Non-Fungible Tokens (NFTs) have changed the game for music ownership, giving artists and fans a new way to buy, sell, and invest in NFT music royalties using blockchain technology. With Ethereum trading at $3,933.03 at the time of writing, the on-chain music royalty market is more accessible than ever. Let’s break down how you can buy and sell tokenized music royalties on leading blockchain marketplaces, and why this is a major opportunity for both musicians and investors.

What Are NFT Music Royalties?

NFT music royalties are digital assets that represent a real share of income generated by songs or albums, think streaming revenue or digital sales. When you buy an NFT tied to music royalties, you’re purchasing fractional ownership in future royalty streams, creating direct alignment between artists and their most engaged fans or collectors. This model not only democratizes access to music investments but also increases transparency through blockchain’s immutable ledger.

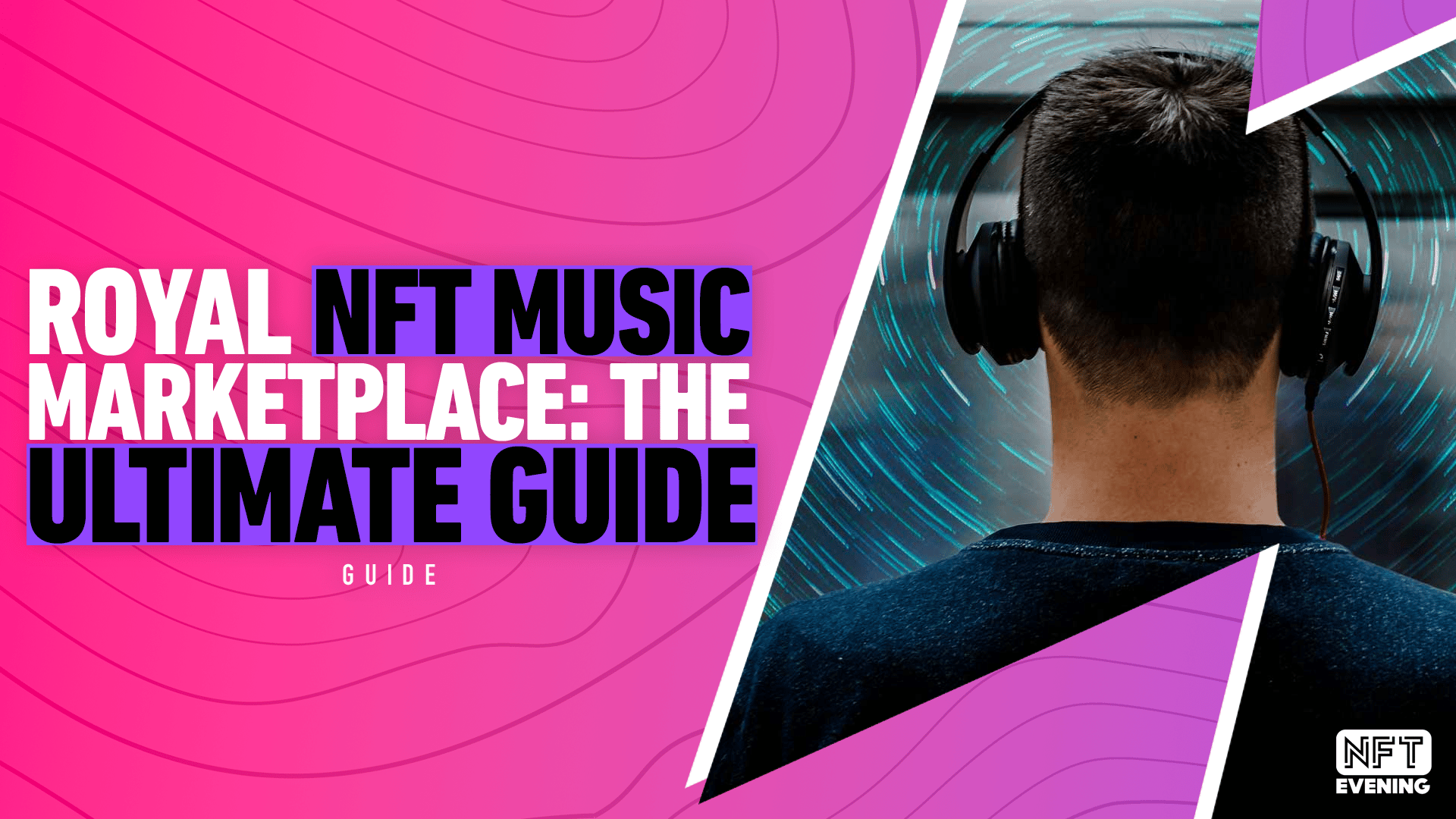

Top Marketplaces for Buying and Selling NFT Music Royalties

The explosion of music royalty marketplaces means there are several platforms to consider. Each has its own ecosystem, fee structure, and blockchain support:

- Royal: Founded by DJ 3LAU, Royal lets users buy rights to streaming royalties as NFTs. Artists decide what percentage of royalties they offer and how many NFTs to mint. Supports Ethereum and Polygon.

- Rarible: A decentralized hub for all types of NFTs, including music, with multi-chain support (Ethereum, Flow, Tezos, Polygon). Rarible allows creators to set ongoing royalty percentages for secondary sales.

- OpenSea: The world’s largest NFT marketplace offers robust trading in tokenized music assets across multiple blockchains with an intuitive interface.

If you want a deeper dive into how these platforms enable on-chain trading of fractionalized royalties, check out our guide: How Blockchain Is Transforming Music Royalty Investments: A Guide for NFT Collectors.

The Step-by-Step Process: Buying NFT Music Royalties

The process is straightforward but requires attention to detail at every step:

- Select Your Marketplace: Choose from platforms like Royal, Rarible, or OpenSea based on your preferred blockchain (Ethereum currently at $3,933.03) and supported payment methods.

- Create and Fund Your Wallet: Download a crypto wallet like MetaMask that’s compatible with your chosen platform. Fund it with sufficient ETH or other required tokens, remember the current price is $3,933.03 per ETH.

- Browse Listings: Explore available NFTs tied to music royalties. Pay close attention to details like the percentage of future income offered and any additional perks (such as exclusive content or fan experiences).

- Make Your Purchase: Once you’ve found the right asset, execute the transaction directly on-chain via the marketplace interface.

Selling Your Music Royalties as NFTs

If you’re an artist or rights holder looking to monetize your catalog through tokenization, here’s what matters most:

- Minting Your Music as NFTs: Use marketplace tools (like those from Royal or Rarible) to turn your song’s royalty rights into tradeable tokens.

- Selecting Royalty Terms: Set transparent terms, what percentage of future revenue will buyers receive? Make sure these are clearly defined during minting.

- Listing and Promotion: List your minted NFTs with detailed descriptions about revenue share and any extras for holders. Promote across social channels; early traction drives price discovery!

This approach not only opens up new revenue streams but also empowers artists with instant liquidity options previously unavailable in traditional publishing deals. For more insights into how fractional ownership works in practice (and why it matters), see our explainer: How Blockchain Enables Fractional Ownership of Music Royalties: A Guide for NFT Investors.

Beyond the technical process, success in music royalty marketplaces depends on understanding the unique dynamics of blockchain-based investments. The transparency of on-chain transactions means every trade, payment, and royalty distribution is verifiable. This not only builds trust but also makes it easier for artists and investors to track performance in real time.

Risks, Rewards, and Key Considerations

While the potential upside is significant, there are important factors to weigh before you buy or sell NFT music royalties:

- Market Volatility: Like any digital asset, NFT prices can swing dramatically. The value of your music royalty NFT may rise or fall based on artist popularity, platform trends, or broader crypto market moves. With Ethereum currently at $3,933.03, entry costs and transaction fees are directly tied to blockchain activity.

- Platform Fees: Most marketplaces charge a fee for each transaction (for example, Rarible takes 2.5% from both buyer and seller). Factor these into your ROI calculations.

- Legal Clarity: Ensure any tokenized rights are free from prior contractual encumbrances. Missteps here can result in disputes or loss of income streams.

- Liquidity: Some NFTs may be harder to resell than others. Look for assets tied to high-profile artists or trending genres if you value quick exits.

If you’re looking for more strategies on mitigating risk while investing in tokenized royalties, our guide on How to Invest in Tokenized Music Royalties Using Blockchain Platforms covers advanced tactics for both new and experienced collectors.

Why Participate? The Value Proposition for Artists and Investors

The real power of buying and selling NFT music royalties lies in its alignment of incentives across creators and fans. Artists unlock new capital without giving up total control over their catalog; fans become true stakeholders with a financial reason to support the music they love. This model is already reshaping how independent musicians fund projects and how superfans engage with their favorite acts.

The ability to track revenue flows transparently via smart contracts reduces friction and eliminates many traditional middlemen. Plus, as platforms evolve toward greater interoperability (multi-chain support), expect increased liquidity and even more innovative royalty-sharing structures in the near future.

Stay Ahead: Tools and Resources for Market Participants

Whether you’re a creator minting your first royalty NFT or an investor tracking portfolio performance, staying informed is critical. Use dashboard analytics provided by major marketplaces to monitor royalty streams, secondary sales activity, and price trends (with ETH at $3,933.03 as your benchmark).

- Diversify: Don’t put all your crypto into one artist’s catalog; spread risk across genres and platforms.

- Engage: Join community forums or Discords linked to top marketplaces, alpha leaks often come from grassroots discussions before hitting mainstream feeds.

- Verify Rights: Always double-check that NFTs represent actual legal rights to future royalties, avoid speculative tokens with unclear terms.

If you want a step-by-step breakdown tailored for indie artists and fans alike, our resource on How Fractionalized Music Royalties on Blockchain Empower Indie Artists and Fans is a must-read.

The era of passive fandom is over, NFT music royalties turn listeners into stakeholders with skin in the game. As Ethereum holds steady at $3,933.03 and tokenized assets gain traction globally, now is the moment to explore this powerful intersection of art and finance.