Passive income from music royalties is no longer reserved for record labels and industry insiders. Thanks to blockchain-driven tokenization, anyone can now invest in music royalties on blockchain platforms and earn a share of streaming, licensing, and sales revenue. This revolution in music ownership is democratizing access, providing fans and investors with new ways to build wealth while supporting the artists they love.

How Tokenized Music Royalties Work

Tokenized music royalties convert royalty rights into digital tokens on a blockchain. Each token represents a fractional ownership stake in a song or catalog’s royalty income. When you buy these tokens, you’re essentially purchasing a piece of the future cash flow generated by that music asset. Smart contracts automate royalty payments, distributing revenue directly to token holders in real time, with full transparency and no middlemen.

This approach unlocks liquidity for artists and rights holders, while giving investors direct exposure to a historically stable, non-correlated asset class. As platforms like Royal, ANote Music, and Artyfile gain traction, the barriers to entry for royalty investing continue to fall.

Top Platforms to Invest in Tokenized Music Royalties

Top Platforms for Tokenized Music Royalty Investments

-

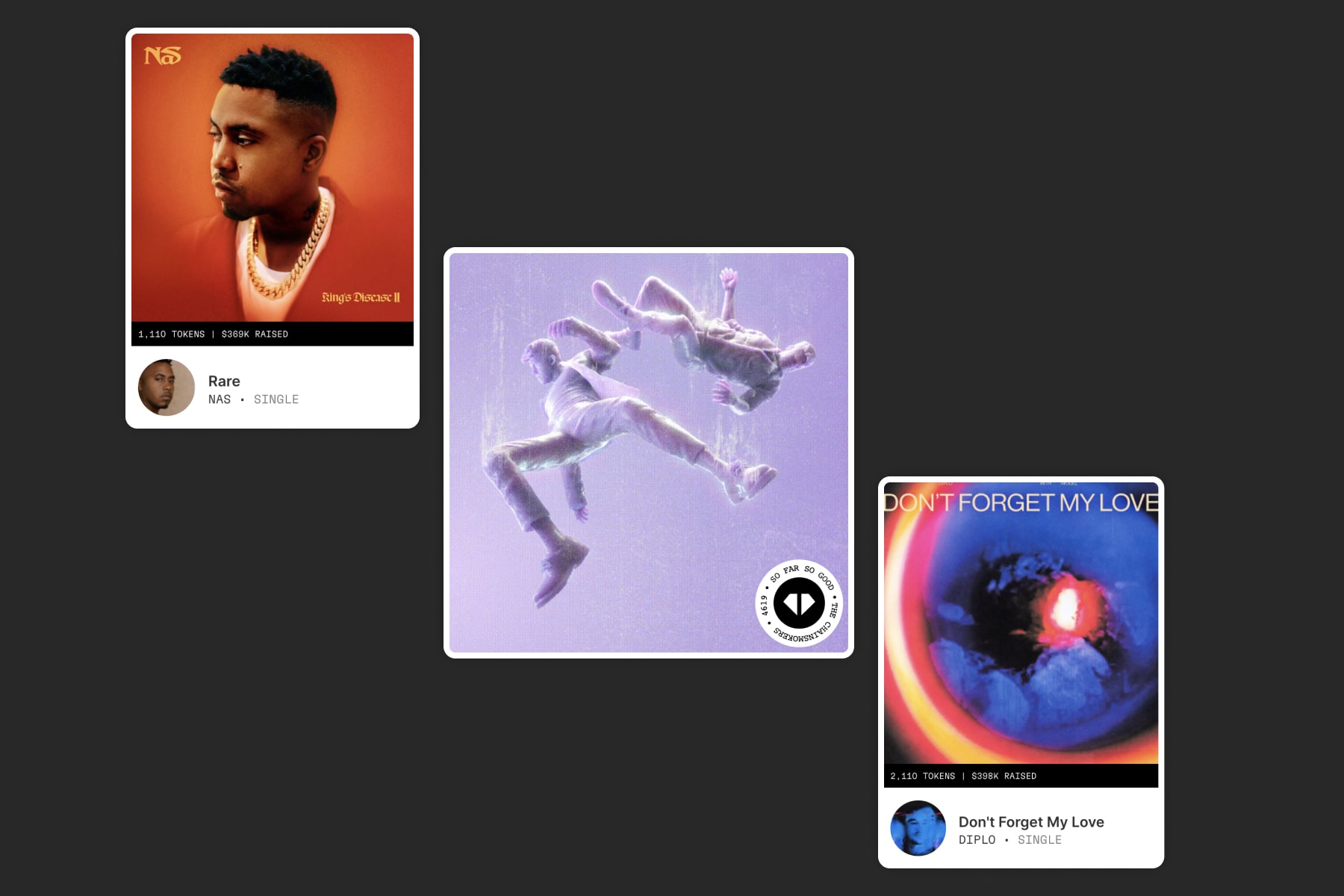

Royal: Co-founded by DJ 3LAU, Royal enables users to purchase tokens representing a share of music royalties. High-profile artists like Nas and The Chainsmokers have partnered with Royal, giving fans access to real royalty streams via blockchain-based tokens.

-

ANote Music: Based in Luxembourg, ANote Music operates a regulated online marketplace for music rights. Investors can buy shares in future royalty streams from established catalogs, with over €10 million in royalty transactions facilitated to date.

-

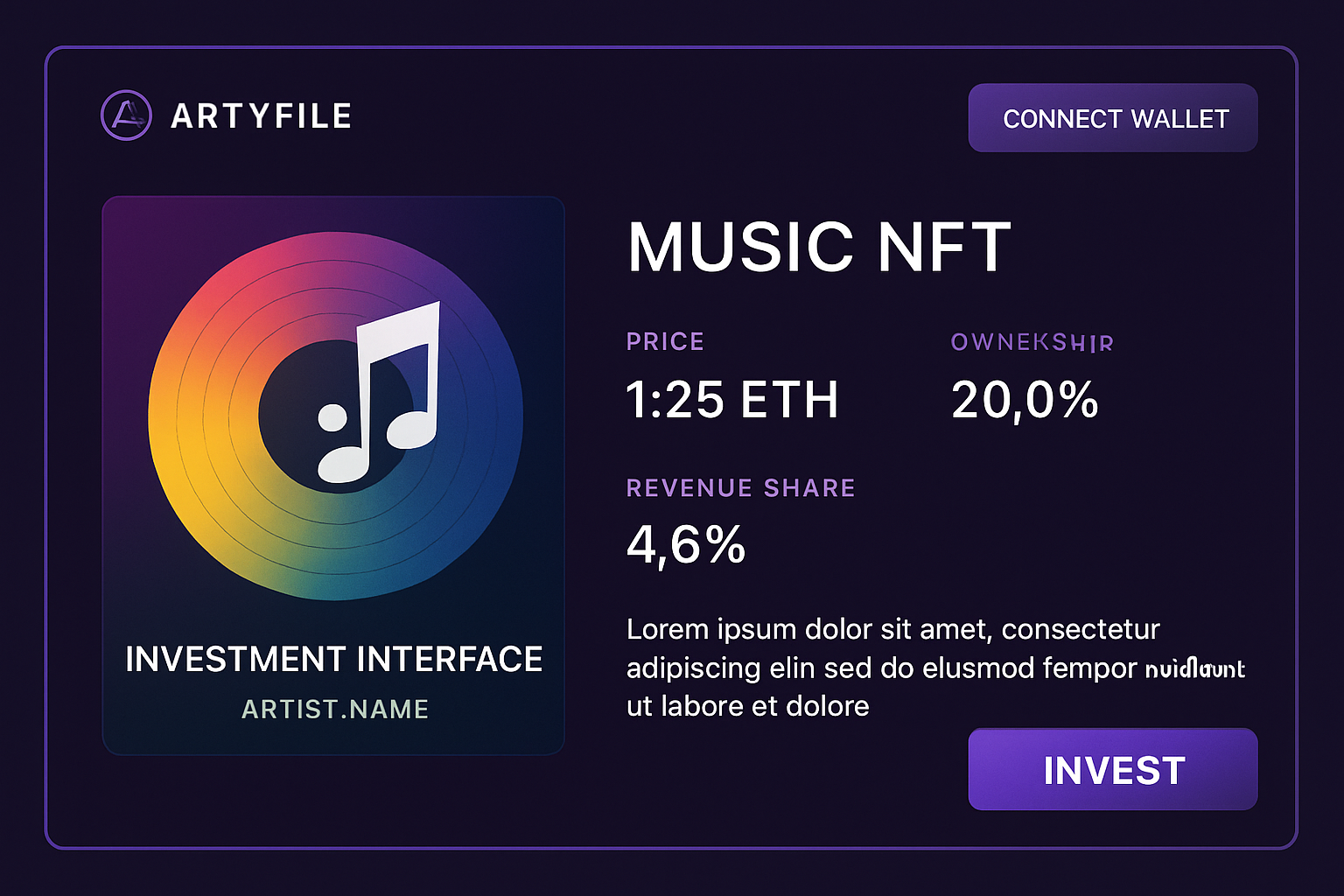

Artyfile: Artyfile offers Limited Edition music NFTs that grant fractional ownership of master recordings. Investors receive streaming revenue and synchronization fees, with each NFT representing a verifiable share in the music’s rights.

Several blockchain platforms now facilitate fractional music royalty ownership:

- Royal: Co-founded by DJ 3LAU, Royal lets fans and investors buy tokens representing shares of streaming royalties from artists like Nas and The Chainsmokers.

- ANote Music: Based in Luxembourg, ANote Music operates a robust marketplace for trading shares in music royalty catalogues. Over €10 million in transactions have already taken place on the platform.

- Artyfile: Specializes in Limited Edition music NFTs that grant fractional ownership of master recordings and streaming revenue.

Each platform leverages blockchain to ensure transparent accounting, instant revenue sharing, and verifiable ownership, key advantages over legacy music investment models.

Step-by-Step: How to Start Earning Passive Income

Getting started with tokenized music royalty investing is straightforward:

- Choose a Platform: Research options like Royal, ANote Music, or Artyfile. Consider their artist partnerships, track record, and user experience.

- Create a Digital Wallet: Set up a wallet compatible with Ethereum or Polygon (depending on the platform) to securely store your tokens.

- Browse Available Assets: Evaluate music catalogs or individual songs based on artist popularity, historical royalty data, and projected returns.

- Buy Tokens: Purchase fractional shares using crypto or fiat currency. Your tokens represent your claim on future royalty payouts.

- Monitor Earnings: Use the platform dashboard to track real-time distributions and manage your portfolio.

This streamlined process makes it possible for anyone, from crypto-savvy traders to music fans, to earn passive income from music IP without the complexities of traditional rights management.

Why Tokenized Royalties Are Gaining Momentum

The surge in music royalty investment platforms is fueled by several key trends:

- Automated Payouts: Smart contracts distribute royalties instantly, no more waiting months for payments.

- Fractional Ownership: Buy as little or as much as you want, making music investment accessible at any budget.

- Secondary Markets: Trade your tokens anytime, unlocking liquidity previously unavailable in music IP markets.

- Direct Artist Support: Your investment directly benefits creators, cutting out unnecessary intermediaries.

This new model is rapidly gaining traction with both retail investors seeking yield and artists looking for new funding streams. As music streaming revenues grow globally, so does the opportunity to earn money with music NFTs and tokenized assets.

One of the most compelling features of tokenized music royalties is the transparency and efficiency that blockchain brings to the table. Investors can track every royalty payment and asset transfer on-chain, removing the opacity that has plagued traditional music rights management. This real-time visibility builds trust and allows for data-driven decisions when managing your portfolio.

Risk Management and Market Dynamics

While the upside is attractive, it’s crucial to approach music royalty investment platforms with a balanced perspective. Royalty streams are tied to actual music consumption, meaning your returns depend on how often a song is streamed, licensed, or used commercially. As with any asset, there’s exposure to market volatility, changing consumer tastes, and platform-specific risks.

For example, some tracks may see spikes in popularity due to viral moments or sync placements, while others might underperform. Diversifying across multiple songs, artists, or catalogs can help smooth out income fluctuations. Always review the historical performance data and legal documentation provided by platforms before committing capital.

The Future: Fractional Ownership and On-Chain Liquidity

Looking ahead, the integration of blockchain with music royalties is set to accelerate. Fractional ownership is unlocking access for global investors, while secondary markets bring new liquidity to what was once an illiquid asset class. As more artists tokenize their catalogs and fans seek ways to invest in songs by major artists, expect to see new financial products and yield opportunities emerge.

Platforms are also exploring innovative features like dynamic royalty splits, instant artist payouts, and even governance rights for token holders. This is a live market with rapid evolution, staying informed is key to capitalizing on new trends and maximizing your passive income potential.

Real-World Example: Earning with Music NFTs

Imagine owning a fraction of streaming royalties from a hit single or evergreen catalog. Each time the song is played on Spotify, Apple Music, or licensed for film and TV, you receive your share, automatically, thanks to programmable smart contracts. This isn’t just theory: investors are already seeing regular payouts from their NFT-backed music assets.

Whether you’re a crypto investor seeking diversification or a music fan wanting deeper engagement, tokenized royalties offer a unique blend of culture and cash flow. The barriers to entry are low, but the upside, especially as Web3 adoption grows, remains substantial.

Start Building Your Royalty Portfolio Today

The convergence of blockchain technology and music IP is empowering a new generation of investors and creators. If you’re ready to earn money with music NFTs, start by researching reputable platforms, understanding the mechanics of royalty flows, and diversifying your holdings across genres and artists.

For a deeper dive into strategies and platform comparisons, check out our comprehensive guide to investing in tokenized music royalties using blockchain platforms.