Blockchain technology is rapidly altering the landscape of music royalty investing, bringing a level of transparency and accessibility never before seen in the industry. As of October 2025, with Bitcoin trading at $107,771.00, digital asset markets are demonstrating both mainstream adoption and investor appetite for alternative, income-generating assets. Music royalties, once the exclusive domain of industry insiders and major labels, are being transformed into tokenized, tradeable assets accessible to a global audience.

Tokenized Music Assets: Fractional Ownership Comes of Age

Traditionally, music royalties were opaque, slow to pay out, and difficult for most investors to access. Blockchain solves these pain points by enabling fractional ownership of music royalty rights. Through tokenization, a song’s future royalty stream is divided into digital tokens. Each token represents a claim on a portion of the revenue generated from streaming platforms or licensing deals.

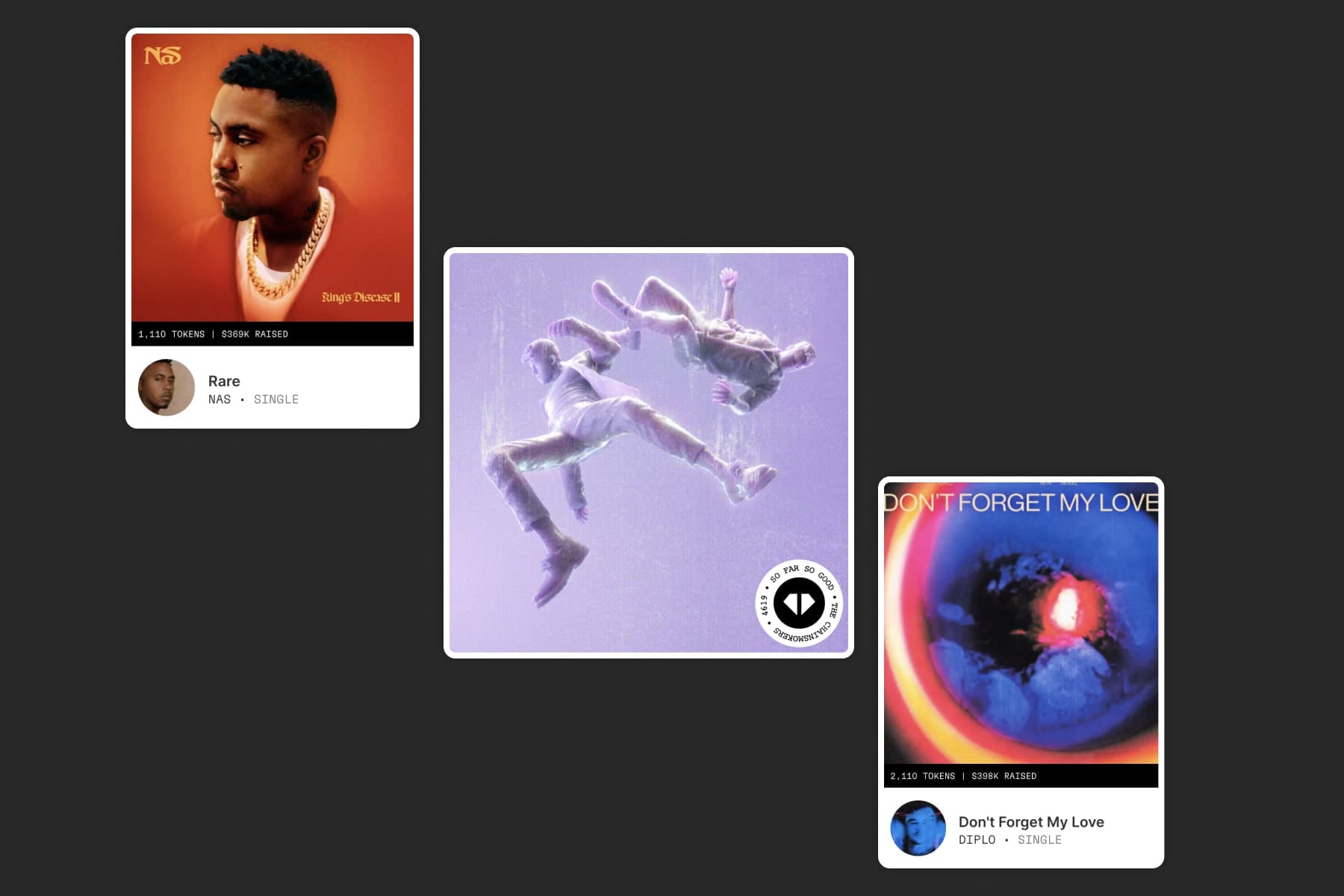

This shift is not just theoretical. Platforms like Royal. io have already distributed tangible earnings to token holders, for example, in July 2022, $36,000 in royalties was paid out to owners of tokens tied to tracks by artists such as Nas and 3LAU. This real-world cash flow on chain validates tokenized music assets as a viable new asset class for investors seeking yield outside traditional markets.

How Blockchain Ensures Transparency and Efficiency

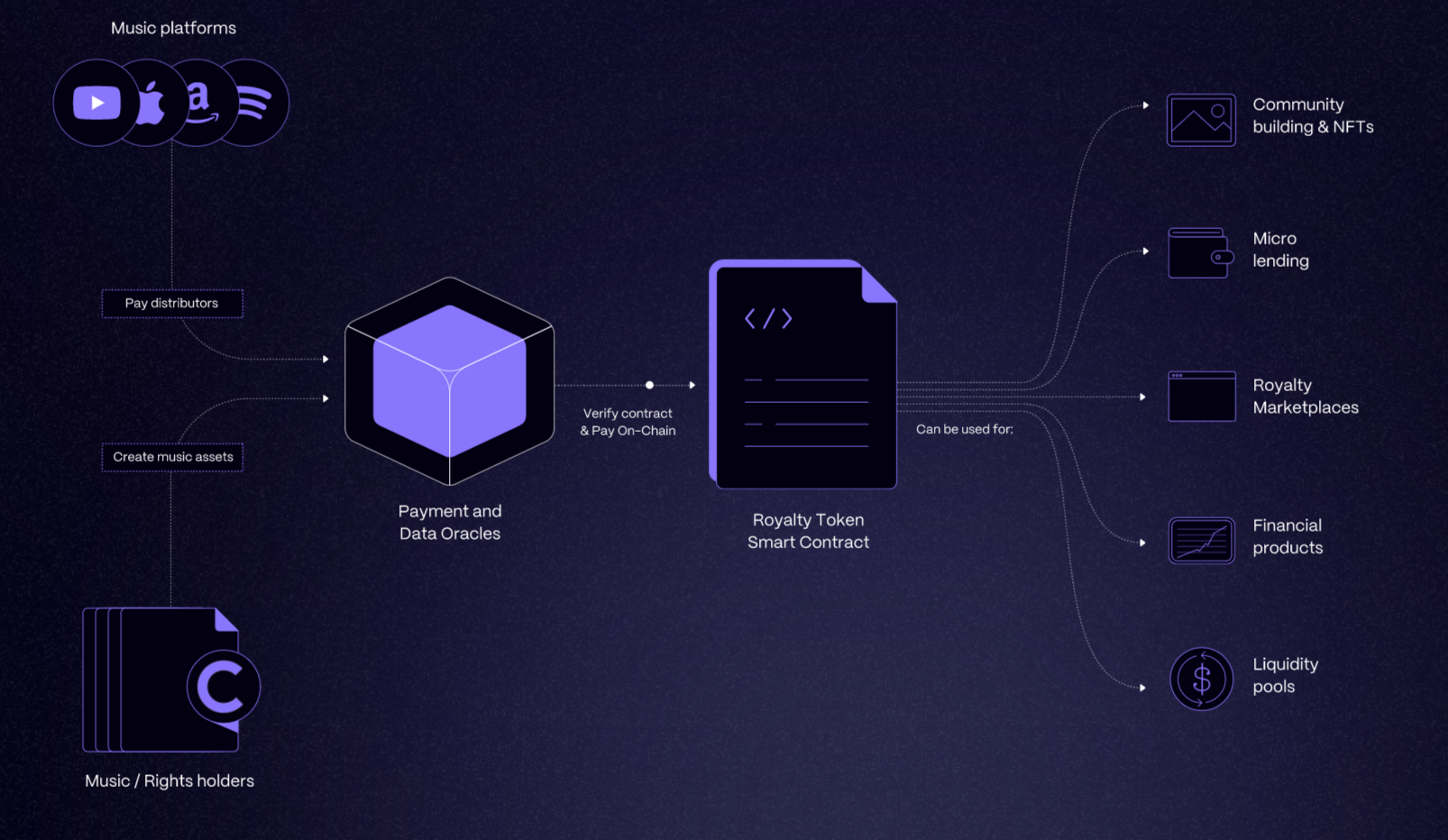

The core strength of blockchain in this context is its ability to provide a transparent ledger for tracking royalty distributions. Every transaction, from the initial token sale to the ongoing distribution of streaming revenue, is recorded immutably. This reduces disputes over payouts and ensures that artists and investors alike are paid accurately and on time.

Moreover, smart contracts automate the process. When a streaming platform pays out royalties, the funds are distributed directly to token holders according to the terms coded into the contract. This removes intermediaries and delays, aligning incentives between creators and their supporters.

Key Benefits of Blockchain-Based Music Royalty Investing

-

Fractional Ownership for Investors and Fans: Blockchain enables the tokenization of music royalties, allowing individuals to purchase fractional shares of a song’s future earnings. Platforms like Royal.io let fans and investors own a portion of streaming royalties, democratizing access to music investments.

-

Transparent and Efficient Royalty Distribution: Blockchain’s immutable ledger ensures transparent tracking of royalty payments, reducing disputes and delays. This transparency benefits both artists and investors by providing real-time, verifiable records of earnings.

-

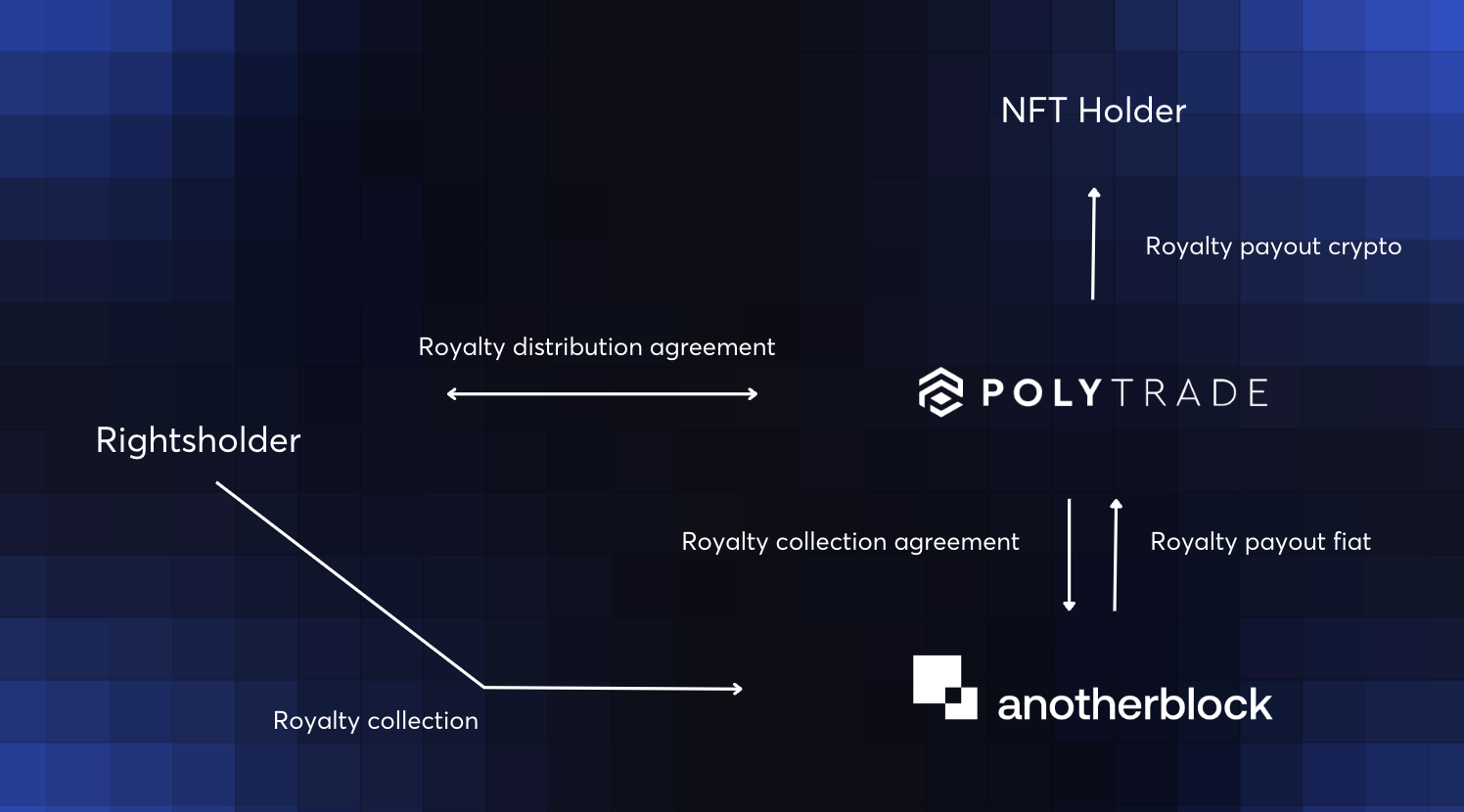

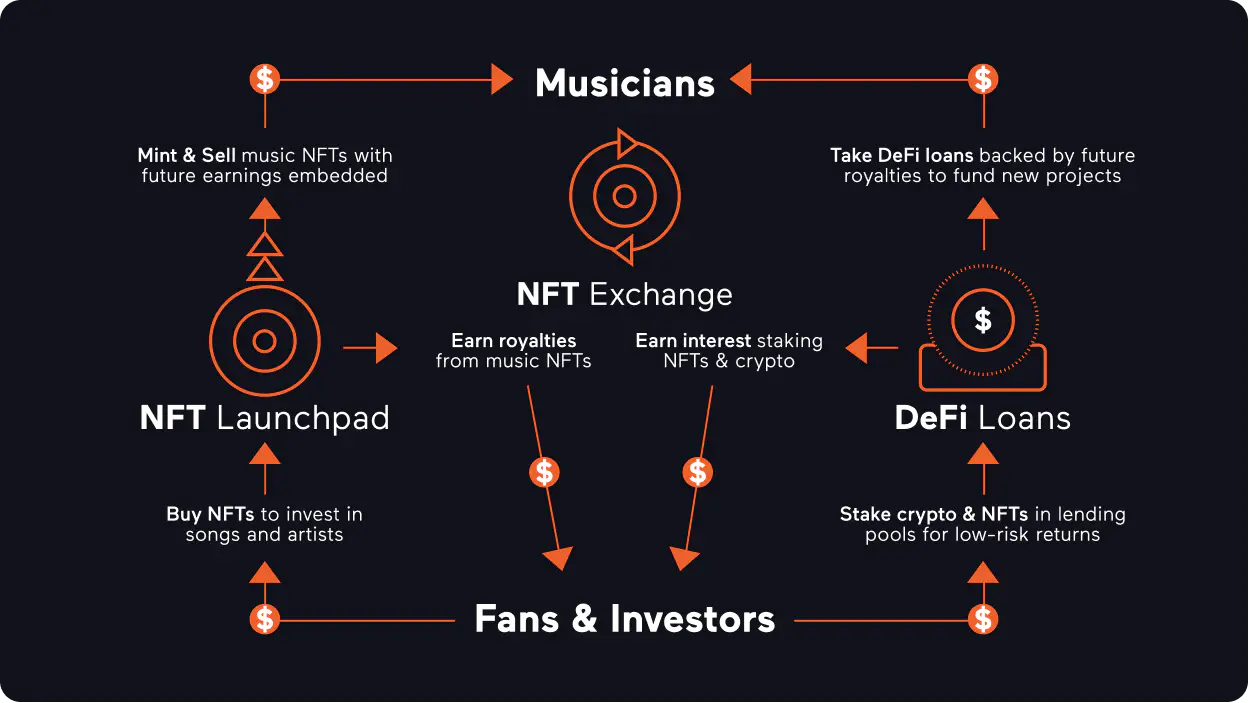

Direct Artist-Fan Engagement and Monetization: By leveraging blockchain, artists can engage directly with their audience through music NFTs and tokenized assets. Platforms such as Anotherblock and Bolero allow fans to invest in songs and share in royalty streams, fostering stronger artist-fan relationships.

-

New Revenue Streams Beyond Traditional Sales: Blockchain-based royalty investing introduces additional income sources for artists, such as selling royalty-backed tokens or NFTs. This diversification helps artists generate revenue outside of conventional streaming and sales channels.

-

Increased Liquidity and Tradeability of Music Assets: Tokenized music royalties can be bought, sold, or traded on secondary markets, enhancing liquidity for both artists and investors. This flexibility transforms music rights into dynamic, tradeable assets.

NFTs vs. Fungible Tokens: Two Paths for On-Chain Music Revenue

Tokenization in music comes in two primary forms: fungible tokens (where each unit is interchangeable) and non-fungible tokens (NFTs) (where each unit is unique). Fungible tokens are ideal for fractionalizing large catalogs or popular singles into thousands of equal shares. In contrast, NFTs can represent unique rights or experiences, such as exclusive access to unreleased tracks or VIP concert tickets, in addition to revenue-sharing rights.

This dual approach allows artists flexibility in how they engage with fans and monetize their work. For example, platforms like Anotherblock and Bolero are pioneering NFT-based models that bundle streaming revenue with perks or exclusive content. This creates deeper engagement between artists and their most loyal supporters while offering new investment opportunities.

The distinction between these models is crucial for investors evaluating risk profiles and potential returns. While fungible tokens provide predictable cash flows tied directly to streaming performance, NFTs may offer additional speculative upside through scarcity or unique fan experiences.

Securitization Trends: Institutional Appetite Meets Blockchain Innovation

The appeal of music royalties extends beyond retail investors. Since 2020, over $8 billion in cumulative issuance has been recorded through securitization deals involving major catalogs, including Concord’s $1.8 billion bond and Hipgnosis’ $1.47 billion catalog transaction. These deals reflect growing institutional interest in music as a stable source of long-term income.

Blockchain-based marketplaces are now bridging the gap between these large-scale deals and individual investors by making fractional shares available globally with minimal friction. As regulatory frameworks evolve and adoption widens, tokenized music royalties are poised to become an integral part of diversified portfolios seeking uncorrelated yield streams.

Yet, the path to mainstream adoption of blockchain music royalties is not without its hurdles. Regulatory clarity, especially regarding the classification of music tokens as securities or commodities, remains a work in progress. Jurisdictions differ in their approach, and artists or investors must stay attuned to compliance requirements as the market matures. Additionally, education is critical, many potential participants are still unfamiliar with how tokenized music assets function, or how to evaluate their risks and rewards compared to traditional investments.

Another challenge is liquidity. While platforms are improving peer-to-peer trading and secondary market access, the market for music royalty investing is still developing. Thin trading volumes or limited buy-side demand can make it harder for holders to exit positions quickly, especially for less prominent catalogs. However, as more artists tokenize their works and as success stories accumulate, both awareness and liquidity should improve.

Practical Steps: How to Participate in Tokenized Music Royalties

For those interested in exploring fractional music royalty ownership, the process is increasingly user-friendly. First, investors should research platforms that specialize in music tokenization, each has unique onboarding requirements, fee structures, and catalog offerings. Due diligence is essential: review the underlying rights being tokenized, the artist’s track record, and the transparency of revenue reporting.

Once onboarded, investors can purchase tokens representing a share of future music streaming revenue or licensing income. These tokens are stored in a digital wallet and entitle holders to periodic payouts based on actual performance data from streaming services or publishers. Importantly, blockchain’s transparent ledger allows investors to independently verify royalty flows, a significant advantage over legacy systems.

Steps to Buy and Sell Tokenized Music Royalties

-

1. Choose a Reputable PlatformSelect a well-established platform that specializes in music royalty tokenization, such as Royal.io, Anotherblock, or Bolero. These platforms partner with artists to tokenize royalty rights and facilitate secure transactions.

-

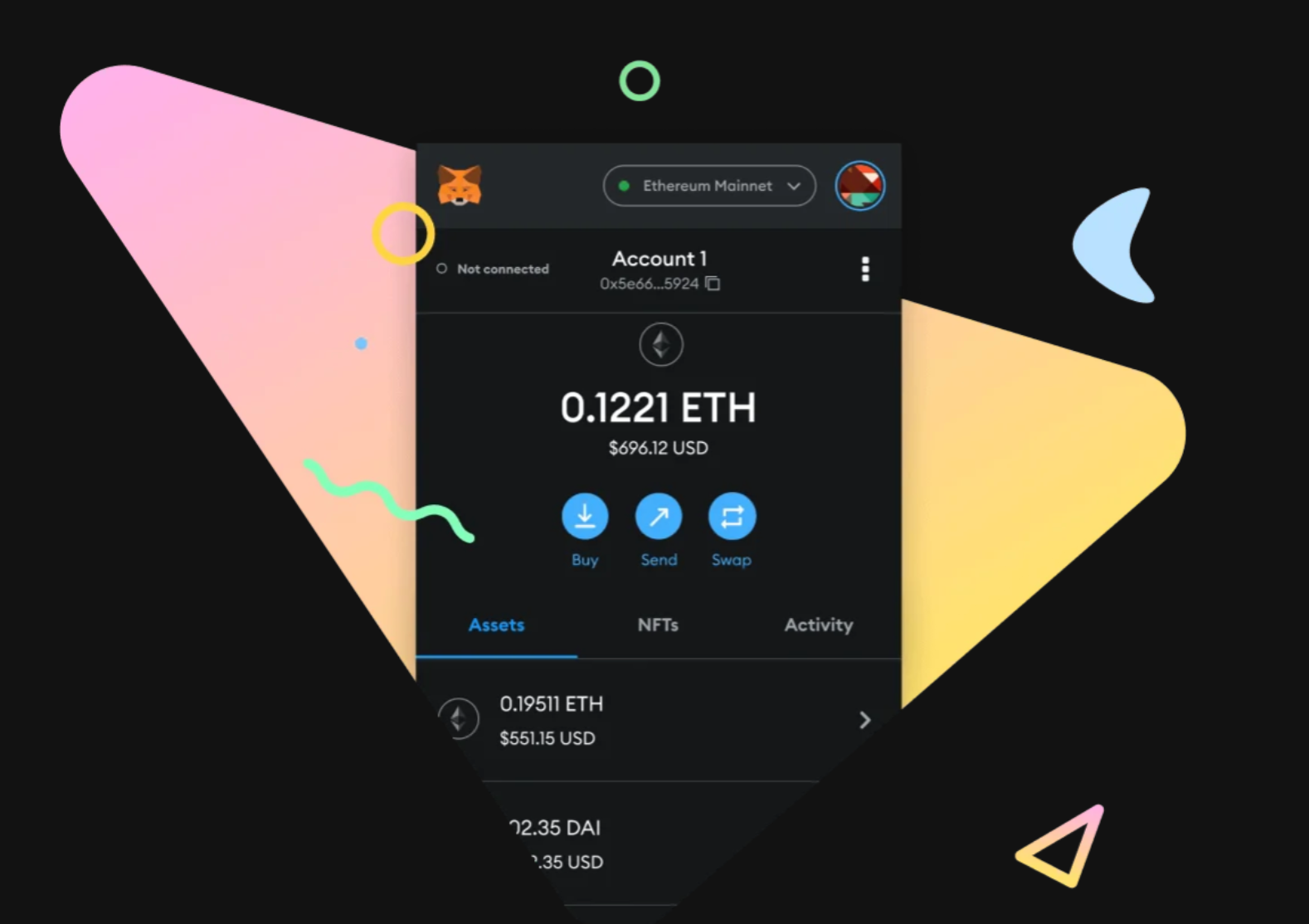

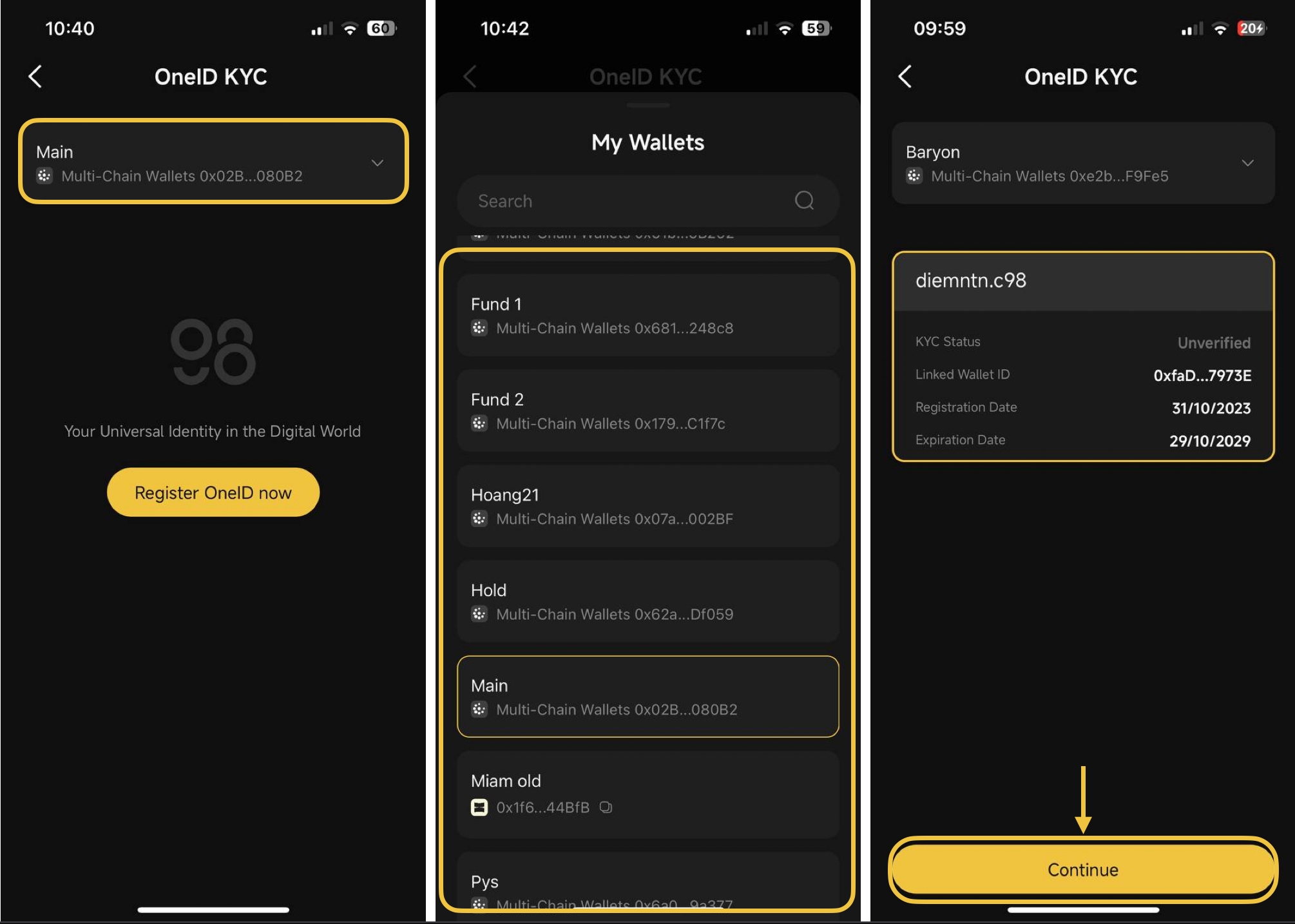

2. Set Up a Digital WalletCreate a compatible cryptocurrency wallet (such as MetaMask or Coinbase Wallet) to store your royalty tokens and manage transactions securely on the blockchain.

-

3. Complete Identity VerificationMost platforms require KYC (Know Your Customer) verification to comply with regulations. Submit necessary identification documents to unlock trading and purchasing features.

-

4. Fund Your WalletDeposit cryptocurrency (commonly Ethereum (ETH) or USDC) into your wallet. Check the platform’s accepted currencies and ensure you have sufficient funds to participate in royalty token sales.

-

5. Browse Available Music Royalty TokensExplore listings of tokenized music assets, often including details about the artist, song, projected royalty yields, and token supply. Platforms like Royal.io and Anotherblock provide transparent information for each offering.

-

6. Purchase Royalty TokensSelect the desired token and follow the platform’s instructions to complete your purchase. Upon successful transaction, the tokens representing fractional royalty ownership are transferred to your wallet.

-

7. Track and Collect RoyaltiesMonitor your token holdings and receive royalty distributions automatically, typically in cryptocurrency, as the underlying music generates revenue from streaming or licensing.

-

8. Sell or Trade Tokens on Secondary MarketsWhen ready, list your tokens for sale on the platform’s marketplace or compatible secondary markets. Set your price or accept bids, and upon sale, receive payment in your wallet.

For artists and rights holders, tokenization offers not just capital but also deeper fan engagement. By selling fractional ownership directly to supporters, musicians align incentives and foster a sense of shared success. This model is particularly empowering for independent artists seeking alternatives to traditional label deals or advances.

To learn more about how blockchain is revolutionizing fractional ownership of music royalties and empowering musicians with instant payouts and transparent revenue sharing, see our guides on fractional ownership and instant payouts.

The Road Ahead: Integration, Innovation, and Opportunity

The coming years will likely see continued convergence between music streaming revenue blockchain solutions and mainstream financial markets. As token standards mature and interoperability improves across platforms, we can expect more seamless trading experiences and broader access to high-quality catalogs. Cross-chain functionality may even allow music royalties to be used as collateral within decentralized finance (DeFi) protocols, unlocking new yield opportunities for both artists and investors.

Ultimately, the transformation of music royalties into tradeable assets is about more than just financial innovation, it’s about democratizing access to creative value and aligning interests across the entire music ecosystem. With Bitcoin holding steady at $107,771.00, digital asset markets have proven their staying power; now, tokenized music assets are poised to do the same for cultural investments.