In the evolving landscape of decentralized finance, tokenized music royalties stand out as a compelling class of real-world assets (RWAs). These digital tokens represent genuine ownership stakes in music revenue streams, transforming passive listening into potential investment income. Platforms like Opulous are at the forefront, bridging artists’ creative output with investors’ capital through blockchain’s immutable ledger. As streaming dominates music consumption, on-chain mechanisms ensure royalties flow directly and transparently, bypassing traditional intermediaries.

Consider the mechanics: a song’s future royalties from Spotify, Apple Music, or YouTube are tokenized into fungible or non-fungible units. Holders receive proportional shares of streaming payouts, recorded immutably on-chain. This model, as highlighted by sources like Zoniqx and RWA. io, simplifies management, boosts liquidity, and fractionalizes assets that were once locked in opaque deals. Unlike NFTs, which often focus on collectible uniqueness, tokenized music royalties prioritize steady cash flows, aligning perfectly with RWA principles.

Tokenization Unlocks Fractional Ownership in Music Assets

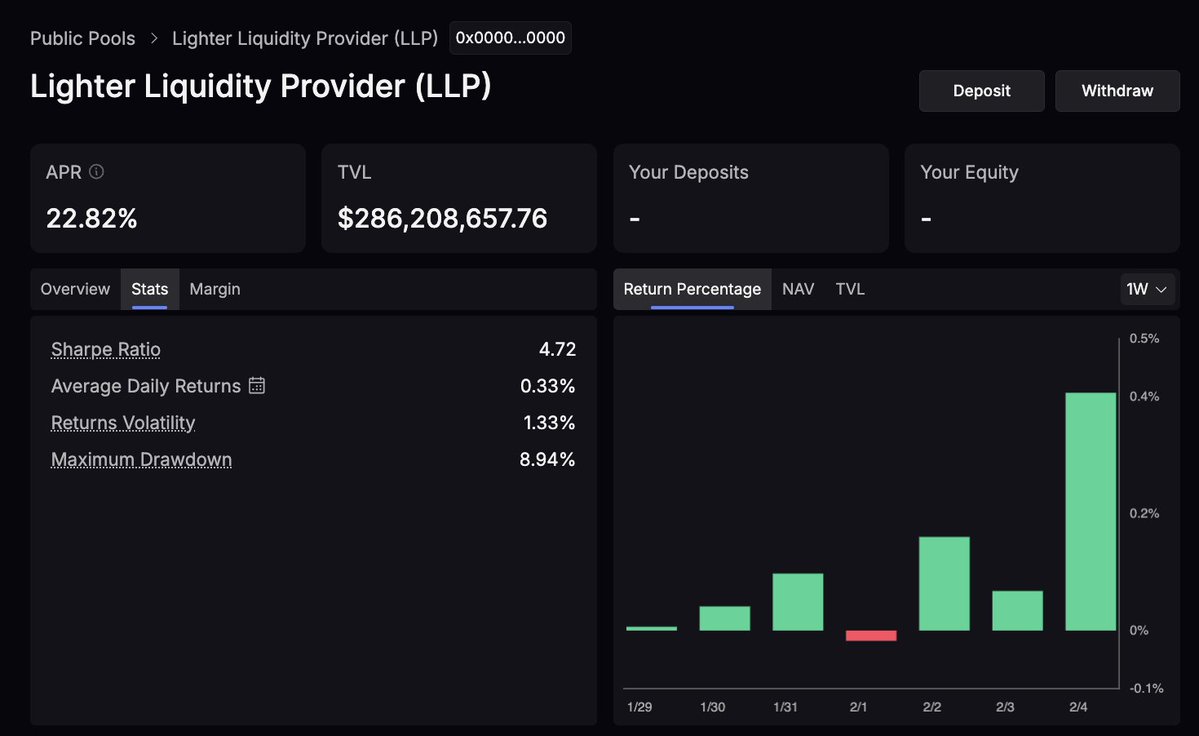

Tokenization converts rights into blockchain-based tokens, enabling fractional music royalties investment. A single track can be split into thousands of shares, allowing retail investors to buy in for pennies. Making A Scene notes this as part of Web3’s push for equitable ownership, while Binance points to OPUL staking for royalty pools decoupled from crypto volatility.

On Algorand and Ethereum, smart contracts automate splits and distributions. Every stream triggers a calculation; payouts settle instantly to wallets. Fadai Mammadov on Medium emphasizes accessibility: music assets, once elite, now invite broad participation. BlockchainX forecasts this trend peaking in Web3 entertainment by 2025, with tokens tying holders to songs’ long-term profits.

Tokenization of music rights makes assets more accessible and liquid, fundamentally democratizing investment opportunities.

This fractional approach creates micro-economies per song, as Algorand describes. Investors diversify across catalogs, mitigating hit-driven risks inherent in music.

Opulous Leads with Music Fungible Tokens and AI Insights

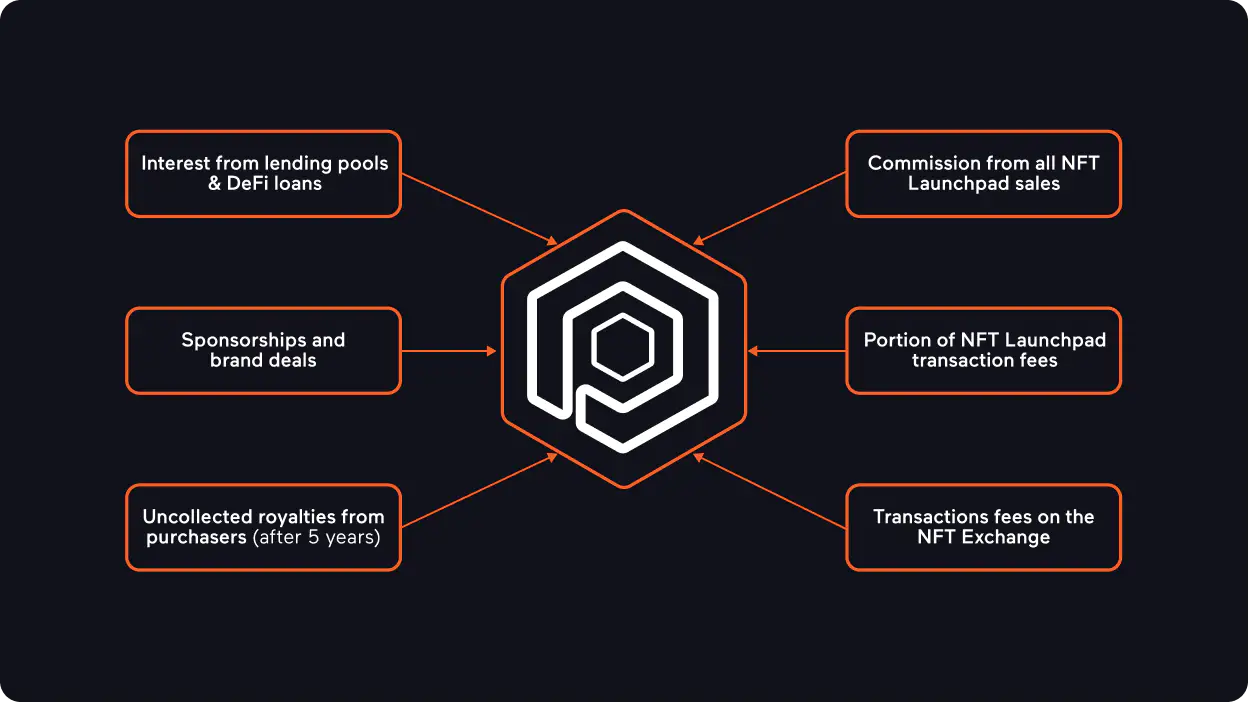

Opulous exemplifies music RWAs blockchain innovation. Artists tokenize royalties into Music Fungible Tokens (MFTs), securing upfront funding while retaining control. Fans and investors purchase fractions, earning from streams. Built on dual chains for efficiency, it features Opulous AI predicting royalties across platforms, fostering informed decisions.

A landmark case: in 2021, Lil Pump sold MFTs for ‘Mona Lisa’ featuring Soulja Boy, raising $500,000 from 927 investors in two hours. Quarterly payouts hit wallets based on performance. OVAULT adds diversification, bundling top catalog access into one token. IQ. wiki praises such platforms for true creator-fan ownership.

Current metrics reflect resilience: OPUL trades at $0.005640, down marginally 0.0122% over 24 hours (high $0.005753, low $0.005614). This stability suits conservative portfolios chasing yield over speculation. Real examples from Opulous illustrate viability.

Opulous (OPUL) Price Prediction 2027-2032

Forecast based on RWA adoption in tokenized music royalties, streaming revenue growth, and blockchain integration in the music industry

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $0.0035 | $0.0120 | $0.0280 | +114% |

| 2028 | $0.0050 | $0.0220 | $0.0450 | +83% |

| 2029 | $0.0080 | $0.0350 | $0.0700 | +59% |

| 2030 | $0.0120 | $0.0550 | $0.1000 | +57% |

| 2031 | $0.0180 | $0.0850 | $0.1500 | +55% |

| 2032 | $0.0250 | $0.1300 | $0.2200 | +53% |

Price Prediction Summary

Opulous (OPUL) shows strong growth potential from $0.0056 in 2026, with average prices projected to reach $0.130 by 2032 amid RWA tokenization boom in music royalties. Bullish scenarios driven by streaming adoption could push highs to $0.220, while bearish regulatory or market risks cap lows.

Key Factors Affecting Opulous Price

- RWA adoption and fractional music ownership growth

- Streaming revenue tokenization via MFTs and OVAULT

- Artist collaborations and platform integrations (Algorand, Ethereum)

- Regulatory developments for tokenized assets

- Crypto market cycles and competition from other RWA projects

- Technological advancements like Opulous AI for royalty predictions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

On-Chain Streaming Revenue Shares: Transparency Meets Yield

On-chain streaming revenue shares via Opulous eliminate disputes. Smart contracts enforce splits; blockchain logs every transaction. TNGlobal explains tokenization’s role in transferability, while Phemex covers peers like Aria with celebrity catalogs (Bieber, Cyrus). Yet Opulous’s focus on fungible, income-generating tokens sets it apart for steady returns.

For artists, immediate liquidity funds tours or production without label debt. Investors gain uncorrelated assets: royalties persist regardless of market cycles. My fundamentals-first lens sees this as low-volatility alpha, with payouts scaling via global streams. Platforms like this reshape economics, per Making A Scene, into fairer webs.

Diving deeper, consider risk-adjusted merits. Volatility hugs OPUL’s low price, but underlying royalties from evergreen hits compound reliably. Staking OPUL unlocks premium pools, enhancing yields tied to artist traction. This structure rewards patience, echoing my ‘steady wins the race’ mantra.

Evergreen catalogs form the bedrock here, delivering predictable income streams that weather streaming algorithm shifts or fleeting trends. While OPUL’s price at $0.005640 reflects broader market caution, the royalties it unlocks operate independently, tethered to cultural endurance rather than token hype.

Navigating Risks in Music Royalty RWAs

Conservative investors like myself scrutinize downsides rigorously. Music royalties carry artist-specific risks: a flop track yields scant returns, and legal disputes over rights can snag distributions. Streaming platforms might tweak payout formulas, as seen with Spotify’s periodic adjustments. Yet blockchain’s transparency mitigates opacity; every royalty source is auditable on-chain. Opulous’s AI tool forecasts these variables, equipping buyers with data-driven edges over gut-feel gambles.

Diversification remains key. Spreading stakes across MFTs or OVAULT bundles tempers single-song exposure. Unlike volatile NFTs, these RWAs emphasize cash flow stability, with historical data showing quarterly payouts persisting through crypto winters. Platforms enforce this via smart contracts, eliminating counterparty defaults common in legacy PROs like ASCAP or BMI.

Key Advantages of Opulous MFTs

-

Fractional Ownership: Opulous MFTs allow fans and investors to purchase fractional shares of songs’ future royalties, enhancing liquidity and accessibility as seen in collaborations like Lil Pump’s ‘Mona Lisa’.

-

AI Predictions: Opulous AI tool forecasts future royalties from streaming platforms, providing transparent data for artists and investors to make informed decisions.

-

Instant Payouts: Smart contracts on Algorand and Ethereum enable instant settlements and quarterly royalty payouts directly to investors’ wallets based on streaming performance.

-

Artist Funding: Artists receive upfront capital by tokenizing royalties, e.g., Lil Pump raised $500,000 from 927 investors in two hours for his track.

-

Low Entry Barriers: With OPUL at $0.005640, fractional MFTs and staking pools make music royalty investment accessible to everyday fans and small investors.

This setup appeals to fixed-income seekers eyeing alternatives. Yields, though modest initially, compound via reinvestment, outpacing inflation in a low-rate world. My analysis favors assets with proven revenue histories, where Opulous shines by partnering established acts.

Investor Strategies for On-Chain Music Yields

Approach fractional music royalties investment methodically: start with OPUL staking for gated pools, then allocate to high-conviction MFTs. Monitor Opulous AI outputs for undervalued tracks; prioritize those with viral potential or library staples. Quarterly reviews align holdings with performance, culling underperformers swiftly.

Compared to bonds or REITs, music RWAs offer uncorrelated returns. While a Treasury yields fixed coupons, tokenized royalties scale with global listens, tapping 600 million-plus streamers. Binance highlights OPUL’s artist-tied economics, shielding from pure crypto beta. For institutions, this fractional liquidity rivals private equity without lockups.

Steady streams from tokenized hits build portfolios resilient to economic squalls, proving patience’s quiet power.

Regulatory horizons clarify too. As RWAs mature, frameworks like MiCA in Europe legitimize these assets, boosting adoption. Opulous’s Algorand base ensures scalability, handling volume spikes from hits without congestion fees.

Glancing ahead, 2026 projections hinge on streaming’s ascent to $50 billion annually. Platforms tokenizing catalogs from majors will proliferate, but Opulous’s first-mover AI and fungible model position it dominantly. Investors entering at $0.005640 capture upside from institutional inflows chasing yield.

Ultimately, Opulous music royalties redefine participation: artists fund dreams upfront, fans own slices of favorites, investors harvest passive income. This blockchain bridge spans creativity and capital, fostering ecosystems where value accrues transparently. In my 17 years parsing alternatives, few match this blend of tangibility and innovation. Explore these opportunities where music’s rhythm meets financial steadiness.