Blockchain is rewriting the rules of music ownership and revenue, shifting power away from opaque intermediaries and into the hands of creators and their communities. With fractional ownership music NFTs and instant royalty payments now possible on-chain, musicians are no longer forced to navigate the labyrinthine legacy systems that have long delayed or diluted their earnings. Instead, blockchain music royalties are setting a new standard for transparency, accessibility, and fan engagement.

From Vinyl to On-Chain: The Evolution of Music Royalties

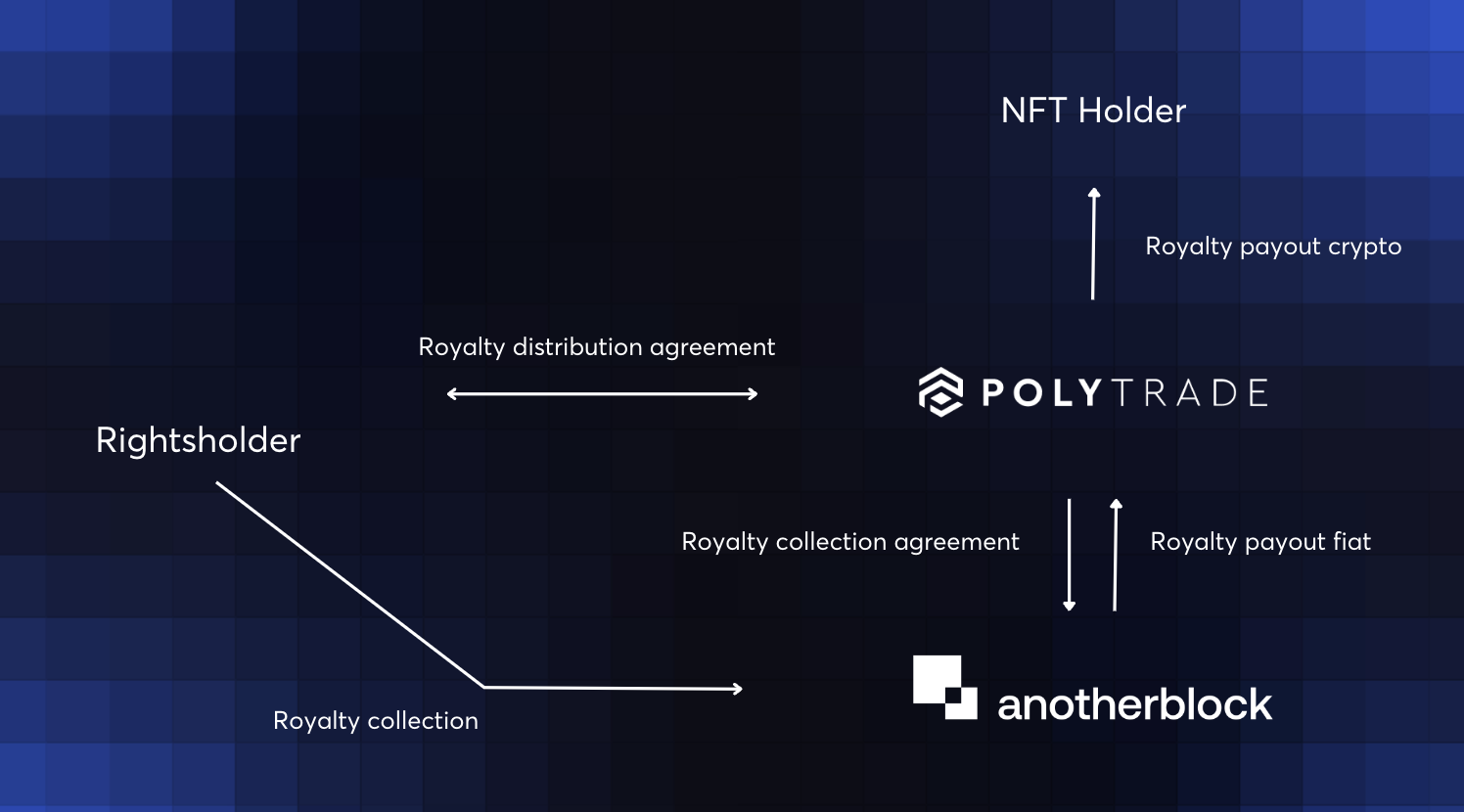

Historically, music royalties have been plagued by inefficiencies. Artists often waited months for payment as record labels, publishers, and collection societies parsed streaming data and divided revenue. The process was slow and riddled with errors or hidden fees. Enter blockchain technology: by leveraging decentralized ledgers and smart contracts, platforms like Royal. io, Bolero, and Anotherblock are enabling artists to tokenize their music rights, sell them directly to fans or investors as NFTs, and receive near-instant payments each time their work is streamed or sold.

This shift is more than just technological – it’s cultural. For the first time since the vinyl era, musicians can offer true ownership stakes in their work to fans at any scale. Platforms such as Bolero let anyone invest in music rights starting from just $10. Meanwhile, Ethereum – currently trading at $4,119.77 – underpins most major NFT music marketplaces with secure smart contract infrastructure.

Fractional Ownership: Fans Become Stakeholders

Fractional ownership through NFTs is transforming how value flows within the industry. Instead of relying solely on streaming payouts or touring income, artists can now raise funds upfront by selling small portions of future royalties directly to supporters. This not only democratizes access to investing in hit songs but also aligns incentives between creators and fans – when a track succeeds on Spotify or TikTok, everyone holding a share benefits.

The impact is tangible:

Artists Who Raised Capital via NFT-Based Royalty Sales

-

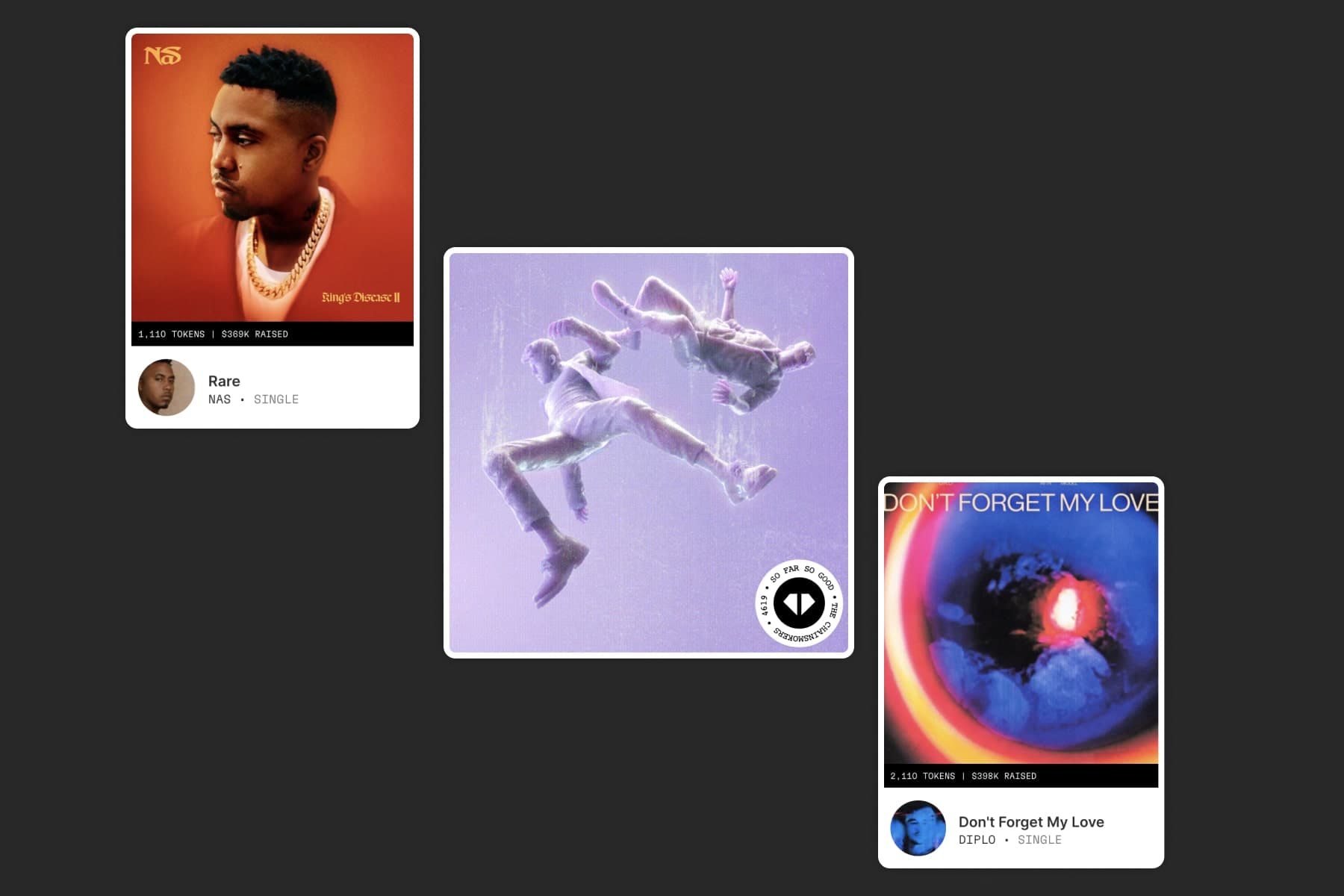

Nas partnered with Royal.io to sell fractional royalty rights to his songs Ultra Black and Rare, allowing fans to invest directly and receive streaming royalty payouts.

-

The Chainsmokers distributed fractional ownership of streaming royalties for their album So Far So Good through Royal.io, giving 5,000 fans a share of future earnings via NFTs.

-

Vérité leveraged Royal.io to offer fans a stake in her streaming royalties, with token holders receiving a portion of the revenue generated from her music.

-

R3HAB collaborated with Anotherblock to tokenize a share of his streaming royalty rights, enabling fans and investors to earn a percentage of streaming income through NFT ownership.

-

Alan Walker used Anotherblock to sell fractional royalty rights for his hit track Faded, allowing fans to purchase NFTs tied to a share of the song’s streaming revenue.

-

La Zarra offered fractional ownership of her music royalties via Bolero, with fans able to purchase “Song Shares” and receive a cut of the master recording’s earnings.

Explore how blockchain enables fractional ownership for investors.

Instant Royalty Payments: Eliminating Industry Bottlenecks

The days of waiting quarters for a royalty check are fading fast thanks to instant royalty payments blockchain. Smart contracts automatically execute royalty splits each time a song is streamed or licensed. This means musicians receive their earnings immediately – no middlemen required. Not only does this reduce administrative costs but it also builds trust through transparent reporting on every transaction.

This instant settlement model is particularly attractive in today’s fast-paced creator economy where cash flow can make or break an independent artist’s career trajectory.

NFT Music Marketplaces: Where Innovation Meets Access

The rise of dedicated NFT music marketplaces like Audius and OpenSea has made minting, selling, and trading tokenized music assets seamless for both established acts and emerging talent. These platforms foster direct monetization while giving collectors unique opportunities to own pieces of musical history – sometimes bundled with exclusive perks like concert tickets or backstage access.

The result? A vibrant ecosystem where on-chain music revenue sharing isn’t just possible – it’s thriving.

For fans, this evolution means they can now actively participate in the success of their favorite artists, not just as listeners but as stakeholders. The NFT music marketplace model brings a new layer of engagement and financial opportunity, bridging the gap between artistic creation and community investment. With instant royalty payments facilitated by blockchain’s immutable ledgers, every stream or sync is accounted for and distributed in real time, ensuring that both artists and their supporters see the rewards of their collaboration without delay.

Transparency is at the core of this transformation. Every transaction, whether it’s a purchase of a fractional royalty share or a payout triggered by a streaming milestone, is recorded on-chain for anyone to verify. This eradicates the “black box” effect that has long plagued traditional royalty accounting. Artists gain unprecedented visibility into where their money comes from, while investors can track performance metrics for each asset they hold.

On-Chain Revenue Sharing: Building Sustainable Music Careers

On-chain music revenue sharing isn’t just about speed; it’s about sustainability. By lowering barriers to entry and automating complex backend processes, blockchain empowers independent musicians to fund projects directly through their communities. Whether it’s raising capital for an album release or sharing future streaming income with early backers, NFT-based fractional ownership offers flexible options that simply didn’t exist in the old model.

This approach also unlocks new forms of fan engagement and loyalty. When supporters have a direct financial stake in an artist’s catalog, they’re more likely to promote tracks, attend shows, and contribute to word-of-mouth growth, creating a virtuous circle where everyone benefits from collective success. These models are already being adopted by forward-thinking artists who want to break free from legacy gatekeepers.

The future of music royalty investing is participatory: fans are no longer passive consumers but active partners in an artist’s journey.

For those considering entering this space, whether as musicians looking for alternative funding or investors seeking exposure to creative assets, the current landscape offers diverse opportunities. Platforms like Royal. io and Bolero continue to innovate with new drops and features, while Ethereum remains the backbone for most NFT transactions at $4,119.77. As adoption grows and regulations evolve, expect even greater integration between blockchain infrastructure and mainstream music distribution channels.

Key Takeaways: Why Blockchain Royalty Markets Matter Now

- Empowered Artists: Direct control over rights management and revenue streams

- Engaged Fans: Ownership stakes create deeper connections with creators

- Transparent Payments: Every transaction is visible on-chain, no hidden fees or delays

- Diverse Investment Options: Fractional ownership lowers barriers for new entrants

- Sustainable Ecosystem: Real-time payouts support ongoing creativity without dependence on intermediaries

The intersection of blockchain technology and music royalties is not just a trend, it’s a structural shift toward fairness, transparency, and shared value creation. As more artists embrace these tools and more fans become co-owners in musical works they love, the potential for innovation in this space will only accelerate.

If you’re ready to dive deeper into how fractional ownership works or want actionable guidance on investing in tokenized royalties, check out our comprehensive guide: How Blockchain Enables Fractional Ownership of Music Royalties: A Guide for NFT Investors.