Imagine owning a slice of the royalties from BTS’s chart-topping ‘The Truth Untold’ or BLACKPINK’s infectious hits, with daily payouts landing in your wallet thanks to blockchain magic. In 2025, this isn’t a fan’s daydream anymore; it’s a real investment opportunity through tokenized music royalties. As someone who’s navigated stocks and crypto for over a decade, I can tell you this shift feels like the early days of fractional real estate, but for music IP. Fans and investors alike are jumping in, drawn by steady streams from global platforms like Spotify and YouTube.

Tokenized music royalties BLACKPINK and BTS royalties blockchain have exploded onto the scene, powered by platforms like Aria Protocol and Story Protocol. These aren’t just NFTs; they’re real-world assets (RWAs) representing actual revenue shares from songs with hundreds of millions of streams. Patience compounds returns, and here, that means compounding from evergreen K-pop anthems that keep pulling in cash year after year.

The 2025 Breakthrough: BTS Leads with ‘The Truth Untold’

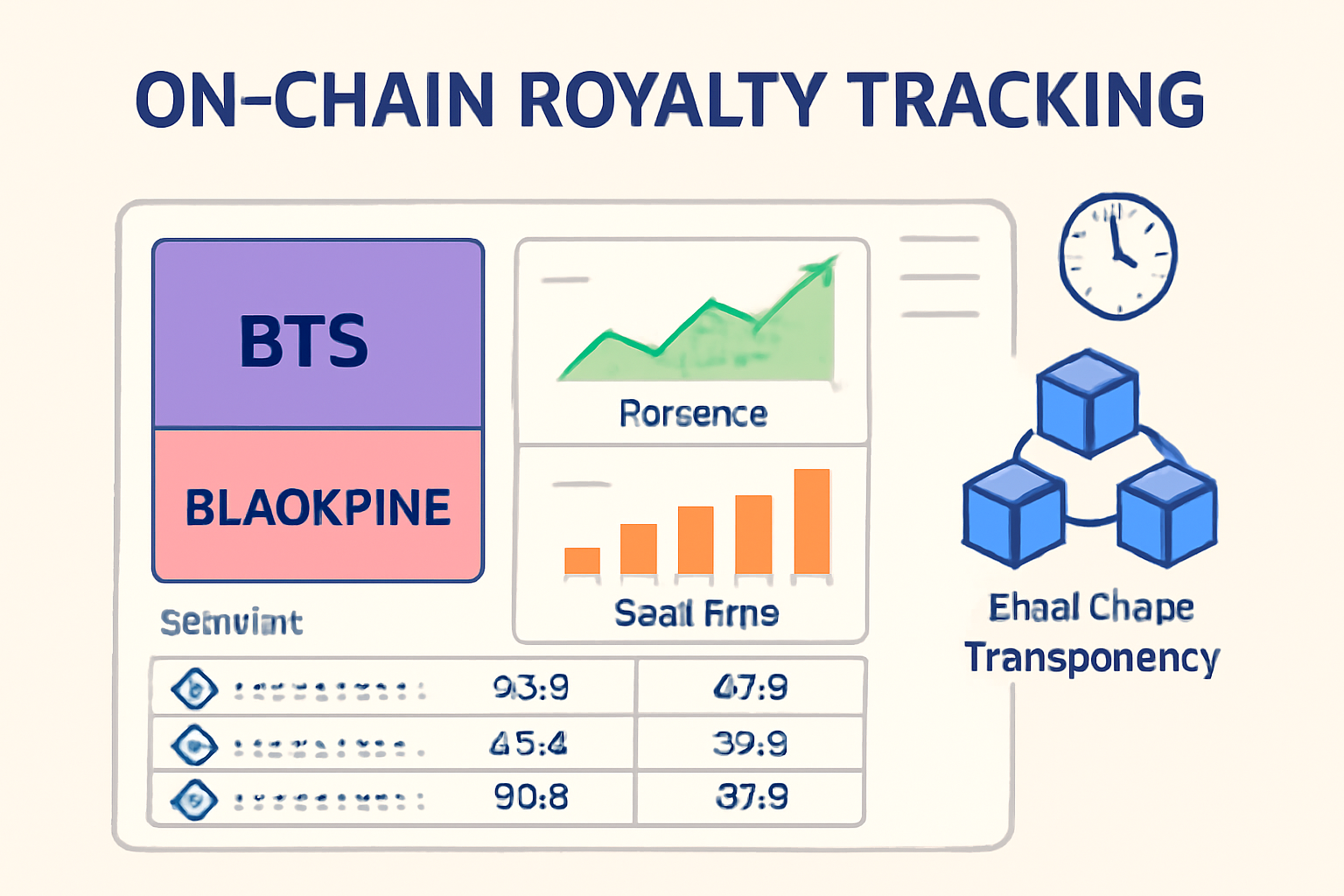

Back in February 2025, BTS made waves by tokenizing copyrights to select major hits on Story Protocol, including their collaboration with Steve Aoki, ‘The Truth Untold. ‘ This track alone boasts over 670 million streams, fueling projections of 6% to 7% annualized royalty yields for token holders. It’s a game-changer for fractional music rights investment, letting everyday investors buy in for pennies on the dollar compared to traditional music funds.

What reassures me most? These aren’t speculative tokens riding hype; they’re backed by verifiable IP rights with transparent on-chain distributions. IP Strategy raised $10.95 million to snap up partial rights to 48 hits, including BTS and BLACKPINK tracks alongside Justin Bieber and Miley Cyrus. Daily royalty distribution keeps the income flowing, smoothing out the bumps of crypto volatility.

BLACKPINK Joins the Party via Aria PRIME’s $100M Push

Fast-forward to September, and Aria PRIME, the institutional arm of Aria Protocol, dropped a bombshell: a $100 million tokenization project for BTS and BLACKPINK music catalogs. Partnering with Story Protocol and Contents Technologies, this gives big players permissioned access while trickling opportunities down to retail investors. Now, music RWA platforms 2025 like Aria let you trade on-chain music royalties trading with the security of blockchain.

Check out this buzz from the crypto community.

Aria Protocol’s $ARIAIP tokens make you an IP asset holder, unlocking revenue shares from streaming and licensing, plus governance votes and staking rewards. It’s thorough ecosystem design that mitigates risks, from smart contract audits to partnerships with licensed exchanges like Seoul Exchange, which is building a dedicated blockchain for Korean IP including K-pop royalties.

Why Tokenized K-Pop Royalties Beat Traditional Investments

K-pop’s global dominance isn’t fading; BTS and BLACKPINK command billions of streams annually, translating to reliable royalties uncorrelated with stock market swings. Think about it: while equities dip on economic news, your slice of ‘Kill This Love’ keeps earning from TikTok dances and playlist adds. Blockchain music assets Aria style democratizes this, with fractional ownership starting small but scaling with popularity.

I’ve seen investors sleep better knowing their portfolio includes cultural assets with built-in scarcity. Unlike volatile memes, these RWAs tie directly to proven hits. Platforms handle the legwork: tokenization, compliance, and payouts. Yet, stay vigilant on platform credibility and evolving regs, especially in South Korea’s forward-thinking scene.

Diving deeper, Aria’s launch on Story IP blockchain raised over $12 million initially, proving demand for K-pop royalties NFT equivalents. IP Strategy’s strategic buys, like the first $APL asset, set the template for sustainable growth.

That momentum carried into Aria PRIME’s broader ecosystem, where institutional money now flows into tokenized catalogs, blending K-pop’s cultural cachet with blockchain’s efficiency. For fans turned investors, it’s reassuring to see yields projected at 6% to 7% from assets like ‘The Truth Untold, ‘ backed by real streaming data rather than promises.

Getting In: Platforms and Steps for Fractional Ownership

Ready to dip your toes? Platforms like Aria Protocol make it straightforward. Buy $ARIAIP tokens to claim your share of royalties from BLACKPINK and BTS hits, with daily distributions hitting your wallet. No need for a music degree; the blockchain verifies everything, from stream counts to payouts. Music Royalty Markets steps it up further, offering a user-friendly hub for buying, selling, and trading these tokenized royalties. We’ve integrated Story Protocol assets seamlessly, so you can fractionalize ownership in K-pop goldmines without the hassle of multiple wallets.

Here’s real talk from the front lines, investors are sharing their wins.

Compare that to traditional bonds or even dividend stocks; music RWAs add diversification with a fun twist. South Korea’s Seoul Exchange partnership with Story Protocol signals regulatory green lights ahead, potentially unlocking trillions in cultural IP for global trading.

Navigating Risks: Smart Strategies for Steady Gains

Every investment has hurdles, and tokenized music royalties are no exception. Market volatility can swing token prices with artist buzz or streaming dips, but the underlying royalties provide a floor, think steady cash from evergreen tracks. Regulatory shifts? They’re evolving favorably, especially in crypto-forward Asia, but always check your local rules. Platform security matters too; stick to audited protocols like Aria, with its $10.95 million-backed acquisitions and daily payouts.

Pros and Cons of Tokenized Music Royalties

| Pros | Cons |

|---|---|

| 6-7% yields 💰 | Token volatility 📉 |

| Daily payouts 📅 | Evolving regs ⚖️ |

| Fractional entry 🔽 | Artist popularity risk 🎤 |

| Uncorrelated to stocks 📊 | Liquidity varies 💧 |

To mitigate, diversify across catalogs, BTS for ballads, BLACKPINK for bangers, and stake for extra rewards. I’ve advised clients to allocate 5-10% of portfolios here, balancing the thrill of fandom with proven revenue math. Patience compounds returns, especially when streams hit 670 million and counting.

Looking ahead, 2025’s launches are just the opener. With Aria PRIME’s $100 million push and IP Strategy’s blueprint, expect more K-pop and global stars to tokenize. Music Royalty Markets is positioned at the forefront, blending NFT music royalties with secure trades for musicians and investors alike. Whether you’re chasing passive income or hedging against fiat erosion, these assets offer transparency you won’t find in opaque funds.

Jump in thoughtfully, track those on-chain metrics, and watch royalties stack up. This is music ownership reimagined, democratized, decentralized, and delivering.