Imagine a world where your favorite song’s royalties flow directly into your wallet the moment it’s streamed, without waiting months for a check from some opaque label. That’s the promise of autonomous music royalty streams powered by blockchain tokenization. Artists get paid instantly, fans can own a slice of the action through fractional music royalty ownership, and everyone benefits from transparent, tamper-proof transactions. As someone who’s navigated the ups and downs of crypto and stocks for over a decade, I can tell you this isn’t just hype; it’s a game-changer reshaping how music makes money.

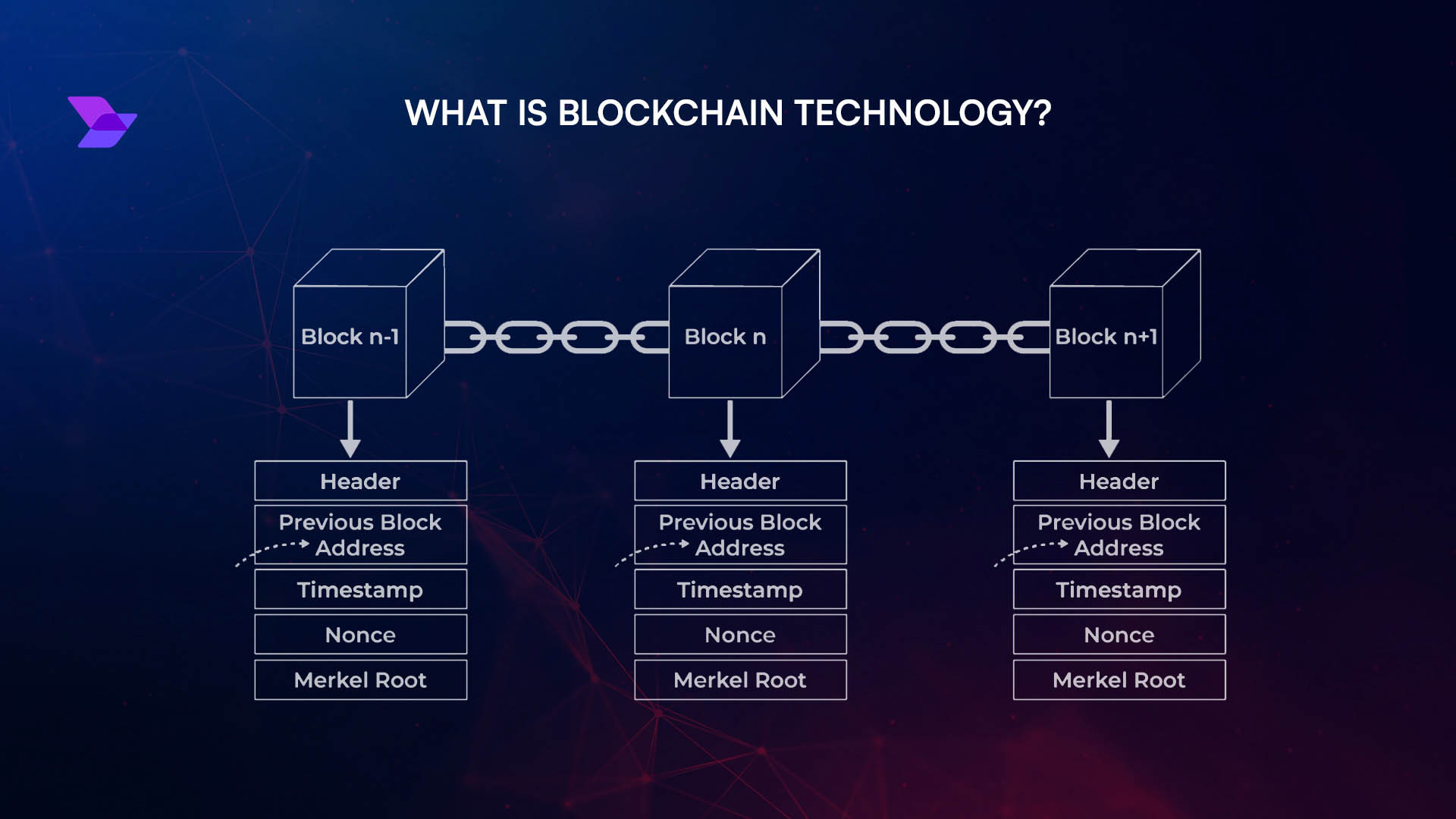

Traditional music royalties are a nightmare. Artists might wait quarters or even years for payouts, bogged down by middlemen, paperwork, and disputes over metadata. Blockchain flips this script with tokenized music royalties blockchain tech. Smart contracts act like digital vending machines: insert revenue from a stream, and out pop proportional shares to token holders. No banks, no delays, just pure efficiency.

Unlocking Fractional Ownership for Everyday Investors

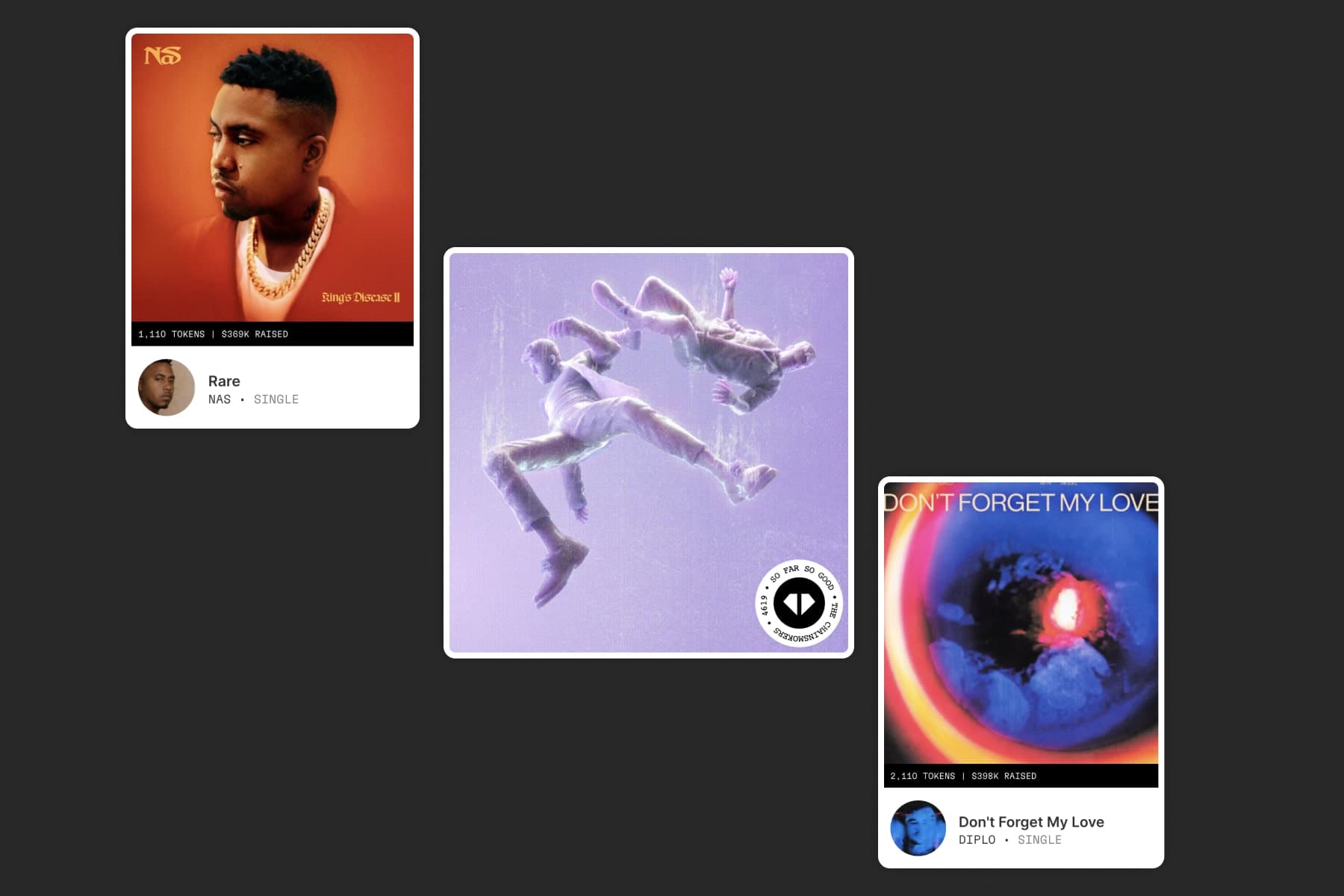

Fractional ownership has long been the secret sauce in stocks and real estate, letting small investors dip into big assets. Now, it’s hitting music. Platforms like Royal. io and Anotherblock let artists tokenize chunks of their royalty rights, selling them as NFTs or tokens. Buy a fraction, and you earn a cut of every stream or sale forever. It’s web3 music revenue sharing at its finest, turning passive fans into active stakeholders.

Take Nas, for example. He teamed up with Royal. io to fractionalize royalties from ‘Ultra Black’ and ‘Rare. ‘ Fans snapped up tokens, now earning real streaming income. Or The Chainsmokers, who shared royalties from ‘So Far So Good’ with 5,000 fans via NFTs. These aren’t one-off gimmicks; they’re sustainable models building loyal communities. And R3HAB’s deal with Anotherblock? Straight-up tokenized streaming rights, paying holders a percentage automatically. Patience here compounds returns, as token values can appreciate alongside the music’s popularity.

This democratizes investing. You don’t need millions to back a hit; a few hundred bucks gets you in. Risks? Sure, like any investment, music success isn’t guaranteed. But blockchain’s transparency lets you track every penny, reassuring even cautious folks like me who’ve seen too many black-box funds.

Smart Contracts: The Engine of Instant Blockchain Royalty Payouts

At the heart of instant blockchain royalty payouts are smart contracts – self-executing code on blockchains like Ethereum or specialized ones like BitSong. When a song streams on Spotify or sells on Bandcamp, revenue hits the blockchain. The contract checks ownership tokens and zaps payouts in real-time, often in stablecoins to dodge volatility.

No more ‘quarterly statements’ arriving late. Zoniqx and BitSong highlight how these contracts distribute based on token count, instantly. Soundverse AI even eyes this for 2026 AI music licensing. It’s reassuring: artists track everything on-chain, no trust required. Polytrade’s partnership with Anotherblock streamlines this further, making NFT royalties flow smoother than ever.

Key Smart Contract Benefits

-

Real-Time Payouts: Smart contracts automatically distribute royalties instantly when music streams or sells, as seen with Nas on Royal.io, eliminating months-long delays.

-

Transparent Audits: Every transaction is recorded on an immutable blockchain ledger, allowing artists and stakeholders to verify payouts easily—no more opaque black boxes like traditional PROs.

-

Automated Splits: Royalties are divided precisely among collaborators based on predefined shares, like token holders on Anotherblock, ensuring fair distribution without manual intervention.

-

Reduced Fees: Cuts out middlemen and admin costs, with blockchain handling distributions efficiently—platforms like Royal.io streamline this for lower overhead and more money to creators.

-

Global Access: Anyone worldwide can buy fractional ownership tokens and receive payouts seamlessly, democratizing investment as with The Chainsmokers’ album on Royal.io.

Brickken and Trinity College Dublin research backs this: automated calculations mean accurate payments artists can verify. Vanar Chain adds that artists regain control, ditching gatekeepers. I’ve crunched numbers on similar crypto yields; the efficiency here could boost artist take-home by 20-30% after cutting admin fat.

Real-World Momentum Building the Tokenized Future

We’re seeing traction. Royal. io’s Nas drop proved demand, with fans thrilled to own music history. Chainsmokers’ experiment scaled to thousands, showing mass appeal. R3HAB’s Anotherblock play taps dance music’s streaming goldmine. Partnerships like Polytrade-Anotherblock signal infrastructure maturing.

Challenges remain, like metadata glitches Franklin Pierce Law notes, but initiatives like MMA standards are fixing that. For investors, it’s about picking tracks with legs – think evergreen hits over fads. Check out how blockchain revolutionizes fractional ownership for deeper dives. This space rewards the patient, blending art with finance seamlessly.

Tokenization isn’t erasing labels yet, but it’s forcing evolution. Artists retain creative control while monetizing smarter. Investors get diversified, recurring income streams uncorrelated to stocks. As we head into 2026, expect more blueprints from Soundverse and BlockchainX guiding this shift.

Picture this: you’re an investor eyeing tokenized music royalties blockchain as a portfolio diversifier. Unlike volatile crypto trades, these offer steady drips from proven catalogs, uncorrelated to market swings. I’ve seen royalties from classics like Nas tracks hum along for years, delivering 5-10% annual yields in good scenarios. Platforms handle the heavy lifting, so you focus on selection.

Navigating Risks with Eyes Wide Open

Blockchain isn’t flawless. Metadata mismatches can snag payouts, as Franklin Pierce Law points out, but fixes like standardized MMA protocols are rolling out. Volatility in token prices? Hedge with stablecoin royalties or diversified bundles. Regulatory fog? Most platforms operate in compliant jurisdictions, and on-chain transparency builds trust. My advice: start small, research catalogs via streaming data, and treat it like any alt asset – patient compounding wins.

These safeguards make fractional music royalty ownership approachable. BitSong and Brickken emphasize how smart contracts cut disputes, letting you sleep easy.

Your Entry Point: Buying and Trading on Blockchain Marketplaces

Ready to jump in? Head to marketplaces like Music Royalty Markets, where tokenized royalties trade seamlessly. Scout listings for hits with strong streams, buy fractions via wallet, and watch instant blockchain royalty payouts hit your account. It’s user-friendly, with tools for tracking performance. For details, explore how to buy fractional music royalties using blockchain marketplaces.

Trading adds liquidity – sell if life changes or double down on risers. Web3 wallets make it global, no borders. Zoniqx’s real-time distribution means your shares pay as music plays, anywhere.

Artists love it too. No more label lock-ins; tokenize, share, retain rights. Fans bond deeper, owning stakes in anthems. This ecosystem fosters creativity, as Vanar Chain notes, empowering direct monetization.

Looking Ahead to 2026 and Beyond

By 2026, Soundverse AI blueprints predict smart contracts licensing AI-generated tracks autonomously. BlockchainX guides point to self-sustaining entertainment tokens. Medium’s Lailoo vision: no more payout waits. We’re building toward a fairer industry, where revenue mirrors listens precisely.

5 Emerging Royalty Trends

-

AI Integration for Licensing: Picture smart contracts handling AI-generated music licensing automatically. Soundverse AI’s 2026 blueprint shows how this ensures seamless, real-time rights management and payouts, reassuring artists with transparent blockchain automation.

-

Cross-Chain Royalty Pools: These pools let royalties flow across blockchains effortlessly. Platforms like Vanar Chain and Zoniqx enable shared, automated distributions based on token holdings, making global payouts reliable and borderless for creators.

-

Fan-Voted Remixes with Shared Royalties: Fans vote on remixes and earn royalties via tokens. Inspired by Royal.io and Anotherblock’s fractional ownership—where Nas and The Chainsmokers share streaming income—this trend builds community-driven revenue that’s fair and engaging.

-

VR Concert Token Tie-Ins: Virtual reality concerts link to tokens for instant royalty shares. Building on blockchain’s real-time payouts, this immerses fans while token holders—like those in Polytrade x Anotherblock—enjoy fractional earnings from immersive experiences.

-

Global Metadata Standards: Standardizing metadata fixes copyright chaos. Franklin Pierce School of Law proposes MMA initiatives for consistent data, paired with smart contracts from BitSong and Brickken, ensuring accurate, automated royalty tracking worldwide.

Music Royalty Markets leads this charge, offering secure trades for musicians and investors alike. Whether you’re tokenizing your demo or investing in legends, the tools are here. Dive in, track transparently, and let patience compound those returns. The beat goes on, now with blockchain backing every note.

Trinity College research shows streaming royalties auto-paying via contracts – it’s happening now. As adoption grows, expect labels to adapt, blending old and new. For creators and collectors, this is your marketplace revolution.