Tokenized music royalties are reshaping how investors tap into the $30 billion global music streaming market, turning passive listening into active income streams. Platforms built on blockchain now let you trade fractions of future royalties from hit songs, often yielding around 10% APY directly from Spotify and Apple Music payouts. This isn’t speculative hype; it’s real-world assets (RWAs) like music catalogs tokenized for seamless tokenized music royalties trading, offering stability amid volatile crypto markets.

These assets bridge entertainment and finance, allowing fans to own pieces of tracks by artists like Nas or The Weeknd while earning proportional royalties. Unlike traditional royalties locked in opaque deals, blockchain ensures transparent, on-chain distribution. Investors buy tokens or NFTs representing shares, trade them on decentralized exchanges, and watch revenues flow automatically via smart contracts. The appeal? Predictable yields from evergreen catalogs, not fleeting token pumps.

Why Blockchain Music Royalties Platforms Outshine Traditional Investments

Streaming revenue grows steadily-7% annually per IFPI reports-yet artists often wait months for payouts and retain tiny fractions after labels take cuts. Enter blockchain music royalties platforms: they fractionalize rights into tradeable tokens, slashing intermediaries. This creates liquid markets for fractional music royalties blockchain assets, where a $100 investment might snag 0.01% of a platinum album’s masters.

In my analysis, the edge lies in verifiable cash flows. Platforms audit streaming data on-chain, so yields like music royalties 10% APY stem from actual plays, not inflationary rewards. Compare that to DeFi farms diluting value; here, a catalog from a veteran artist like Justin Bieber generates compounding returns as playlists endure. Risks persist-artist relevance fades, platforms charge fees-but diversification across catalogs mitigates this, much like equity index funds.

Early adopters report steady payouts; one Opulous note holder shared royalties from 50,000 monthly streams netting 8-12% annualized. This model empowers artists too, funding tours via upfront sales of future rights without debt.

Opulous and OVAULT: Powerhouses for RWA Music Royalties Yields

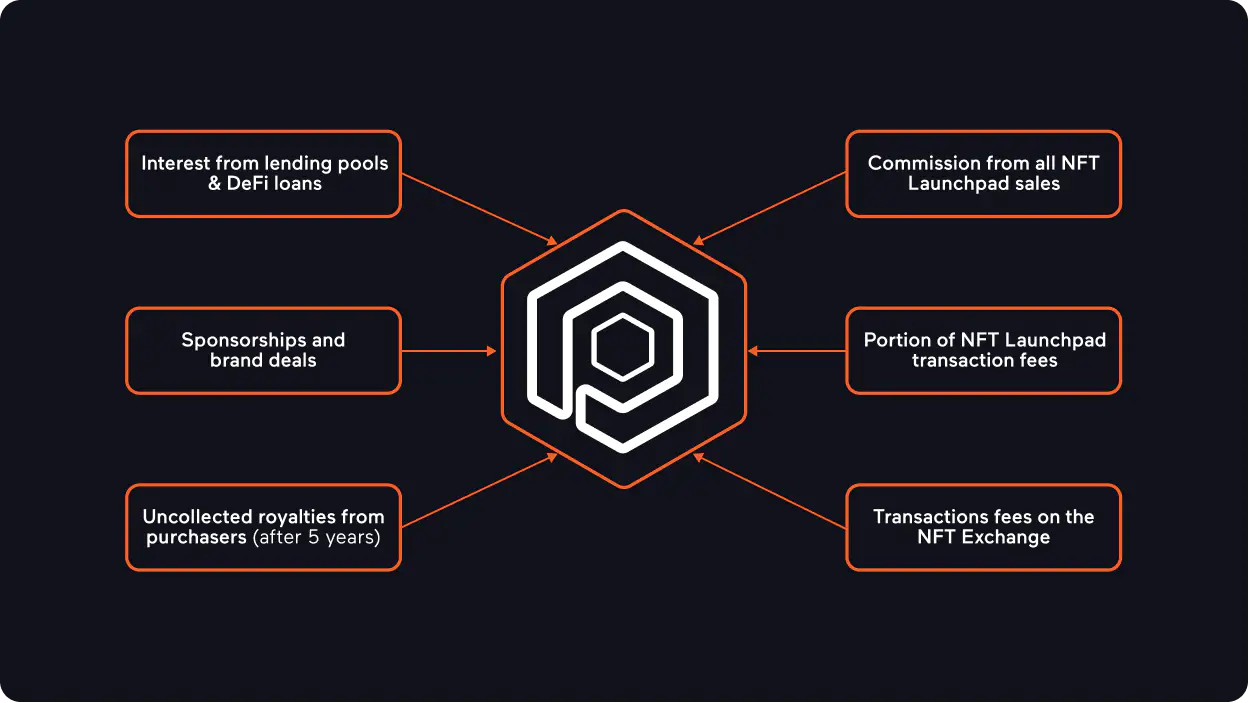

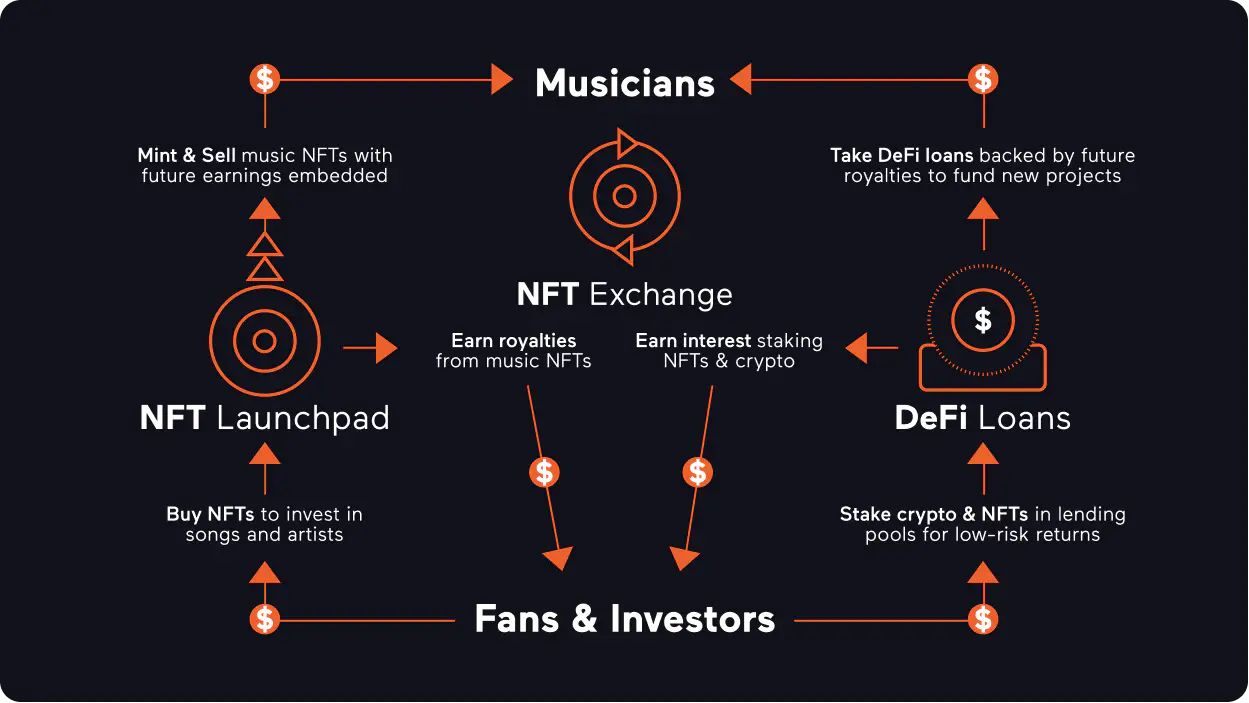

Opulous stands out in the crowded field, blending AI predictions with tokenized crowdfunding. Its Opulous. AI forecasts Spotify revenues, guiding investors to high-potential catalogs. The core product? “Notes” that grant shares in royalty payments, tradeable like stocks.

OVAULT elevates this with liquid staking: deposit USDC, access tokenized music catalogs, and earn up to 10% APY from streaming. No lockups, pure revenue-backed yields. Opulous 2.0 adds OLOAN, loans collateralized by artists’ streaming history-smarter than predatory advances. As a CFA tracking RWAs, I see Opulous’s edge in data-driven selection; their AI sifts billions of streams for undervalued gems.

Top Opulous Features

-

Opulous.AI: AI tool predicts streaming revenue on Spotify & more, empowering creators and investors with data-driven insights.

-

OVAULT: Stake USDC on tokenized music catalogs for up to 10% APY from real streaming revenue.

-

OLOAN: Artists access loans backed by historical streams, unlocking funding without losing ownership.

-

Tradeable Royalty Notes: Buy/sell tokenized shares of future royalties like digital assets on blockchain.

-

On-Chain Payouts: Transparent, verifiable streaming revenue distributions via blockchain tech.

Investors start small: buy OPUL tokens or notes via their dashboard, stake in OVAULT, and track via app. Yields hold because music streams rarely crash; catalogs are defensive assets in portfolios.

Diversifying with Royal. io, Anotherblock, and Beyond

Royal. io, co-founded by DJ 3LAU, pioneered NFT royalties-Nas sold shares of “Ultra Black” here, letting fans earn from every stream. Anotherblock tokenizes performer royalties for acts like The Weeknd, with NFTs yielding direct DSP payouts. Bolero’s “Song Shares” fractionalize masters; La Zarra fans bought in early.

Aria Protocol tokenizes IP like Bieber’s “Peaches, ” boasting up to 30% APY potential via staking, though averages hover at 7% for safer bets. Audius decentralizes streaming itself, rewarding AUDIO holders with artist tips and governance. These RWA music royalties yields vary by track virality, but blending them curbs single-asset risk. Check how to invest for step-by-step entry.

These platforms democratize access, but success hinges on picking catalogs with enduring appeal. A track like “Peaches” benefits from Bieber’s catalog depth, sustaining streams years post-peak. Investors blending Opulous’s AI-vetted notes with Royal’s NFT drops build resilient portfolios targeting music royalties 10% APY.

Top Blockchain Music Royalties Platforms: Yields and Token Performance

| Platform | Token | Yield | Notes |

|---|---|---|---|

| Opulous | OPUL | 10% APY | OVAULT stable rewards from streaming revenue, AI predictions 🎵💰 |

| Aria | ARIAIP | 7-30% APY | IP staking on songs like Justin Bieber’s Peaches, higher risk ⚠️ |

| Audius | AUDIO | Variable | Governance staking rewards tied to network growth 📈 |

| Royal.io | NFTs | 8-15% | Royalties on proven hits like Nas ‘Ultra Black’ & ‘Rare’ 🔥 |

| Anotherblock | NFTs | 8-15% | NFT shares with artists like The Weeknd & R3HAB 👥 |

Diversification shines here. Allocate 40% to broad catalogs like Opulous, 30% to star-powered NFTs from Royal or Bolero, 20% to high-upside like Aria, and 10% to ecosystem plays like Audius. This mirrors my equity strategies: balance growth with income.

Trading adds liquidity. Platforms integrate with DEXs; sell notes mid-stream if needed, unlike illiquid private equity. Blockchain’s transparency lets you verify payouts via explorers, building trust absent in legacy PROs.

Tax implications? Royalties count as income; track via wallet tools. Liquidity improves yearly as DEX volumes rise 200% per DeFiLlama.

Looking ahead, tokenized royalties could capture 5% of streaming by 2030, per Deloitte analogs. Blockchain cuts delays; artists get instant funds, fueling creativity. Investors gain uncorrelated returns- music hums while tech dips.

Platforms like Music Royalty Markets streamline this: Buy, sell, trade tokenized shares with fractional precision. Their NFT focus pairs perfectly with Opulous notes or Royal drops. Dive in analytically; a $1,000 stake at 10% APY nets $100 yearly passives, scaling with reinvestment. Empower your portfolio-own the soundtrack to sustainable growth.

Explore trading marketplaces to launch today.