Imagine earning a share of streaming royalties every time BTS, BLACKPINK, or Justin Bieber racks up millions of plays. Thanks to Aria Protocol’s $APL token, this is no longer reserved for record labels or industry insiders. Fans and investors now have a direct route to participate in the financial upside of their favorite artists’ global hits, transforming music IP into a liquid, yield-bearing asset on blockchain.

$APL Token: Real-Time Market Data and What It Means for Music Royalties

As of today, $APL trades at $0.9233, reflecting its growing adoption as a bridge between fans and the music royalty market. With a 24-hour high of $0.9318 and low of $0.9133, the token has shown both stability and liquidity since launch. These numbers aren’t just ticker tape – they represent fractionalized ownership in actual royalty-generating music IPs from some of the world’s most streamed artists.

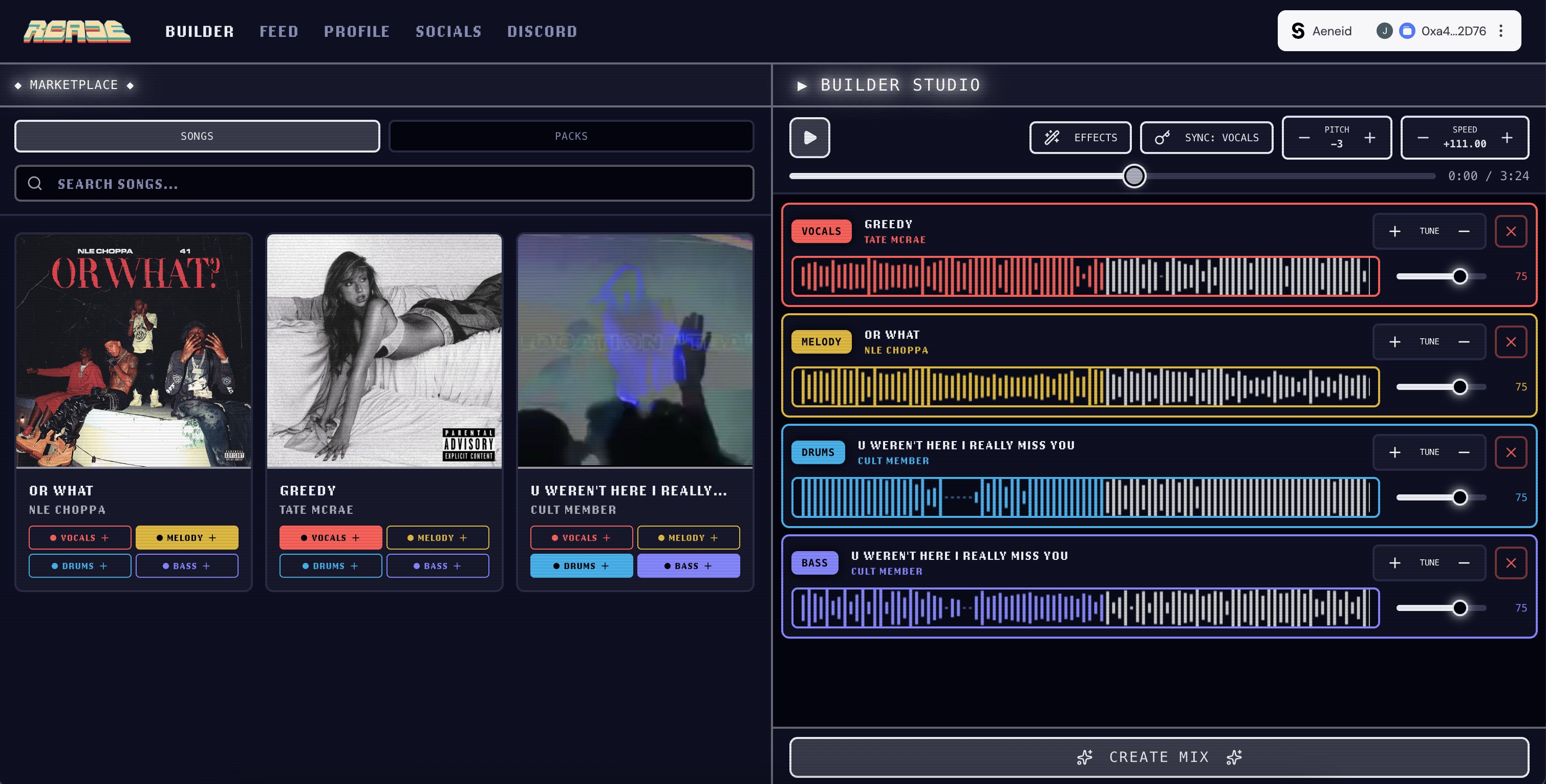

The protocol’s innovation lies in converting partial copyright income rights into tradable digital tokens. For example, when Aria Protocol tokenized royalties from Justin Bieber’s ‘Peaches’ in January 2025, it raised $7 million within nine minutes – a testament to pent-up demand for fractional music investing. Soon after, Aria made headlines by onboarding BTS’s ‘The Truth Untold’ via Story Protocol, opening new avenues for fans to own pieces of K-pop royalty streams.

How Does Earning Royalties with $APL Tokens Work?

Owning $APL isn’t just about price speculation; it’s about earning real-world yields from streaming and licensing activity. When you stake your $APL tokens through Aria Protocol’s platform, you receive daily distributions tied directly to the underlying performance of songs by BTS, BLACKPINK, Justin Bieber, and more. According to KuCoin data and recent project disclosures, holders can expect annualized returns between 5-8%, paid out transparently via smart contracts.

This model democratizes access to music revenue streams that were once locked behind complex legal agreements or major capital requirements. Now anyone can participate for less than a dollar per token – aligning fan enthusiasm with artist success in a tangible way.

The Rise of Tokenized Music IP RWAs: Why Fans and Investors Are Paying Attention

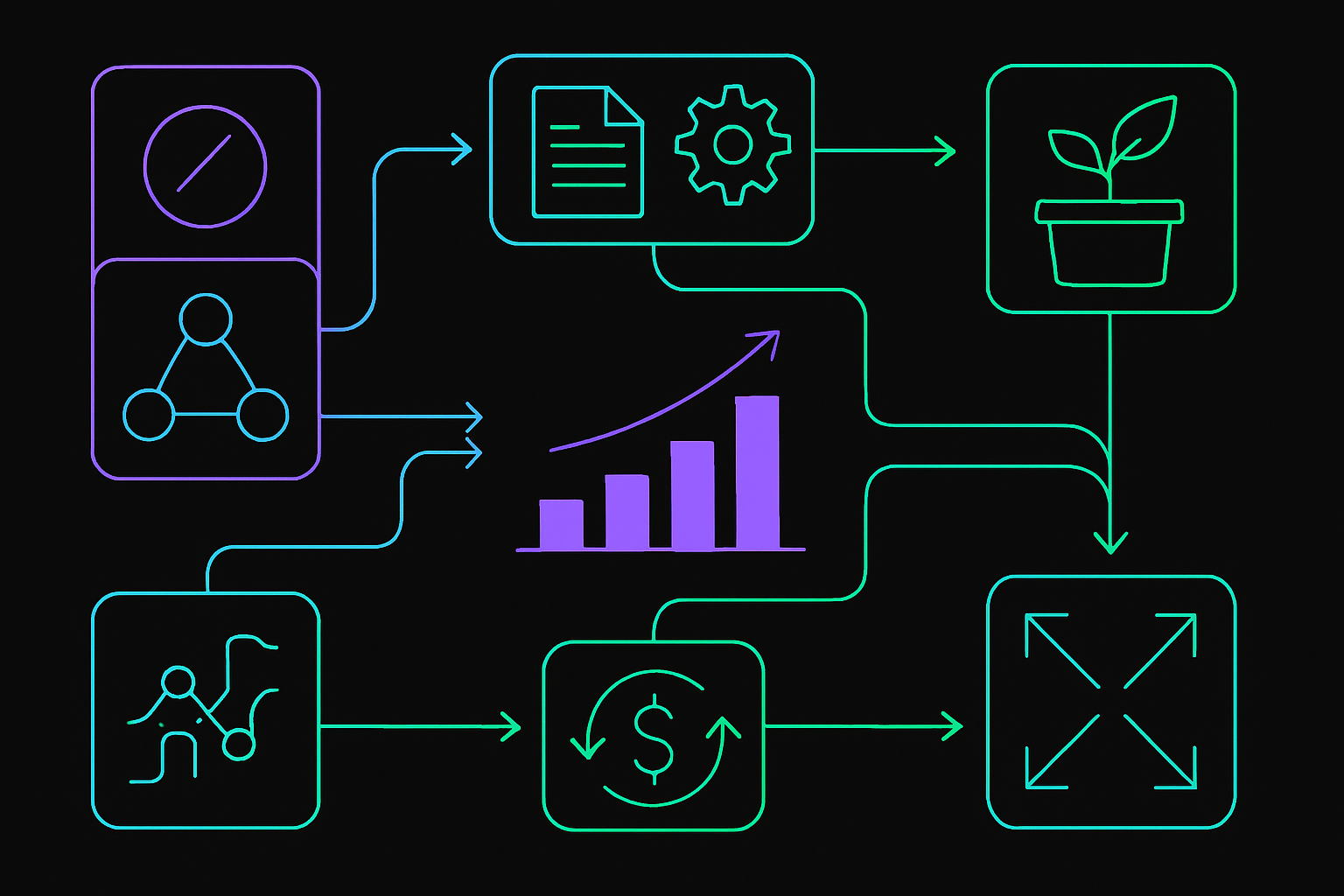

The concept behind music IP RWAs (real-world assets) is simple but powerful: turn traditional intellectual property rights into blockchain-based assets that are divisible, tradable, and programmable. In practice this means:

- Liquidity: Fans can buy or sell their positions instantly on secondary markets.

- Transparency: On-chain records ensure clear attribution and automated royalty distribution.

- Diversification: Exposure isn’t limited to one song or artist; portfolios can span genres and geographies.

Aria Protocol ($APL) Price Prediction 2026-2031

Forecast based on music IP adoption, RWA trends, and current 2025 price baseline of $0.9233

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | % Change (Avg vs. Current) |

|---|---|---|---|---|

| 2026 | $0.88 | $1.05 | $1.22 | +13.7% |

| 2027 | $0.98 | $1.23 | $1.54 | +33.2% |

| 2028 | $1.14 | $1.44 | $1.87 | +56.0% |

| 2029 | $1.31 | $1.67 | $2.24 | +80.9% |

| 2030 | $1.43 | $1.89 | $2.61 | +104.7% |

| 2031 | $1.55 | $2.08 | $2.98 | +125.3% |

Price Prediction Summary

Aria Protocol’s $APL token is projected to experience steady growth over the next six years, underpinned by expanding adoption of music IP tokenization, increasing user participation in royalty-based crypto assets, and the onboarding of major global artists. While short-term volatility is likely, the base case suggests $APL could more than double in value by 2031, assuming continued integration with music industry IP and favorable regulatory developments. Bearish scenarios account for market corrections or slower adoption, while bullish cases reflect rapid expansion in on-chain music rights and broader acceptance of RWA tokens.

Key Factors Affecting Aria Protocol Price

- Adoption of music IP tokenization by major artists and labels

- Expansion of real-world asset (RWA) narratives in crypto

- Yield attractiveness vs. traditional finance and DeFi alternatives

- Global regulatory clarity on music royalties and digital securities

- Competitive landscape from other IP/RWA tokenization platforms

- Ongoing technical improvements in Aria’s protocol and staking mechanisms

- General crypto market cycles and macroeconomic conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

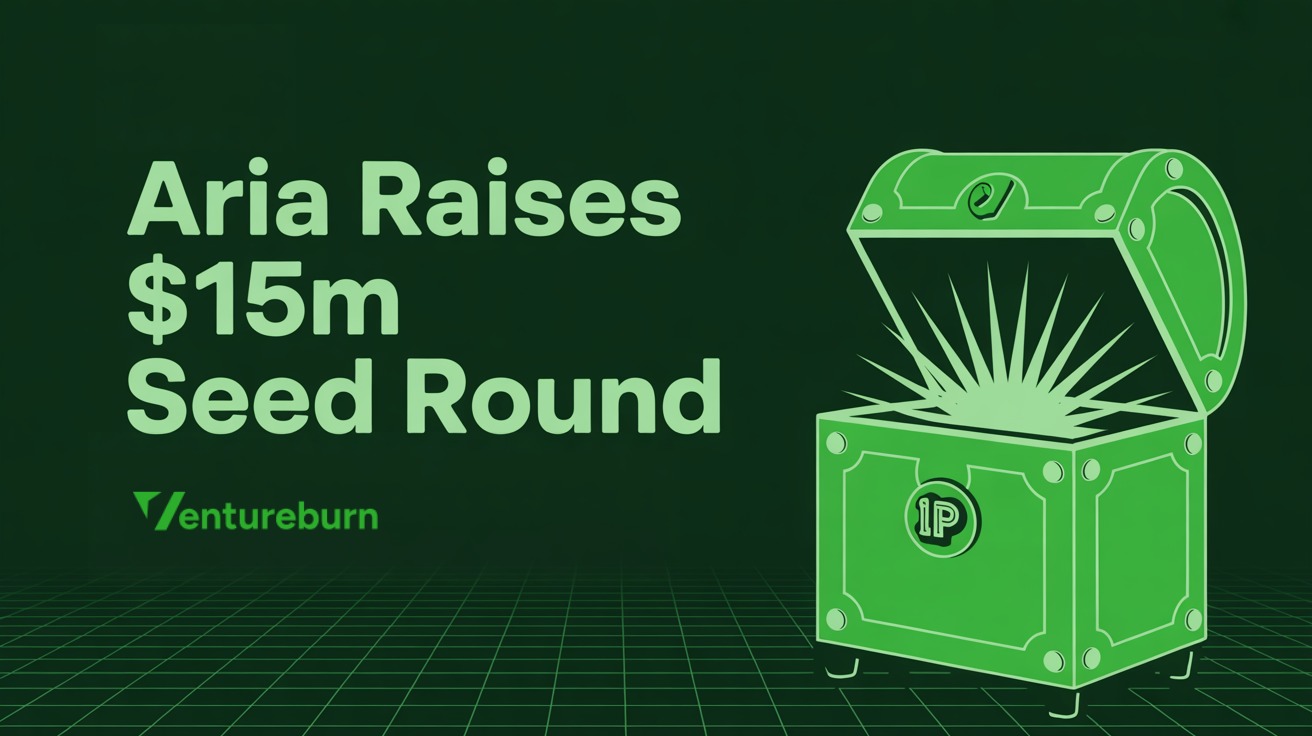

The surge in interest isn’t just hype; it reflects deeper trends in how people value culture as an investable asset class. Major venture capital inflows – including Aria’s recent $15 million seed round – signal institutional confidence that blockchain-powered royalty markets are here to stay.

If you want an even deeper dive into how tokenized royalties are reshaping fan investment across K-pop and global pop music scenes, check out our comprehensive overview at this guide.

As $APL continues to trade at $0.9233, its role as a gateway to music royalty investing on blockchain is becoming more pronounced. Unlike traditional music rights platforms, Aria Protocol’s system is built for speed and accessibility. Secondary market liquidity means fans can enter or exit positions with minimal friction, while automated smart contracts remove the need for middlemen. This is a seismic shift for both music superfans and seasoned investors seeking alternative yield sources.

Beyond the headline names like BTS, BLACKPINK, and Justin Bieber, Aria’s catalog now covers income rights from over 50 high-performing tracks. Each $APL token is underpinned by streaming and licensing revenue – so as these songs climb charts or go viral on TikTok, holders see direct financial benefits. The transparent nature of blockchain ensures that every micro-royalty is accounted for and distributed in real time.

What Makes Tokenized Music Rights So Compelling?

The core value proposition of platforms like Aria Protocol lies in fractional ownership. Instead of needing millions to buy into a publishing catalog, anyone can start with just a few dollars’ worth of $APL tokens. This low barrier to entry has opened up royalty investing to an entirely new demographic:

Key Benefits of Earning Royalties with $APL Tokens

-

Direct Access to Iconic Music Royalties: $APL tokens let fans earn real royalty income from songs by global stars like BTS, BLACKPINK, and Justin Bieber, including hits such as Justin Bieber’s ‘Peaches’ and BTS’s ‘The Truth Untold’.

-

Daily Royalty Yields: Holders of $APL tokens receive daily payouts from streaming and performance revenues, with expected annual returns of 5–8% based on the underlying music IP portfolio.

-

Fractional Ownership and Accessibility: Fans can purchase small fractions of music IP rights, making music investment affordable and accessible to a global audience, not just industry insiders.

-

On-Chain Transparency and Security: All royalty distributions and ownership records are managed on the blockchain, ensuring transparent, automated, and tamper-proof payouts.

-

Portfolio Diversification with Real-World Assets: $APL tokens provide exposure to a diversified basket of music royalties, allowing holders to invest in real-world assets (RWAs) and reduce risk compared to single-song investments.

-

Tradable and Liquid Investments: Tokenized music rights via $APL are tradable on supported crypto exchanges, offering liquidity and flexibility not available with traditional music royalty deals.

-

Empowering Artist-Fan Relationships: By enabling fans to share in the financial success of their favorite artists, $APL tokens foster deeper engagement and loyalty between artists and their communities.

For artists and rights holders, this model has additional upsides. By fractionalizing their IP, they unlock immediate liquidity without giving up full control or future upside. For fans, it means having skin in the game – every stream or sync placement becomes personal.

Risks and Considerations: What Should Investors Know?

No investment is without risk. While annualized returns between 5-8% are attractive compared to traditional fixed income products, royalty flows can fluctuate based on streaming trends, copyright disputes, or broader shifts in consumer behavior. Token prices like $APL’s current $0.9233 may also be volatile in response to market sentiment or new artist partnerships.

Additionally, regulatory frameworks around music IP RWAs are still evolving globally. Prospective buyers should review offering documents carefully and consider platform-specific risks before allocating capital.

The Road Ahead: Where Does Music Royalty Investing Go Next?

The success of $APL tokens signals that music IP RWA platforms are not just a passing trend but a foundational shift in how intellectual property is valued and traded. As more artists tokenize their catalogs – from chart-topping singles to deep cuts – expect the range of available assets (and potential yields) to widen further.

The intersection of fandom and finance creates new possibilities for community-driven promotion and engagement as well. Imagine fanbases coordinating streams not just out of loyalty but because they have a direct stake in the song’s success.

If you’re considering diversifying your portfolio with music royalty RWAs or simply want to support your favorite artists in an innovative way, $APL tokens offer an accessible entry point. As always, balance your enthusiasm with due diligence – but there’s no denying that the future of music ownership is being written on-chain today.