Picture this: you’re streaming your favorite song, and with every play, a fraction of the royalty lands in your digital wallet. In 2025, tokenized music royalties are turning fans and investors into co-owners, unlocking passive income streams that were once reserved for major labels and industry insiders.

Tokenized Music Royalties: How Blockchain Is Changing Music Ownership

Music tokenization transforms royalties into blockchain-based tokens, enabling anyone to buy fractional shares of songs or catalogs. Each token represents a slice of future streaming, licensing, or sync revenue. Platforms like Royal and Zoniqx have made it possible for both casual fans and savvy investors to participate directly in the success of music assets, no middleman required.

This shift isn’t just about technology; it’s about transparency. With blockchain ledgers recording every transaction, royalty payments are distributed in real time. No more waiting months for statements or questioning where your cut went. For artists, this means new funding models. For investors? A seat at the table, and a share of the pie.

Your First Steps: Investing in Fractional Music Ownership in 2025

The process is more accessible than ever:

- Select a platform: Reputable names like Royal and Audius specialize in blockchain music royalty investing.

- Set up your wallet: Most platforms support Ethereum or Polygon wallets for secure storage and transactions.

- Research assets: Analyze an artist’s popularity, historical streaming data, and projected income. Diversification across genres can help manage risk.

- Buy tokens: Purchase your chosen royalty tokens, often starting as low as $10, using crypto or fiat currency.

- Track earnings: Use the platform dashboard to monitor your portfolio’s performance and receive real-time royalty payouts.

The entry point is low, platforms like Bolero let you start with just $10. This means virtually anyone can build a diversified portfolio of music rights and earn proportional returns as songs perform globally.

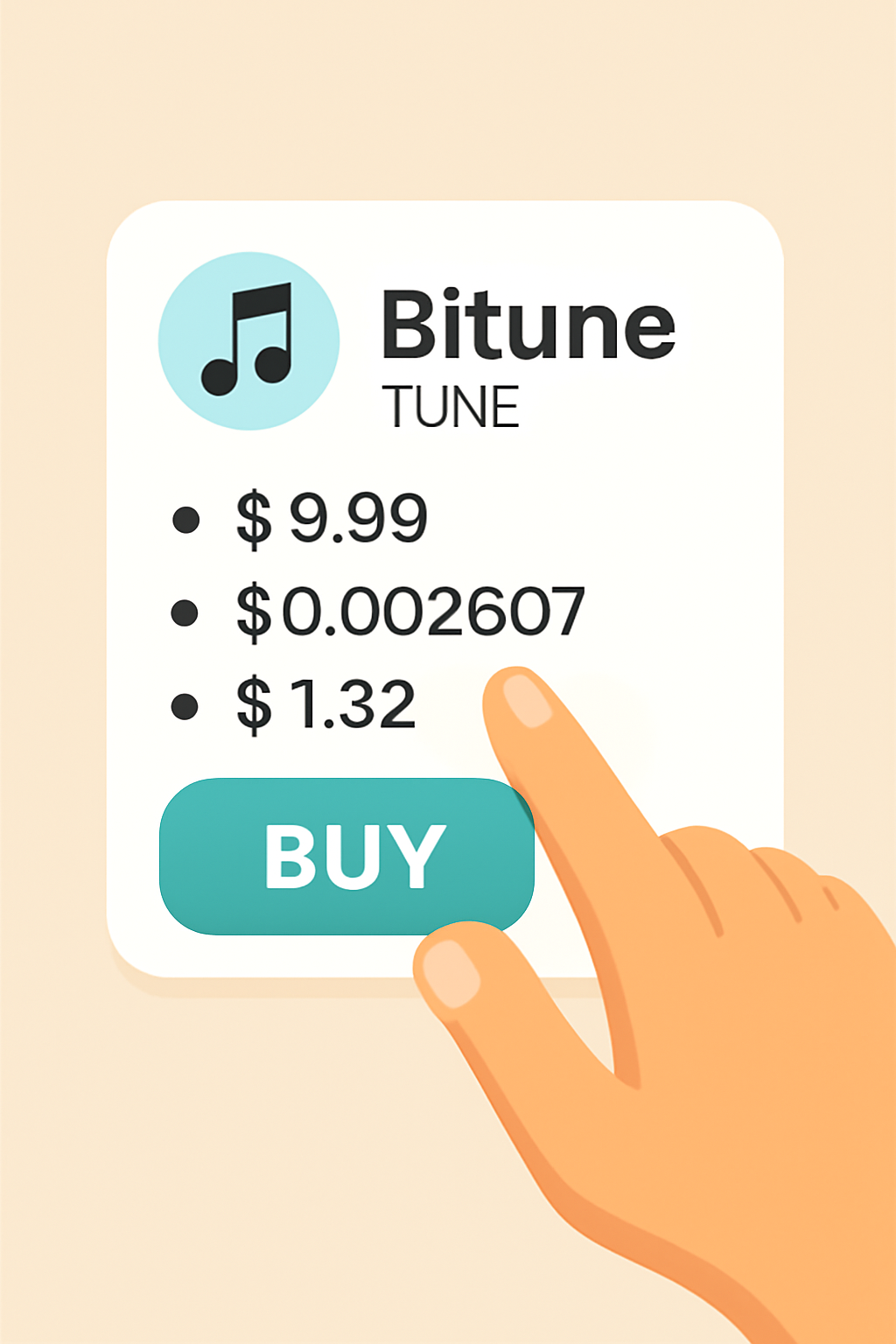

The Current Market Pulse: Bitune (TUNE) Highlights Volatility and Opportunity

The market for music royalty tokens is dynamic, and volatile. As of November 12,2025, Bitune (TUNE) is trading at $0.002607, with an intraday high of $0.002615 and a low of $0.002606. These micro-movements matter: even small price swings can impact returns when scaled across thousands of streams or multiple assets.

Bitune (TUNE) Price Prediction 2026-2031

Professional forecasts based on tokenized music royalty trends, adoption, and evolving market dynamics. All prices in USD per TUNE token.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Potential % Change (Avg.) |

|---|---|---|---|---|

| 2026 | $0.00210 | $0.00285 | $0.00360 | +9.3% |

| 2027 | $0.00200 | $0.00325 | $0.00420 | +14.8% |

| 2028 | $0.00220 | $0.00370 | $0.00510 | +41.9% |

| 2029 | $0.00200 | $0.00430 | $0.00630 | +65.0% |

| 2030 | $0.00230 | $0.00510 | $0.00790 | +95.7% |

| 2031 | $0.00270 | $0.00600 | $0.00980 | +130.2% |

Price Prediction Summary

Bitune (TUNE) is projected to steadily appreciate over the next six years, fueled by growing adoption of music royalty tokenization, wider use cases in passive income, and increasing integration with blockchain entertainment platforms. While the minimum price scenario reflects crypto market volatility and regulatory risks, the base and maximum cases suggest significant upside as tokenized music assets gain mainstream traction. By 2031, TUNE’s average price could more than double from current levels, with bullish scenarios pointing to nearly 4x growth if adoption accelerates and the broader crypto market remains favorable.

Key Factors Affecting Bitune Price

- Expansion of tokenized music royalty platforms and investor adoption

- Broader acceptance of fractional ownership in music and entertainment assets

- Regulatory clarity and compliance in key jurisdictions

- Advancements in blockchain scalability and royalty distribution technology

- Competition from other music royalty and real-world asset (RWA) tokens

- General cryptocurrency market cycles and investor sentiment

- Security and reliability of smart contracts and platform infrastructure

- Artist participation and success of tokenized music projects

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This volatility also creates opportunity for active traders who understand both music trends and crypto cycles, two worlds colliding on-chain.

Navigating Risks: What Every Investor Should Know

No reward comes without risk, and tokenized royalties are no exception:

- Market Volatility: The value of your tokens fluctuates with both song performance and broader crypto trends.

- Regulatory Uncertainty: Legal frameworks are evolving fast; keep up with changes to stay compliant.

- Tech Barriers and Security: While blockchain adds security layers, smart contract bugs or hacks remain possible if platforms aren’t properly audited.

If you’re serious about earning passive income from blockchain music royalties, or want deeper insights into strategies for managing these risks, explore our complete guides on fractional ownership investing.

For those ready to dive deeper, the most successful investors in fractional music ownership 2025 are leveraging smart diversification, AI-powered analytics, and a keen eye for emerging genres. Don’t just chase chart-toppers; look at the long tail, sync licensing deals for indie tracks, viral TikTok hits, or catalogs with steady historical performance all offer unique risk-reward profiles.

![]()

AI tools are now standard for evaluating catalog performance. Platforms increasingly offer predictive dashboards that crunch streaming data, social trends, and even sync placement potential. This lets you spot undervalued assets before the crowd, stacking the odds in your favor.

Key Strategies for Maximizing Passive Income

- Diversify across genres and eras: Don’t put all your tokens in one basket. Blend pop hits with evergreen classics or niche genres to smooth out volatility.

- Monitor platform updates: Stay alert to new catalog drops, artist partnerships, or royalty distribution changes, these can dramatically affect token value and yield.

- Reinvest earnings: Use royalty payouts to acquire more tokens or rebalance your portfolio as trends shift.

- Stay informed on regulations: As SEC-compliant music tokens become more common, regulatory clarity can unlock new markets and lower risk profiles.

The flexibility of blockchain-based royalty platforms means you can adjust positions instantly in response to market news or artist momentum, a sharp contrast to the slow-moving world of traditional music rights.

Looking Ahead: The Future of Blockchain Music Royalties

The rise of music NFT passive income is already reshaping how value is created and shared in entertainment. Expect even greater integration between streaming platforms and royalty marketplaces by late 2025. As real-world asset tokenization expands, from art to real estate, music remains a uniquely accessible entry point for both new digital investors and lifelong fans.

If you’re ready to start earning from every play, not just listening, now is the time to explore tokenized music royalties. Let the charts do the talking.