Imagine earning a steady stream of income every month, not from stocks or property, but from your favorite songs streaming worldwide. In 2025, this vision is becoming reality through tokenized music royalties on the blockchain. By owning fractional shares in songs or entire catalogs, investors can now access music industry cash flows that were once reserved for labels and insiders. Let’s break down how blockchain is transforming music royalty investing and how you can start building passive income in this new era.

Tokenization: Turning Songs Into On-Chain Assets

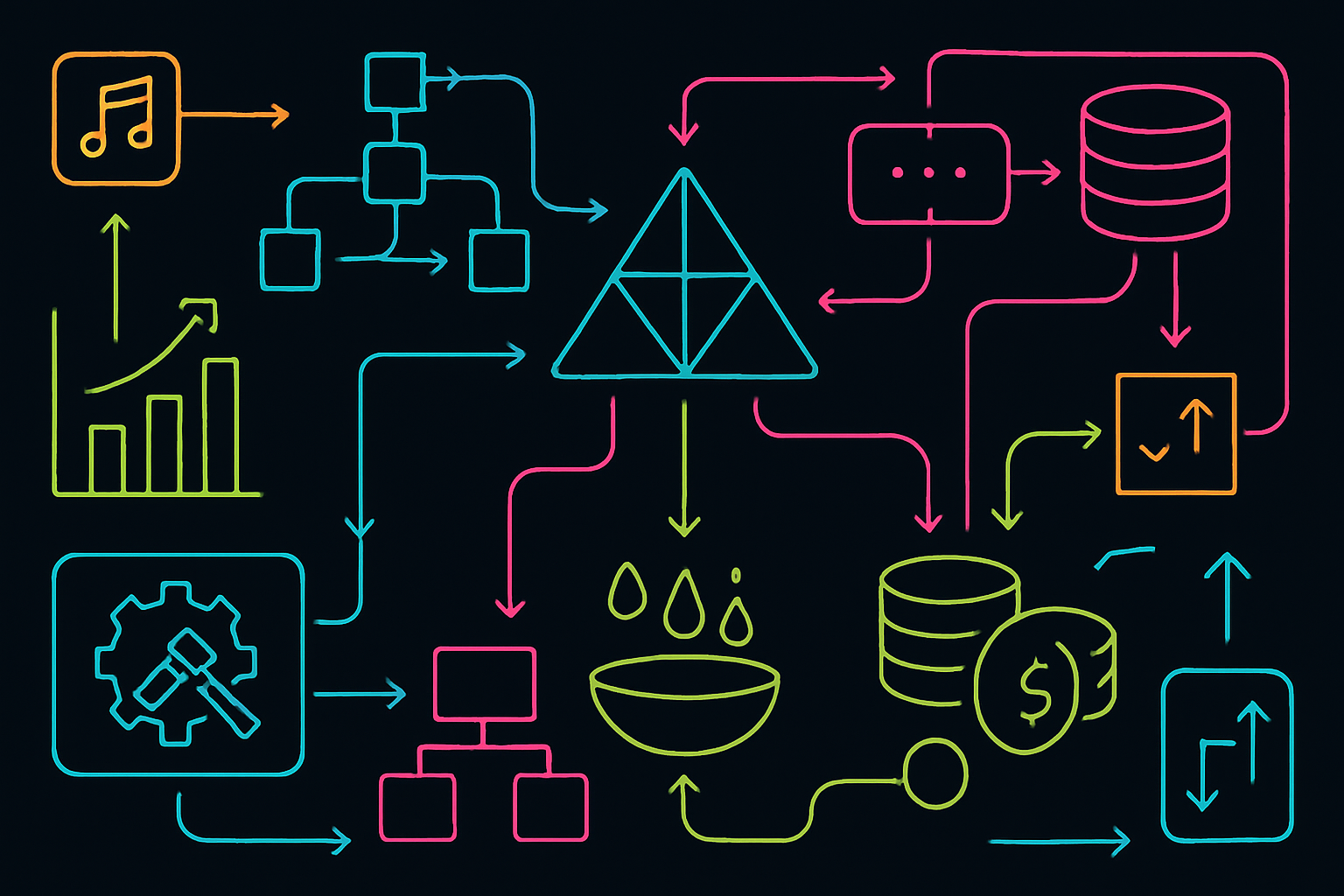

At its core, music royalty tokenization means converting future royalty rights into digital tokens that live on a blockchain. Each token represents a claim on a portion of the revenue generated by streams, downloads, or licensing deals for a song or album. This process unlocks several game-changing benefits:

- Fractional ownership: Investors can buy small stakes in high-performing tracks rather than needing millions to purchase full rights.

- Liquidity: Tokens can be traded instantly on secondary markets, letting you enter or exit positions with ease.

- Transparency: Blockchain records every transaction and payout, eliminating hidden fees and delays.

This approach democratizes access to music revenue streams, whether you’re a fan supporting an indie artist or an investor seeking yield uncorrelated with traditional markets. As platforms like Royal, ANote Music, and Audius continue to grow, the opportunities for both artists and investors are multiplying.

The Mechanics: How to Invest in Tokenized Music Royalties

Diving into the world of on-chain music investment doesn’t require technical wizardry, but it does pay to understand the process before committing capital. Here’s a step-by-step overview tailored for 2025’s leading platforms:

- Education First: Learn how blockchain music royalties work and what drives their value. Token prices reflect projected royalty income based on streaming data and licensing trends.

- Select Your Marketplace: Choose reputable platforms such as Royal (backed by artists like 3LAU), ANote Music (Europe-based), or Audius (decentralized streaming). Each offers different catalogs and payout models.

- Create a Digital Wallet: You’ll need an Ethereum- or Polygon-compatible wallet to store your tokens securely and receive payouts directly.

- Diversify Your Portfolio: Don’t put all your funds into one song, spread across multiple artists, genres, or catalogs for risk management.

- Purchase Tokens: Use crypto (or fiat where supported) to buy fractional royalty rights. Transactions are instant and verifiable via smart contracts.

- Earnings and Management: Track your portfolio using platform dashboards. Royalties are distributed automatically based on actual song performance, no middlemen required.

The Current Landscape: Why Passive Income Music Blockchain Is Booming in 2025

The surge in interest around blockchain music royalties isn’t just hype, it reflects deep structural changes in both technology and culture. Here’s why investors are flocking to this asset class now more than ever:

- Payouts Are Faster Than Ever: Thanks to smart contracts, royalty distributions happen automatically after each stream, sometimes within hours instead of months.

- No More Gatekeepers: Artists tokenize their own work directly, bypassing legacy intermediaries who used to take hefty cuts of earnings.

- Pandemic-Proof Yield: Streaming revenues proved resilient during global disruptions, making music royalties attractive compared to traditional dividend assets.

- Sustainability and Transparency: Blockchain ledgers provide full visibility into payment flows so investors can verify earnings in real time, no more black box accounting.

This democratization is also empowering artists themselves: by selling royalty tokens directly to fans or investors they gain upfront funding while retaining creative control, a win-win for both sides of the market. For more details about how these systems work technically and legally, see our comprehensive guide on fractional ownership via tokenization.

But while the promise of passive income music blockchain is compelling, it’s important to approach these investments with a clear strategy and a realistic understanding of risk. The market is still maturing, and not every song or catalog will deliver blockbuster returns. Let’s explore how savvy investors are navigating the evolving landscape.

Smart Strategies: Maximizing Returns in 2025’s Music Royalty Marketplaces

Success in music royalty NFT investing hinges on combining traditional due diligence with Web3 analytics. Here are tactics top investors use to boost their odds:

- Analyze Streaming Trends: Use on-chain data and platform dashboards to track play counts, regional growth, and social buzz for potential assets.

- Favor Catalogs With Sync Potential: Songs licensed for film, TV, or ads often generate outsized royalties. Look for catalogs with proven sync history or viral momentum.

- Diversify Across Eras and Genres: Don’t just chase today’s hits. Legacy tracks with steady play rates can provide reliable yield, while emerging genres may offer high upside.

- Monitor Platform Fees and Token Liquidity: Some marketplaces charge transaction fees or have thin trading volumes, factor these into your return calculations.

The most successful portfolios blend blue-chip hits with high-upside indie releases, balancing steady cash flow against speculative growth. For a practical walkthrough on building such a portfolio, check our step-by-step guide.

Comparison of Leading Music Royalty Marketplaces (2025)

| Marketplace | Platform Fees | Payout Speed | Catalog Diversity |

|---|---|---|---|

| Royal | 2.5% transaction fee | Instant to 24 hours | Popular artists, trending singles, electronic/hip-hop focus |

| ANote Music | 1% seller fee, 0.5% buyer fee | Monthly | Wide: European, indie, and legacy catalogs |

| Audius | No platform fee (gas fees apply) | Real-time (per stream) | Decentralized, indie artists, emerging genres |

Risks and Realities: What Every Investor Should Know

No investment is without risk, and tokenized music royalties are no exception. Here are key factors to weigh before you allocate capital:

- Market Volatility: Streaming popularity can spike or fade quickly; projected earnings aren’t guaranteed.

- Platform Risk: Not all platforms are created equal. Assess their smart contract security, legal compliance, and transparency before depositing funds.

- Regulatory Uncertainty: Music royalty NFTs operate at the intersection of IP law and securities regulation, jurisdictional rules may evolve rapidly.

- Payout Delays from Rights Holders: While blockchain speeds up distributions, delays can still occur if upstream rights holders don’t report usage promptly.

A prudent approach combines diversification with ongoing monitoring, don’t treat music tokens as set-and-forget assets. Stay plugged into platform updates and industry news to adapt as conditions change.

The Road Ahead: Fractional Music Ownership Goes Mainstream

The fusion of blockchain technology with music rights has opened an entirely new asset class, one where fans become investors and artists retain more control over their work. As regulatory clarity improves and secondary markets deepen liquidity, expect even more creative models for sharing value between creators and supporters.

If you’re ready to take your first steps into this space, or want to refine your existing strategy, explore our latest resources on buying and selling tokenized royalties. The future of music ownership is unfolding on-chain; those who educate themselves early will be best positioned to benefit from this paradigm shift.