Tokenized music royalties are rapidly transforming the way artists, fans, and investors interact with music assets. By leveraging blockchain technology, these marketplaces enable fractional music ownership, transparent revenue sharing, and a more direct connection between creators and their supporters. If you’re considering how to buy or sell tokenized music royalties on blockchain marketplaces, it’s essential to understand both the technology and the practical steps involved.

What Are Tokenized Music Royalties?

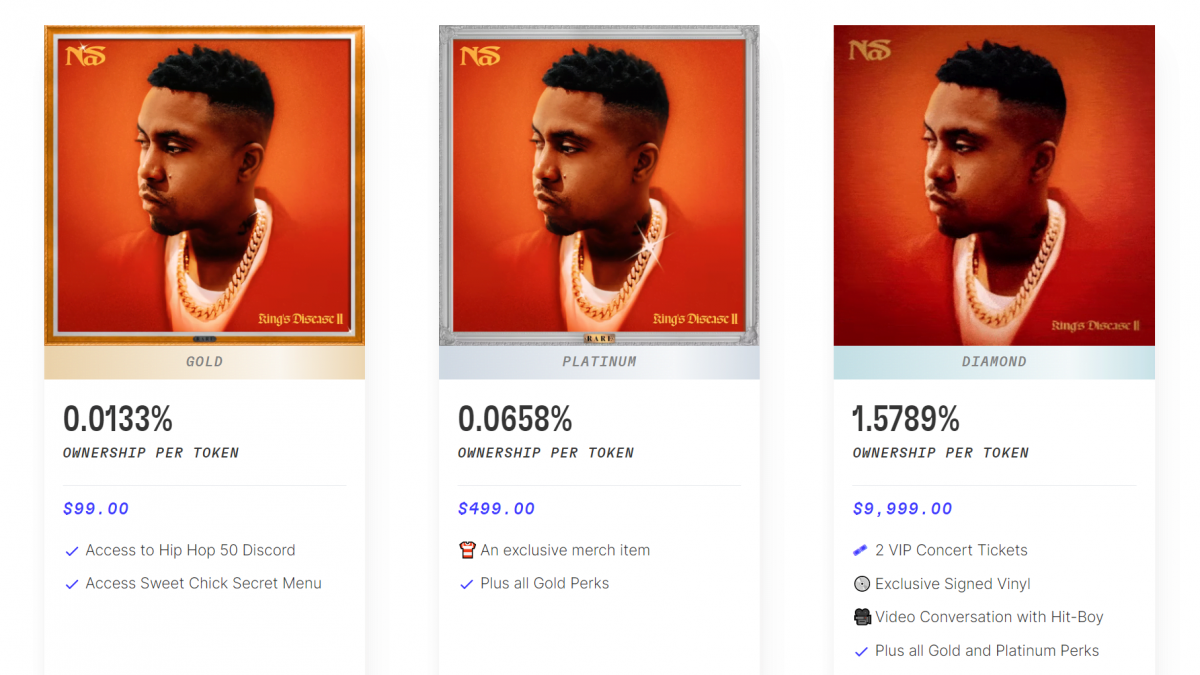

At their core, tokenized music royalties convert the right to receive future music revenues into digital tokens on a blockchain. Each token represents a fraction of a song’s streaming or licensing income, allowing holders to earn a portion of royalties as the music is played or monetized. This innovation is enabling both established and emerging artists to unlock liquidity and invite fans to become true stakeholders in their success.

Unlike traditional royalty arrangements, blockchain-based systems automate royalty tracking and payment via smart contracts. This means faster, more transparent distribution and fewer intermediaries. For investors and collectors, it’s a new asset class with passive income potential and direct exposure to the performance of individual tracks or catalogs.

How to Buy Tokenized Music Royalties: Step-by-Step

Buying music royalties on a blockchain marketplace is straightforward but requires attention to detail. Here’s a concise guide to get started:

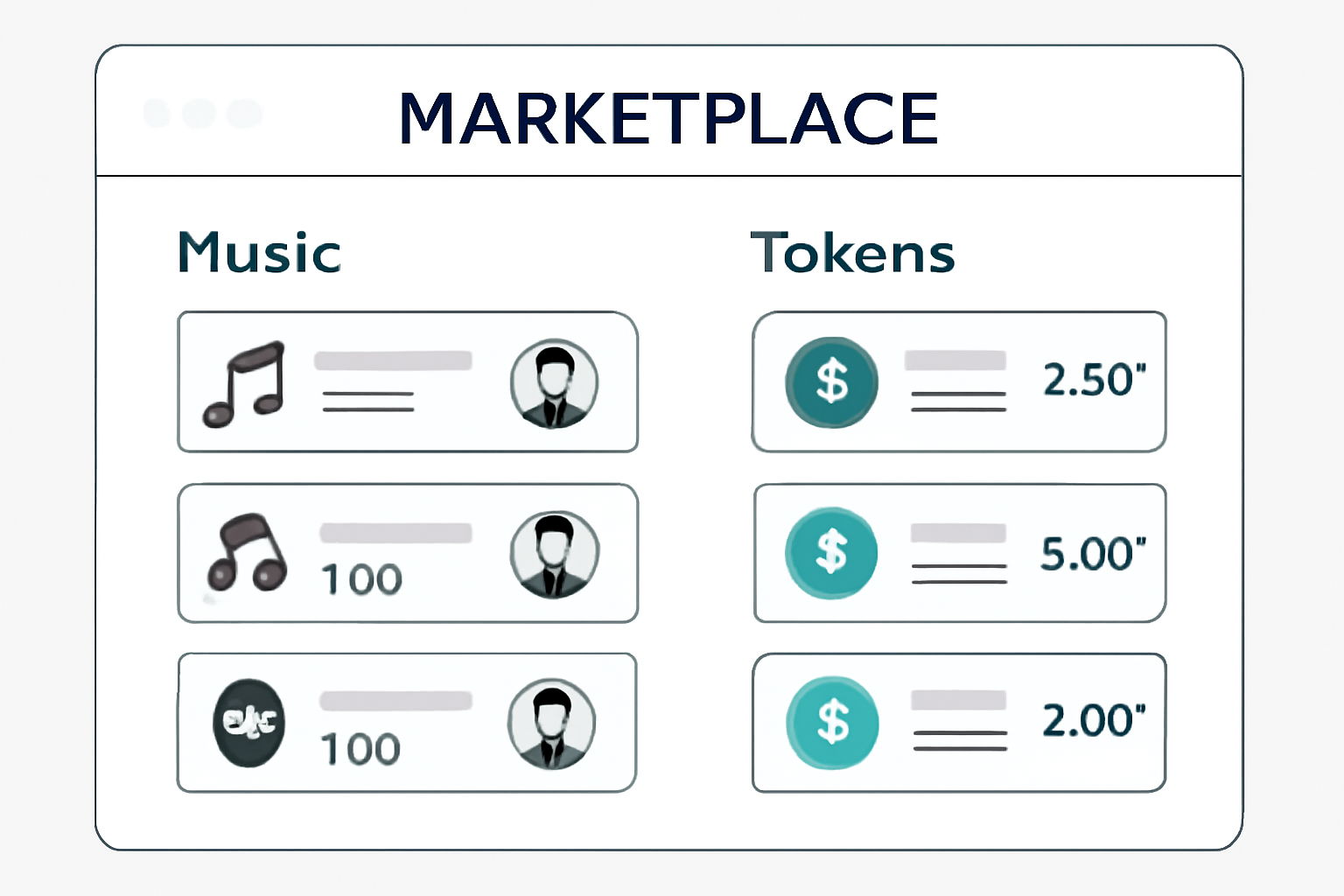

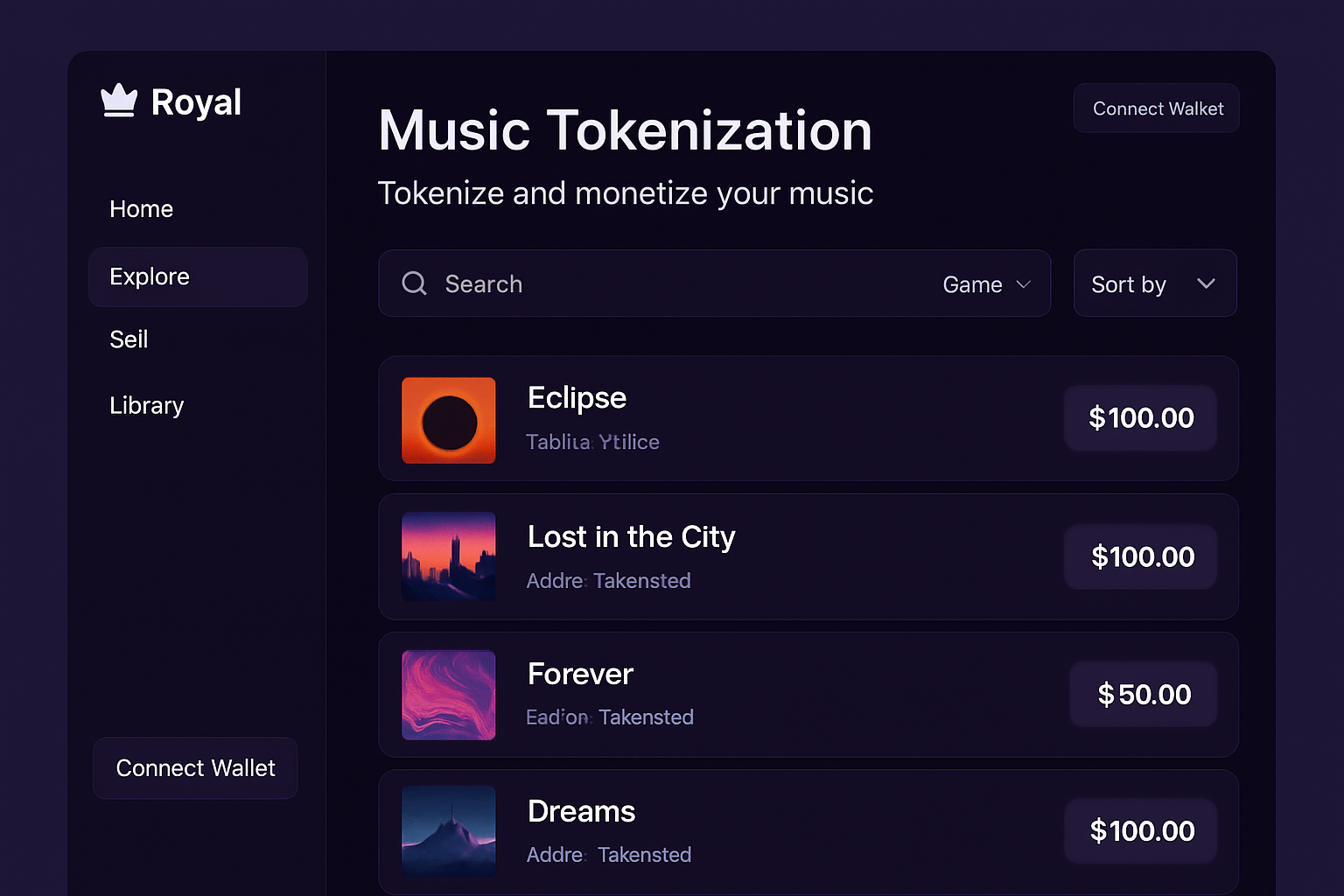

- Choose a Marketplace: Select a reputable platform like Royal, Anotherblock, or Collabhouse. Each offers its own catalog, user experience, and blockchain compatibility. Research platform reputation, supported artists, and fee structures before proceeding.

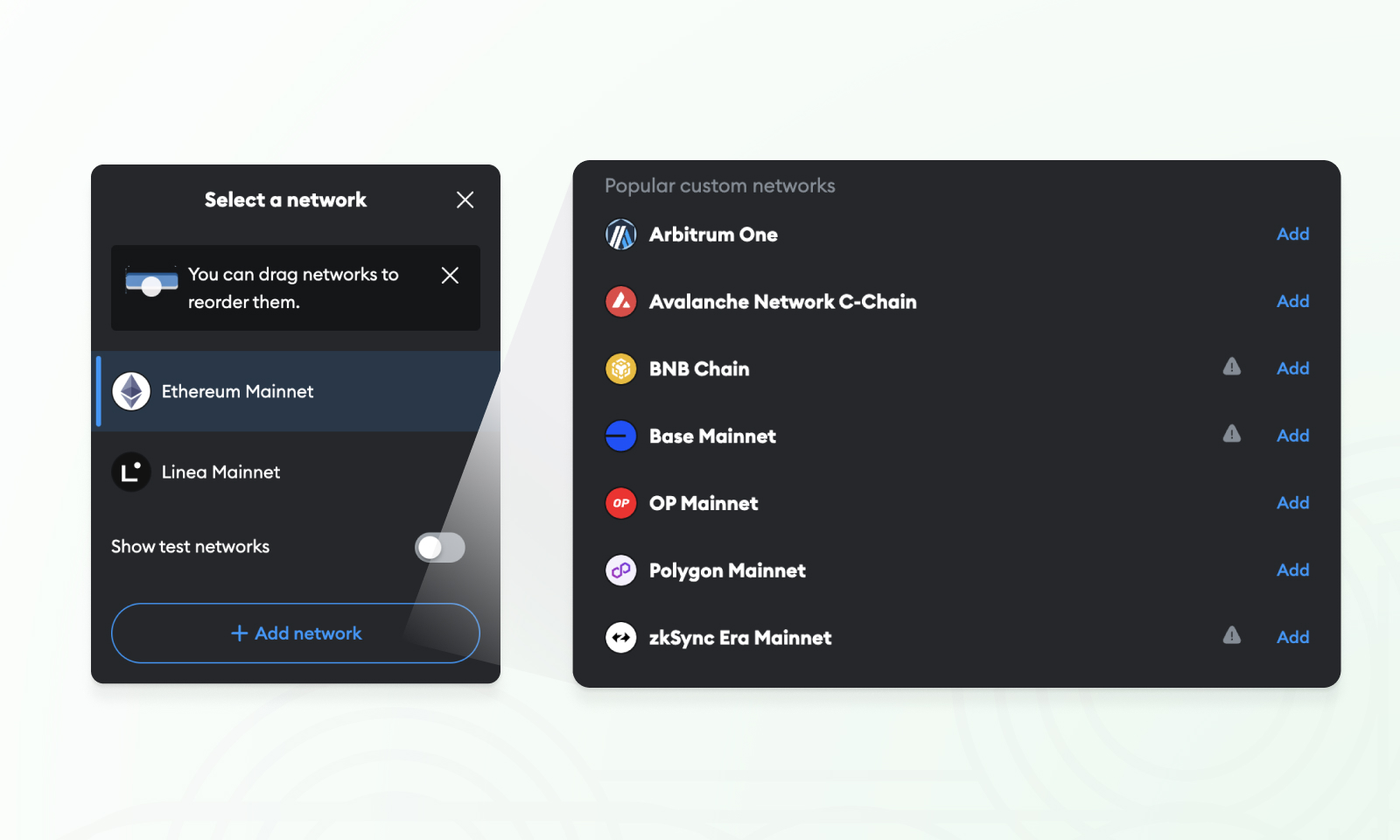

- Set Up a Digital Wallet: You’ll need a crypto wallet compatible with the platform’s blockchain (such as Ethereum or Polygon). This wallet will store your tokens and facilitate transactions.

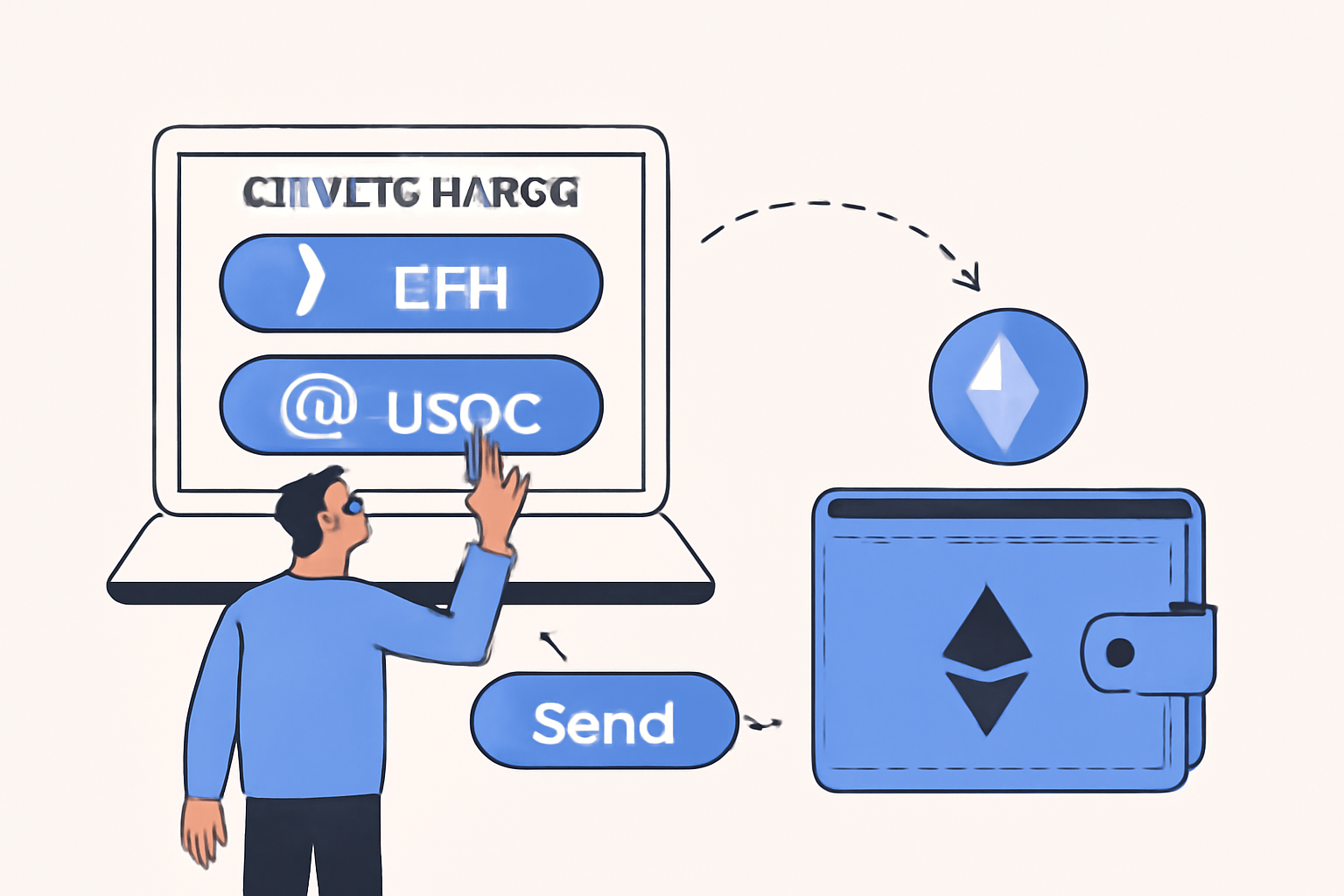

- Fund Your Wallet: Purchase the required cryptocurrency (often ETH or USDC) using a trusted exchange, then transfer it to your wallet address.

- Browse Available Tokens: Explore listings by song, artist, or royalty share. Platforms typically provide details on historic earnings, token supply, and payout schedules.

- Purchase Tokens: Once you’ve selected a tokenized royalty, complete the transaction through the marketplace interface. The tokens will be transferred to your wallet.

- Receive Royalties: As the underlying music generates revenue, your share is distributed automatically to your wallet, often in the platform’s designated cryptocurrency.

This process enables both fans and investors to align their interests with artists, supporting creative work while earning a share of future revenues. For further detail on the investment process, see our step-by-step guide to investing in tokenized music royalties.

Selling Tokenized Music Royalties: For Artists and Rights Holders

If you’re an artist or rights holder, tokenizing royalties can unlock new capital and foster deeper fan engagement. The process generally involves:

Key Steps for Artists to Tokenize and Sell Music Royalties

-

Choose a Reputable Tokenization Platform: Select a well-established marketplace that supports music royalty tokenization, such as Royal, Anotherblock, or Collabhouse. These platforms enable artists to fractionalize and sell music royalties as digital tokens.

-

Set Up a Compatible Digital Wallet: Create a cryptocurrency wallet (e.g., MetaMask, Coinbase Wallet) that works with the platform’s blockchain, such as Ethereum or Polygon. This wallet will securely hold your royalty tokens and facilitate transactions.

-

Tokenize Your Music Royalties: Work with the chosen platform to convert a portion of your song’s royalty rights into digital tokens. Define the percentage of royalties to be sold and ensure all legal documentation is in place.

-

List Royalty Tokens on the Marketplace: Publish your tokenized royalty shares for sale on the selected platform. Set clear terms, pricing, and provide detailed information to attract potential investors and fans.

-

Promote Your Tokenized Offering: Engage your fan base and the broader investor community through social media, newsletters, and platform tools to increase visibility and trust in your offering.

-

Distribute Royalties via Smart Contracts: As your music generates revenue, the platform’s smart contracts will automatically distribute the appropriate share of royalties to token holders in cryptocurrency, ensuring transparency and efficiency.

You’ll work with your chosen marketplace to define what percentage of royalties you wish to tokenize. The platform will help convert this share into digital tokens, which you can then list for sale. Engaging your fanbase through social media or exclusive content can significantly boost demand for your tokens.

Why Blockchain Marketplaces Are Disrupting Music Royalty Investment

The rise of decentralized marketplaces for music royalty NFTs is democratizing access to an asset class once reserved for industry insiders. Investors gain liquidity, transparency, and fractional exposure; artists gain new funding avenues and more control over their intellectual property. These platforms also provide secondary markets where tokens can be traded, allowing holders to realize gains or rebalance portfolios as market conditions evolve.

For those seeking passive income or diversification into alternative assets, tokenized music royalties represent a compelling opportunity. However, it’s critical to understand the legal implications, platform fee structures, and potential volatility based on song performance. For more on how blockchain is transforming royalty investments, explore this in-depth guide for NFT collectors.

Secondary markets are a defining feature of blockchain-based music royalty platforms. Once you own music royalty tokens, you’re not locked in. Instead, you can list your tokens for sale on the same marketplace or a compatible secondary exchange. This liquidity makes it possible to respond to changes in song performance, artist popularity, or broader market sentiment, much like trading traditional financial assets.

Navigating Risks and Maximizing Value

As with any emerging asset class, tokenized music royalties come with unique risks and considerations. Market volatility is inherent: token prices may fluctuate based on streaming numbers, artist news, or shifts in the broader crypto landscape. Additionally, while smart contracts automate payouts and reduce counterparty risk, it’s important to review each platform’s transparency on historical earnings and legal compliance.

For investors seeking stable cash flows, look for songs with established streaming histories and transparent payout schedules. Diversification, spreading investments across multiple tracks or catalogs, can help mitigate the impact of underperforming assets. Artists should carefully assess how much of their catalog to tokenize and ensure they retain sufficient rights for future flexibility.

Best Practices for Buyers and Sellers

- Due Diligence: Investigate platform credibility, artist reputation, and token terms before committing funds.

- Understand Royalty Streams: Know what revenue sources (streaming, sync licensing) are included in each token.

- Monitor Performance: Use analytics dashboards provided by marketplaces to track earnings and token value over time.

- Stay Informed: Follow platform updates on regulatory changes or new features that could affect your holdings.

The integration of blockchain with music royalties is still evolving. Regulatory frameworks continue to develop globally, which may impact how tokens are structured or traded in different jurisdictions. Both artists and investors should stay informed about local laws and consult professionals as needed.

Looking Ahead: The Future of Fractional Music Ownership

The shift toward fractional music ownership is more than a technological upgrade, it’s a cultural realignment that puts creators and fans at the center of value exchange. As adoption grows, expect more sophisticated financial products, greater catalog diversity, and enhanced analytics tools for both buyers and sellers.

Platforms like Royal, Anotherblock, and Collabhouse are leading the way by offering seamless interfaces and robust legal frameworks. For those ready to explore this frontier, staying disciplined, through careful research and risk management, will be key to long-term success. If you’re interested in learning how blockchain eliminates industry middlemen and empowers artists with instant payouts, see our guide on how blockchain is disrupting traditional royalty models.