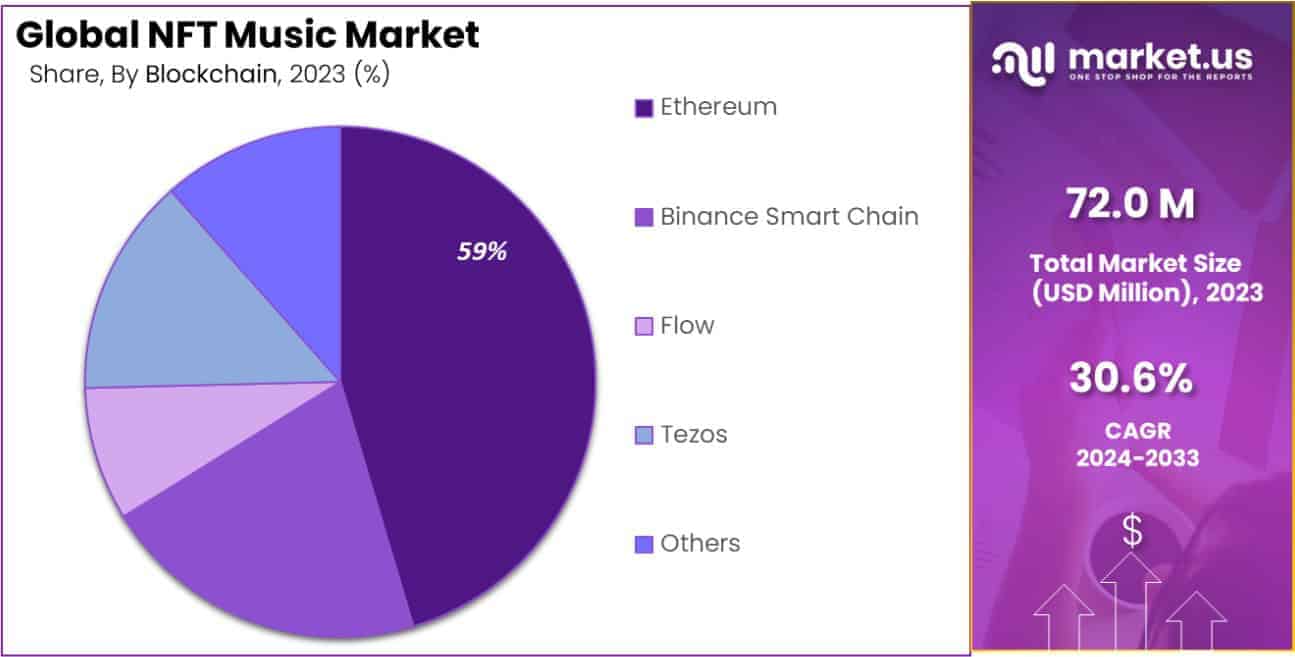

Blockchain technology is rapidly redefining how music royalties are bought, sold, and experienced. For NFT collectors and investors, this seismic shift presents both fresh opportunities and new complexities. By enabling artists to tokenize their music rights into non-fungible tokens (NFTs), blockchain platforms are democratizing access to music investments, empowering fans to own a piece of their favorite songs while earning a share of future royalty streams.

![]()

From Traditional Royalties to Tokenized Music Rights

The legacy music industry has long relied on opaque royalty structures. Revenue from streaming, radio play, or sync licensing trickles through a labyrinth of intermediaries before reaching artists and rights holders. This system is slow, inefficient, and often leaves creators with little transparency over their earnings.

Enter blockchain music royalties: Smart contracts embedded within Music NFTs can automate royalty distribution instantly and transparently. Every transaction is recorded on-chain, providing an immutable record of ownership and payments. Platforms like Royal, BAND Royalty, and Artyfile now allow fans to purchase fractional ownership in songs or entire catalogs as NFTs. These tokens entitle holders to a proportional share of streaming revenue or sync fees – an entirely new model for music investing.

How NFT Music Investments Work

NFT music investments unlock direct participation in the success of individual tracks or artists. Here’s how the process typically works:

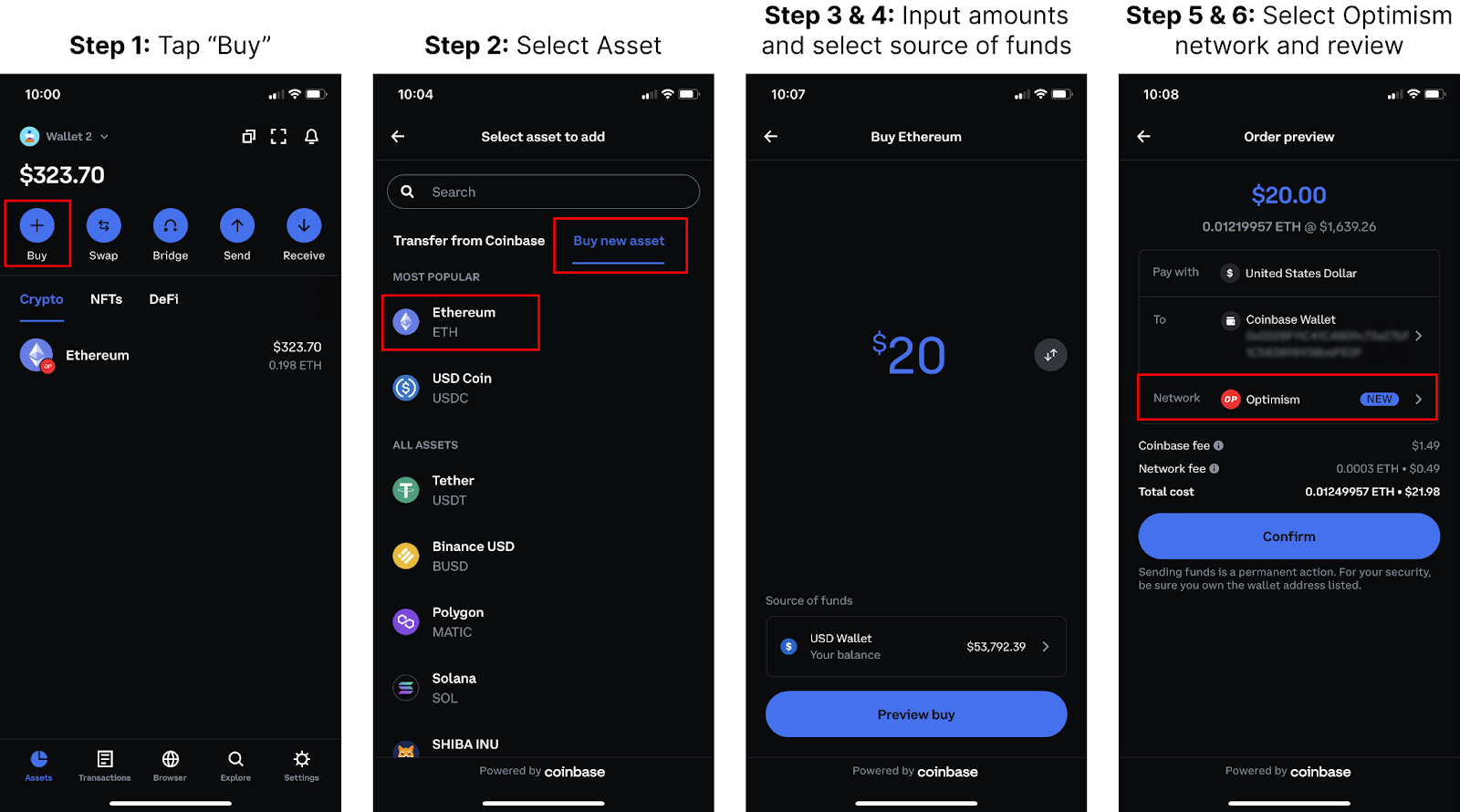

Essential Steps to Invest in Music Royalty NFTs

-

1. Research Reputable Music NFT PlatformsBegin by exploring established platforms like Royal, BAND Royalty, and Artyfile. These platforms partner with well-known artists and offer NFTs linked to real music royalties.

-

2. Set Up a Compatible Crypto WalletCreate a secure cryptocurrency wallet (such as MetaMask or Coinbase Wallet) that supports Ethereum or the blockchain used by your chosen platform. This wallet will store your NFTs and facilitate transactions.

-

3. Fund Your Wallet with CryptocurrencyPurchase the required cryptocurrency (commonly ETH for Ethereum-based platforms) through reputable exchanges like Coinbase or Binance, and transfer it to your wallet to cover NFT purchases and transaction fees.

-

4. Analyze NFT Offerings and TermsReview available music royalty NFTs, focusing on details such as the artist, song catalog, royalty percentage, and rights granted. Platforms like Royal and BAND Royalty provide transparent breakdowns of revenue-sharing mechanisms.

-

5. Complete the NFT PurchaseConnect your wallet to the platform and follow the purchase process. Confirm the transaction details and ensure you receive the NFT in your wallet. Blockchain records will verify your ownership and entitlement to royalties.

-

6. Track Royalties and Manage Your InvestmentMonitor your NFT’s performance through the platform’s dashboard. Royalties are distributed automatically via smart contracts, allowing you to claim earnings or reinvest as desired.

For example, on Royal (co-founded by 3LAU), users can buy shares of songs as NFTs. When those songs generate revenue from Spotify or Apple Music streams, NFT holders receive their cut automatically via smart contract payouts. BAND Royalty takes it further by letting users stake their NFTs for additional rewards from a curated catalog featuring top-tier artists like Beyoncé and Jay-Z.

Key Platforms Shaping the Marketplace

The growth of tokenized music royalties owes much to platforms that bridge the gap between musicians and collectors:

- Royal: Empowers fans to own shares in songs by purchasing NFTs directly from artists. Notable releases include Nas’s “Ultra Black” and The Chainsmokers’ debut NFT drop.

- BAND Royalty: Offers access to a diverse catalog where staking NFTs yields regular royalty distributions from global hits.

- Artyfile: Enables limited edition NFT sales tied directly to master recordings – buyers receive a portion of worldwide streaming income.

This direct-to-fan model not only creates new revenue streams for musicians but also transforms fans into stakeholders with real financial incentives tied to an artist’s success.

Navigating Risks: Due Diligence for Collectors

The promise of blockchain-based fractional music ownership comes with its own set of challenges. Investors must carefully evaluate each opportunity by considering platform credibility, legal clarity around rights transfer, and the volatility inherent in NFT markets. It’s essential to understand exactly what rights are embedded in each token – does it cover only streaming revenue? Are sync fees included? Is there recourse if future regulations change?

If you’re interested in deeper technical detail on how blockchain enables fractional ownership in this sector, see our comprehensive guide here.

Collectors should also be vigilant about the authenticity of the music rights being tokenized. Not all NFT offerings are created equal; some may lack proper licensing or clear contractual backing. This is especially relevant as legal frameworks for digital assets and copyright continue to evolve. Platforms with robust due diligence processes, transparent smart contract code, and clear documentation of rights provide greater security for investors.

Transparency and Revenue Tracking: The Blockchain Advantage

One of the most compelling benefits of blockchain music royalties is radical transparency. Every royalty payment, transfer of ownership, or secondary sale is recorded on-chain for anyone to audit. This reduces disputes and builds trust between artists, fans, and investors. For example, when an NFT tied to a hit song changes hands on a marketplace like Artyfile, both the transaction and future royalty entitlements are updated in real time.

Beyond transparency, blockchain automates revenue sharing with smart contracts. When streaming platforms pay out royalties, these funds are distributed instantly and proportionally to all NFT holders according to the terms programmed into the contract. There’s no need to wait months for manual accounting or worry about hidden deductions by intermediaries.

Market Volatility and Portfolio Strategy

The NFT music investment space is still young and subject to significant price swings. Rarity, artist reputation, song performance metrics, and broader crypto market trends can all affect valuation. Prudent collectors diversify across artists and genres rather than betting everything on a single track or catalog. Additionally, understanding liquidity constraints – how easily you can sell your NFTs – is critical in this emerging market.

If you’re considering adding tokenized music royalties to your portfolio, it’s wise to approach them as part of a broader alternative asset strategy. Music NFTs can provide uncorrelated returns compared to traditional equities or bonds but should be balanced against risk tolerance and investment horizon.

The Road Ahead: Empowering Artists and Fans Alike

By shifting control away from legacy intermediaries toward creators and their communities, blockchain-powered royalty markets foster a more equitable ecosystem. Artists gain faster access to capital by pre-selling royalty shares directly to fans who believe in their work. Collectors enjoy new ways to engage with music while earning real financial rewards tied to cultural impact.

The future promises even more innovation as legal standards mature and platforms experiment with dynamic royalty splits or integration with live events and merchandise sales. For those ready to embrace this intersection of technology and culture, participating in a music royalty NFT marketplace could be both an exciting investment opportunity and a way to support creative independence.