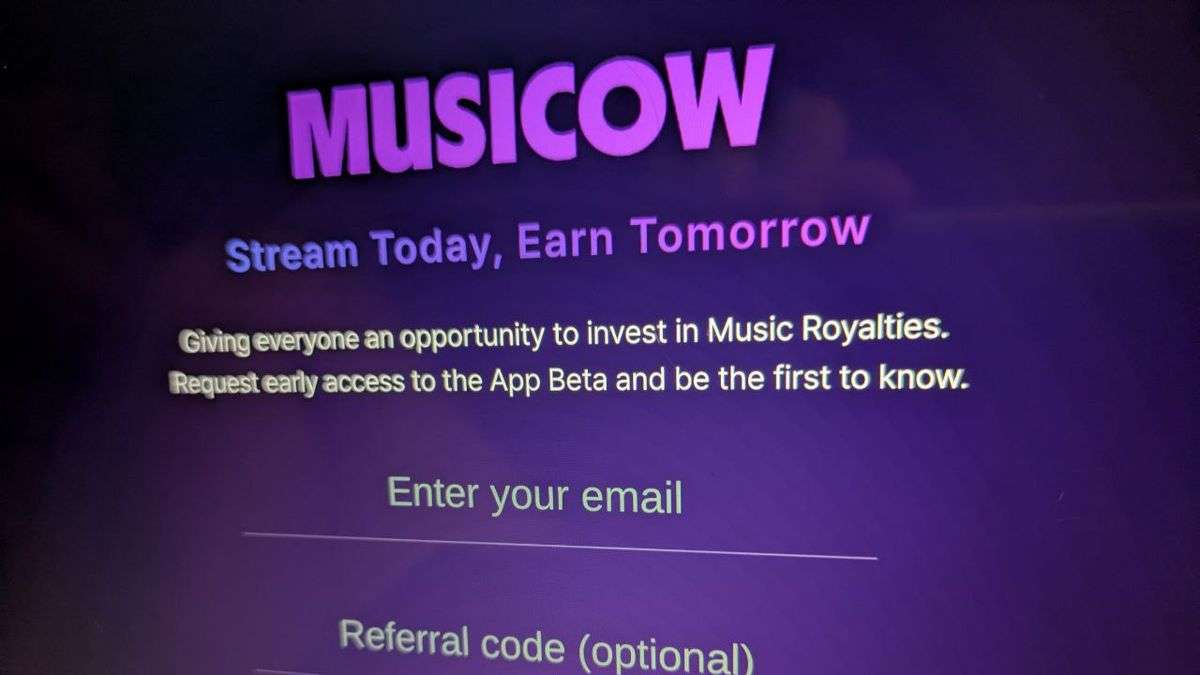

Tokenized music royalties are redefining the relationship between fans, artists, and the music industry. By leveraging blockchain technology, platforms now enable fans to invest directly in songs by major artists, purchasing fractional ownership of royalty streams once reserved for record labels and industry insiders. This innovation is not just a passing trend; it is a fundamental shift in how music is monetized and experienced.

How Blockchain Brings Music Royalties On-Chain

Traditionally, royalty rights were complicated assets managed through opaque contracts and slow payment cycles. Blockchain technology simplifies this by tokenizing future earnings as digital assets. Each token represents a share of the song’s revenue from streaming, sales, or licensing. These tokens are traded on secure, transparent marketplaces, letting fans and investors buy music royalties online in a matter of minutes.

Platforms like Royal.io and ANote Music have pioneered this model. For example, Royal. io, co-founded by musician 3LAU, allows major artists to sell streaming royalty rights as digital tokens. Notable collaborations include Nas, who offered fans a share in the streaming royalties for his tracks “Ultra Black” and “Rare, ” and Diplo, who sold portions of the royalties for “Don’t Forget My Love. ” ANote Music, meanwhile, has facilitated over €10 million in royalty transactions since 2020, opening up the market to a diverse pool of investors.

Why Fans Are Investing in Fractional Music Ownership

For fans, tokenized music royalties offer more than just passive income. By investing in music royalty tokens, supporters gain a sense of ownership and a direct stake in the success of their favorite artists. This new asset class is attractive for several reasons:

Key Benefits of Tokenized Music Royalties for Fans & Investors

-

Direct Financial Participation: Fans can invest directly in songs or albums by major artists, gaining a share of future royalty streams from platforms like Royal.io and ANote Music. This gives fans a tangible stake in the success of the music they love.

-

Potential for Passive Income: Investors receive regular royalty payouts based on streaming, sales, and licensing revenues. Platforms such as ANote Music and Anotherblock facilitate transparent, blockchain-based distributions.

-

Exclusive Perks and Experiences: Some tokenized offerings include special rewards like access to unreleased tracks, VIP concert tickets, or unique digital collectibles, as seen with Royal.io and the Kings of Leon NFT album release.

-

Portfolio Diversification: Tokenized music royalties offer a new asset class for investors, allowing diversification beyond traditional stocks and bonds. This is facilitated by platforms like ANote Music, which lets users build a portfolio of royalty streams.

-

Transparency and Security: Blockchain technology ensures transparent tracking of royalty flows and secure ownership records, reducing the risk of fraud or misreporting. Leading platforms such as Royal.io and Anotherblock leverage these features for investor confidence.

Some platforms sweeten the deal with exclusive perks. For instance, NFT holders of Kings of Leon’s album When You See Yourself received lifetime front-row concert seats and digital collectibles. Similarly, 3LAU’s Ultraviolet NFT sale offered fans limited-edition experiences and raised over $11.6 million, demonstrating the scale and enthusiasm behind this movement. For more on these examples, see Underground Art Report.

Platforms Leading the Tokenized Royalty Revolution

Several platforms are at the forefront of on-chain music royalties:

- Royal. io: Empowers artists to sell fractional royalty rights directly to fans as blockchain-based assets.

- Anotherblock: Focuses on streaming royalties for major artists like The Weeknd and R3hab, letting users buy NFTs representing royalty shares.

- ANote Music: Operates a robust online marketplace for royalty streams, supporting both established and emerging artists.

This ecosystem is growing rapidly as more artists and music companies seek faster payments, greater transparency, and new ways to engage their audiences. Tokenization also enables artists to retain more control over their work compared to traditional music industry models. For a deeper dive into how platforms are transforming the landscape, visit Cointelegraph Magazine.

Tokenized music royalties aren’t just a technical upgrade, they’re a catalyst for new forms of community and financial empowerment. As the market matures, fans are moving beyond passive streaming into active, portfolio-style music investment. With the ability to buy music royalties online, individuals can now diversify their holdings with assets tied to the performance of songs by chart-topping artists, or even up-and-coming creators with viral potential.

For artists, this shift means more than just upfront capital. It’s about building a loyal, invested fanbase that benefits directly from a song’s success. Artists can bypass traditional record label advances, opting instead for transparent, on-chain funding and ongoing engagement with their most ardent supporters. This model is especially powerful for independent musicians, who can now raise capital without giving up creative control or future revenue streams.

Risk, Reward, and Transparency in Blockchain Music Investment

Of course, as with any emerging asset class, there are risks to consider. Royalty income can fluctuate based on streaming trends, platform changes, and broader shifts in music consumption. However, blockchain’s transparency means every transaction and payout is verifiable, reducing the opacity that once plagued royalty accounting. Investors can track song performance in real time, and smart contracts automate revenue distribution, minimizing human error and delays.

For those seeking to invest in music royalties, due diligence is key. Look for platforms with robust legal frameworks, clear rights verification, and a track record of successful payouts. It’s also wise to balance exposure across genres and artists, much like any diversified portfolio. The best platforms provide detailed analytics, historical earnings data, and transparent terms, empowering both seasoned investors and first-time buyers.

What’s Next for On-Chain Music Royalties?

The future of fractional music ownership is bright. As blockchain adoption accelerates and more artists tokenize their catalogs, expect to see even greater integration of music and Web3 experiences. Innovations like Selena Gomez royalty tokens or BTS music royalties could bring millions of new fans into the on-chain economy, further blurring the lines between fandom, ownership, and investment.

Regulatory clarity will be essential as this market grows. Platforms are already working closely with legal experts to ensure compliance with securities laws and intellectual property regulations. As these frameworks solidify, institutional capital may flow into the space, bringing greater liquidity and stability.

Top Tips for Safely Investing in Tokenized Music Royalties

-

Research Reputable Platforms: Stick to established platforms like Royal.io, ANote Music, and Anotherblock. These services have a proven track record with major artists and transparent operations.

-

Understand the Underlying Rights: Carefully review what rights you are purchasing. Some tokens represent streaming royalties only, while others may include broader revenue streams. Always check the official documentation or whitepaper provided by the platform.

-

Evaluate Artist and Song Performance: Analyze the historical and projected performance of the song or catalog. Platforms like ANote Music provide data on past earnings and streaming statistics, helping you make informed decisions.

-

Consider Regulatory and Tax Implications: Tokenized royalties may be subject to local securities laws and taxation. Consult with a financial advisor or legal expert to understand your obligations before investing.

-

Diversify Your Investments: Avoid putting all your funds into a single song or artist. Build a diversified portfolio across different genres, artists, and platforms to mitigate risk, as recommended by leading platforms like ANote Music.

-

Monitor Platform Security and Transparency: Ensure the platform uses robust blockchain security measures and offers transparent reporting of royalty distributions. Look for regular audits and clear payout schedules.

-

Stay Informed About Industry Trends: The music royalty tokenization landscape evolves rapidly. Follow updates from reputable sources like RWA.io and Blockchain App Factory to stay aware of new opportunities and risks.

Ultimately, tokenized music royalties are democratizing access to an asset class that was once the exclusive domain of industry insiders. Whether you’re a lifelong music fan or a forward-thinking investor, this is a rare opportunity to participate in the upside of the songs shaping our culture, while supporting the artists who create them.