Blockchain is rapidly dismantling the music industry’s opaque royalty structures, replacing them with transparent, on-chain systems that empower artists, fans, and investors alike. The rise of fractional ownership music through tokenization is turning music royalties into liquid, tradable assets, democratizing access to a market once reserved for labels and high-net-worth individuals.

From Vinyl to Blockchain: A New Era for Music Royalties

The shift from physical records to digital streaming changed how we experience music, but it barely scratched the surface of who profits from it. Historically, royalties flowed through a labyrinth of intermediaries, often leaving artists underpaid and fans disengaged. Blockchain technology flips this script by enabling musicians to tokenize their royalty streams, offering direct, fractional ownership via NFT music investment platforms.

Platforms like Anotherblock, Royal, and Opulous have made headlines by letting artists like Nas sell streaming royalty rights directly to their audiences. For example, Royal enabled Nas to sell fractional shares of his hit tracks “Ultra Black” and “Rare”: an innovation that created unprecedented liquidity for creators while giving fans a literal stake in the song’s success.

Tokenized Music Royalties: How It Works

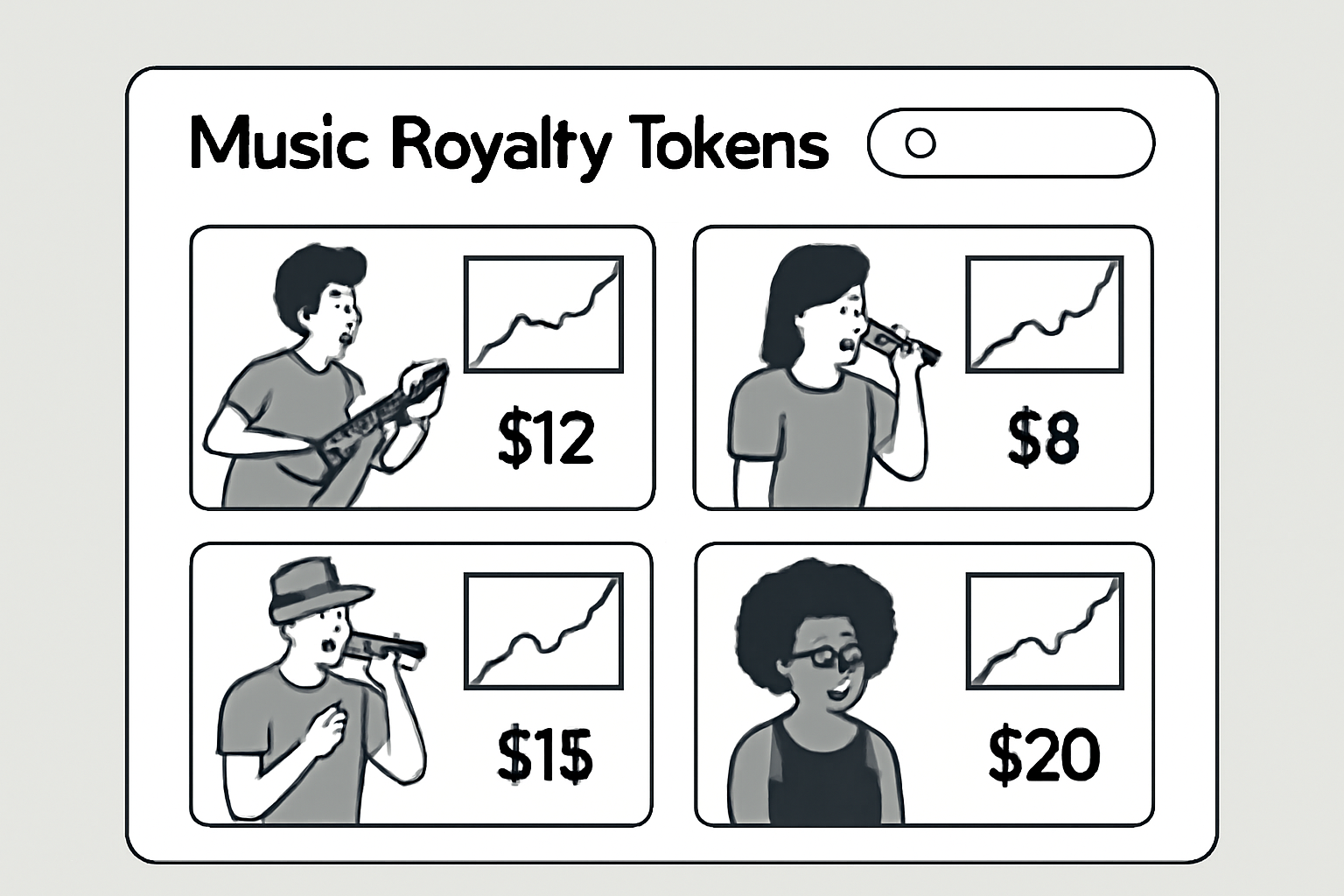

The mechanics are elegantly simple yet revolutionary. Artists mint NFTs or tokens representing a percentage of future royalty earnings. These are then listed on a music royalty marketplace, where anyone can buy fractions, sometimes as little as 0.1%: of the song’s revenue stream. When royalties are paid out (from streaming platforms or sync deals), smart contracts automatically distribute the earnings proportionally to all token holders.

Top Benefits of Blockchain Music Royalties

-

Transparent and Automated Royalty Payments: Blockchain ensures accurate, real-time tracking and distribution of royalties through immutable ledgers and smart contracts, minimizing disputes and delays.

-

Fractional Ownership Opens New Investment Opportunities: Platforms like Royal and Anotherblock enable artists to tokenize music rights, allowing fans and investors to buy fractions of songs and share in future earnings.

-

Enhanced Liquidity for Artists: Tokenization provides upfront liquidity by letting artists sell portions of their future royalties, reducing reliance on traditional advances or loans.

-

Stronger Artist-Fan Engagement: Investors who own music tokens are incentivized to promote songs, and artists can reward holders with exclusive content, backstage passes, or merchandise—as seen on Opulous.

-

Democratized Access to Music Investments: Fractional ownership lowers barriers, letting smaller investors and fans participate in music royalty income streams previously accessible only to industry insiders.

This model does more than just improve liquidity; it injects transparency into an industry notorious for its “black box” accounting practices. Every transaction is recorded on an immutable ledger, ensuring that payouts are traceable and verifiable in real time, a major leap forward compared to legacy systems.

Leading Platforms Powering Fractional Ownership

The competitive edge comes from diverse platforms offering unique value propositions:

- Royal: Co-founded by DJ 3LAU, lets fans buy shares in songs and receive royalty payouts directly as the tracks earn revenue (details here).

- Anotherblock: Focuses on streaming royalties with regular payouts based on actual performance data (more info).

- Opulous: Goes beyond financial returns by offering exclusive perks, such as backstage passes or merch, for active token holders who help promote the music online.

This new breed of platforms is redefining what it means to be an investor, or even a fan, in the digital age. The result? Increased liquidity, faster payouts via smart contracts, and a deeper connection between creators and their communities.

However, the path to widespread adoption of tokenized music royalties is not without obstacles. Regulatory clarity remains a moving target. Many jurisdictions are still determining whether music royalty tokens qualify as securities, which could trigger compliance requirements and limit participation for smaller investors. Volatility is another factor: the value of these assets can swing with both market sentiment and the unpredictable nature of music consumption trends.

Despite these hurdles, momentum continues to build. Platforms are investing heavily in user education, streamlined onboarding, and robust security measures to lower entry barriers. As more artists see the upside, upfront liquidity, transparent accounting, and direct fan engagement, the supply of tokenized assets grows. Meanwhile, investors are drawn by the prospect of passive income from streaming royalties and the diversification benefits that come with owning a piece of cultural IP.

What’s Next for Blockchain Music Royalties?

The next phase will likely be defined by increased interoperability between platforms and standardized royalty reporting protocols. As on-chain analytics mature, expect to see granular data on song performance driving real-time price discovery in secondary markets, making music royalty marketplace activity as dynamic as any crypto exchange.

This isn’t just theory, major deals are already happening. For example, Royal’s $400K sale representing 33% of streaming royalties across 12K and unique buyers marked a pivotal moment for fan-powered ownership (see details). Anotherblock’s regular payouts based on actual Spotify data prove that smart contracts can deliver both speed and accuracy in royalty settlements (read more).

For artists, this evolution means more control over their catalog and new ways to activate superfans as stakeholders rather than just consumers. For investors, from crypto-native traders to traditional asset managers, it opens up a fresh asset class with cash flow potential uncorrelated to equities or bonds.

Key Takeaways for Artists, Fans and Investors

- Transparency: Immutable ledgers eliminate hidden fees and opaque accounting.

- Liquidity: Fractionalization turns illiquid rights into tradable assets.

- Diversification: Royalties offer yield potential distinct from mainstream financial markets.

- Community Engagement: Token holders often receive exclusive perks, deepening loyalty beyond streaming stats.

The convergence of blockchain technology and music royalties is still early, but it’s already rewriting industry norms at a blistering pace. As regulatory frameworks solidify and user experience improves, expect on-chain fractional ownership to become not just an innovation but an expectation among creators and collectors alike.