The music industry is undergoing a seismic shift as fractionalized music royalties on blockchain platforms allow independent artists to bypass traditional gatekeepers and fans to become true stakeholders in the songs they love. This new paradigm is not just about technology – it’s about fundamentally reimagining who gets to profit from creativity, and how value flows between creators and their communities.

From Vinyl Pressings to On-Chain Royalties: A New Era for Indie Artists

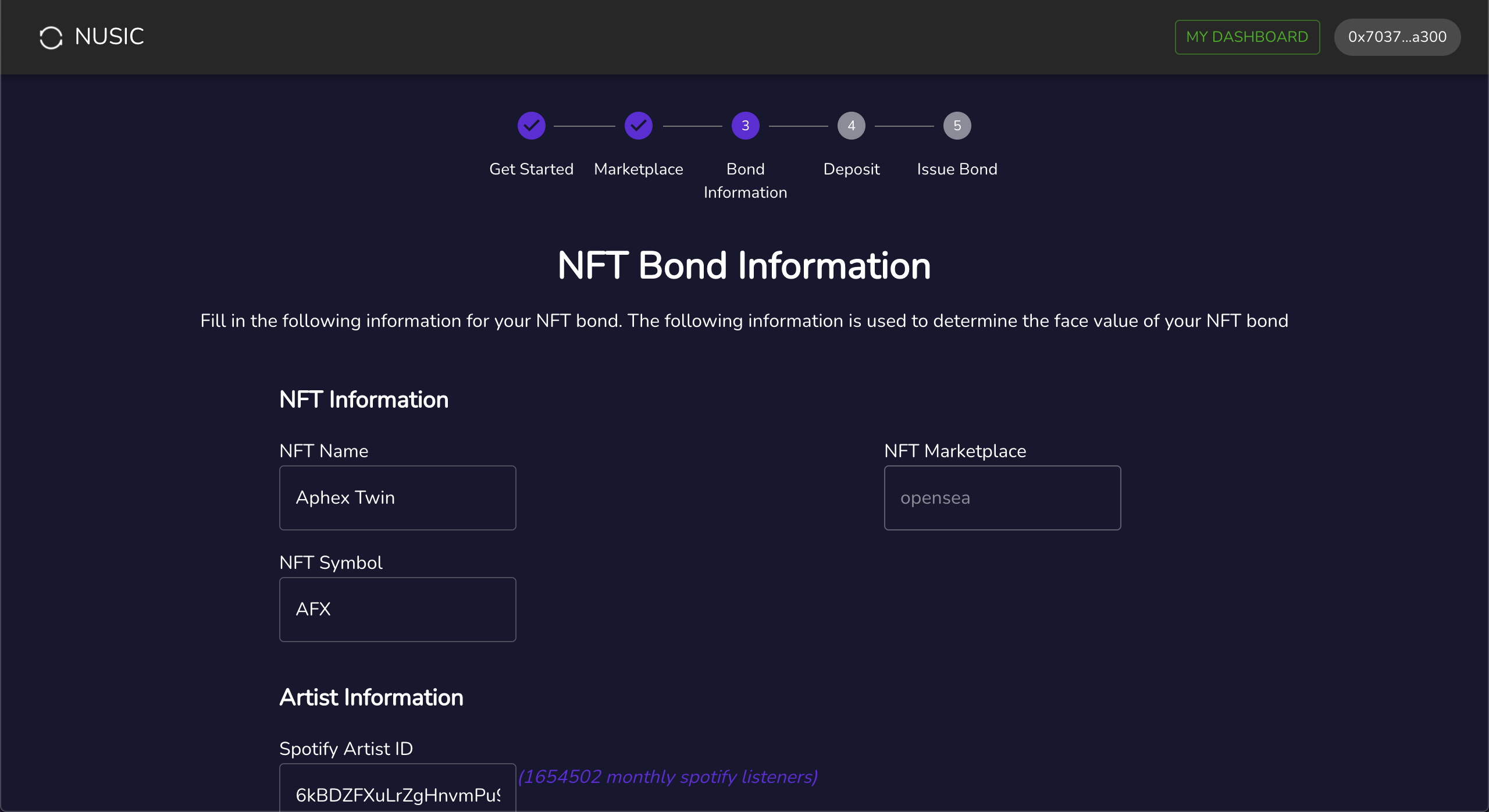

For decades, musicians have been at the mercy of opaque royalty systems and intermediaries that siphon off significant portions of their earnings. Now, blockchain-based royalty marketplaces are flipping this model on its head by enabling artists to tokenize a percentage of future royalties. For example, platforms like Royal let indie musicians sell fractional ownership of streaming rights directly to fans and investors. This means an artist can issue 25% of their song’s royalties as NFTs, instantly raising capital while retaining control over their work.

This model is not hypothetical – it’s already happening. In a high-profile case, Rihanna’s producer Jamil “Deputy” Pierre sold 300 NFTs representing 0.99% of streaming royalties from the hit “Bitch Better Have My Money. ” Fans who purchased these tokens now receive royalty payouts every time the song is streamed. Such examples illustrate how blockchain music royalties are turning listeners into partners in an artist’s success.

Fan Investment: Turning Listeners into Stakeholders

The implications for fans are profound. No longer limited to passive listening or merchandise purchases, supporters can now invest in music royalties themselves. By purchasing NFT shares in a song or catalog, fans gain exposure to future revenue streams – if the track goes viral on Spotify or TikTok, their wallet benefits too.

Top Benefits for Fans Investing in On-Chain Music Royalties

-

Direct Financial Participation: Fans can earn a share of streaming and royalty revenues by owning fractionalized music rights, turning music appreciation into a potential income stream.

-

Deeper Artist-Fan Connection: By investing directly in an artist’s music via platforms like Royal or Anotherblock, fans support their favorite creators and share in their success.

-

Portfolio Diversification: Music royalty tokens offer a new asset class for fans, allowing them to diversify their investments beyond traditional stocks and crypto assets.

-

Increased Transparency: Blockchain platforms provide real-time, immutable records of royalty payments and ownership, ensuring fans can track their earnings and rights with confidence.

-

Monthly Dividend Opportunities: Some services, like Sonomo, provide regular payouts to token holders, offering fans a steady income stream from their favorite songs.

-

Ownership of Iconic Catalogs: Fans can own fractional shares of legacy tracks and proven hits, such as those offered through Anotherblock, gaining exposure to established music assets.

This approach deepens the relationship between artists and audiences. Fans aren’t just cheering from the sidelines; they’re financially incentivized to promote tracks they own a piece of. The result? A more engaged community and grassroots marketing that can rival any label campaign.

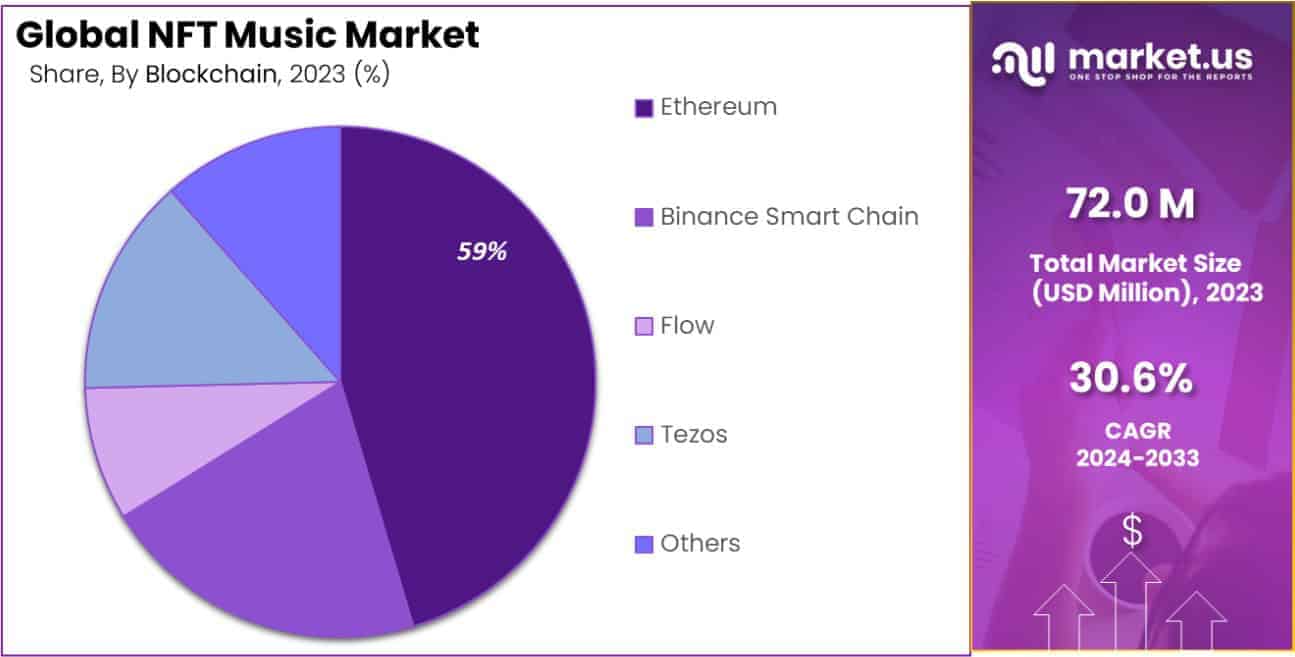

The Rise of Music Royalty Marketplaces

The infrastructure making all this possible is evolving rapidly. Platforms such as Royal (founded by musician 3LAU), Anotherblock, Fractis, and Sonomo offer user-friendly interfaces where artists list royalty shares as NFTs and investors build diversified portfolios of songs across genres and eras. These marketplaces provide transparent dashboards showing real-time earnings and upcoming payout dates, with smart contracts automating revenue splits based on ownership percentages.

Transparency is key here: Blockchain ledgers allow anyone to verify transactions and track exactly how much each token holder earns from streaming services or licensing deals. This stands in stark contrast to legacy systems where royalty statements are often delayed and riddled with errors or hidden fees.

Case Study Spotlight: Nas and Royal. io

A landmark moment came when legendary rapper Nas partnered with Royal. io to sell streaming royalty rights for his tracks “Ultra Black” and “Rare. ” Fans could buy as little as $50 worth of royalty tokens – making it possible for virtually anyone to participate in the upside of chart-topping hits previously reserved for industry insiders. This democratization is rapidly expanding access for both artists seeking funding and everyday listeners eager to invest in culture itself.

As more artists and fans embrace this model, the music royalty marketplace is becoming a dynamic new asset class. Investors can now diversify across thousands of tracks, from indie gems to proven hits, each represented as a unique NFT with transparent, on-chain revenue streams. Platforms like Sonomo even offer monthly dividend payouts and portfolio-building tools, while Anotherblock and Fractis continue to onboard both legacy catalogs and up-and-coming acts.

“Fractionalized music royalties are unlocking a new era of transparency and participation for independent musicians, “ says a recent industry analyst. “For the first time, artists can access immediate funding without giving up creative control, and fans can share in the journey from day one. “

This shift is also fueling innovation in fan engagement. Artists are experimenting with exclusive perks for token holders: early access to unreleased tracks, VIP event invites, or even creative input on future releases. By aligning incentives through shared ownership, musicians cultivate loyal communities that actively contribute to their success.

Risks and Rewards: Navigating the New Royalty Frontier

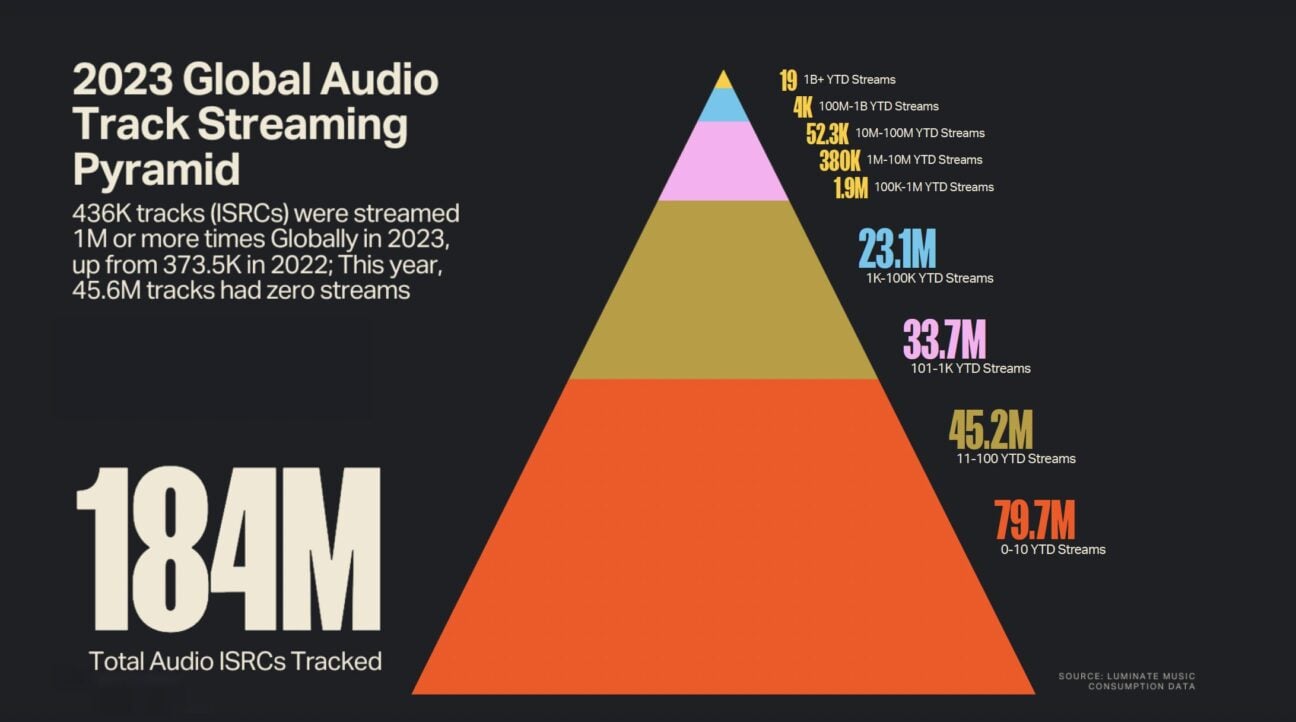

Of course, investing in fractionalized music royalties carries its own set of risks. Song performance can be unpredictable, a viral hit one month may fade into obscurity the next. Secondary markets for these NFTs are still maturing, so liquidity varies between platforms and catalogs. Yet as blockchain adoption grows and more data becomes available, price discovery is improving and investor confidence is rising.

For independent artists weighing this path, understanding the mechanics of smart contracts, royalty splits, and platform fees is crucial. Transparency is an advantage, but it demands diligence from both creators and investors. Reputable marketplaces provide detailed analytics dashboards so that everyone involved knows exactly how much they’re earning in real time.

Key Considerations for Investing in Blockchain Music Royalties

-

Platform Reputation & Security: Choose established platforms like Royal, Anotherblock, or Jukebox with proven security measures and transparent track records to minimize risk.

-

Transparency of Royalty Streams: Ensure the platform provides clear, verifiable data on how royalties are calculated, distributed, and tracked on-chain for each tokenized asset.

-

Liquidity & Secondary Market Access: Assess whether you can easily buy or sell your royalty tokens on active secondary markets, as platforms like Anotherblock and Jukebox offer peer-to-peer trading.

-

Catalog Quality & Proven Hits: Prioritize investments in songs or catalogs with a track record of streaming success or established artists, as seen with Nas on Royal or Rihanna’s producer on Anotherblock.

-

Regulatory Compliance & Legal Rights: Confirm that the platform operates within legal frameworks and that your ownership of royalties is enforceable and recognized by rights organizations.

-

Dividend Frequency & Payout Mechanisms: Review how often royalties are paid out (e.g., monthly on Sonomo) and the reliability of the payout process.

-

Fee Structures & Costs: Analyze all associated fees—including platform, transaction, and withdrawal fees—that can impact your net returns on music royalty investments.

The regulatory landscape is also evolving. As governments clarify rules around NFTs and digital securities, expect further standardization in how music rights are tokenized and traded globally.

The Road Ahead: A More Equitable Music Economy

The rise of on-chain music royalties signals a broader transformation within creative industries: one where value flows directly between those who make art and those who believe in it most passionately. Whether you’re an indie songwriter raising your first round of capital or a fan hoping to invest in tomorrow’s classics, blockchain-powered royalty marketplaces offer unprecedented access, along with new responsibilities.

This isn’t just financial innovation; it’s cultural infrastructure for a digital age where creativity is both collectible and investable. The next wave of independent music will be built not just on talent but on communities empowered by technology to share in every stream, sync deal, or breakthrough moment.

If you’re ready to explore further or want deep dives into how blockchain is revolutionizing fractional ownership of music royalties, there’s never been a better time to get involved, as an artist or as an investor.