Imagine owning a slice of your favorite K-Pop hit, not just a digital collectible, but a real piece of the royalties. Thanks to tokenized music royalties on blockchain, that dream is now reality for fans and investors around the world. We’re seeing an explosive shift as platforms like Aria Protocol pull $101.4 million worth of K-Pop IP on-chain, letting anyone invest in the success of BTS, BLACKPINK, and other global icons. Let’s break down how this tech is rewriting the rules for music ownership and fan engagement.

K-Pop Royalties Hit Blockchain: $101.4M Goes On-Chain

Aria Protocol has just rewritten the playbook for music rights. By tokenizing a whopping $101.4 million in Korean music IP on Story Protocol’s blockchain, Aria is opening up royalty investment to anyone with an internet connection and a wallet. This isn’t some distant vision, the numbers are live and verified (source). Forget dusty record contracts, now you can buy IPRWA tokens representing fractional ownership in K-Pop hits and collect streaming revenue as it rolls in.

This is about more than bragging rights at fan meetups. Early adopters have already seen annual returns between 7-12%, with some early birds cashing out gains up to 70%. The liquidity is real, the transparency is next-level, and with every new catalog onboarded (from Contents Technologies’ deep vault), we’re seeing more fans morph into micro-investors.

How Tokenized Music Royalties Actually Work

Here’s where it gets tactical: Tokenized royalties aren’t just NFTs you flip for hype, they’re income-generating assets tied directly to streaming or licensing revenue. Platforms like Aria mint IPRWA tokens (think: Intellectual Property Rights Wrapped Assets) that represent fractions of music rights, so when BLACKPINK racks up streams or BTS lands another sync deal, holders get paid out automatically via smart contracts.

No more waiting months for opaque royalty statements; everything’s tracked on-chain for instant verification and distribution. Plus, these tokens can be traded 24/7 on dedicated exchanges like Seoul Exchange (which now partners exclusively with Story Protocol). That means you can buy in, sell out, or stack your position whenever you spot momentum, just like trading crypto or stocks.

Top Benefits for Fans Investing in K-Pop Royalty Tokens

-

Direct Profit Sharing: Fans can earn a share of streaming and licensing royalties from top K-Pop hits like those in Aria’s $101.4 million tokenized catalog. This means your favorite artist’s success can boost your own wallet.

-

Fractional Ownership of Iconic Songs: Platforms like Aria and Story Protocol let fans buy small, affordable pieces of music rights—including tracks by BTS, BLACKPINK, and Psy—turning listeners into stakeholders.

-

Transparent and Secure Investments: Blockchain tech ensures all transactions and royalty distributions are recorded openly, reducing fraud and guaranteeing fair payouts for every token holder.

-

Tradable Digital Assets: K-Pop royalty tokens can be bought, sold, or traded on exchanges like the Seoul Exchange, giving fans liquidity and the chance to profit from rising demand for popular songs.

-

Early Access and Exclusive Perks: Early investors in projects like Aria have seen returns as high as 70%, and some platforms offer exclusive artist content, VIP experiences, or governance rights to token holders.

-

Global Reach and Diverse Catalogs: With platforms like Royal.io expanding globally, fans can invest in not just K-Pop but also global hits by artists such as Nas and 3LAU, diversifying their music investment portfolio.

From Seoul to Wall Street: The Global Expansion

K-Pop might be leading the charge, but this movement is global, and fast-moving artists everywhere are jumping aboard. In Korea, Seoul Exchange has teamed up with Story Protocol to build South Korea’s first blockchain exchange dedicated to cultural IP assets (including not only music but also K-dramas, webtoons, games, even patents). That’s a massive bridge from local fandoms to international capital markets, making it as easy to invest in a chart-topping single as it is to buy shares of Tesla or Apple.

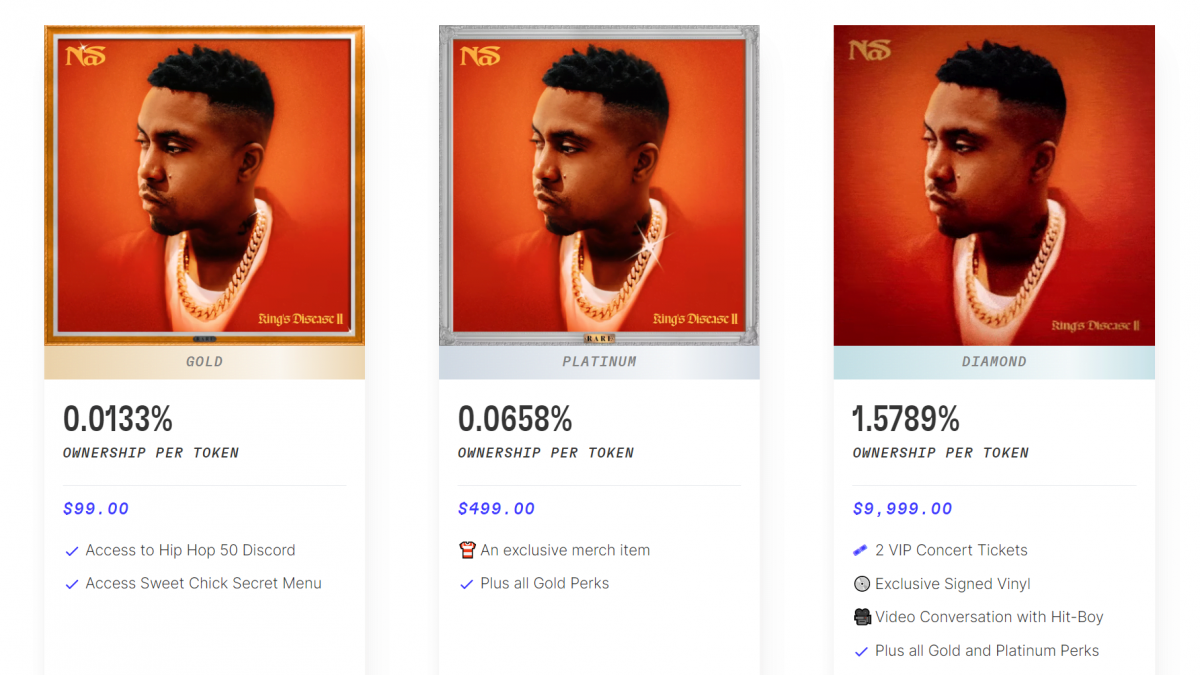

Meanwhile, Western artists are catching on quick: Royal. io (co-founded by DJ 3LAU) made headlines when rapper Nas dropped streaming royalty rights for his tracks as NFTs, letting fans literally cash in alongside him (source). This isn’t just hype; it’s a new class of compliant digital securities that’s turning every stream into investable yield.

But it’s not just the megastars or major catalogues that are getting in on the action. Independent artists and niche genres are riding this wave too, using blockchain music ownership to sidestep gatekeepers and connect directly with superfans. Platforms like Royal. io and Aria Protocol are empowering these creators to fund new projects, reward loyal listeners, and build communities where everyone has skin in the game. It’s a win-win: artists get upfront capital without giving up control, while fans earn real music NFT revenue sharing for their support.

Why This Matters for Fans and Investors

The appeal is obvious: fractional music royalties mean you don’t need deep pockets to start investing. With IPRWA tokens, anyone can own a slice of a hit song’s future earnings, whether that’s BTS song royalties tokenized on Story Protocol or Justin Bieber royalties blockchain-enabled for global distribution. And since everything is transparent and automated via smart contracts, there’s less room for shady accounting or delayed payments. You can literally watch your wallet grow as streams rack up worldwide.

What’s more, this model is turbocharging fan engagement. Instead of just streaming your idol’s new single, you’re actively rooting for its success because you’re sharing in the upside. It’s community-powered momentum trading at its finest, with every viral TikTok dance or YouTube reaction video potentially boosting your own returns.

Tactical Checklist: Getting Started With Tokenized Music Royalties

Of course, there are risks, market volatility, changing streaming trends, and regulatory uncertainty all play a role (just like with any emerging asset class). But the upside is undeniable: early participants in Aria Protocol’s tokenization have already seen annual returns between 7-12%, with some lucky traders realizing up to 70% gains during the initial wave (source). As more catalogs go on-chain and liquidity grows via dedicated exchanges like Seoul Exchange, we’re likely to see even more sophisticated strategies emerge, think swing trading royalty tokens based on upcoming album drops or predicted streaming spikes.

The Road Ahead: What Comes Next?

The fusion of blockchain tech with global pop culture isn’t slowing down anytime soon. As protocols like Aria PRIME roll out institutional-focused platforms with $100 million and TVL (source), expect more major players (labels, funds, even pension investors) to pile into IP-backed digital assets. Meanwhile, everyday fans will keep finding new ways to monetize their passion, whether that means stacking BTS tokens or discovering the next breakout indie act via fractional ownership.

Top 5 Artists with Tokenized Songs for Fan Investment

-

BTS – The global K-Pop sensation BTS has had their music rights tokenized via the Story Protocol and Aria platform, letting fans invest directly in their chart-topping hits.

-

BLACKPINK – BLACKPINK‘s iconic tracks are part of the $101M K-Pop IP tokenized by Aria on Story Protocol, opening up a new world of fan-powered music investment.

-

Psy – Famous for Gangnam Style, Psy is among the artists whose royalty rights have been tokenized on Story Protocol, giving fans a stake in his viral legacy.

-

Nas – The legendary rapper Nas made headlines by partnering with Royal.io to tokenize streaming royalties for his songs, letting fans own a piece of his music’s future earnings.

-

3LAU – EDM producer 3LAU is a pioneer in blockchain music, using Royal.io to tokenize his tracks and empower fans to invest directly in his creative output.

If you’ve ever wanted to turn fandom into financial upside, or just want a front-row seat as blockchain rewrites the rules of entertainment investing, now’s your shot. The next time you hear that catchy hook on repeat? Remember: it could be making you money while it climbs the charts.