In the evolving landscape of music finance, tokenized music royalties are emerging as a compelling asset class for both retail and institutional investors. Blockchain technology is fundamentally transforming how music rights are bought, sold, and managed, offering unprecedented transparency and efficiency. Instead of traditional opaque royalty structures, anyone can now own fractional shares of a song’s revenue stream with just a few clicks.

Why Tokenized Music Royalties Are Gaining Traction

The tokenization process converts rights to music assets, such as songs or entire catalogs, into digital tokens that are recorded and managed on a blockchain. Each token represents a direct claim on a portion of the underlying royalty income generated by streaming, sales, licensing, or synchronization deals. This innovation is not merely technical; it is reshaping the economics of music ownership for artists and investors alike.

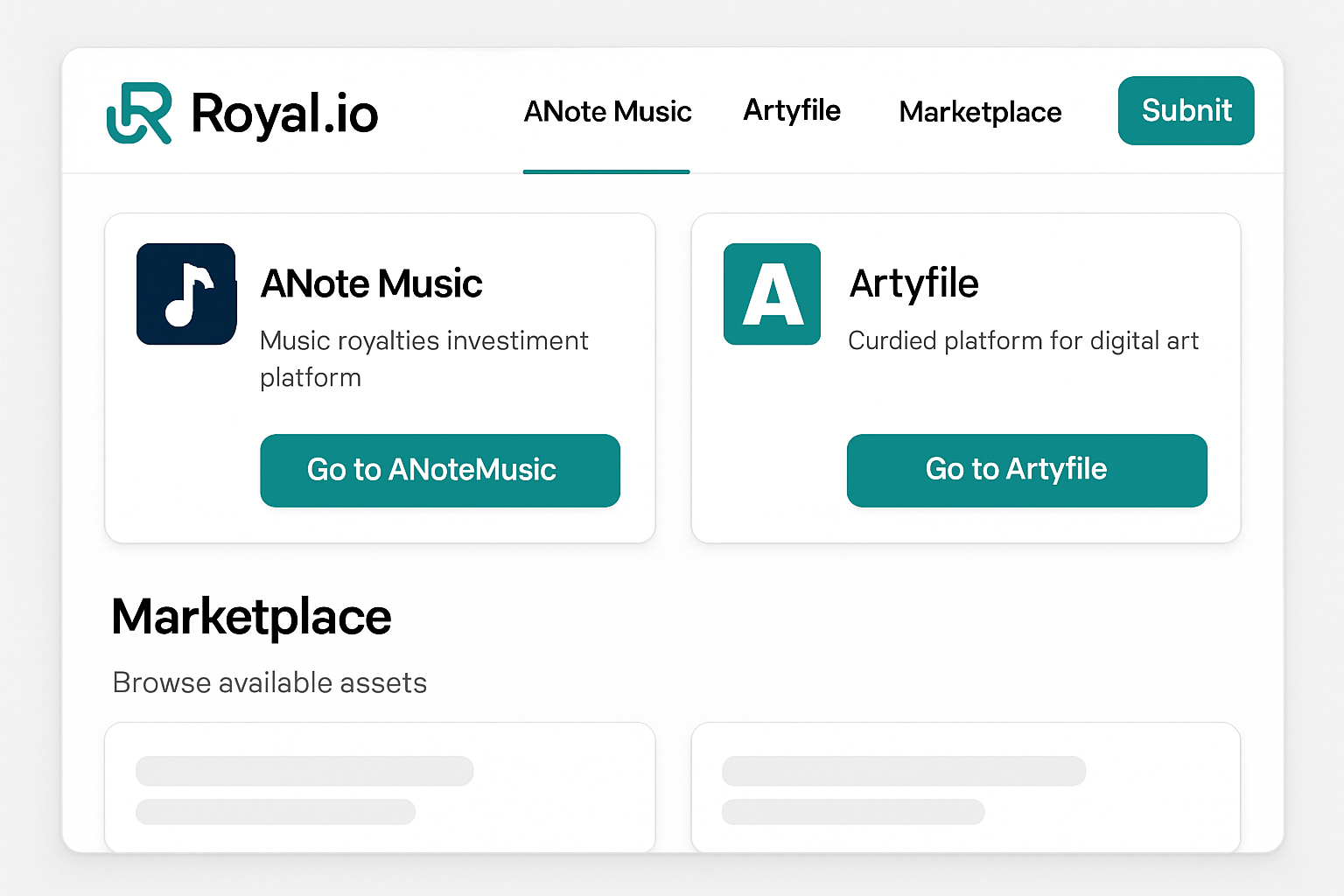

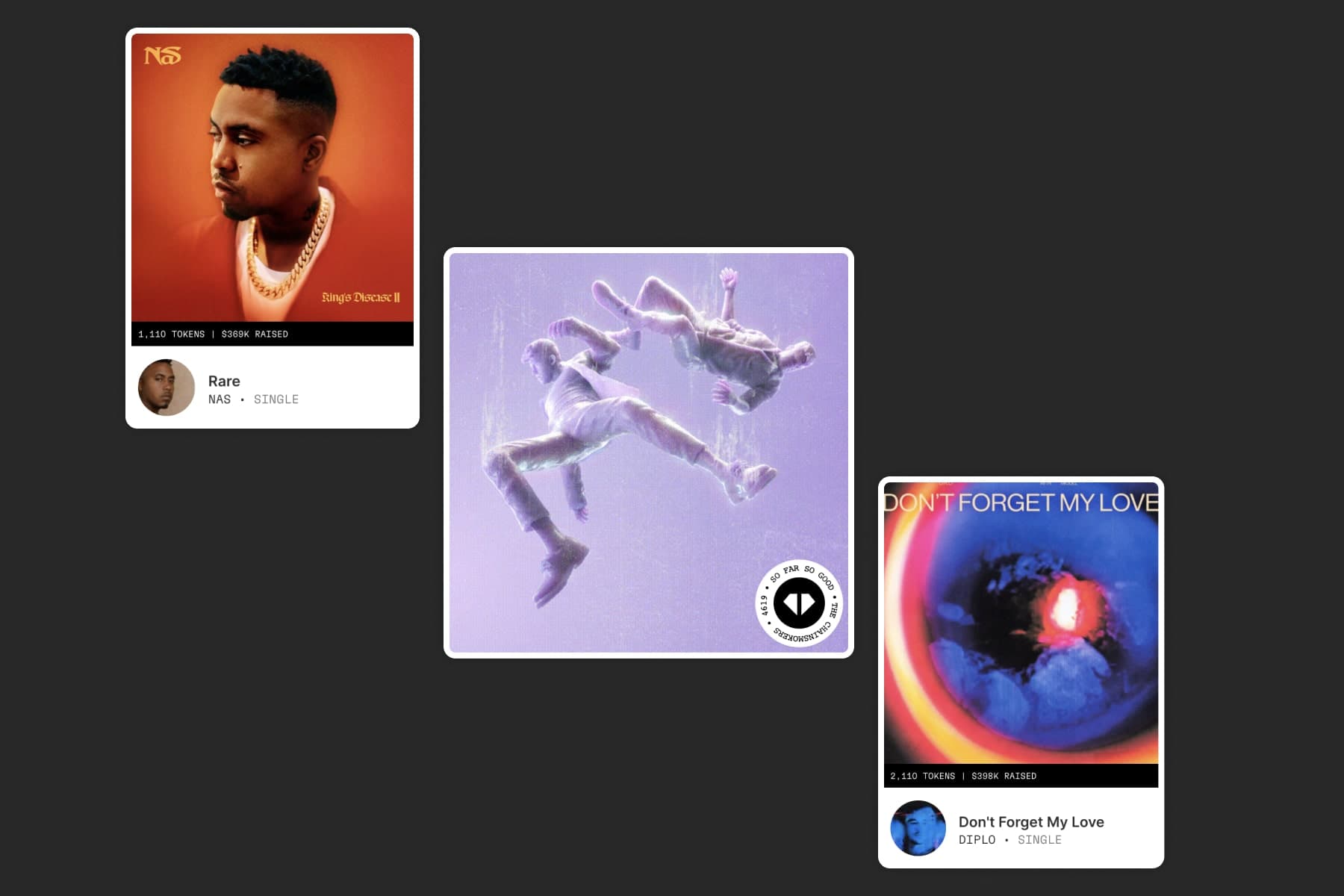

Platforms like Royal, ANote Music, and Artyfile have pioneered this space by letting users buy tokens that reflect real-world royalty streams. For example, Royal enables fans to invest in tracks from artists such as Nas and The Chainsmokers, sharing in their streaming revenue. Luxembourg-based ANote Music has already facilitated over €10 million in transactions by connecting rightsholders with investors through its online marketplace.

Getting Started: Key Steps to Blockchain Music Investment

If you’re new to blockchain music investment or NFT music royalties, here’s what you need to know before committing capital:

Step-by-Step Guide to Investing in Tokenized Music Royalties

-

Understand Tokenized Music Royalties: Tokenization transforms music royalty rights into digital tokens on a blockchain. Each token represents a fractional share in the royalty income from a song or catalog, allowing investors to earn a portion of the revenue generated from streams, sales, and licensing.

-

Choose a Reputable Platform: Select a well-established platform such as Royal (co-founded by 3LAU), ANote Music (Luxembourg-based marketplace), or Artyfile (Limited Edition music NFTs). These platforms facilitate the purchase and management of tokenized music royalties.

-

Set Up a Digital Wallet: Create a digital wallet compatible with the platform’s blockchain network (such as Ethereum or Polygon). This wallet will securely store your music royalty tokens and enable seamless transactions.

-

Research and Select Investments: Carefully evaluate available music assets by considering factors like artist popularity, historical streaming data, and projected royalty income. Diversifying your investments across multiple songs or catalogs can help manage risk.

-

Purchase Tokens: Buy your chosen royalty tokens through the platform. Payment options may include cryptocurrencies or traditional currencies, depending on the platform’s offerings.

-

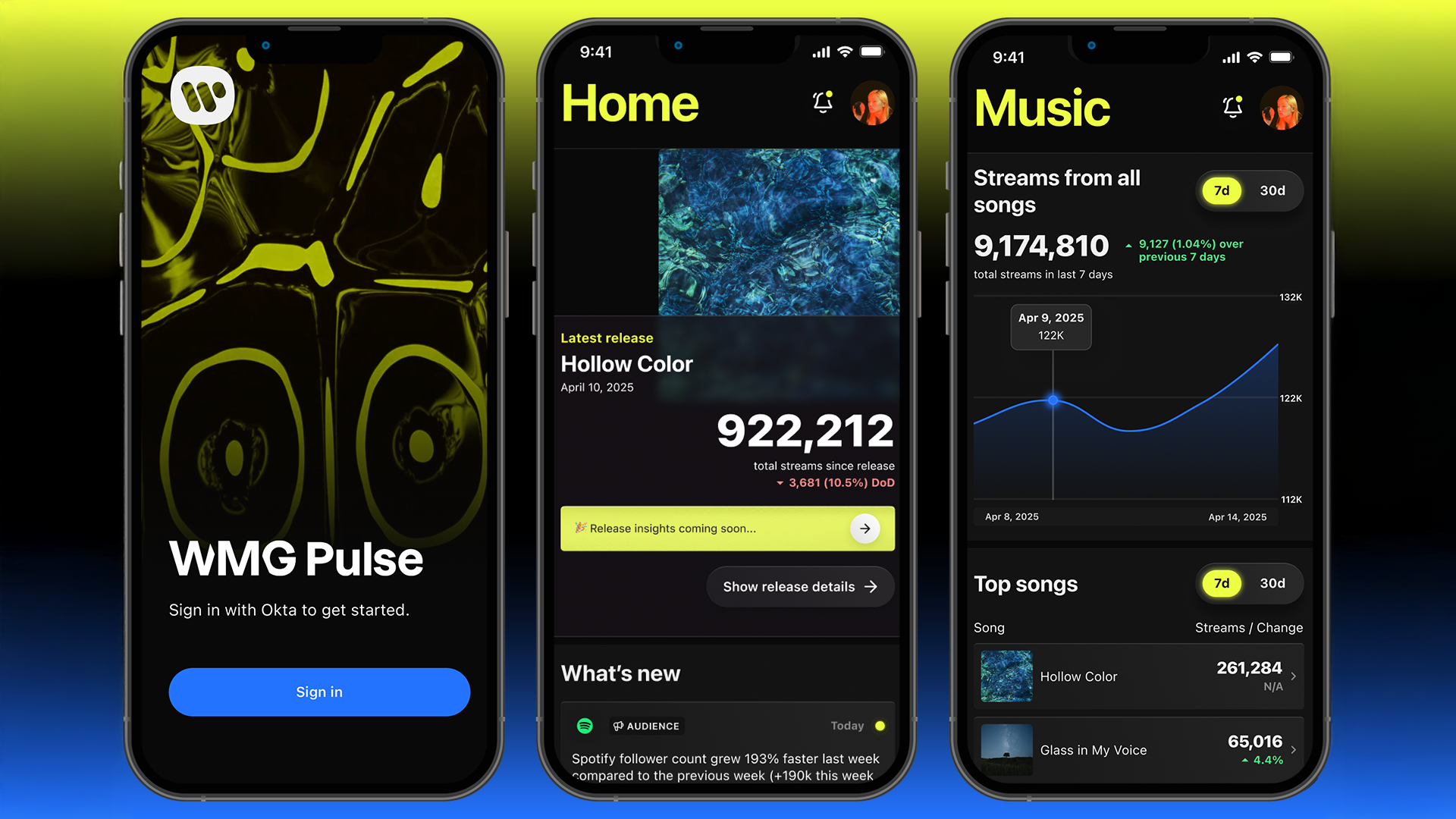

Monitor and Manage Your Investments: Use the platform’s dashboard to track your earnings, receive periodic royalty distributions, and manage your portfolio over time.

-

Considerations and Risks: Be aware of market volatility, platform reliability, and the legal or tax implications in your jurisdiction when investing in tokenized music royalties.

1. Understand the Asset: Not all tokens are equal. Some represent master recording rights while others may relate only to publishing or specific usage types (like streaming vs synchronization). Carefully review what each token entitles you to before purchasing.

2. Select a Reputable Platform: Choose platforms with robust security protocols and transparent transaction histories. Look for those with established artist partnerships and proven royalty distribution track records. For more insights into platform selection and due diligence strategies, see this detailed guide.

3. Set Up Your Digital Wallet: Most platforms require a compatible crypto wallet (such as MetaMask for Ethereum or Phantom for Solana) to store your tokens securely and receive payouts.

Evaluating Risk: What Every Investor Should Know

While blockchain-based royalty markets offer exciting yield opportunities, they also introduce new risks compared to traditional fixed income or equities:

- Market Volatility: Royalty income fluctuates based on streaming trends and consumer behavior.

- Platform Security: Not all marketplaces are equally robust; always verify their security certifications and history of timely payouts.

- Legal and Tax Implications: Jurisdictions vary widely in how they treat digital assets and royalty income; consult with an advisor before investing significant sums.

The promise of fractional music ownership is not just about passive income, it’s about democratizing access to an industry once reserved for insiders. As more artists embrace blockchain solutions for monetization and fan engagement, expect this market segment to continue expanding rapidly through 2025 and beyond.

Liquidity is a crucial consideration for anyone entering the music royalty markets. While blockchain platforms have made secondary trading more accessible, not all tokens offer the same level of tradability. Some platforms provide built-in secondary marketplaces, letting you buy and sell tokens with other investors. However, liquidity can vary based on the popularity of the underlying music asset and current market sentiment. Patience may be required if you wish to exit your position quickly.

Yield Expectations and Portfolio Diversification

Unlike traditional dividend stocks or bonds, NFT music royalties can exhibit variable income streams. Royalty payments are typically distributed quarterly or monthly, reflecting real-world music consumption patterns. Returns depend on several factors: song popularity, geographic reach, and licensing activity. As with any investment, diversification is key. Consider spreading your capital across multiple artists, genres, or even different types of rights (e. g. , master vs publishing) to help buffer against unpredictable swings in streaming revenue.

The transparency of blockchain-based royalty tracking also enables more rigorous due diligence than was previously possible in private deals. Many platforms now publish historical earnings data and forward-looking projections for each asset on offer. This empowers investors to analyze cash flow consistency and make informed decisions aligned with their risk tolerance.

Staying Ahead: Trends Shaping Blockchain Music Investment

The intersection of AI and blockchain is poised to further revolutionize this space. Automated royalty accounting using smart contracts reduces administrative overhead and ensures timely payouts for both artists and investors. Meanwhile, advances in AI-driven music analytics are making it easier to forecast potential hit songs or catalogs with strong earning potential, tools that were previously out of reach for non-industry participants.

As regulatory clarity improves around digital assets globally, expect tokenized music royalties to attract a broader spectrum of investors, from crypto-native enthusiasts to traditional asset managers seeking uncorrelated yield streams. For those willing to navigate this emerging landscape thoughtfully, the opportunity set is both diverse and dynamic.

If you want a step-by-step walkthrough tailored for beginners who are serious about generating passive income through fractional ownership of music rights, be sure to read our comprehensive guide at How To Invest in Tokenized Music Royalties for Passive Income.