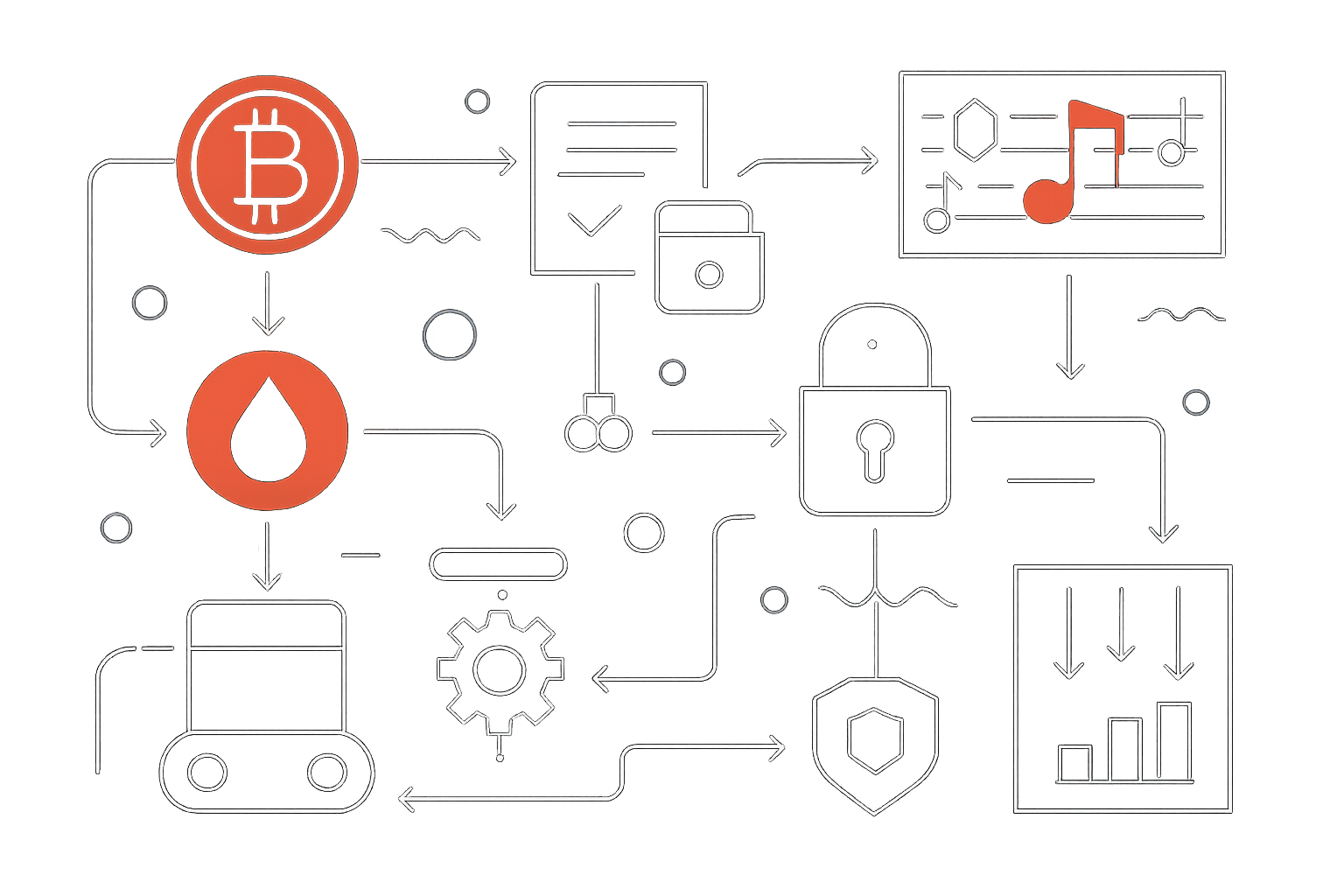

Fractional music royalties have moved from niche curiosity to a core strategy for both music fans and investors seeking passive income. Thanks to blockchain-powered marketplaces, owning a share of a hit song’s streaming revenue is now as accessible as buying an NFT, no music industry credentials or massive budgets required. With platforms like SongVest, Royal, and Bolero lowering the entry barrier, it’s never been easier to diversify your portfolio with tokenized music royalties.

![]()

Why Fractional Music Royalties Are Gaining Traction

The appeal is clear: fractional music royalties offer steady cash flow potential and align with the rising trend of real-world asset tokenization. Instead of shelling out six figures for a full catalog, you can now buy $10-$100 slices of songs or entire baskets (as seen on Sonomo), earning proportional payouts as tracks rack up streams globally. Platforms like SongVest and Royal are leading this shift, letting users collect quarterly or even monthly royalty payments without complex paperwork.

Blockchain technology is the backbone here. It ensures every transaction is transparent, every payout traceable, and every ownership share immutable. This transparency not only builds trust but also opens the door for secure secondary trading, allowing you to buy or sell your royalty shares just like any other NFT asset.

Step 1: Select Your Blockchain Music Marketplace

The first move? Choosing where to invest. The top blockchain music marketplaces each cater to different user profiles:

- SongVest: Buy fractional shares in hit songs via SongShares; receive quarterly payouts directly tied to streaming and licensing revenue.

- Sonomo: Invest in diversified baskets of songs for monthly payouts, ideal for risk mitigation across multiple tracks.

- Bolero: Fractional ownership starting at just $10; earn passive income based on real-time song performance.

- Artyfile and Collabhouse: Focused on NFTs that represent master rights or royalty splits; supports both crypto and fiat payments for maximum accessibility.

- Royal: Purchase shares in charting singles or albums; access detailed analytics including streaming stats before you commit capital.

This diversity means there’s a platform, and an investment minimum, for everyone from crypto-native traders to first-time royalty buyers. For more detail on platform comparisons and their unique features, see our guide on how to buy and sell NFT music royalties on blockchain marketplaces.

Step 2: Set Up Your Digital Wallet and Fund Your Account

You’ll need a digital wallet compatible with the marketplace’s blockchain (Ethereum and Polygon dominate the space). This wallet stores your NFTs and processes transactions securely. Some platforms now accept traditional currency, lowering the learning curve for newcomers, but having a crypto wallet remains essential if you want full access to all available assets and secondary trading markets.

- Select a wallet provider: MetaMask, Coinbase Wallet, or Trust Wallet are popular choices supporting ERC-20 tokens and NFTs.

- Add funds: Transfer ETH or MATIC (depending on platform) from your exchange account into your wallet, or use fiat payment options where available (e. g. , Collabhouse).

- Connect your wallet: Link it directly through the marketplace’s onboarding portal; security protocols ensure only you control your assets.

Navigating Asset Selection: What Makes a Strong Music Royalty Investment?

This is where data-driven analysis pays off. Each marketplace offers detailed information about available assets, including artist popularity, past streaming numbers, payout history, and projected earnings growth. Platforms like Royal even provide live dashboards tracking Spotify/Apple Music streams so you can benchmark performance before buying in.

- Diversification matters: Consider baskets over single tracks if you want steadier returns (see Sonomo’s model).

- Payout frequency: Some assets pay quarterly (SongVest), others monthly (Sonomo), so match timing with your cash flow goals.

- Earning potential vs risk: Higher-profile artists may offer lower percentage yields but greater stability; emerging acts could be higher risk/higher reward plays.

After narrowing down your options, it’s time to execute your first purchase. On most blockchain music marketplaces, the process is streamlined and transparent. You’ll see the price per share, total number of shares available, and projected royalty yield before you commit. For example, SongVest and Bolero clearly display historical earnings data, while Artyfile lets you track ownership percentages in real time. This level of granularity empowers investors to make fully informed decisions.

Making Your Purchase: From Offer to Ownership

Once you’ve selected an asset:

- Review all terms: Double-check payout schedules, minimum hold periods, and platform fees.

- Initiate payment: Use your connected wallet or fiat option (where available). Confirm the transaction on-chain for maximum security.

- Claim your NFT: The NFT representing your fractional royalty share is minted directly to your wallet, your proof of ownership on the blockchain.

This NFT not only entitles you to a proportional share of future royalties but can also be resold or transferred on secondary markets if liquidity is needed. Platforms like Royal and Collabhouse support peer-to-peer trading, adding flexibility for dynamic portfolio management.

| Platform | Payout Frequency | Minimum Investment |

|---|---|---|

| SongVest | Quarterly | $10 |

| Sonomo | Monthly | $10 (basket) |

| Bolero | Monthly/Quarterly | $10 |

| Artyfile/Collabhouse | User-defined/NFT-based | $20-$50 (varies) |

| Royal | User-defined/Streaming-based | $25-$100 (varies) |

Tracking Royalties and Managing Your Portfolio On-Chain

Your journey doesn’t end at purchase. Most platforms provide real-time dashboards where you can monitor accrued royalties, upcoming payouts, and asset performance. Quarterly or monthly statements are standard; some even offer direct integration with streaming analytics for ultra-transparent reporting. If you want to rebalance or exit a position, simply list your NFT on a supported secondary marketplace, blockchain’s transparency ensures seamless transfer of both ownership and future royalty rights.

The tax landscape for tokenized music royalties is evolving fast. In most jurisdictions, royalty income is taxable as ordinary income while capital gains from NFT sales may be taxed separately, consult a crypto-savvy accountant before scaling up your exposure.

Risks, Rewards, and Future Trends in Music Royalty Investment

No investment is risk-free. Streaming numbers can fluctuate with trends; artist disputes or copyright issues may impact payouts; platform security remains paramount. However, the upside is compelling: as more artists tokenize their catalogs and fan-driven investing becomes mainstream, early adopters are positioned for outsized returns compared to traditional royalty deals.

If you’re seeking more insights into how blockchain is transforming this sector, including real-world case studies, see our deep dive on how blockchain is transforming music royalty investments for NFT collectors.

Key Takeaways for New Investors in Tokenized Music Royalties

- Diversification via baskets or multiple tracks helps reduce volatility.

- Payout frequency and minimums vary by platform, match these with your cash flow needs.

- KYC/AML compliance may be required depending on jurisdiction; verify before funding large amounts.

- The best returns often come from combining data analysis with cultural intuition, spotting trends early pays off big in this market.

Top Tokenized Music Royalty Assets of 2025

-

“Blinding Lights” by The Weeknd (SongVest)Fractional shares of this global hit have consistently delivered strong royalty payouts to investors on SongVest, with transparent quarterly earnings and high streaming volumes.

-

“Levitating” by Dua Lipa (Royal)Available on Royal, this pop anthem offers investors a share of streaming royalties from major platforms, backed by detailed performance analytics and robust demand.

-

“Old Town Road” by Lil Nas X (ANote Music)Through ANote Music, investors can access fractional royalties from this record-breaking track, benefiting from its enduring popularity and diverse revenue streams.

-

Sonomo Top 100 Basket (Sonomo)Sonomo offers diversified Baskets like the Top 100, allowing investors to own fractions of royalties from multiple chart-topping songs, reducing risk while maximizing exposure.

-

“Stay” by The Kid LAROI & Justin Bieber (Bolero)On Bolero, this streaming sensation is tokenized for fractional ownership, providing passive income opportunities from its global streaming success.

-

“Dance Monkey” by Tones and I (Artyfile)Investors on Artyfile can purchase limited edition NFTs representing shares in this viral hit’s master rights, with quarterly royalty payouts and secondary market liquidity.

The bottom line: Blockchain-powered fractional music royalties give everyone, from superfans to seasoned investors, a shot at earning real-world income from the songs they love. As on-chain infrastructure matures and artist adoption accelerates, expect liquidity, transparency, and investment opportunities to keep growing exponentially. Ready to claim your stake in the next chart-topping hit? The tools are here, the rest is up to you.