Investing in tokenized music royalties using blockchain has rapidly matured from a niche experiment into a viable asset class for both music fans and professional investors. As of 2024, the convergence of blockchain technology and music royalty trading platforms is unlocking new ways to buy, sell, and trade fractional ownership in songs, albums, and entire catalogs. This is not just about supporting your favorite artist – it’s about tapping into a transparent, on-chain revenue stream with the potential for passive income.

Understanding Tokenized Music Royalties: The Basics

At its core, tokenized music royalties refer to the process of converting rights to future royalty income from a musical work into digital tokens on a blockchain. Each token represents a fractional claim on the revenue generated by streams, downloads, licensing deals, or sync placements. Holders of these tokens are entitled to receive their share of ongoing royalty payments directly via smart contracts – no middlemen required.

This model addresses many pain points in traditional music rights management: delayed payments, opaque accounting practices, and high barriers to entry for retail investors. With platforms like Royal (founded by 3LAU), ANote Music, and Anotherblock leading the charge in 2024, even newcomers can participate in this dynamic secondary market for music rights.

Why Blockchain? Transparency and Security in Music Investments

Blockchain music investment is fundamentally changing how value flows in the creative economy. By recording every transaction on an immutable ledger and automating payouts through smart contracts, blockchain ensures that artists and investors alike receive fair compensation with unprecedented transparency. This eliminates royalty black boxes that have plagued the industry for decades.

The benefits go beyond transparency. Token holders can trade their positions on secondary markets at any time – providing liquidity that was previously unthinkable for such illiquid assets. This dynamic market structure is fostering new strategies for both passive income seekers and active traders looking to speculate on emerging hits or established classics.

How to Get Started: Platforms and Wallet Setup

If you’re ready to buy music royalties in 2024, your first step is choosing a reputable marketplace. Top platforms include:

- Royal: Offers fractional ownership of tracks by major artists like Nas and The Chainsmokers; payouts are automated via Ethereum-based smart contracts.

- ANote Music: Based in Luxembourg with over €10 million in transactions; connects investors directly with rights holders across genres.

- Anotherblock: Focuses on streaming royalties; features collaborations with global acts including The Weeknd and R3hab.

You’ll need to set up a digital wallet compatible with your chosen platform’s blockchain network (like Ethereum or Polygon). This wallet will store your royalty tokens securely and enable you to participate in marketplace transactions without relying on centralized intermediaries. For a step-by-step walkthrough on wallet setup and platform onboarding, see our detailed guide here.

Selecting Your Investments: Due Diligence Matters

The most successful investors treat tokenized music royalties as they would any other alternative asset: with careful research and diversification. Before purchasing tokens representing fractional music ownership, analyze factors such as:

- Artist popularity and streaming history: Past performance can be indicative but not always predictive of future earnings.

- Payout frequency and terms: Review how often royalties are distributed (monthly or quarterly) and what share each token represents.

- Cultural relevance and catalog age: New releases may offer growth potential; legacy hits may provide more stable cash flow.

- Platform track record: Assess security protocols, transaction transparency, and user reviews before committing capital.

Diversifying across multiple songs or catalogs can help mitigate risk due to market volatility or unexpected shifts in consumer listening trends. For more insights into risk management strategies specific to this sector, check out our comprehensive analysis here.

Once you’ve selected your target assets and completed your due diligence, purchasing fractional music ownership is straightforward. Most platforms allow you to buy royalty tokens using either cryptocurrencies or traditional payment methods, depending on their integration with fiat on-ramps. After purchase, your tokens are deposited directly into your digital wallet, and you become eligible for a share of royalty distributions as specified in the smart contract.

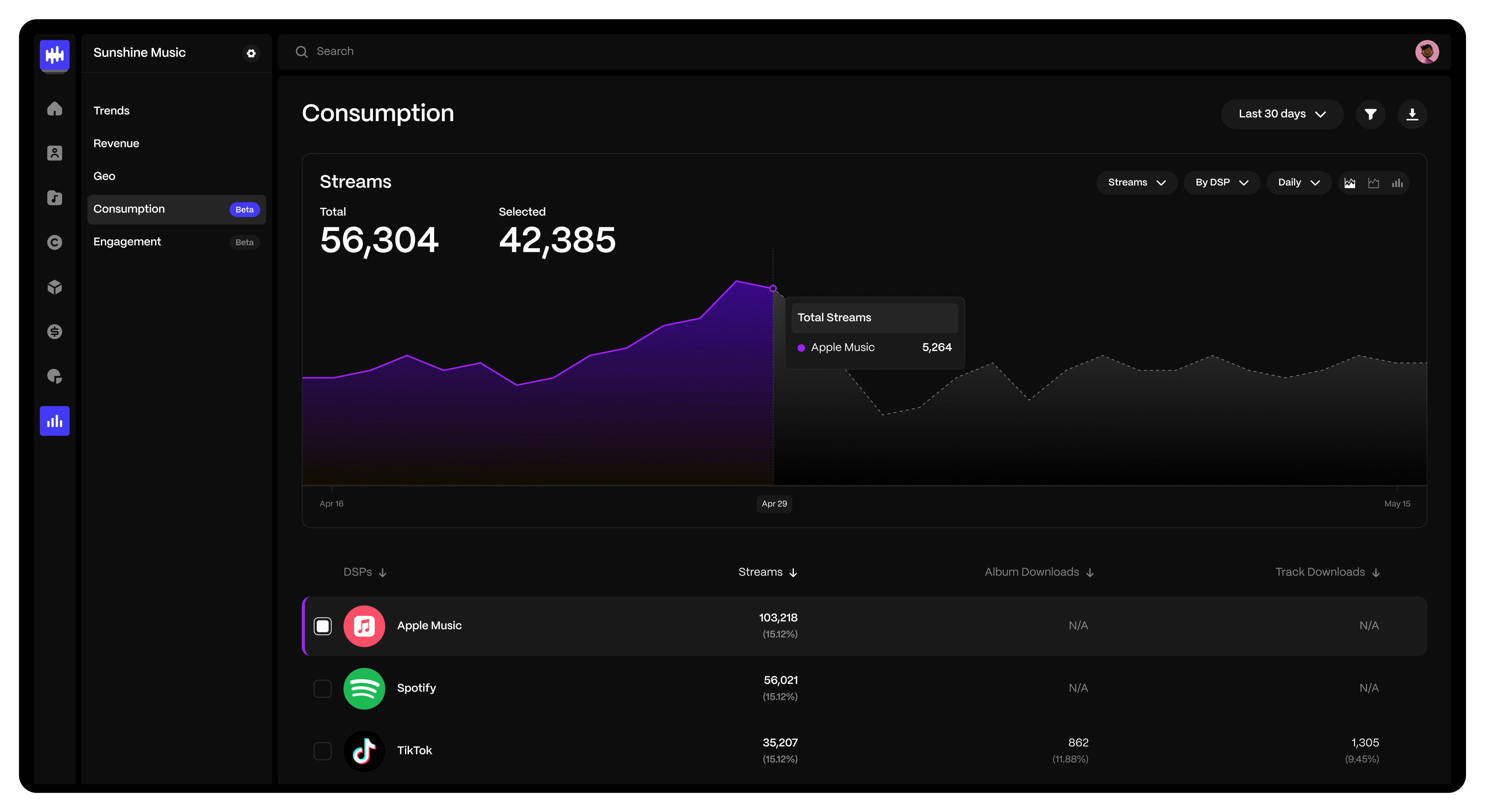

Active management of your portfolio is essential. Use the platform’s dashboard to monitor real-time performance, track royalty distributions, and stay updated on catalog news or artist developments. Many platforms now offer secondary trading, enabling you to sell your tokens to other investors if you wish to rebalance your holdings or realize gains.

Risks, Rewards, and Market Dynamics

Tokenized music royalties offer a compelling blend of potential passive income and exposure to the cultural economy, but they are not without risk. Royalty streams can fluctuate based on consumer tastes, platform changes, or even viral moments. A top-charting song today could see its earnings erode quickly if audience attention shifts. Furthermore, the legal landscape around blockchain-based rights management is still evolving, and jurisdictional differences may impact your tax obligations or the enforceability of smart contracts.

Liquidity is another consideration. While blockchain music investment platforms have improved tradability, secondary market volumes can vary significantly between songs and catalogs. Blue-chip catalogs by established artists typically see higher liquidity, while niche assets may be harder to sell quickly at a fair price.

Looking Ahead: The Future of Music Royalty Trading Platforms

The rise of music royalty trading platforms is democratizing access to music assets, allowing fans and investors to participate in the upside of streaming growth and catalog appreciation. As the ecosystem matures, expect to see enhanced analytics, more artist-driven offerings, and broader integration with NFT music collectibles. Platforms are also experimenting with AI-driven royalty forecasting and dynamic pricing, giving investors better tools to assess value and risk.

For those interested in the intersection of technology, music, and finance, tokenized music royalties represent a frontier with both opportunity and complexity. Staying informed and leveraging educational resources is crucial. For a deeper dive into the mechanics of trading and portfolio strategies, explore our guide on how to buy and sell tokenized music royalties on blockchain marketplaces.

Key Advantages of Blockchain Music Royalty Investment

-

Enhanced Transparency: Blockchain’s immutable ledger ensures all royalty transactions are recorded and visible, reducing disputes and guaranteeing artists and investors can track earnings in real time.

-

Fractional Ownership: Tokenization allows investors to own small, tradable shares of music royalty rights, making it accessible to a wider audience and enabling portfolio diversification.

-

Efficient and Prompt Payments: Smart contracts automate royalty distributions, ensuring artists and investors receive payments quickly and accurately without intermediaries.

-

Global Accessibility: Blockchain platforms like ANote Music, Royal, and Anotherblock allow users worldwide to invest in music royalties, breaking down geographic barriers.

-

Secondary Market Liquidity: Investors can buy and sell royalty tokens on secondary markets, creating a dynamic ecosystem and offering the potential for capital gains in addition to passive income.

Ultimately, whether you’re a seasoned investor or a music enthusiast, the key is to invest in value, not just hype. Tokenized music royalties can offer both financial and cultural returns, but only for those who approach the market with rigor, curiosity, and a willingness to adapt as the landscape evolves.