Indie artists pour their souls into tracks, only to watch labels skim 80% of future royalties in traditional deals. This lopsided split starves creators of well-deserved cash flow, forcing many to hustle side gigs just to eat. Enter fractional music royalties blockchain: a game-changer that lets artists tokenize their royalties, sell fractions directly to fans and investors, and reclaim control over indie artist royalty ownership. No more opaque contracts or delayed checks; blockchain enforces fair splits on-chain.

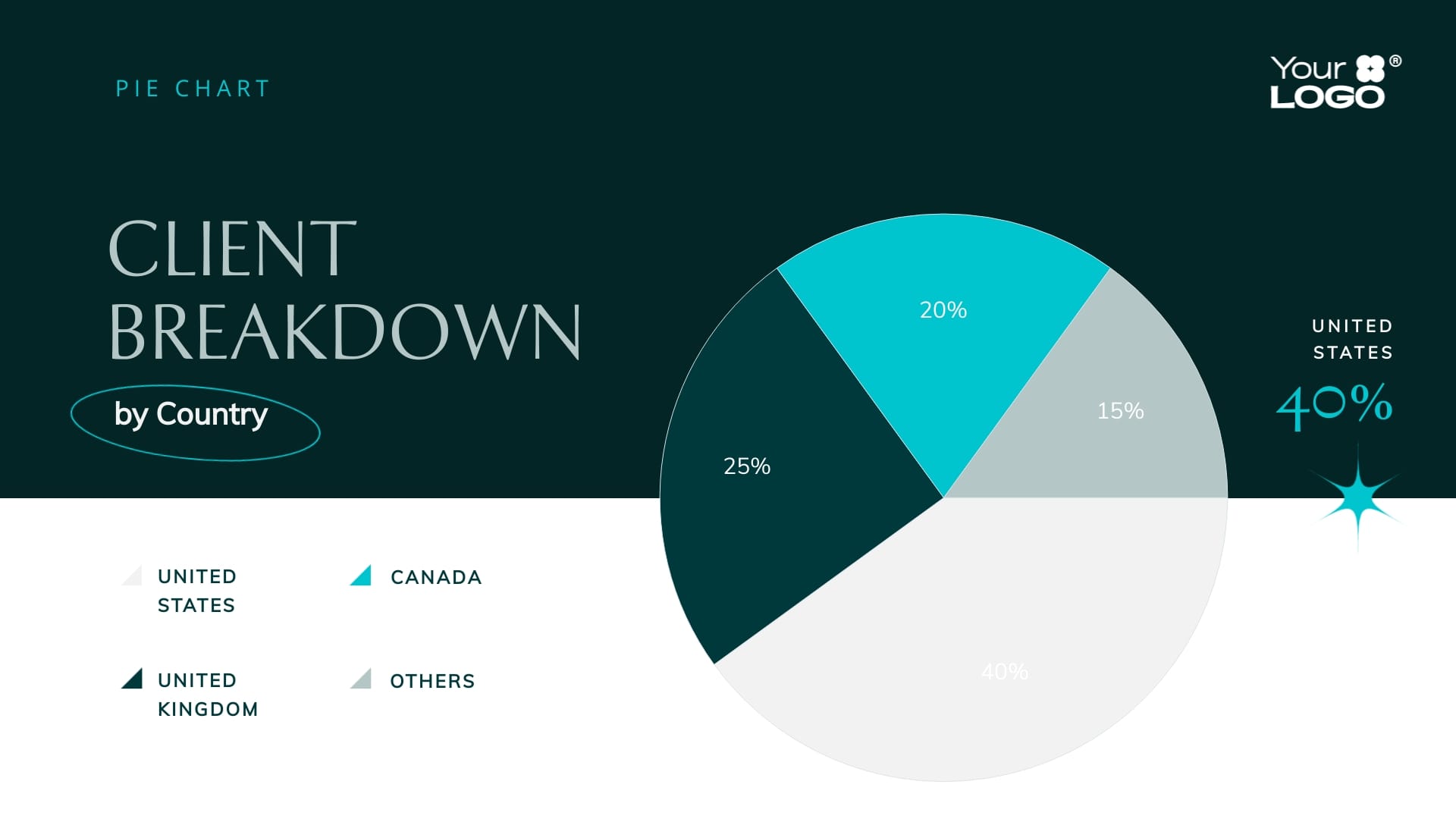

Quantitatively, consider a track generating $100,000 in lifetime royalties. Under legacy models, the artist nets $20,000 after the label’s cut. Tokenized alternatives flip this: artists define splits like 50% to self, 30% co-writer, 20% producer via smart contracts. Platforms such as Arpeggi Labs and Sound. xyz mint these as NFTs, automating payouts in real-time. Investors buy in for modest sums, say $100 fractions, unlocking tokenized music royalties trading with liquidity absent in old-school rights markets.

Decoding the 80/20 Trap in Music Economics

Labels justify their dominance by fronting advances and marketing, but data reveals the imbalance. Sources like Making A Scene highlight how artists surrender 80% or more, often recouping nothing if streams underperform. IndieChain notes chronic issues: delayed payments averaging 6-12 months, murky splits leading to disputes, and unverifiable ownership. Crunch the numbers: at 1 million Spotify streams ($4,000 revenue), a 20% artist share yields $800 post-label, barely gas money after production costs.

Independent artists often struggle with delayed payments, unclear royalty splits, unverified achievements, and disputes over content ownership. (IndieChain)

Blockchain disrupts this via immutable metadata. Once encoded, song details, title, writers, blockchain music revenue sharing percentages, travel tamper-proof across platforms. Zora and Audius exemplify: decentralized streaming triggers instant smart contract executions, bypassing PROs like ASCAP that bottleneck distributions.

Tokenization: From Illiquid Rights to Tradeable Assets

Fractional ownership turns royalties into liquid assets. RWA. io touts benefits: heightened liquidity, broader investor access, transparent tracking. Artists raise capital upfront by selling NFT music royalty fractions, retaining majority stakes. Zoniqx explains: sell 20% future royalties for $50,000 now, versus waiting years for trickle-down payments.

5 Key Tokenized Royalty Wins

-

1. Instant Payouts: Smart contracts auto-execute real-time payments on Audius or Sound.xyz, slashing delays from months to seconds.

-

2. Custom Splits: Artists set precise shares—e.g., 50% artist, 30% co-writer, 20% producer—enforced immutably via Arpeggi Labs.

-

3. Investor Liquidity: Fractional tokens trade freely, unlocking retail access to royalty streams previously label-locked.

-

4. Immutable Credits: On-chain metadata locks tamper-proof ownership, credits, and splits forever on Zora.

-

5. No Intermediaries: Direct P2P distribution cuts labels, ensuring 100% transparent flows without middlemen.

Model it analytically. Assume a track’s projected net present value (NPV) at 10% discount rate over 10 years: $100,000. Tokenize into 1,000 fractions at $100 each; artist sells 300 ($30,000 immediate liquidity) while holding 70%. Future revenues auto-distribute proportionally, yielding superior risk-adjusted returns versus label advances with recoupment cliffs.

Smart Contracts Engineer Equity into Every Stream

Smart contracts are the precision tool. Ranger Land details automation: code once, pay forever. Define splits in Solidity, e. g. , if revenue = $1,000, execute 500 to artist, 300 collaborator, 200 producer, instantly upon DSP ingestion. ScoreDetect’s 2024 guide confirms: blockchain ensures fair and prompt payments, slashing admin fees from 20-30% to near-zero.

ANote Music democratizes this for retail: build portfolios of royalty streams once gated by insiders. For indies, it’s liberation, bypass majors, crowdfund via fans. Substack’s infrastructure thesis holds: fractional platforms bridge retail capital to IP cash flows, with on-chain verifiability minimizing fraud risks quantified at 15-20% in traditional audits.

Platforms like blockchain marketplaces now host these trades, blending music passion with quant-grade investing. Yet challenges persist: volatility in crypto payouts, regulatory gray zones. Dive deeper into implementation mechanics next.

Implementation starts with encoding your track’s economics into code. Platforms like Arpeggi Labs let artists compose directly on-chain, embedding indie artist royalty ownership from inception. Mint as an NFT on Zora or Sound. xyz, where smart contracts lock in custom splits, say 50/30/20, verifiable forever. Release via Audius for decentralized streaming; every play triggers atomic payouts in USDC, no banks involved.

Quantify the edge: traditional PRO distributions lag 90-180 days with 15% leakage; blockchain clocks in under 60 seconds at and lt;1% gas fees. A track at 500k annual streams ($2k revenue) under labels nets $400 artist take-home yearly. Tokenized? Same track yields $1k instantly to artist at 50% split, compounding via reinvestment. Scale to catalog: 10 tracks flip $20k legacy income to $50k on-chain, a 2.5x uplift modeled via Monte Carlo sims on stream volatility.

Traditional vs. Tokenized: A Side-by-Side Breakdown

Legacy systems chain artists to intermediaries; blockchain liberates via programmability. Substack nails it: fractional platforms funnel retail dollars into royalty streams, once label-only turf. Making A Scene quantifies the flip from 80/20 traps to balanced, tradeable fractions.

Traditional Label Deals vs. Blockchain Fractional Royalties

| Metric | Label Deal | Blockchain Tokenized |

|---|---|---|

| Artist Share | Typically 20% (80% label cut) | Customizable (e.g., 50% artist, 30% co-writer, 20% producer) 💰 |

| Payout Speed | 6-12 months ⏳ | Instant / Real-time via smart contracts ⚡ |

| Liquidity | Illiquid | Tradeable NFT fractions 📈 |

| Costs | 20-30% admin fees 💸 | <1% gas fees 🪙 |

| Control | Contractual haze 😵 | Immutable on-chain 🔒 |

This table underscores why tokenized music royalties trading surges: investors snag diversified portfolios at $50 entry points, per ANote Music’s model. Indies retain upside while offloading risk selectively.

Navigating Hurdles in the On-Chain Melody

Volatility bites: crypto-denominated payouts swing with ETH prices, eroding yields 20-30% in bear markets. Solution? Peg splits to stables like USDC, stabilizing NPV calcs. Regulatory fog looms too; SEC eyes tokens as securities if yields promise fixed returns. Yet clarity emerges: utility NFTs with dynamic royalties skirt issues, as Zoniqx posits. IndieChain flags disputes; blockchain’s audit trail nukes them, with metadata hashing ownership tamper-proof.

RWA. io projects $1B tokenized music market by 2027, driven by liquidity premiums. For quants, alpha lies in pricing models: Black-Scholes variants on royalty volatility yield mispricings, buying low beta catalogs at 15% discounts to fair value. Platforms aggregate this: smart contract automation ensures blockchain music revenue sharing precision.

Featured. com spotlights direct fan-artist transactions, minting loyalty into capital. ScoreDetect’s guide affirms prompt payments reshape incentives. Ranger Land’s thesis: automation scales equity exponentially.

Music Royalty Markets pioneers this frontier, tokenizing royalties for seamless NFT music royalty fractions. Trade fractions with blockchain’s ironclad transparency, optimizing portfolios where streams meet Sharpe ratios. Artists fund tours upfront; investors harvest uncorrelated yields. The math mandates migration: illiquid rights recoup at 5-7% IRR under labels, tokenized hit 12-18% with liquidity boosts. Dive in, decode the streams, and let numbers orchestrate your edge.