmart contracts on blockchain, powered by Chainlink, automate royalty calculations and distributions, ensuring timely, error-free payments without intermediaries.

-

3. Fan-Artist BondsTokenization fosters direct connections as fans gain fractional ownership in artists’ royalties, aligning incentives and enhancing engagement, per Zoniqx innovations.

-

4. Liquidity BoostsTokens trade on secondary markets, transforming illiquid royalties into flexible assets that investors can buy or sell easily, boosting market efficiency.

-

5. Diversification PerksMusic royalties add passive income streams to portfolios, offering uncorrelated returns and hedging against traditional market volatility in 2026.

Fractional Ownership Unlocks New Investor Access

Fractional music royalties blockchain democratizes what was once an elite playground. Pre-2026, only high-net-worth individuals or funds could snap up entire catalogs. Now, platforms enable shares as small as 0.1%, mirroring fine art tokenization successes like Maecenas. This accessibility fuels broader participation, with Zoniqx noting enhanced liquidity as tokens trade 24/7 on decentralized exchanges.

For artists, it’s a lifeline. Tokenizing upfront provides capital for tours or studios without loans. Investors, meanwhile, tap diversified cash flows uncorrelated to stocks or crypto volatility. In my decade analyzing cross-asset plays, this stands out: music royalties offer yields often 8-12% annually, buffered by evergreen catalogs.

The blockchain automates ownership tracking and royalty distribution. The artist decides how much to share and keeps full control. – Making A Scene!

Smart Contracts: The Engine of Trust and Efficiency

Smart contracts are the unsung heroes here. They calculate royalties per stream, enforce splits, and disburse funds instantly, slashing admin costs by up to 90%. Chainlink’s insights underscore this: immutable code means no disputes, just verifiable payouts. For blockchain music investments 2026, this reliability trumps legacy PROs like ASCAP.

Consider fan engagement too. Tokens often bundle perks – exclusive drops or voting rights – forging loyalty loops. Platforms like Music Royalty Markets integrate this seamlessly, letting you trade with confidence. Yet, success demands diligence: vet platforms for audits and legal wrappers ensuring off-chain rights sync with on-chain tokens.

Risk management is key. While yields allure, streaming volumes fluctuate with trends. Diversify across genres and eras; blend hip-hop bangers with classic rock staples. My motto holds: smart diversification beats blind speculation. As regulations mature, expect clearer paths, but always prioritize audited chains like Ethereum or Solana derivatives.

Trading these assets mirrors stocks yet feels futuristic. Wallets connect, tokens swap, royalties accrue. Early adopters are reaping rewards, with some portfolios yielding double-digit returns amid 2026’s market thaw.

Getting hands-on with trading music royalties NFT platforms starts with selecting a reputable marketplace like Music Royalty Markets. These venues list tokenized assets backed by verifiable streaming data, often from PROs like BMI or SoundExchange. Connect your wallet, scan listings, and execute trades with gas fees minimized on layer-2 solutions. Yields compound as streams roll in, paid out weekly or monthly via stablecoins.

Navigating Risks in Blockchain Music Investments 2026

Every opportunity carries pitfalls, and streaming royalties fractional ownership is no exception. Streaming volatility tops the list: a viral hit surges revenues, but flops crater them. Diversify across 10-20 tokens spanning genres – pop for growth, jazz for stability. Regulatory shifts loom too; jurisdictions like the EU demand KYC for RWAs, while the US SEC eyes securities classification. Platforms wrapping rights in SPVs mitigate this, but verify legal opinions.

Counterparty risks linger if off-chain rights falter. Smart contract bugs, though rare post-audits, demand vigilance. I advise allocating no more than 5-10% of your portfolio here, balancing with bonds or gold. Historical data shows tokenized music weathering crypto winters better than pure alts, thanks to real revenue anchors.

Transparency sets this apart. Blockchain explorers reveal every payout, unlike black-box funds. Zoniqx and Chainlink reports affirm: automated distributions cut disputes by 95%, with fans buying tokens for perks like metaverse gigs. This fusion of investment and fandom redefines engagement.

Market Projections: What Lies Ahead

By late 2026, expect tokenized royalties to hit $5 billion, propelled by AI playlists boosting streams and Web3 adoption. GenX AI notes fractionalization unlocks artist earnings, while RWA. io predicts on-chain cash flows dominating. Investors eyeing blockchain music investments 2026 should watch Solana for speed, Polygon for fees.

Tokenized Streaming Royalties Token Price Prediction 2027-2032

Bear, Base, and Bull market scenarios (prices per token, assuming 1B fixed supply equivalent to 2026 market caps of $3B bear, $5B base, $8B bull)

| Year | Minimum Price (Bear) | Average Price (Base) | Maximum Price (Bull) |

|---|---|---|---|

| 2027 | $3.30 | $6.25 | $11.20 |

| 2028 | $3.63 | $7.81 | $15.68 |

| 2029 | $3.99 | $9.76 | $21.95 |

| 2030 | $4.39 | $11.71 | $29.63 |

| 2031 | $4.75 | $14.05 | $38.52 |

| 2032 | $5.13 | $16.59 | $48.15 |

Price Prediction Summary

The tokenized streaming royalties sector is set for substantial expansion from 2027-2032, driven by 15% YoY streaming growth, rapid artist tokenization adoption, and blockchain-enabled fractional ownership. Base case anticipates ~22% CAGR in average price to $16.59 by 2032, with bull scenarios potentially surpassing $48 amid mass adoption and favorable regulations, while bear cases maintain modest 10% growth to $5.13.

Key Factors Affecting Tokenized Streaming Royalties Price

- 15% YoY global streaming revenue growth

- 200% surge in artist tokenizations boosting supply of investable assets

- 10% average annual yield from automated royalty distributions

- Regulatory developments enhancing RWA legitimacy and investor protection

- Technological improvements in smart contracts for transparency and liquidity

- Crypto market cycles influencing overall adoption

- Increased fan engagement and secondary market trading

- Competition from traditional music investments and emerging RWA sectors

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Platforms evolve too. Music Royalty Markets pioneers NFT-gated royalties, blending collectibles with income. Early movers like those tokenizing catalogs from icons see 15% and IRR. My take: pair rising stars with proven hits for asymmetric upside. Tools like Dune dashboards track volumes, informing entries.

For practical entry, master marketplace dynamics. Stress-test scenarios: if streams halve, does yield hold 6%? Platforms providing historical sims empower this. Fan tokens add alpha, granting governance over merch drops.

Tokenization allows for the fractionalization of music royalties, enabling artists to sell a percentage of their future earnings as digital tokens. – GenX AI

This ecosystem matures, rewarding patient allocators. From $1 billion today, scaling hinges on interoperability – cross-chain bridges linking royalties to gaming royalties or film residuals. Investors blending fundamentals (catalog depth) with technicals (token velocity) thrive. Smart diversification, as always, trumps speculation, positioning portfolios for the streaming era’s next wave.