Afrobeats pulses through global playlists, with artists like Wizkid and Tems commanding massive streaming audiences and generating eye-watering royalties. In the past 30 days alone, Tems raked in $1,187,740 from streams, while Wizkid followed closely at $1,088,050. Yet, these earnings often remain locked in traditional payout cycles, delaying cash flow for creators. Enter blockchain tokenization: a game-changer for tokenized Afrobeats royalties, enabling fractional ownership and instant revenue sharing. Imagine investors buying slices of Wizkid’s streaming royalties on-chain, turning passive fan support into active portfolio assets.

This isn’t hype; it’s strategy. Platforms are already tokenizing music rights worldwide, and Afrobeats stands poised to dominate music royalty markets Afrobeats investors crave. By fractionalizing earnings from hits like Tems’ ‘Burning’ or Wizkid’s ‘Essence, ‘ artists gain upfront capital, fans earn yields, and blockchain ensures transparency. No more opaque PROs or delayed checks; royalties flow directly via smart contracts.

Afrobeats Royalty Powerhouses: Real Numbers, Real Potential

The streaming economy favors Afrobeats heavyweights. Recent data spotlights their dominance: Tems at the top with $1,187,740 in 30-day royalties, Wizkid securing $1,088,050, Burna Boy at $937,987, and Tyla hitting $858,247. These figures underscore a booming market ripe for disruption through wizkid streaming royalties blockchain models.

| Artist | 30-Day Streaming Royalties |

|---|---|

| Tems | $1,187,740 |

| Wizkid | $1,187,050 |

| Burna Boy | $937,987 |

| Tyla | $858,247 |

These aren’t isolated wins. Afrobeats streams surged globally, fueled by TikTok virality and Spotify algorithms. But artists face hurdles: intermediaries siphon cuts, and liquidity lags. Tokenization flips this script, converting future royalties into tradeable NFTs or tokens. Investors snag fractional shares, earning pro-rata from every play. For Wizkid, whose catalog spans billions of streams, this means diversified funding without debt.

Tokenization Mechanics: From Streams to Smart Contracts

At its core, tems fractional music ownership tokenizes royalty rights as digital assets on blockchain. A song’s streaming revenue stream gets mapped to an ERC-20 token or NFT collection. Each token represents ownership stake; when streams generate cash, smart contracts automate distributions. Platforms like Royal. io exemplify this, partnering with Nas for ‘Ultra Black’ royalties. Afrobeats could mirror it seamlessly.

Benefits stack strategically: increased liquidity lets artists sell future earnings now. Fractionalization democratizes entry; a $100 investment buys into Tems’ next hit. Transparency reigns, with on-chain ledgers verifiable by anyone. No disputes, just code-enforced fairness. Check out how tokenized music royalties work for the blueprint.

Critics worry about regulation, but blockchain’s auditability addresses that. In Nigeria’s vibrant scene, where blockchain music royalties Nigeria gain traction, this model empowers local talent against global gatekeepers.

Why Afrobeats Leads the Tokenized Charge

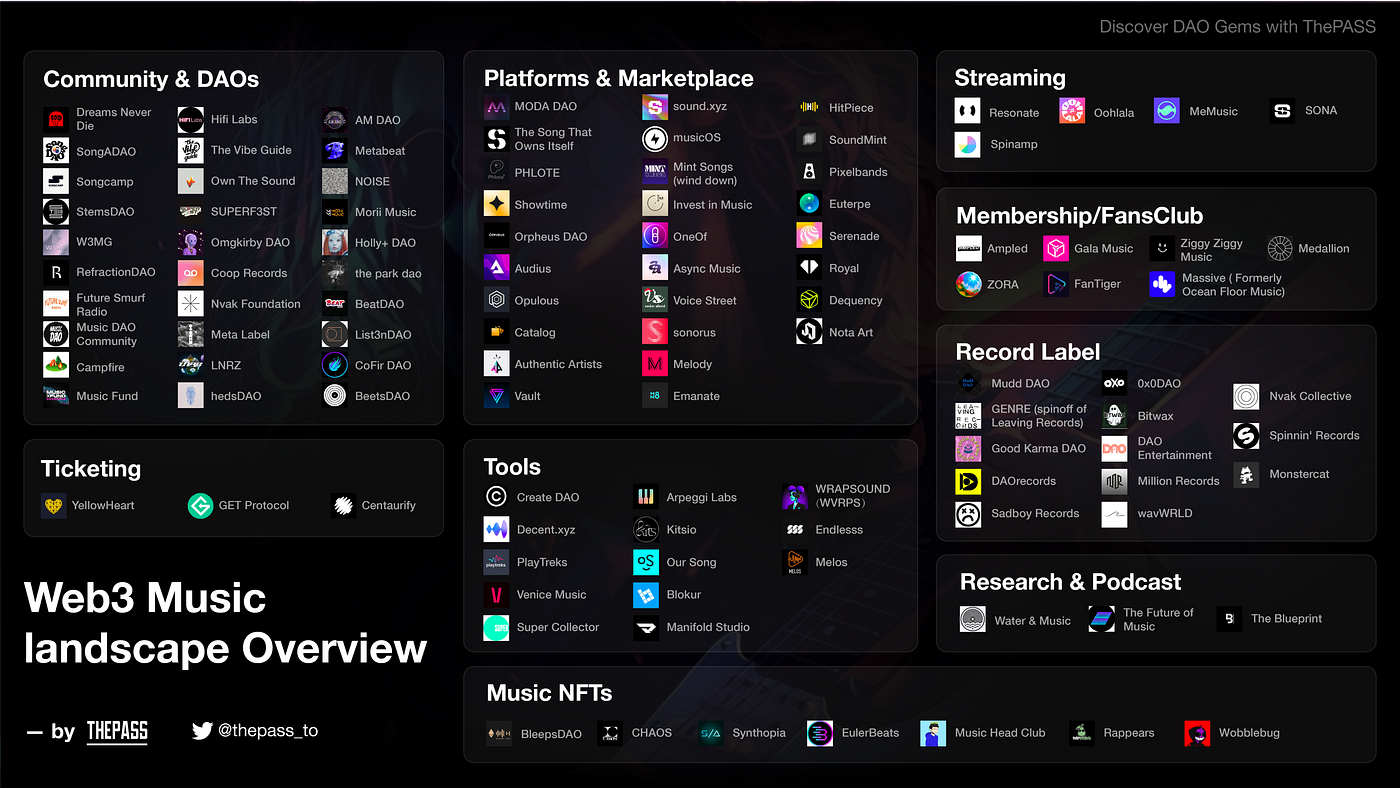

Afrobeats’ youth-driven, borderless appeal aligns perfectly with Web3 ethos. Wizkid and Tems boast Gen-Z superfans ready to invest, not just stream. Platforms like SongBits and anotherblock already fractionalize tracks; extending to burna boy royalty tokens feels inevitable. Royal and Zoniqx use smart contracts for real-time splits, proving scalability.

Financial inclusion shines here. African artists, often underserved by banks, access global capital via fractional streaming royalties investors. Wizkid could tokenize 10% of his catalog, raising millions instantly while retaining control. Fans vote on merch or tours via token governance. This isn’t charity; it’s compounded value creation.

Picture platforms like Royal. io and anotherblock scaling to Afrobeats catalogs. Royal’s Nas collaboration tokenized ‘Ultra Black’ royalties, delivering fans quarterly payouts. Zoniqx and SongBits push further with NFT-backed shares, real-time splits via smart contracts. Music Royalty Markets stands ready to host tokenized Afrobeats royalties, blending NFT music with seamless on-chain trading. Investors eye these as high-yield RWAs, with Wizkid’s $1,088,050 monthly streams signaling steady cash flows.

🎵 **Top Platforms Tokenizing Music Royalties: Potential for Afrobeats Stars like Wizkid & Tems** *

* Tokenized platforms enable **daily/real-time payouts** vs. traditional **quarterly royalties**

| Platform 🏆 | Key Feature 🎵 | Artist Example (Afrobeats Relevance) | Liquidity Score 💰 |

|---|---|---|---|

| 👑 **Royal.io** | **Streaming Shares** – Nas partnership for tokenized royalty shares & fan investment | **Nas** (Hip-Hop pioneer); **Wizkid Potential** – $1,088,050 (30-day streams) | **9/10** ⭐⭐⭐⭐⭐⭐⭐⭐⭐ |

| 🎧 **anotherblock** | **NFT Rights** – Real-time payouts & tokenized cash flows | **Steve Angello** (EDM); **Tems Potential** – $1,187,740 (30-day streams) | **9/10** ⭐⭐⭐⭐⭐⭐⭐⭐⭐ |

| 🎤 **SongBits** | **Direct Fractional Sales** – Purchase shares straight from recording artists | **Direct from artists**; **Burna Boy Potential** – $937,987 (30-day streams) | **8/10** ⭐⭐⭐⭐⭐⭐⭐⭐ |

| 🔗 **Zoniqx** | **Smart Contract Splits** – Automated, transparent revenue sharing on-chain | **Collaboration splits**; **Tyla Potential** – $858,247 (30-day streams) | **7/10** ⭐⭐⭐⭐⭐⭐⭐ |

Investors sharpen strategies here. Diversify across Tems’ soulful hooks and Wizkid’s dance anthems for balanced exposure. Yields beat bonds, with transparency trumping private equity opacity. Yet, select platforms wisely; Music Royalty Markets excels with user-friendly interfaces and audited contracts. Dive deeper via how blockchain revolutionizes fractional ownership.

Strategic Investor Advantages

-

High Streaming Yields: Wizkid ($1,088,050) and Tems ($1,187,740) royalties over past 30 days via platforms like Royal.io

-

Low Entry Barrier: Minimum investment as low as $100 for fractional ownership in music royalties

-

Global Liquidity: Trade tokenized royalties on blockchain platforms like Royal.io and anotherblock

-

Fan Engagement Perks: Governance votes and exclusive access, as seen on Royal.io with artists like Nas

-

Inflation Hedge: RWA tokens backed by real streaming cash flows protect against fiat erosion

Risks exist, demanding savvy navigation. Volatility ties to streams; a flop hurts yields. Regulatory gray areas linger, though U. S. SEC nods to tokenized notes signal progress. Counter with due diligence: audit tokenomics, track artist metrics. Platforms mitigate via insurance funds and legal wrappers. For fractional streaming royalties investors, this beats waiting on Spotify checks.

Investor Playbook: Positioning for Afrobeats Token Boom

Build portfolios blending momentum and fundamentals. Allocate 20% to Wizkid’s proven catalog, 30% to Tems’ rising trajectory. Monitor streams via on-chain dashboards; pivot on data, not hype. Music Royalty Markets streamlines this with fractional NFT royalties, secondary markets, and yield optimizers. Governance tokens let holders shape artist collabs, deepening loyalty.

Vision forward: Wizkid drops a royalty NFT drop tied to his next album, fractions flying to global wallets. Tems follows, blending Afrobeats with Web3 grants for emerging producers. Burna Boy and Tyla join, catalogs tokenized for perpetual yields. This wave hits music royalty markets Afrobeats hardest, rewarding early movers. Blockchain strips intermediaries, channeling more to creators and savvy backers. Financial inclusion scales; Nigerian talent taps diaspora dollars instantly.

Strategic minds act now. Scout listings on Music Royalty Markets, where innovation fuses with verifiable value. Afrobeats royalties, once elusive, become portfolio staples. Tokenize the beat, own the future.