Independent musicians in 2024 are rewriting the playbook for funding their creative projects. The catalyst? Fractional ownership of music royalties, powered by blockchain technology. This model is enabling artists to raise capital directly from fans and investors, sidestepping the traditional industry gatekeepers and retaining control over their work. No longer do indie musicians have to choose between creative freedom and the financial muscle of a major label.

The Mechanics of Fractional Music Royalty Ownership

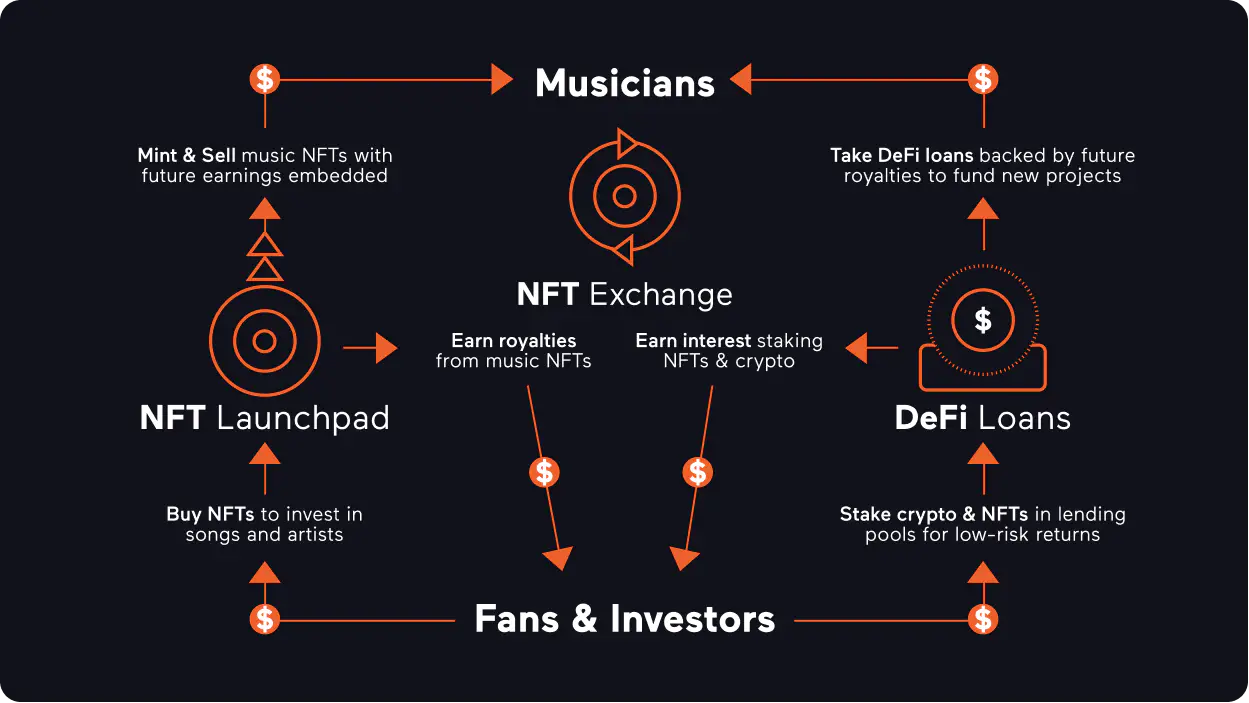

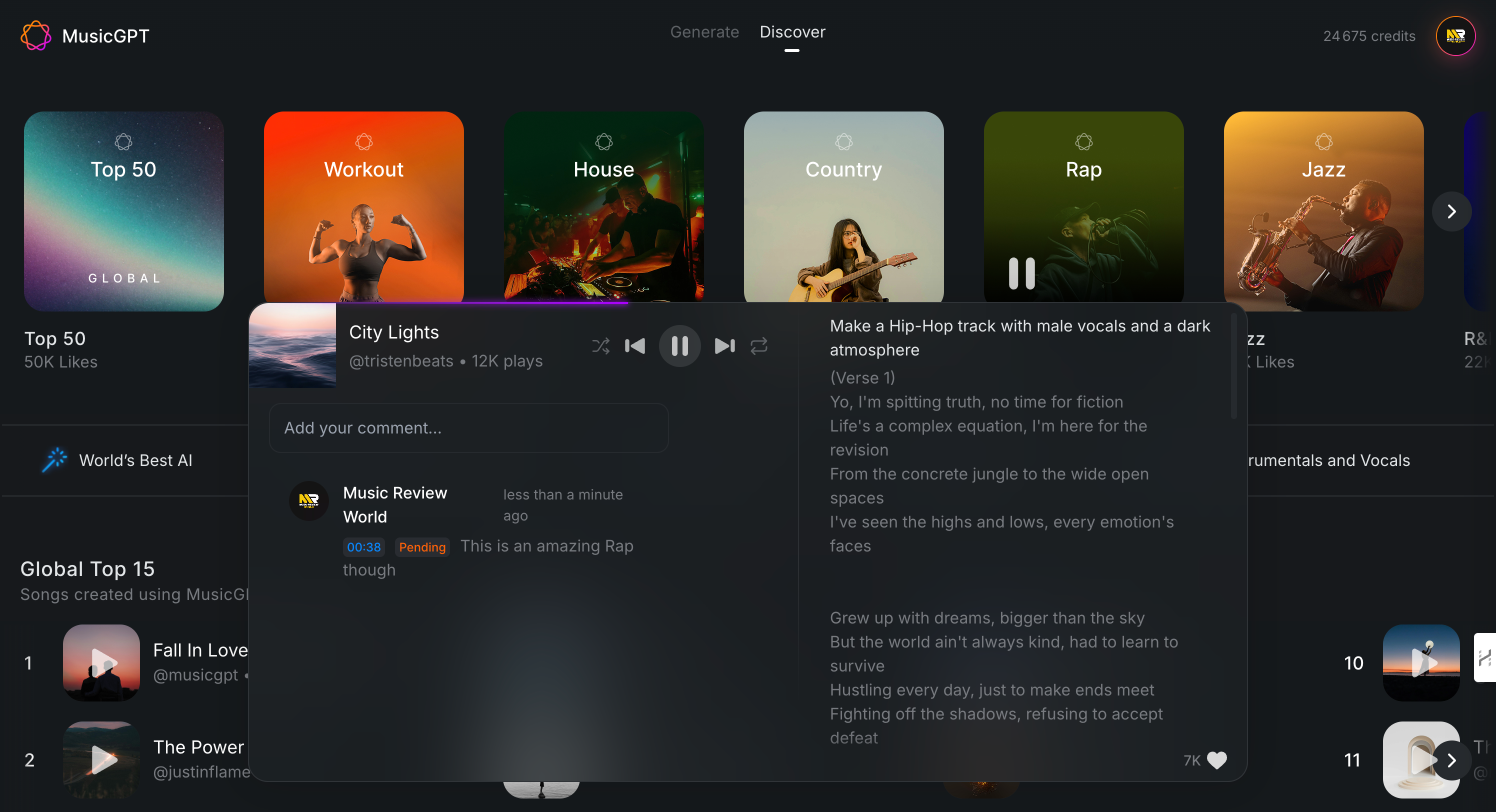

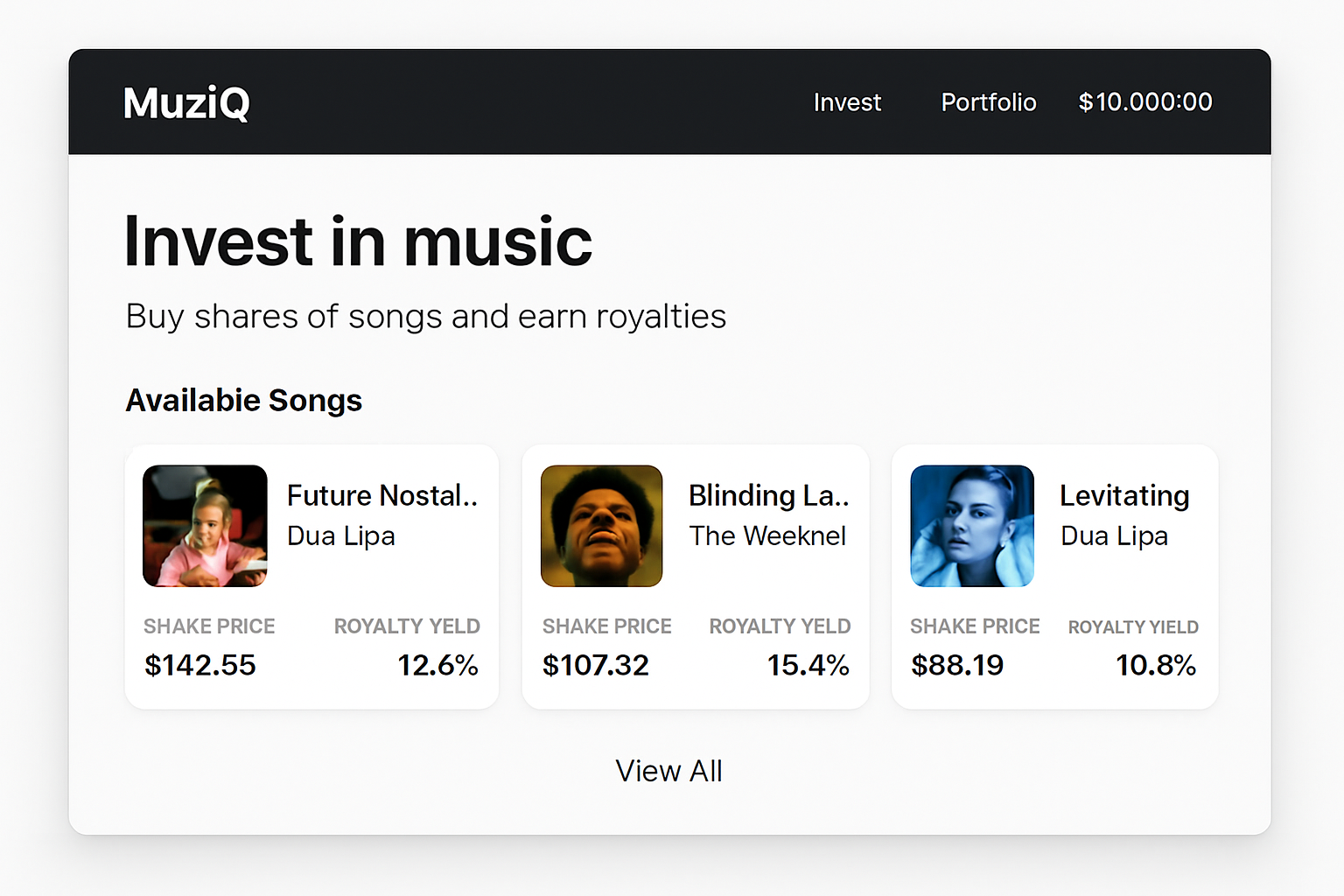

At its core, fractional ownership lets artists “tokenize” a portion of their future royalty streams. Instead of selling all rights or signing restrictive deals, an artist can offer, for example, 25% of the royalties from an upcoming single or album as digital tokens. These tokens are then sold to fans and investors on platforms like MuziQ and Ownable Music. Each token represents a claim on a share of future streaming revenue, sync placements, or performance royalties.

This process is made seamless by blockchain infrastructure. Smart contracts automatically manage royalty splits and payouts, ensuring that every token holder receives their fair share with transparency and efficiency. Administrative headaches are minimized, disputes are rare, and both artists and investors can track earnings in real time.

Why 2024 Is a Breakout Year for Indie Artist Funding

The numbers tell the story: In 2024, the independent artist market is valued at $104.61 billion and is projected to rise sharply in coming years. This explosive growth coincides with new funding models that empower creators to monetize directly through their communities. Platforms like MuziQ allow artists to launch campaigns without fees while keeping 100% ownership of their music – investors receive quarterly payouts tied directly to real-world royalty flows.

Ownable Music gives fans the chance to invest in specific releases, sharing in revenue as songs gain traction across streaming services or other channels. Investors can exit positions by trading tokens on open exchanges or through catalog sales – adding liquidity that was previously unheard of in music assets.

Key Benefits of Fractional Music Royalty Ownership for Indie Artists

-

Direct Fan Funding: Platforms like MuziQ and Ownable Music enable indie artists to raise capital directly from fans by offering fractional ownership of future royalties, bypassing traditional label advances.

-

Retention of Creative Control: By leveraging fractional ownership, artists can secure necessary funding without giving up rights to major labels, allowing them to maintain full autonomy over their music and creative direction.

-

Transparent and Automated Royalty Distribution: Blockchain-powered platforms such as SongCoins use smart contracts to automate royalty splits, ensuring all contributors receive their fair share promptly and transparently.

-

Deeper Fan Engagement: Allowing fans to invest in music projects fosters a more dedicated and supportive community, turning listeners into stakeholders who are financially and emotionally invested in an artist’s success.

-

Flexible Exit and Liquidity Options: Platforms like Ownable Music provide investors—and by extension, artists—with liquidity options such as catalog sales or secondary market trading, making it easier to access funds and manage investments.

This approach doesn’t just inject much-needed capital into indie projects; it also builds deeper fan engagement and loyalty. Fans become stakeholders in an artist’s journey – literally invested in their success.

Tokenization: From Catalogs to Crowdfunding

The trend extends beyond new releases: legacy catalogs are also being fractionalized for investment. Investors now have access to blue-chip music assets once reserved for industry insiders or private equity funds. At the same time, up-and-coming musicians use tokenized royalties as crowdfunding tools that align incentives between creator and audience.

For those seeking more details about how this process works at a technical level – including smart contract automation and NFT integration – see our guide on blockchain-enabled fractional ownership of music royalties.

Fractional music royalty ownership is not just a financial innovation; it’s a cultural one. By lowering the barrier to entry for both artists and investors, this model is democratizing access to an asset class that was historically opaque and exclusive. In 2024, indie musicians are leveraging blockchain-powered platforms to retain creative and economic sovereignty, while fans gain a seat at the table as true partners in the music economy.

Transparency is a cornerstone of this shift. Blockchain-based royalty management ensures every micro-payment is recorded and distributed according to pre-set terms, eliminating the traditional industry’s “black box” reputation. Smart contracts automate splits for co-writers, producers, and token holders, reducing administrative overhead and virtually eradicating late or missed payments. This level of clarity has been a game-changer for artists who previously faced months-long delays or ambiguous statements from labels and collecting societies.

Risks, Rewards, and New Market Dynamics

While the promise of direct funding and transparent payouts is compelling, fractional music royalty ownership comes with its own set of risks that both artists and investors must weigh carefully. Revenue streams can be unpredictable, streaming income fluctuates based on algorithmic trends, sync placements are competitive, and catalog value can rise or fall with shifting public taste.

However, diversification is now possible at an unprecedented scale. Investors can spread risk across dozens or hundreds of tracks or catalogs instead of betting on a single artist’s career trajectory. For musicians, selling only a fraction, often 10% to 25%: of future royalties means they can raise substantial capital upfront without sacrificing long-term upside or creative rights.

How Indie Artists Are Using Funds Raised Through Tokenization

- Recording and Production: Financing high-quality studio sessions without label advances

- Marketing and Promotion: Funding digital ad campaigns or influencer partnerships

- Tours and Merchandising: Launching tours with upfront capital for logistics

- Creative Freedom: Investing in experimental projects outside mainstream trends

The flexibility afforded by this funding model allows artists to pursue their vision on their terms, a significant departure from traditional industry contracts that often dictate creative direction in exchange for financial support.

The Future: Community-Driven Music Economies

The next frontier lies in community-driven ecosystems where fans act as both investors and promoters. Decentralized Autonomous Organizations (DAOs) are emerging as collaborative collectives that vote on project funding decisions, share in royalties, and even influence creative choices. This structure fosters shared incentives: when the music succeeds, everyone benefits proportionally.

If you’re interested in exploring how these new economies work, and how you can participate as an artist or investor, see our detailed primer on fractionalized music royalties on blockchain platforms.

Key Drivers of Fractional Music Royalty Ownership in 2024

-

Direct Fan Investment via Platforms like MuziQ: Platforms such as MuziQ allow fans to invest directly in indie music projects, providing artists with upfront funding while fans receive a share of future royalties.

-

Artist Autonomy and Retention of Rights: Fractional ownership models empower independent artists to secure funding without giving up creative or ownership rights to major labels, fostering greater artistic freedom.

-

Transparent and Automated Royalty Distribution with Blockchain: The integration of blockchain technology—exemplified by platforms like SongCoins—enables automated, transparent royalty splits through smart contracts, reducing disputes and administrative overhead.

-

Liquidity and Tradability of Royalty Shares: Platforms such as Ownable Music offer investors the ability to trade royalty shares on open markets, providing liquidity and flexible exit options for both artists and fans.

-

Growing Market Value of the Indie Artist Sector: The independent artist market was valued at $104.61 billion in 2024 and is projected to grow significantly, attracting more investors to fractional royalty models.

As we move deeper into this era of tokenized assets and transparent revenue sharing, the balance of power continues to shift toward creators and their communities. The result? A more resilient, equitable landscape for independent musicians, and new opportunities for anyone seeking exposure to the future cash flows of global hits.